0xbit

No content yet

0xbit

Recent market movements once again confirm: gold is a safe-haven asset, while BTC is a risk asset, even more volatile than U.S. stocks (especially the Tech 7 giants). The sharp decline in gold and silver is due to market makers actively shorting for hedging purposes and leverage unwinding; the drop in cryptocurrencies like BTC mainly reflects the collapse of macro liquidity and the failure of rate cut expectations. The only thing that could boost the crypto market is the Fed's liquidity injection, but this expectation was shattered with the announcement of the new hawkish Federal Reserve Chair

BTC-2,21%

- Reward

- like

- Comment

- Repost

- Share

BTC remains a risk asset, while gold is a risk-averse asset!

BTC's liquidity is controlled by Wall Street institutions, following the fluctuations of the US dollar market, and its volatility is even greater than that of mature assets like US stocks.

Gold is a global asset, truly borderless. When the US dollar fluctuates, it remains relatively stable. When the dollar falls, gold rises!

BTC's liquidity is controlled by Wall Street institutions, following the fluctuations of the US dollar market, and its volatility is even greater than that of mature assets like US stocks.

Gold is a global asset, truly borderless. When the US dollar fluctuates, it remains relatively stable. When the dollar falls, gold rises!

BTC-2,21%

- Reward

- like

- Comment

- Repost

- Share

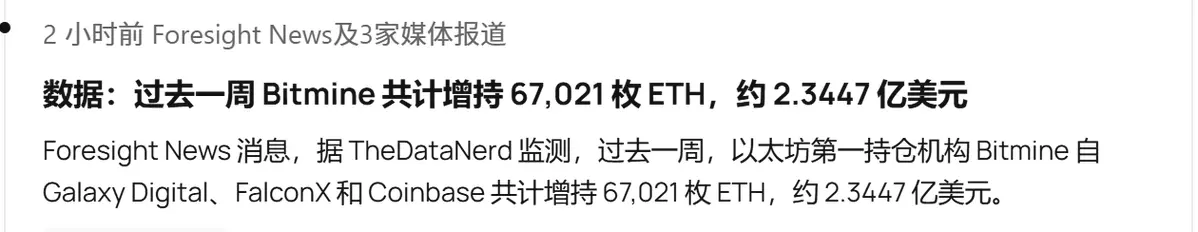

The news must be viewed together!

