Bitcvesting

No content yet

Bitcvesting

Significant Outflow Sign of Bitcoin ETF, Pompliano: Even though BTC Price is Already Cheap**

Spot Bitcoin ETF products in the United States recorded an outflow of funds amounting to US$1.17 billion in the last five days. This marks the longest period since April when the price of Bitcoin was still around US$79,625.

Nevertheless, crypto entrepreneur Anthony Pompliano believes that the current conditions actually open up opportunities. In his interview with CNBC, he stated that at the level of US$112,000 to US$113,000, Bitcoin appears to be very cheap.

Pompliano added that entering September and

View OriginalSpot Bitcoin ETF products in the United States recorded an outflow of funds amounting to US$1.17 billion in the last five days. This marks the longest period since April when the price of Bitcoin was still around US$79,625.

Nevertheless, crypto entrepreneur Anthony Pompliano believes that the current conditions actually open up opportunities. In his interview with CNBC, he stated that at the level of US$112,000 to US$113,000, Bitcoin appears to be very cheap.

Pompliano added that entering September and

- Reward

- like

- Comment

- Repost

- Share

📢 Ripple vs SEC Lawsuit Officially Ends, XRP Soars 13%!

After 4.5 years of legal battle, Ripple and the SEC have officially ended their lawsuit, with all charges dropped as of Thursday (08/08). In response, XRP surged 13% to US$3.35.

📌 Key outcomes:

Court reaffirms XRP is not a security in public sales

Ripple to pay a US$50 million fine for institutional sales

Major regulatory hurdle is now gone

✅ Ripple's legal chief confirmed operations will return to normal. ETF optimism rises asBloomberg’s Eric Balchunas raised the XRP ETF approval odds to 95%. Japan’s SBI Holdings also filed for an XRP

After 4.5 years of legal battle, Ripple and the SEC have officially ended their lawsuit, with all charges dropped as of Thursday (08/08). In response, XRP surged 13% to US$3.35.

📌 Key outcomes:

Court reaffirms XRP is not a security in public sales

Ripple to pay a US$50 million fine for institutional sales

Major regulatory hurdle is now gone

✅ Ripple's legal chief confirmed operations will return to normal. ETF optimism rises asBloomberg’s Eric Balchunas raised the XRP ETF approval odds to 95%. Japan’s SBI Holdings also filed for an XRP

- Reward

- like

- Comment

- Repost

- Share

📢 Trump Officially Allows Crypto in 401(k) Retirement Plans!

President Donald Trump has signed an executive order allowing crypto to be included in 401(k) retirement portfolios in the U.S. (Thursday, August 7th).

💼 This opens the door for crypto to tap into the US$12.5 trillion retirement market, signaling massive potential for broader adoption among American workers.

🔧 Key mandates from the order:

Department of Labor to revise ERISA rules limiting crypto

SEC to facilitate access to crypto for retirement participants

🧭 This move aligns with Trump’s broaderpro-crypto stance, following:

Crea

President Donald Trump has signed an executive order allowing crypto to be included in 401(k) retirement portfolios in the U.S. (Thursday, August 7th).

💼 This opens the door for crypto to tap into the US$12.5 trillion retirement market, signaling massive potential for broader adoption among American workers.

🔧 Key mandates from the order:

Department of Labor to revise ERISA rules limiting crypto

SEC to facilitate access to crypto for retirement participants

🧭 This move aligns with Trump’s broaderpro-crypto stance, following:

Crea

- Reward

- like

- Comment

- Repost

- Share

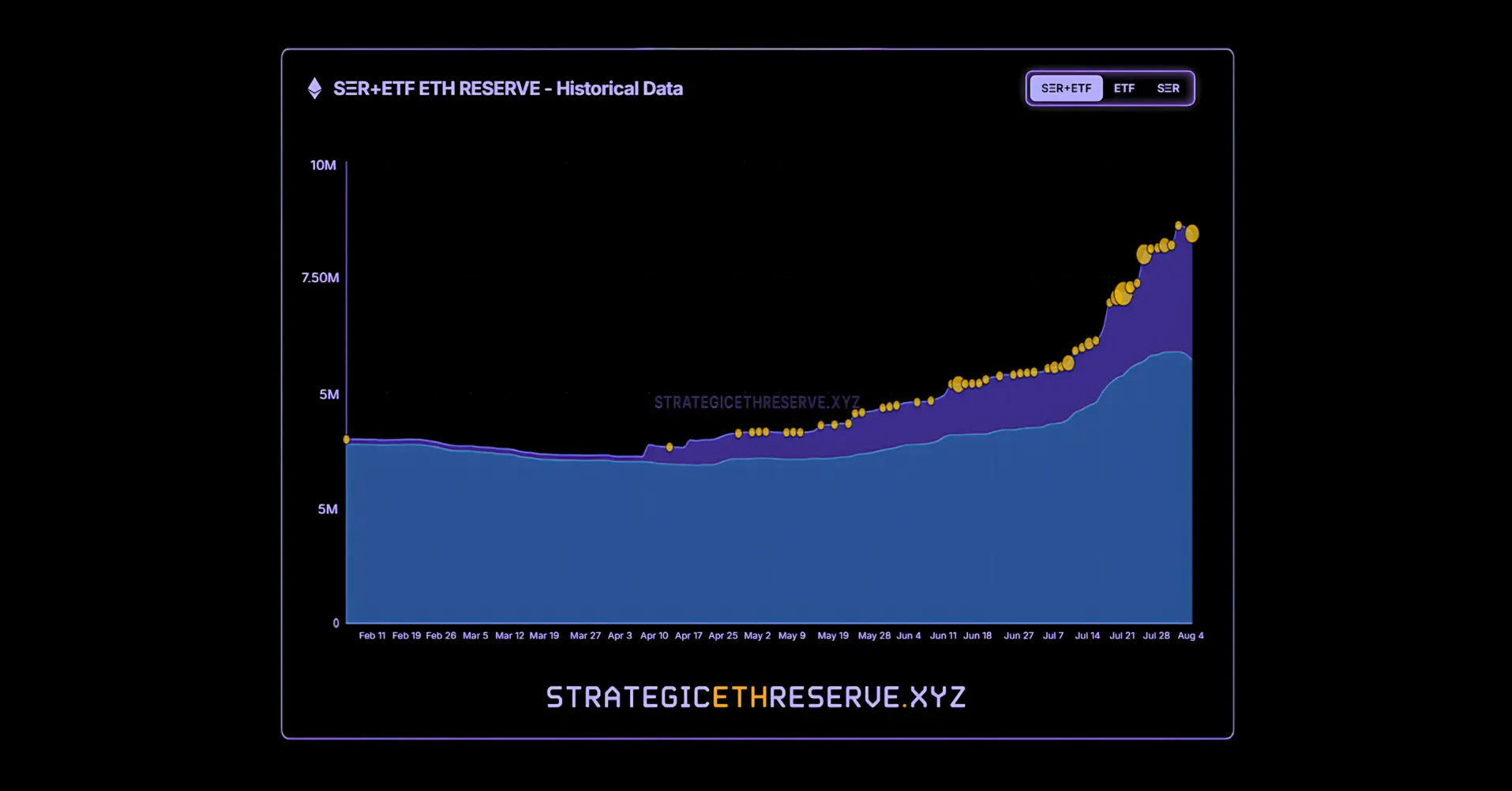

📈 Institutions Accumulate 4M ETH in Just 6 Months!

Global financial institutions have doubled their Ethereum (ETH) holdings, from 3.9M ETH in February to 8.4M ETH as of August 6, 2025 a 113% surge.

🏦 Key contributors:

ETF Players:

BlackRock: 2.9M ETH

Grayscale: 1.2M ETH

Public Companies:

Bitmine: 833K ETH (largest holder globally)

🚀 Since major acquisitions in early April, ETH price soared +151%, from US$1,425 toUS$3,570.

📊 Tom Lee (FundStrat) forecasts ETH could break US$4,000 by year-end, driven by sustained institutional dominance.

💡 Strong sign of growing institutional trust in ETH a

Global financial institutions have doubled their Ethereum (ETH) holdings, from 3.9M ETH in February to 8.4M ETH as of August 6, 2025 a 113% surge.

🏦 Key contributors:

ETF Players:

BlackRock: 2.9M ETH

Grayscale: 1.2M ETH

Public Companies:

Bitmine: 833K ETH (largest holder globally)

🚀 Since major acquisitions in early April, ETH price soared +151%, from US$1,425 toUS$3,570.

📊 Tom Lee (FundStrat) forecasts ETH could break US$4,000 by year-end, driven by sustained institutional dominance.

💡 Strong sign of growing institutional trust in ETH a

ETH0,51%

- Reward

- like

- Comment

- Repost

- Share

🏦 64 Public Companies Hold Nearly 3 Million ETH!

A total of 64 public companies have accumulated 2.96 million ETH worth US$10.81 billion, representing 2.45% of Ethereum’s total circulating supply (120.7 million ETH), according to SER Entities (Aug 5).

