Save the Children recently announced the launch of a Bitcoin fund, a move that further extends the application scenarios of cryptocurrencies into the fields of public welfare and charity.

The fund not only allows Save the Children to hold Bitcoin but also plans to pilot digital wallets. The core goal is to leverage the characteristics of cryptocurrencies to accelerate the delivery efficiency of emergency aid. In traditional charitable aid, issues such as cumbersome fund transfers and slow cross-border payments often arise. The decentralization and convenience of cross-border transfers of crypt

The fund not only allows Save the Children to hold Bitcoin but also plans to pilot digital wallets. The core goal is to leverage the characteristics of cryptocurrencies to accelerate the delivery efficiency of emergency aid. In traditional charitable aid, issues such as cumbersome fund transfers and slow cross-border payments often arise. The decentralization and convenience of cross-border transfers of crypt

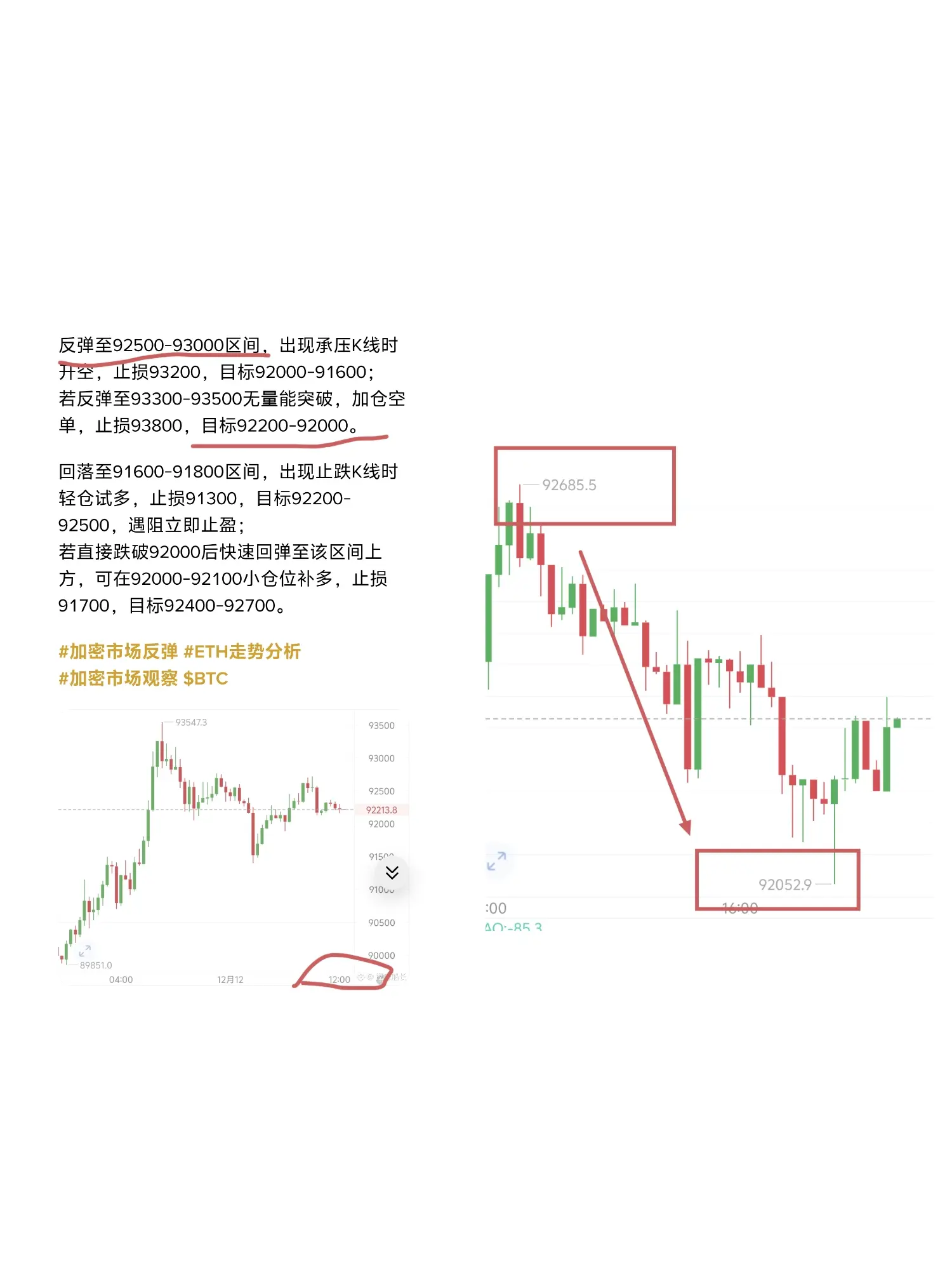

BTC-2.3%