View Original

- Reward

- like

- Comment

- Repost

- Share

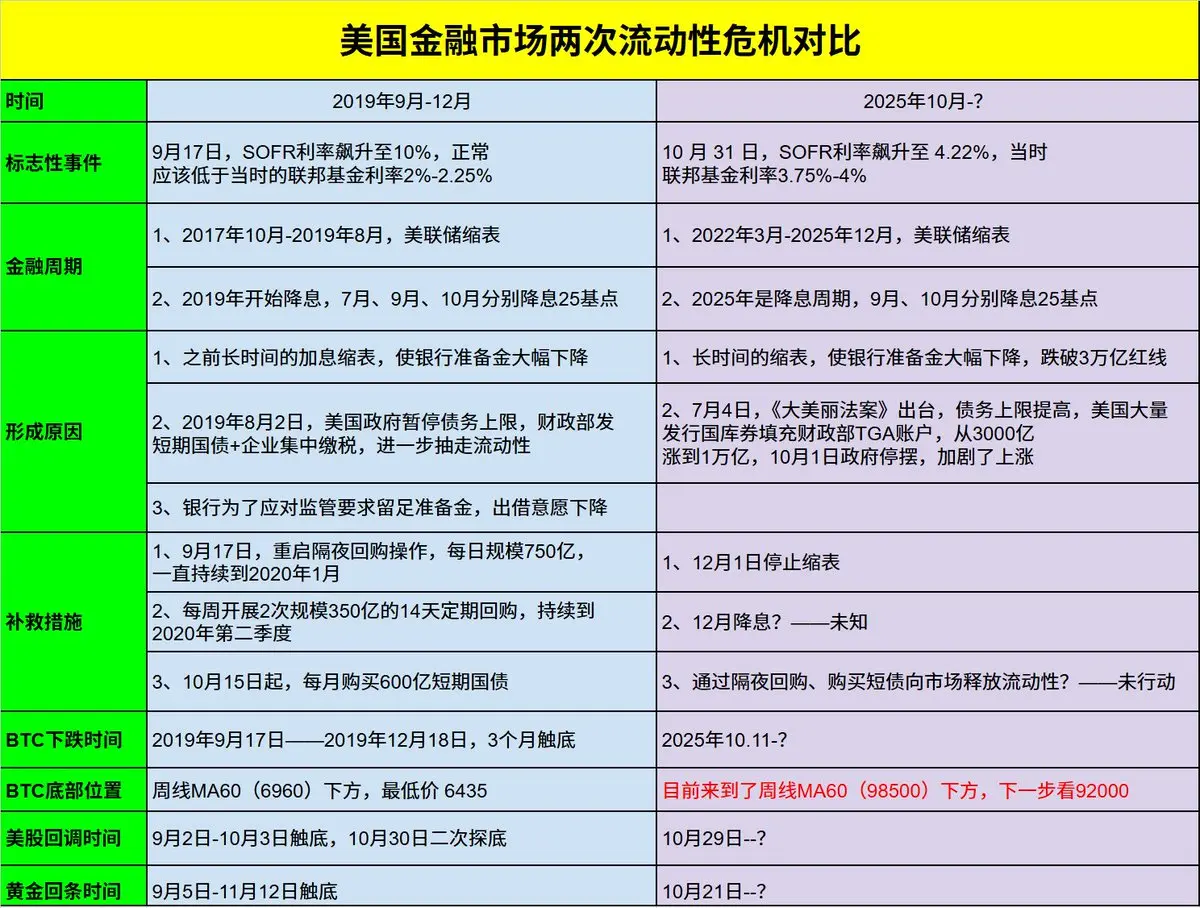

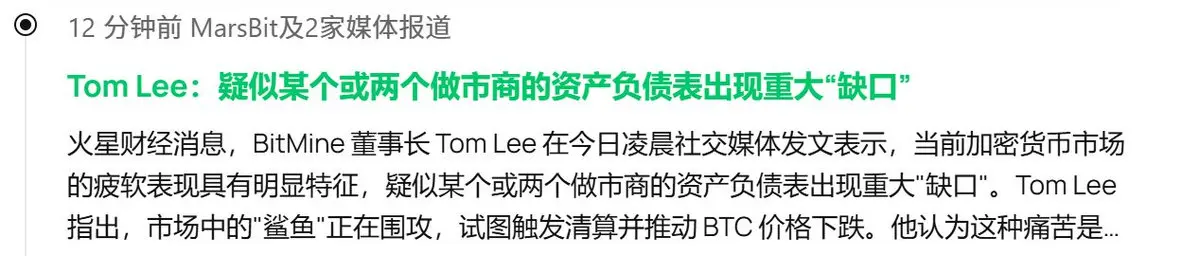

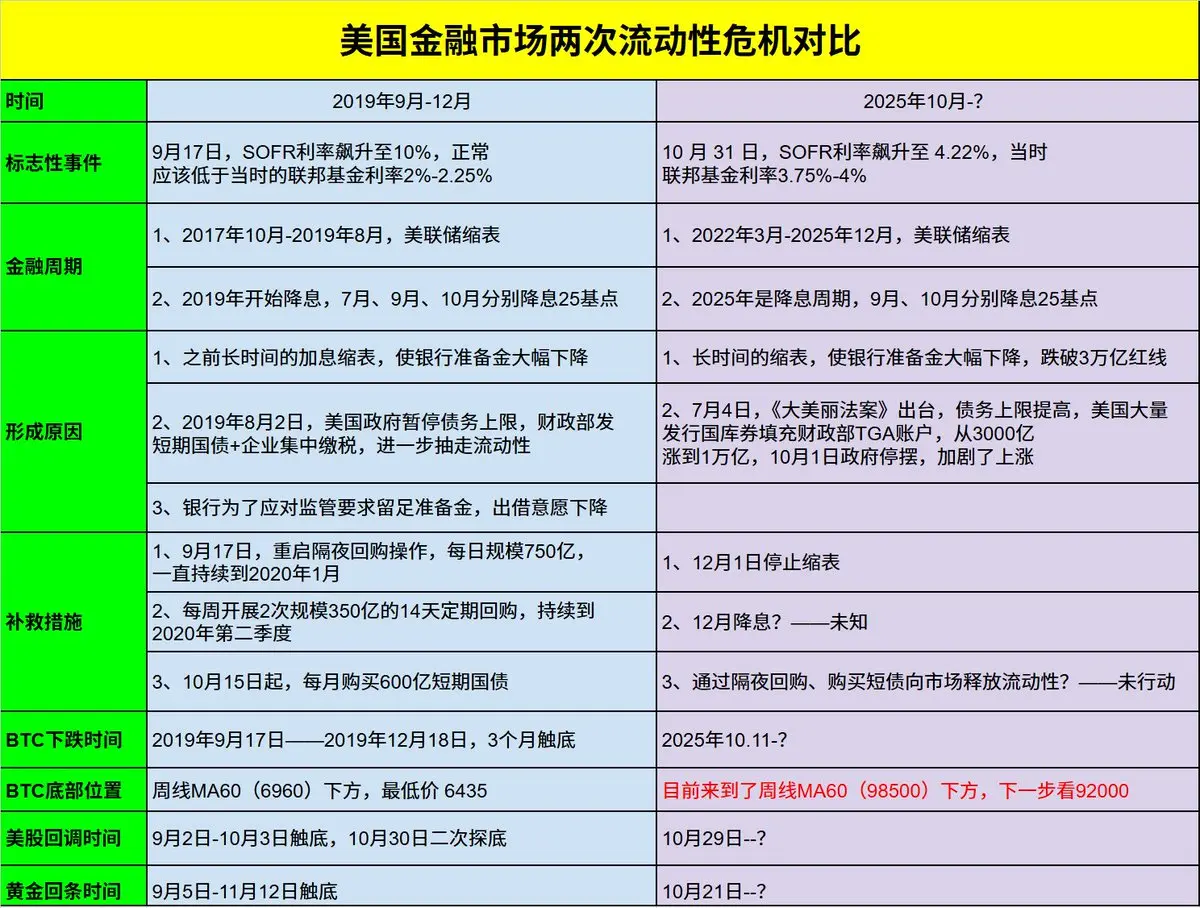

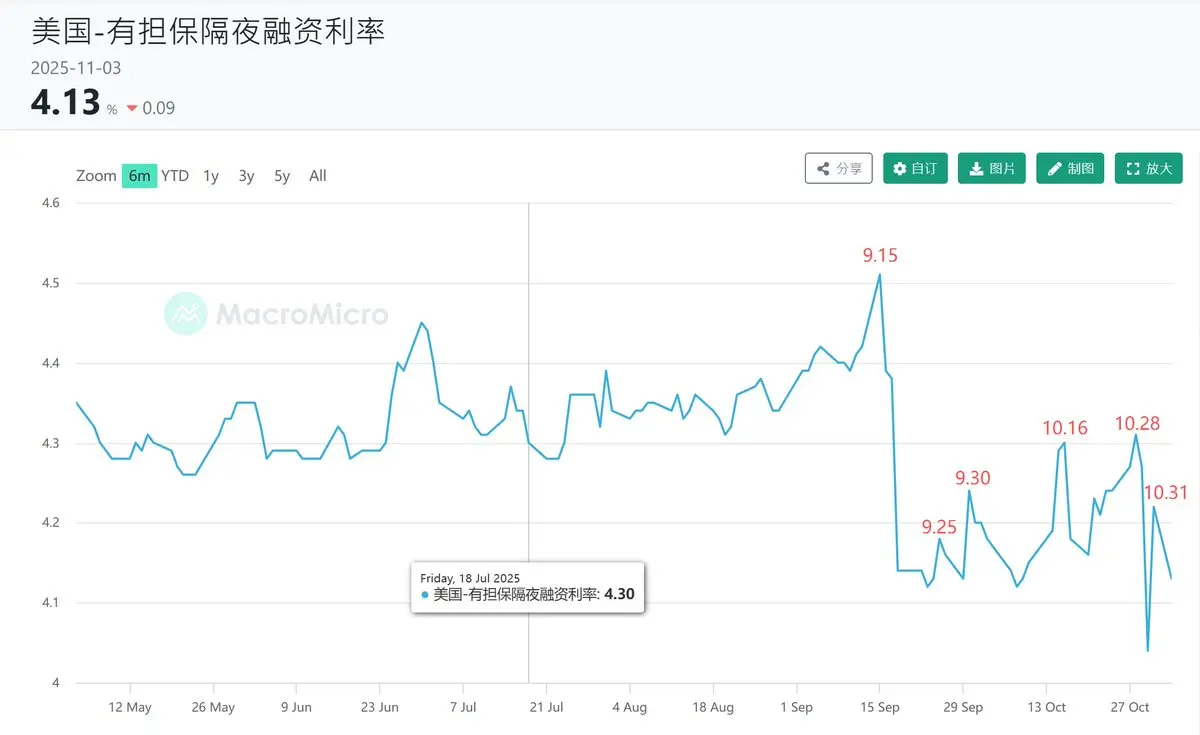

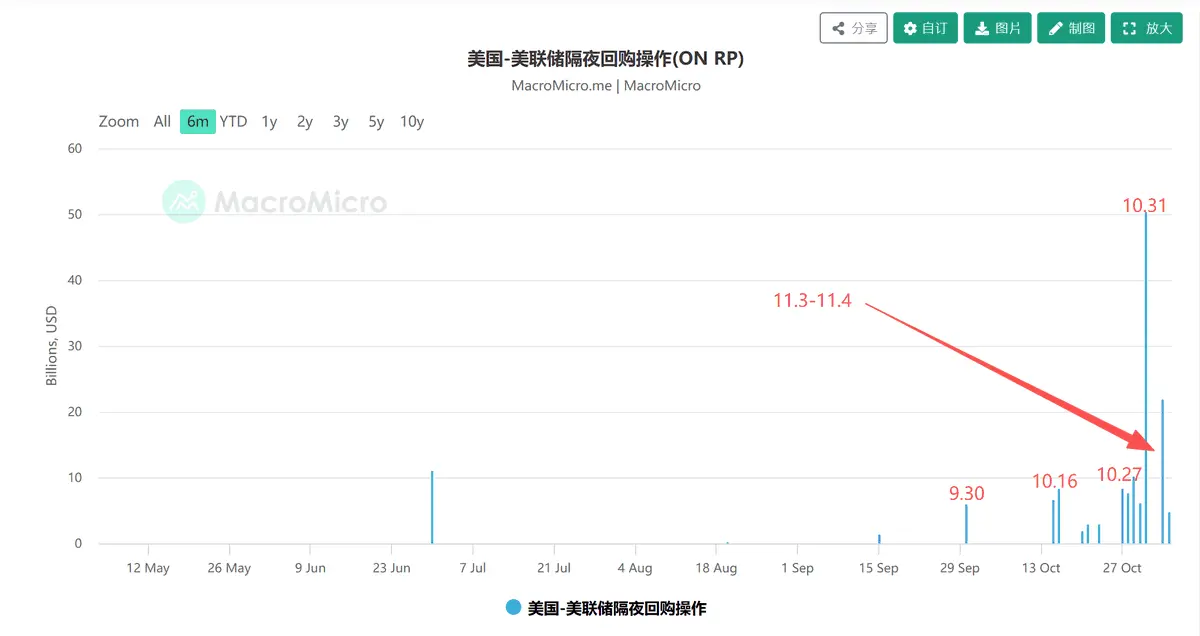

Comparison of the two liquidity crises in the US financial markets:

1. This time it is not as severe as in 2019, and the degree of easing is far less than in 2019.

2. This liquidity crisis, compounded by the government shutdown, has increased uncertainty.

3. Currently, the depth of the BTC drop is similar to that of 2019.

4. This market has hit bottom, and it may take further easing from the Federal Reserve—such as overnight repos and the purchase of short-term government bonds!

1. This time it is not as severe as in 2019, and the degree of easing is far less than in 2019.

2. This liquidity crisis, compounded by the government shutdown, has increased uncertainty.

3. Currently, the depth of the BTC drop is similar to that of 2019.

4. This market has hit bottom, and it may take further easing from the Federal Reserve—such as overnight repos and the purchase of short-term government bonds!

