Jace

No content yet

Ethereum is sending mixed signals.

Despite exchange supply hitting multi-year lows, $555M in $ETH saw outflows last week, largely driven by U.S. regulatory uncertainty.

Meanwhile, Bitcoin continues to dominate liquidity and risk appetite.

Until $ETH can consistently outperform $BTC, the case for an Ethereum-led altseason in 2026 remains unconvincing.

Strength leads cycles, narratives follow.

Despite exchange supply hitting multi-year lows, $555M in $ETH saw outflows last week, largely driven by U.S. regulatory uncertainty.

Meanwhile, Bitcoin continues to dominate liquidity and risk appetite.

Until $ETH can consistently outperform $BTC, the case for an Ethereum-led altseason in 2026 remains unconvincing.

Strength leads cycles, narratives follow.

BTC0.7%

- Reward

- like

- Comment

- Repost

- Share

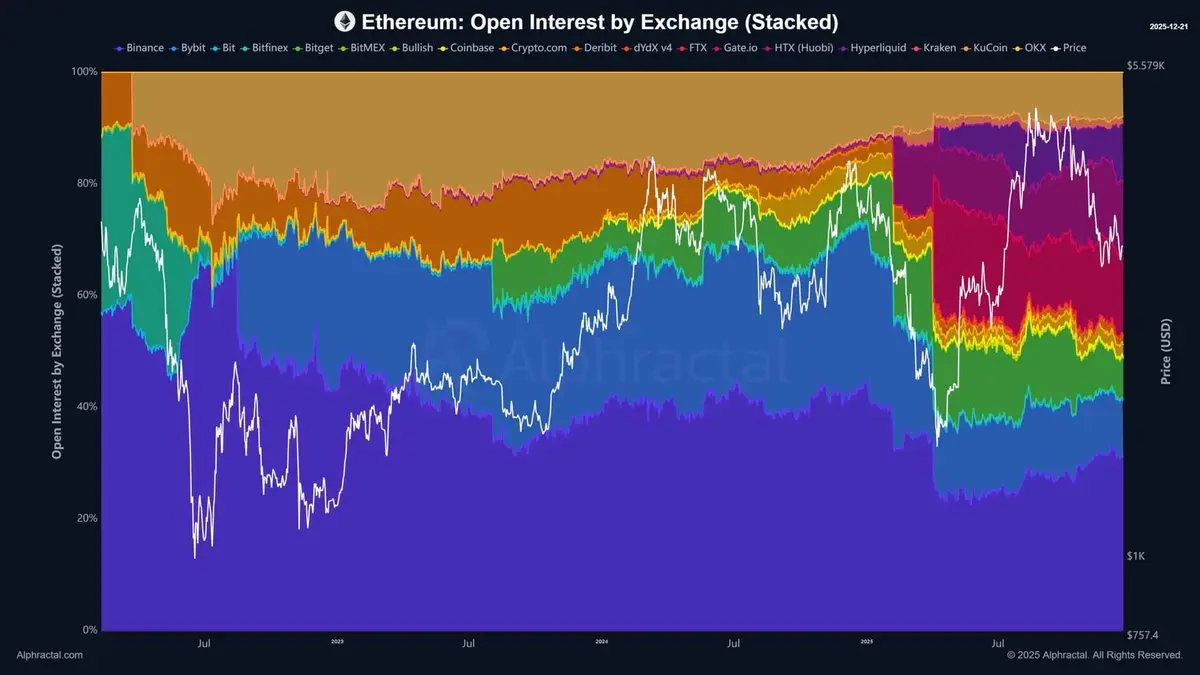

Ethereum is in a classic transition phase.

$644M in $ETH ETF outflows and a sharp drop in open interest show institutions and leveraged traders stepping back.

But beneath the surface, the largest whales are accumulating at record levels, something they rarely do during hype cycles.

This isn’t panic selling, it’s risk being flushed out.

Historically, these quiet consolidations are where the next major $ETH move is built.

$644M in $ETH ETF outflows and a sharp drop in open interest show institutions and leveraged traders stepping back.

But beneath the surface, the largest whales are accumulating at record levels, something they rarely do during hype cycles.

This isn’t panic selling, it’s risk being flushed out.

Historically, these quiet consolidations are where the next major $ETH move is built.

- Reward

- like

- Comment

- Repost

- Share

Altcoin season isn’t over, it’s evolving.

$BTC dominance remains elevated, signaling cautious capital rotation rather than broad risk-on behavior.

History suggests alt outperformance begins after patience peaks, not before.

2026 may not mark the start of Altseason, it may simply reveal who positioned correctly.

