AutumnRiley

No content yet

AutumnRiley

$410M in liquidations followed the US jobs data.

Unemployment fell to 4.3% in January, reinforcing fears of prolonged tight monetary policy from the Fed. Trump celebrated the numbers, but crypto reacted to liquidity risks.

Bitcoin was pushed out of its consolidation range, opening the path toward $62k unless bulls regain control.

$BTC

Unemployment fell to 4.3% in January, reinforcing fears of prolonged tight monetary policy from the Fed. Trump celebrated the numbers, but crypto reacted to liquidity risks.

Bitcoin was pushed out of its consolidation range, opening the path toward $62k unless bulls regain control.

$BTC

BTC1,36%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

💰$BTC is currently gathering the densest zone of long liquidity on the annual chart.

The question of sentiment always works the same way.

No one believes in a rebound at the very bottom of the market.

Similarly, no one believes in a collapse at the very peak.

We are currently in a phase of maximum depression.

But this is just a game played by whales; the market will grow and grow strongly.

The question of sentiment always works the same way.

No one believes in a rebound at the very bottom of the market.

Similarly, no one believes in a collapse at the very peak.

We are currently in a phase of maximum depression.

But this is just a game played by whales; the market will grow and grow strongly.

BTC1,36%

- Reward

- like

- Comment

- Repost

- Share

All 8 traders once made huge profits on Hyperliquid, but every one of them ended up getting wiped out. 🚨 Stay away from high leverage.

HYPE0,53%

- Reward

- like

- Comment

- Repost

- Share

$BNB is currently trading inside a high-probability order block zone at $825.8 – $843.2.

This is the area where buyers need to defend.

A successful defense followed by an upward market structure shift could trigger a strong impulsive move to the upside.

Initial target: $868.1 (VAL)

Beyond that, continuation depends on volume expansion and acceptance above value.

This is a zone to observe, not chase.

This is the area where buyers need to defend.

A successful defense followed by an upward market structure shift could trigger a strong impulsive move to the upside.

Initial target: $868.1 (VAL)

Beyond that, continuation depends on volume expansion and acceptance above value.

This is a zone to observe, not chase.

BNB2,35%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

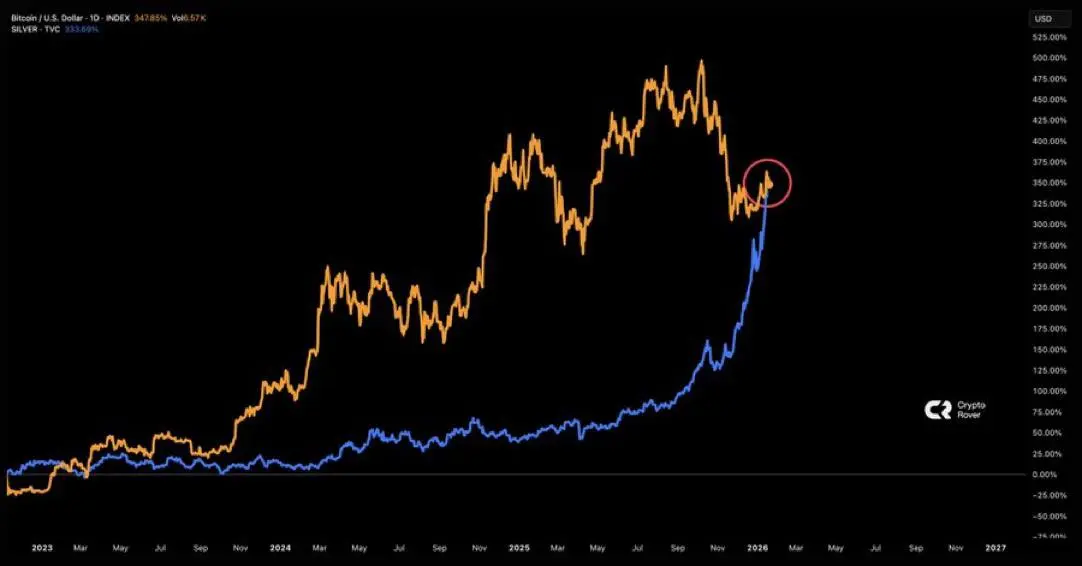

Silver is on 🔥!

From its 2022 lows, it’s surging so fast that it’s about to overtake Bitcoin’s multi-year gains and it did in months what BTC took 4 years to do.

While Bitcoin rose ~400% from $18k to $91k over 3.5 years, silver shot ~350%+ from ~$20 to $90 in a fraction of the time.

Different assets, different drivers, but the speed of silver’s rally is absolutely insane.

#silver #btc

From its 2022 lows, it’s surging so fast that it’s about to overtake Bitcoin’s multi-year gains and it did in months what BTC took 4 years to do.

While Bitcoin rose ~400% from $18k to $91k over 3.5 years, silver shot ~350%+ from ~$20 to $90 in a fraction of the time.

Different assets, different drivers, but the speed of silver’s rally is absolutely insane.

#silver #btc

BTC1,36%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Markets are not moving randomly.

They are reacting to geopolitical pressure

.

Donald J. Trump’s continuous involvement in geopolitics is adding uncertainty, and markets are pricing that risk accordingly.

🔹 Metals (Safe Haven)

Gold and Silver are acting exactly as expected — strong bullish trends as capital looks for safety.

🔹 Stocks (Risk Assets)

Equities are showing distribution and instability. In uncertain macro conditions, risk appetite fades, and stocks become vulnerable to a bearish phase.

🔹 Crypto (High-Risk, Fast-Reacting Market)

Crypto is always the first to react.

That’s why we se

They are reacting to geopolitical pressure

.

Donald J. Trump’s continuous involvement in geopolitics is adding uncertainty, and markets are pricing that risk accordingly.

🔹 Metals (Safe Haven)

Gold and Silver are acting exactly as expected — strong bullish trends as capital looks for safety.

🔹 Stocks (Risk Assets)

Equities are showing distribution and instability. In uncertain macro conditions, risk appetite fades, and stocks become vulnerable to a bearish phase.

🔹 Crypto (High-Risk, Fast-Reacting Market)

Crypto is always the first to react.

That’s why we se

- Reward

- 1

- 1

- Repost

- Share

BeratLe :

:

Happy New Year! 🤑- Reward

- like

- Comment

- Repost

- Share

More than 53% of tokens launched since 2021 are no longer active

CoinGecko data shows that over half of crypto tokens introduced in the past five years have lost liquidity and trading activity.

The largest wave of project shutdowns occurred in 2025, as the market shifted away from speculation and began demanding real utility from crypto projects.

CoinGecko data shows that over half of crypto tokens introduced in the past five years have lost liquidity and trading activity.

The largest wave of project shutdowns occurred in 2025, as the market shifted away from speculation and began demanding real utility from crypto projects.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More88.47K Popularity

7.72K Popularity

7.97K Popularity

54.96K Popularity

4.42K Popularity

Pin