BTC-2,21%

- Reward

- like

- Comment

- Repost

- Share

The halt is about to end, and a pullback is a great opportunity to buy the dip!

From the weekly perspective, BTC may once again test 99,000 this week, which is near the blue M60 line.

The reason is that, since the standstill has not yet ended, employment data and CPI data cannot be released on time, and there are internal disagreements within the Federal Reserve regarding whether to cut interest rates in December!

The outlook for interest rate cuts is unclear, and with another Federal Reserve official warning about inflation, the market has fallen into panic selling again.

However, it is unlik

From the weekly perspective, BTC may once again test 99,000 this week, which is near the blue M60 line.

The reason is that, since the standstill has not yet ended, employment data and CPI data cannot be released on time, and there are internal disagreements within the Federal Reserve regarding whether to cut interest rates in December!

The outlook for interest rate cuts is unclear, and with another Federal Reserve official warning about inflation, the market has fallen into panic selling again.

However, it is unlik

BTC-2,21%

- Reward

- like

- Comment

- Repost

- Share

BTC Market Analysis:

From the weekly perspective, BTC may once again test 100,000 this week, which is near the blue M60 line.

The reason is that, since the standstill has not yet ended, employment data and CPI data cannot be released on time, and there is disagreement within the Federal Reserve regarding whether to cut interest rates in December!

The outlook for interest rate cuts is uncertain, and with another Federal Reserve official warning about inflation, the market has once again experienced a panic sell-off.

However, the level of panic should gradually decrease, as this week the likelih

From the weekly perspective, BTC may once again test 100,000 this week, which is near the blue M60 line.

The reason is that, since the standstill has not yet ended, employment data and CPI data cannot be released on time, and there is disagreement within the Federal Reserve regarding whether to cut interest rates in December!

The outlook for interest rate cuts is uncertain, and with another Federal Reserve official warning about inflation, the market has once again experienced a panic sell-off.