$BTC dominance remains elevated, signaling cautious capital rotation rather than broad risk-on behavior.

History suggests alt outperformance begins after patience peaks, not before.

2026 may not mark the start of Altseason, it may simply reveal who positioned correctly.

BTC0.7%

- Reward

- like

- Comment

- Repost

- Share

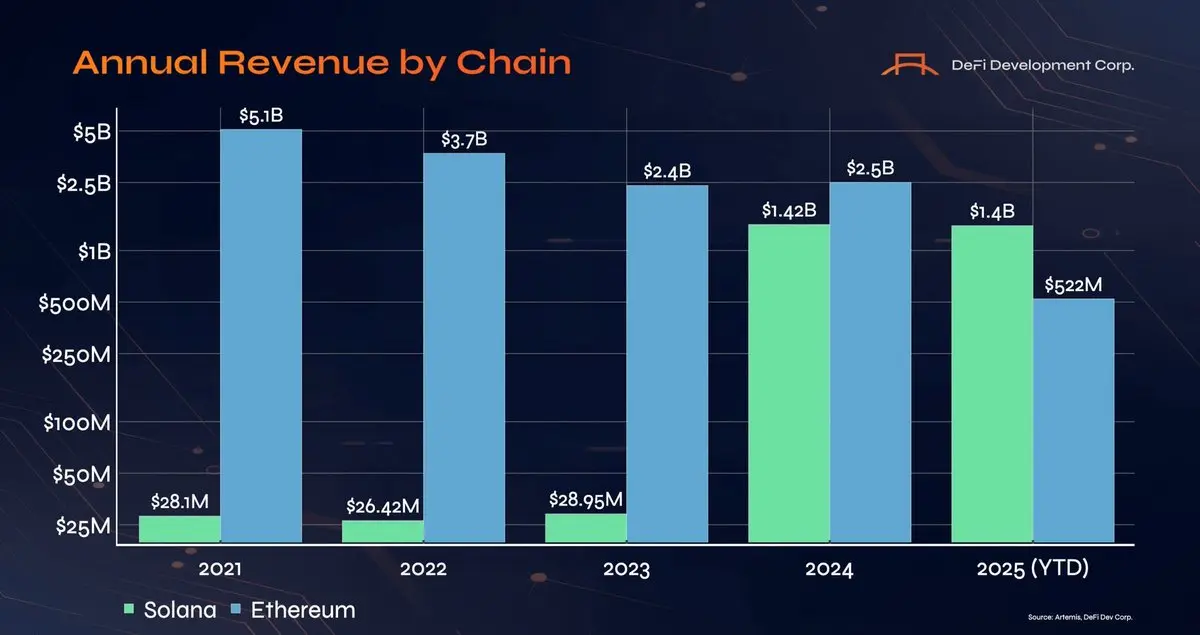

The $SOL vs. $ETH debate is evolving beyond headlines.

Solana is now leading in on-chain revenue growth, with RWA capital expanding nearly 2× faster than Ethereum, a clear signal of accelerating real-world usage.

Despite a soft SOL/ETH price ratio in 2025, fundamentals tend to move first.

When that gap closes, it rarely does so quietly.

Solana is now leading in on-chain revenue growth, with RWA capital expanding nearly 2× faster than Ethereum, a clear signal of accelerating real-world usage.

Despite a soft SOL/ETH price ratio in 2025, fundamentals tend to move first.

When that gap closes, it rarely does so quietly.

SOL-0.46%

- Reward

- like

- Comment

- Repost

- Share

7.6K $ETH sold + $19M ETF outflows hit the market, yet price holds near the realized price.

No panic. No breakdown. Sellers are being absorbed, smart money quietly accumulates, and spot/futures flows show orderly rotation, not liquidations.

RSI & MACD hint consolidation with upside potential, while ascending support keeps $3,600 in play.

This is classic accumulation at key levels, $ETH may be gearing for its next leg. Watch realized price & structure closely.

No panic. No breakdown. Sellers are being absorbed, smart money quietly accumulates, and spot/futures flows show orderly rotation, not liquidations.

RSI & MACD hint consolidation with upside potential, while ascending support keeps $3,600 in play.

This is classic accumulation at key levels, $ETH may be gearing for its next leg. Watch realized price & structure closely.

- Reward

- 2

- 2

- Repost

- Share

JackBtc :

:

Watching Closely 🔍View More

While the S&P 500 and Nasdaq keep grinding higher, $BTC has quietly decoupled, with correlations hitting yearly lows. That’s not weakness, that’s Bitcoin trading on its own cycle again.

Short term pain, long term asymmetric upside.