However, the level of panic should gradually decrease, as this week the likelih

BTC-2,21%

- Reward

- like

- Comment

- Repost

- Share

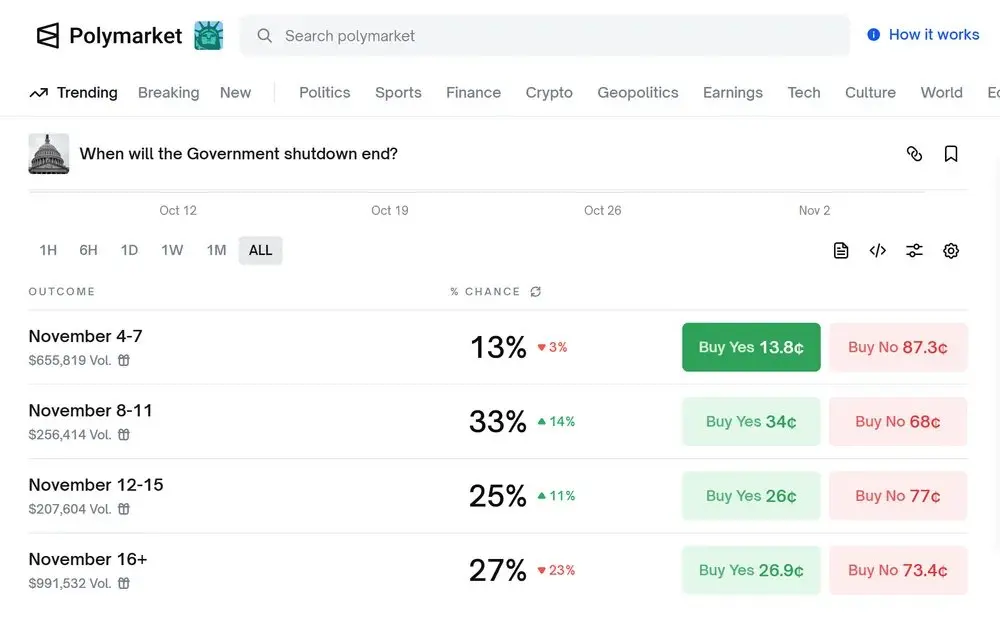

In the next 2 weeks, there is more Favourable Information than Unfavourable Information!

Favourable Information 1:

Recently, both the Democratic and Republican parties have realized that if the stalemate continues, something might happen, so they are actively promoting the passage of a "temporary funding bill." Therefore, there are bets on Polymarket that the stalemate will end between the 12th and 15th.

Favourable Information 2:

Although the CPI data for the 13th could not be released on time, the market generally accepted that even if the shutdown were to end immediately, the Labor Departmen

View OriginalFavourable Information 1:

Recently, both the Democratic and Republican parties have realized that if the stalemate continues, something might happen, so they are actively promoting the passage of a "temporary funding bill." Therefore, there are bets on Polymarket that the stalemate will end between the 12th and 15th.

Favourable Information 2:

Although the CPI data for the 13th could not be released on time, the market generally accepted that even if the shutdown were to end immediately, the Labor Departmen

- Reward

- like

- Comment

- Repost

- Share

The Great Beauty Act overall increases government spending and raises the fiscal deficit!

• Increase in expenditure areas:

The bill significantly increases funding for areas such as national defense, border security, and energy production. These measures aim to strengthen national security and energy independence, such as the construction of a border wall and the expansion of military spending.

• Reduce expenditure areas:

At the same time, the bill cuts social welfare programs such as Medicaid, welfare support, student loan assistance, nutrition programs, and "green energy" subsidies. These cu

View Original• Increase in expenditure areas:

The bill significantly increases funding for areas such as national defense, border security, and energy production. These measures aim to strengthen national security and energy independence, such as the construction of a border wall and the expansion of military spending.

• Reduce expenditure areas:

At the same time, the bill cuts social welfare programs such as Medicaid, welfare support, student loan assistance, nutrition programs, and "green energy" subsidies. These cu

- Reward

- like

- Comment

- Repost

- Share

From the price trend of coins for $SUI and $APT :

Both are public chains based on the MOVE programming language concept, with APT being listed first and the airdrop benefiting a large number of people, taking the lead.

The SUI ecosystem is assumed to be better and more prosperous than APT; therefore, the price of SUI coins has more potential.

The listing of APT is also the pinnacle, representing a microcosm of many hot concepts in VC coins.

View OriginalBoth are public chains based on the MOVE programming language concept, with APT being listed first and the airdrop benefiting a large number of people, taking the lead.

The SUI ecosystem is assumed to be better and more prosperous than APT; therefore, the price of SUI coins has more potential.

The listing of APT is also the pinnacle, representing a microcosm of many hot concepts in VC coins.

- Reward

- like

- Comment

- Repost

- Share

$ASTER has formed strong support at 0.916

In addition to the recent @CZ's open call, the trading volume at the bottom has increased.

Although the platform's trading volume has decreased a bit recently, the project has been continuously repurchasing.

When the market rebounds, it will rebound even stronger.

The support of $ASTER may be stronger than $XPL .

View OriginalIn addition to the recent @CZ's open call, the trading volume at the bottom has increased.

Although the platform's trading volume has decreased a bit recently, the project has been continuously repurchasing.

When the market rebounds, it will rebound even stronger.

The support of $ASTER may be stronger than $XPL .

- Reward

- like

- Comment

- Repost

- Share

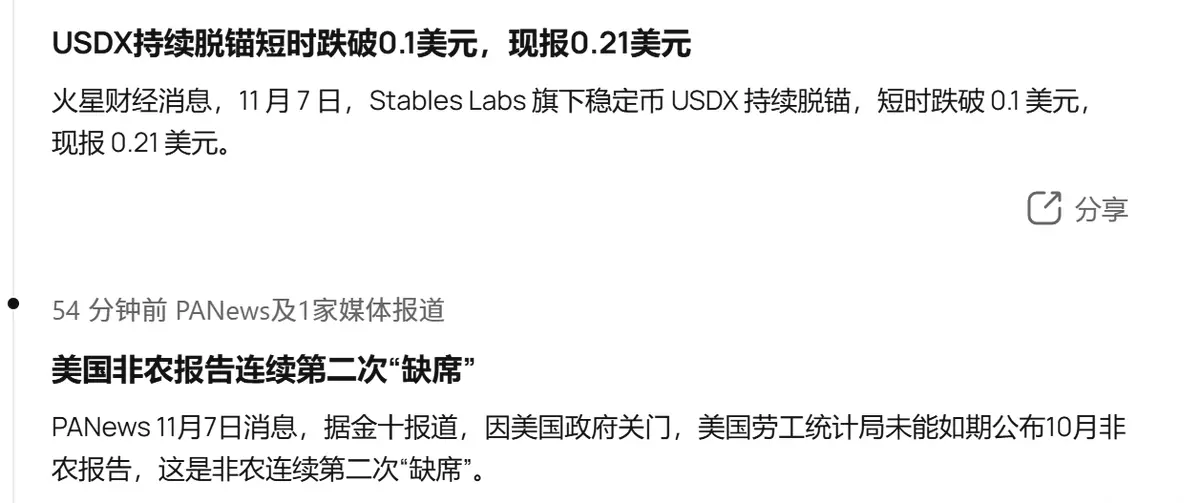

The standstill continues,

Non-farm data missing,

USDX explosion

Caused today's decline!

View OriginalNon-farm data missing,

USDX explosion

Caused today's decline!

- Reward

- like

- Comment

- Repost

- Share

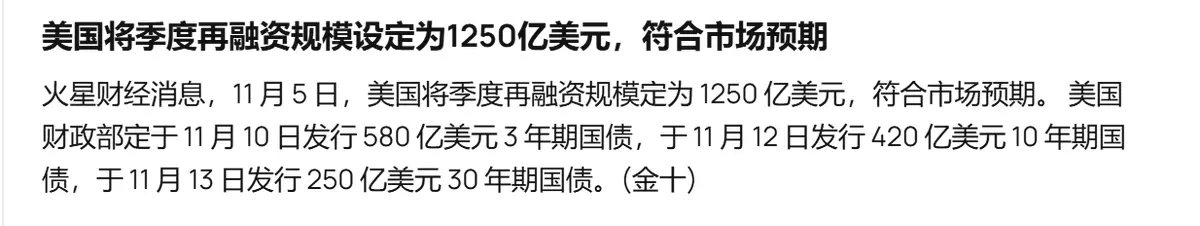

If the stalemate cannot be resolved before November 13,

Quarterly refinancing will continue to drain market liquidity!!

View OriginalQuarterly refinancing will continue to drain market liquidity!!

- Reward

- like

- Comment

- Repost

- Share

The crypto world has fallen again, when can we buy the dip?

The decline since mid-September is fundamentally due to the tightening of liquidity in the U.S. financial markets; if the crypto world wants to stop falling and rebound, we need to see when the liquidity in the financial system will ease.

The Federal Reserve has the following three short-term tools to address market liquidity:

1. Overnight repurchase

The Federal Reserve provides overnight loans to primary dealers by purchasing Treasury securities and other eligible collateral, and recovers the principal and interest the next day.

2. R

View OriginalThe decline since mid-September is fundamentally due to the tightening of liquidity in the U.S. financial markets; if the crypto world wants to stop falling and rebound, we need to see when the liquidity in the financial system will ease.

The Federal Reserve has the following three short-term tools to address market liquidity:

1. Overnight repurchase

The Federal Reserve provides overnight loans to primary dealers by purchasing Treasury securities and other eligible collateral, and recovers the principal and interest the next day.