At the same time, capital rotation is getting selective: $BNB holding green, flipping $XRP, and showing real on-chain strength.

This market isn’t risk-on vs risk-off anymore.

It’s positioning.

And smart money is already adjusting.

Short term pain, long term asymmetric upside.

At the same time, capital rotation is getting selective: $BNB holding green, flipping $XRP, and showing real on-chain strength.

This market isn’t risk-on vs risk-off anymore.

It’s positioning.

And smart money is already adjusting.

- Reward

- like

- Comment

- Repost

- Share

Whales selling at a loss is never noise.

$PUMP is down ~30% on the month after a $6.3M whale fully exited, even as the team keeps buying back tokens daily. Buybacks are absorbing pressure, but the trend is still bearish.

Oversold doesn’t mean reversal, structure does.

Watch $0.0025 support and EMA reclaim closely.

$PUMP is down ~30% on the month after a $6.3M whale fully exited, even as the team keeps buying back tokens daily. Buybacks are absorbing pressure, but the trend is still bearish.

Oversold doesn’t mean reversal, structure does.

Watch $0.0025 support and EMA reclaim closely.

PUMP1.86%

- Reward

- like

- Comment

- Repost

- Share

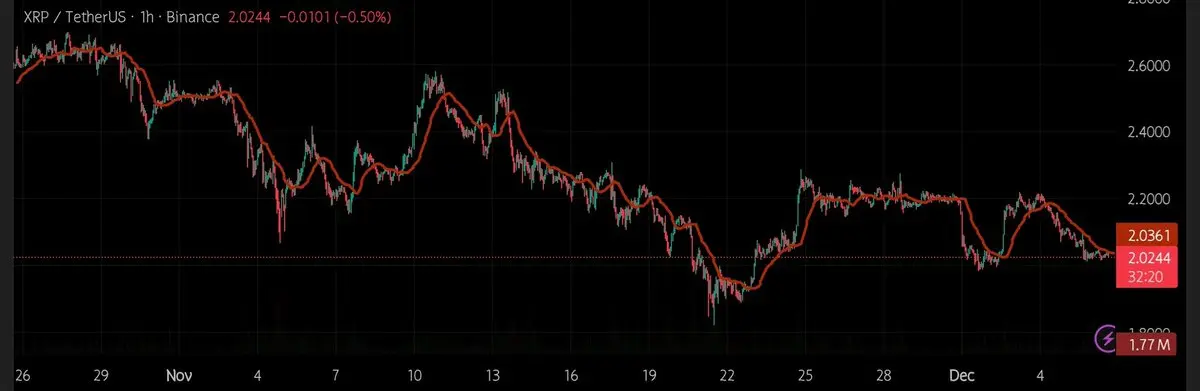

$16.4M in fresh inflows, a 19-day streak, ETF exposure expanding… yet $XRP keeps compressing near the $2 Fibonacci zone.

This isn’t distribution, it looks like absorption. RSI steady, MACD coiling, liquidity building while Ripple quietly expands payments, custody, and real-world adoption.

Markets often lag fundamentals. When positioning completes, price doesn’t ask for permission.

Shared Via Coinex Creator Program @creators

This isn’t distribution, it looks like absorption. RSI steady, MACD coiling, liquidity building while Ripple quietly expands payments, custody, and real-world adoption.

Markets often lag fundamentals. When positioning completes, price doesn’t ask for permission.

Shared Via Coinex Creator Program @creators

- Reward

- like

- Comment

- Repost

- Share

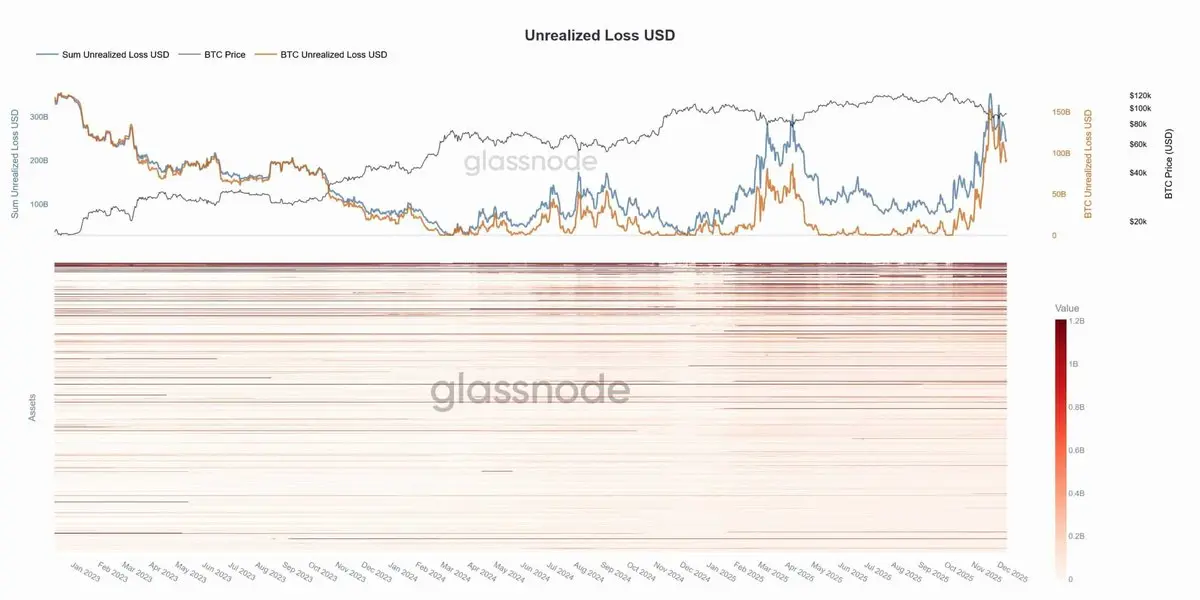

A $BTC whale just offloaded 2,000 $BTC at a $5M realized loss, a clear capitulation move.

Unrealized losses across crypto have now ballooned to $350B, with Bitcoin alone carrying $85B.

Meanwhile, exchange netflows stay negative for 5 days straight, signaling quiet accumulation.

$BTC is now pinned between EMA20 support and major EMAs overhead.

Above $94K = momentum flips.

Lose $90K = pressure resumes.

This is the exact zone where cycles turn.

Unrealized losses across crypto have now ballooned to $350B, with Bitcoin alone carrying $85B.

Meanwhile, exchange netflows stay negative for 5 days straight, signaling quiet accumulation.

$BTC is now pinned between EMA20 support and major EMAs overhead.

Above $94K = momentum flips.

Lose $90K = pressure resumes.

This is the exact zone where cycles turn.

BTC0.7%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

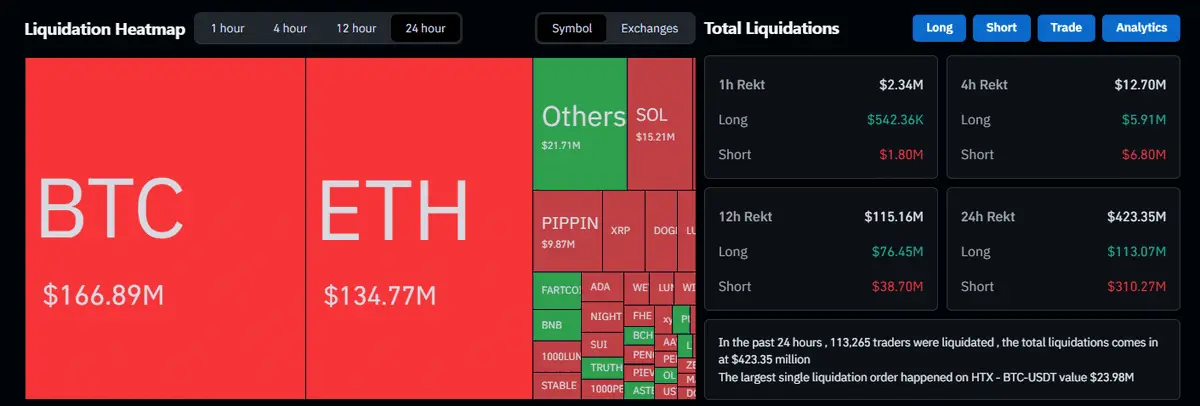

$XRP just proved again why it moves on its own timeline.

$BTC ripped, $ETH and $SOL followed… but XRP barely woke up.

$423M wiped out across the market, volatility exploding, yet $XRP still lagging is the real red flag here.

If this momentum doesn’t shift soon, the market might start pricing that weakness in.

Watching closely.

$BTC ripped, $ETH and $SOL followed… but XRP barely woke up.

$423M wiped out across the market, volatility exploding, yet $XRP still lagging is the real red flag here.

If this momentum doesn’t shift soon, the market might start pricing that weakness in.

Watching closely.

- Reward

- like

- Comment

- Repost

- Share

Whales are shaking the Solana waters again, another 100k $SOL (~$13M) just hit exchanges.

Selling pressure is stacking up, DMI is deep in the red, and $SOL is fighting to hold that $130 support.

If this bleed continues, sub-$130 isn’t off the table… but a reclaim above $140 flips the script fast.