2. R

- Reward

- like

- Comment

- Repost

- Share

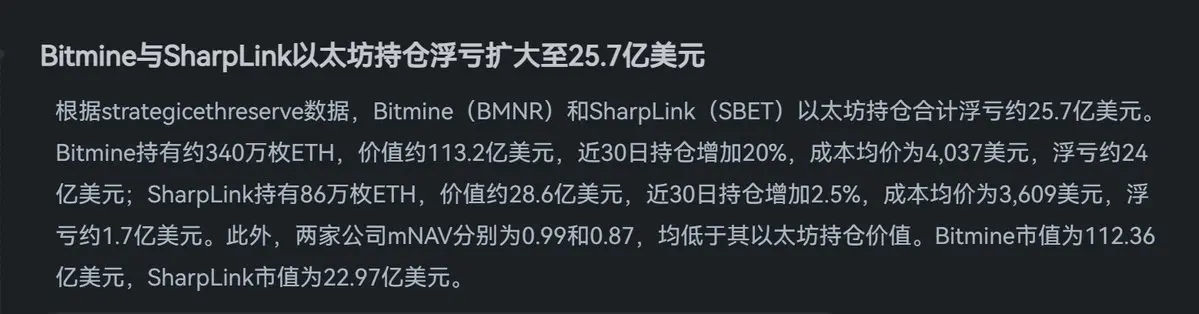

In this cycle, mainstream tokens like BTC and ETH have gained a significant inflow of external funds through the "Treasury" model.

In terms of time, it's a magnified version of "Grayscale".

When the cryptocurrency market enters a bear market and coin prices drop, these treasury companies will see their asset values shrink, and their stocks will also decline.

Then a vicious cycle is formed, Davis double kill!

The rise and fall come from the same source. In a bull market, the rise can be very crazy, while the decline can be very tragic for the brothers!

View OriginalIn terms of time, it's a magnified version of "Grayscale".

When the cryptocurrency market enters a bear market and coin prices drop, these treasury companies will see their asset values shrink, and their stocks will also decline.

Then a vicious cycle is formed, Davis double kill!

The rise and fall come from the same source. In a bull market, the rise can be very crazy, while the decline can be very tragic for the brothers!

- Reward

- like

- Comment

- Repost

- Share

Use data to prove that the current financial market is facing a liquidity crisis!

1. Bank reserves fall below 3 trillion

-What is bank reserve?

The essence of a bank is to absorb deposits and issue loans. This means that not 100% of the money deposited into the bank is kept there, and of course, not 100% can be loaned out. A portion of the funds needs to be kept to handle cash withdrawals from depositors; otherwise, there would be a risk of a bank run.

-Why 30 trillion?

30 trillion is the market-recognized watershed between "Liquidity Abundance" and "Liquidity Tightness."

After the 2008 financ

View Original1. Bank reserves fall below 3 trillion

-What is bank reserve?

The essence of a bank is to absorb deposits and issue loans. This means that not 100% of the money deposited into the bank is kept there, and of course, not 100% can be loaned out. A portion of the funds needs to be kept to handle cash withdrawals from depositors; otherwise, there would be a risk of a bank run.

-Why 30 trillion?

30 trillion is the market-recognized watershed between "Liquidity Abundance" and "Liquidity Tightness."

After the 2008 financ

- Reward

- like

- Comment

- Repost

- Share

Always increase the position,

Forever filled with tears of joy!

View OriginalForever filled with tears of joy!

- Reward

- like

- Comment

- Repost

- Share

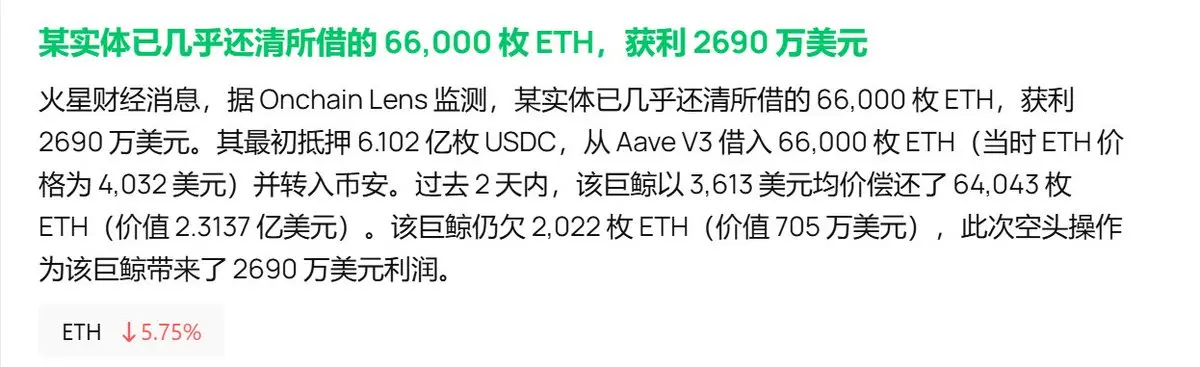

Lending arbitrage, worth learning from!

View Original

- Reward

- like

- Comment

- Repost

- Share

Why do people say that the end of the government shutdown in the United States will ease market Liquidity?

The U.S. Treasury maintains a funding account at the Federal Reserve, commonly referred to in the news as the TGA account.

The Ministry of Finance's sources of income mainly consist of two types: taxation and the issuance of government bonds.

Expenditures mainly go to the following five areas, except for paying interest on national debt, the other funds are all flowing into economic activities.

During the suspension period, all tax revenue continued as usual, except for the issuance o

View OriginalThe U.S. Treasury maintains a funding account at the Federal Reserve, commonly referred to in the news as the TGA account.

The Ministry of Finance's sources of income mainly consist of two types: taxation and the issuance of government bonds.

Expenditures mainly go to the following five areas, except for paying interest on national debt, the other funds are all flowing into economic activities.

During the suspension period, all tax revenue continued as usual, except for the issuance o

- Reward

- like

- Comment

- Repost

- Share

The stablecoin public chain XPL has fallen so much, can it be bought?

Compared to the concept of stablecoin public chains, XPL has the best practical effect so far, ranking second in the AAVE protocol, and should currently be considered a leader in this field.

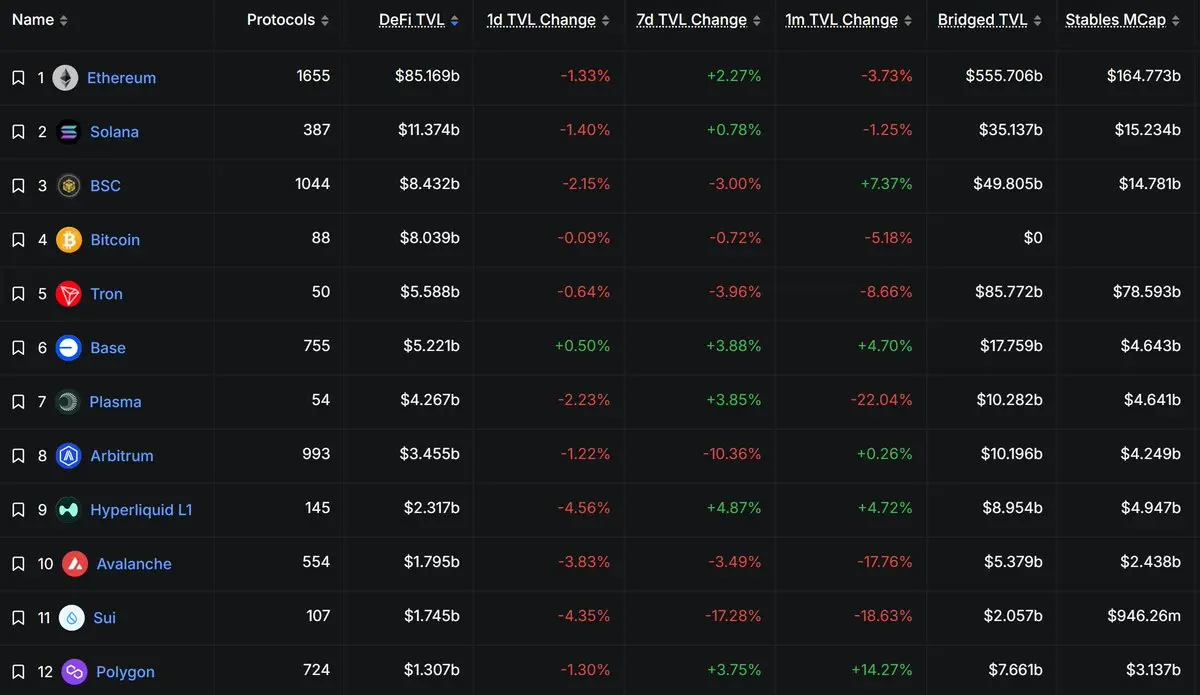

In terms of TVL of public chains, Plasma's TVL has surpassed popular public chains such as Arbitrum, Hyperliquid L1, Avalanche, SUI, and Polygon.

The current circulating market value of $XPL is 568 million, with a total market value of 3 billion.

Find a few dedicated public chains/new public chains to compare.

$APT, the leader in mov

View OriginalCompared to the concept of stablecoin public chains, XPL has the best practical effect so far, ranking second in the AAVE protocol, and should currently be considered a leader in this field.

In terms of TVL of public chains, Plasma's TVL has surpassed popular public chains such as Arbitrum, Hyperliquid L1, Avalanche, SUI, and Polygon.

The current circulating market value of $XPL is 568 million, with a total market value of 3 billion.

Find a few dedicated public chains/new public chains to compare.

$APT, the leader in mov

- Reward

- 2

- Comment

- Repost

- Share

Trending Topics

View More212.45K Popularity

7.95K Popularity

10.81K Popularity

11.08K Popularity

5.4K Popularity

Pin