Volatility is heating up, stay sharp.

Shared Via Coinex Creator Program @creators

Selling pressure is stacking up, DMI is deep in the red, and $SOL is fighting to hold that $130 support.

If this bleed continues, sub-$130 isn’t off the table… but a reclaim above $140 flips the script fast.

Volatility is heating up, stay sharp.

Shared Via Coinex Creator Program @creators

- Reward

- like

- Comment

- Repost

- Share

Whales just dropped $400M+ in $ETH longs while spot buyers are defending the $3K zone like a fortress.

This isn’t noise, it’s conviction.

When the biggest players take the same side, the market listens.

If ETH holds above $3,000, the next move could be explosive.

If it loses this level… expect a quick 8–10% sweep.

Ethereum is at a make-or-break floor, and the smart money is already choosing its direction.

This isn’t noise, it’s conviction.

When the biggest players take the same side, the market listens.

If ETH holds above $3,000, the next move could be explosive.

If it loses this level… expect a quick 8–10% sweep.

Ethereum is at a make-or-break floor, and the smart money is already choosing its direction.

- Reward

- like

- 1

- Repost

- Share

klcai :

:

Isn't that nonsense?Dogecoin is flashing some serious warnings

Exchange inflows rising, network activity fading, and support levels getting thinner by the day. If bulls don’t reclaim $0.1535, the path toward $0.081 becomes very real.

This market doesn’t lie, momentum is shifting, and only strong demand can flip the trend.

Stay sharp, manage risk, and don’t ignore the data.

Shared Via Coinex Creator Program @creators

Exchange inflows rising, network activity fading, and support levels getting thinner by the day. If bulls don’t reclaim $0.1535, the path toward $0.081 becomes very real.

This market doesn’t lie, momentum is shifting, and only strong demand can flip the trend.

Stay sharp, manage risk, and don’t ignore the data.

Shared Via Coinex Creator Program @creators

- Reward

- like

- Comment

- Repost

- Share

$BTC continues to show strong structural integrity despite recent pullbacks. Price is stabilizing above the $90K region, a key support that has consistently attracted buyers throughout this cycle.

What the chart highlights:

• Price Structure: After tapping liquidity near the local lows, $BTC has recovered into a controlled consolidation zone. This behavior indicates sustained demand and strong market absorption.

• Volatility Metrics: The volatility index remains compressed. Historically, these low-volatility pockets often precede expansion phases, suggesting that the market is gearing up for a

What the chart highlights:

• Price Structure: After tapping liquidity near the local lows, $BTC has recovered into a controlled consolidation zone. This behavior indicates sustained demand and strong market absorption.

• Volatility Metrics: The volatility index remains compressed. Historically, these low-volatility pockets often precede expansion phases, suggesting that the market is gearing up for a

- Reward

- like

- Comment

- Repost

- Share

Ripple just moved 250M $XRP, and the entire liquidity structure shifted within minutes.

• Exchange reserves down 2.51%

• Taker Buy CVD climbing aggressively

• Double-bottom forming at $1.99

• Neckline sitting at $2.2443, the level everyone’s watching

When supply tightens + buy pressure rises, reactions get sharper.

If $XRP clears the neckline with momentum, the road to $2.50 isn’t just possible, it’s structurally supported.

On-chain, liquidity, and market behavior are finally pointing in the same direction.

This next move might define the trend.

• Exchange reserves down 2.51%

• Taker Buy CVD climbing aggressively

• Double-bottom forming at $1.99

• Neckline sitting at $2.2443, the level everyone’s watching

When supply tightens + buy pressure rises, reactions get sharper.

If $XRP clears the neckline with momentum, the road to $2.50 isn’t just possible, it’s structurally supported.

On-chain, liquidity, and market behavior are finally pointing in the same direction.

This next move might define the trend.

XRP-0.47%

- Reward

- like

- Comment

- Repost

- Share

$XRP continues to exhibit a structured downtrend, maintaining a sequence of lower highs while trading beneath its short-term moving average.

The 2.02–2.03 support band is providing stability, though current momentum and volume remain subdued.

A decisive reclaim of 2.10 would be the first indication of trend improvement, whereas a breakdown below 2.00 could accelerate bearish continuation.

A disciplined, confirmation-driven approach remains prudent.

The 2.02–2.03 support band is providing stability, though current momentum and volume remain subdued.

A decisive reclaim of 2.10 would be the first indication of trend improvement, whereas a breakdown below 2.00 could accelerate bearish continuation.

A disciplined, confirmation-driven approach remains prudent.

XRP-0.47%

- Reward

- like

- Comment

- Repost

- Share