📊 Additionally, Ethereum ETFs hold 5.71 million ETH valued at US$20.88 billion, with daily inflows of 133,080 ETH.

💼 Combined, these institutional holdings now control almost 7% of global ETH supply, a strong signal of growing confidence inEthereum’s long-term value.

🏢 Top holders include:

Bitmine Immersion Tech (833,100 ETH / US$3.05B)

Sharp

A total of 64 public companies have accumulated 2.96 million ETH worth US$10.81 billion, representing 2.45% of Ethereum’s total circulating supply (120.7 million ETH), according to SER Entities (Aug 5).

📊 Additionally, Ethereum ETFs hold 5.71 million ETH valued at US$20.88 billion, with daily inflows of 133,080 ETH.

💼 Combined, these institutional holdings now control almost 7% of global ETH supply, a strong signal of growing confidence inEthereum’s long-term value.

🏢 Top holders include:

Bitmine Immersion Tech (833,100 ETH / US$3.05B)

Sharp

ETH0,51%

- Reward

- like

- Comment

- Repost

- Share

🏴☠️ Lost Bitcoin in Landfill Could Be Worth $8 Billion by 2030!

James Howells, a British computer engineer, has officially given up searching for a hard drive containing 8,000 BTC that was accidentally thrown into a landfill.

💸 The lost Bitcoin is currently worth $914 million, but based on projections of BTC reaching $1 million per coin by 2030, it could be valued at $8 billion.

⚖️ Howells sued Newport City Council for access to the landfill but was denied. He even offered to buy the site, but the court ruled thatthe drive is now government property under existing law.

📈 Predictions of BTC

James Howells, a British computer engineer, has officially given up searching for a hard drive containing 8,000 BTC that was accidentally thrown into a landfill.

💸 The lost Bitcoin is currently worth $914 million, but based on projections of BTC reaching $1 million per coin by 2030, it could be valued at $8 billion.

⚖️ Howells sued Newport City Council for access to the landfill but was denied. He even offered to buy the site, but the court ruled thatthe drive is now government property under existing law.

📈 Predictions of BTC

- Reward

- like

- Comment

- Repost

- Share

📉 The Fed Expected to Cut Rates by 25 Basis Points Next Month

According to the CME FedWatch Tool, the likelihood of a Federal Reserve rate cut in September has surged to nearly 95%.

💰 The market expects the rate to be lowered from 4.25–4.50% to 4.00–4.25% during the upcoming September 17 FOMC meeting. Only 5.6% expect no change, and none anticipate a hike.

📉 This signals strong expectations that the Fed may begin easing its monetary policy due to slowing growth or easing inflation.

🚀 A rate cut could benefit risk assets likestocks and crypto, as lower borrowing costs typically support liqu

According to the CME FedWatch Tool, the likelihood of a Federal Reserve rate cut in September has surged to nearly 95%.

💰 The market expects the rate to be lowered from 4.25–4.50% to 4.00–4.25% during the upcoming September 17 FOMC meeting. Only 5.6% expect no change, and none anticipate a hike.

📉 This signals strong expectations that the Fed may begin easing its monetary policy due to slowing growth or easing inflation.

🚀 A rate cut could benefit risk assets likestocks and crypto, as lower borrowing costs typically support liqu

- Reward

- like

- Comment

- Repost

- Share

📈 Ethereum Overtakes Bitcoin in Open Interest, Hits Record $58 Billion!

Ethereum (ETH) made history in July by reaching $58 billion in open interest, surpassing Bitcoin (BTC) for the first time. The spike reflects growing confidence from institutions and whales, especially within DeFi and smart contracts.

📊 Derivatives activity on CME also surged, with ETH hitting $7.85 billion, a sign of heavy participation from major financial players.

⚠️ However, the buildup of leverage raisesconcerns of mass liquidations, potentially triggering a sharp market correction.

💬 “Open interest is at an all-ti

Ethereum (ETH) made history in July by reaching $58 billion in open interest, surpassing Bitcoin (BTC) for the first time. The spike reflects growing confidence from institutions and whales, especially within DeFi and smart contracts.

📊 Derivatives activity on CME also surged, with ETH hitting $7.85 billion, a sign of heavy participation from major financial players.

⚠️ However, the buildup of leverage raisesconcerns of mass liquidations, potentially triggering a sharp market correction.

💬 “Open interest is at an all-ti

ETH0,51%

- Reward

- like

- Comment

- Repost

- Share

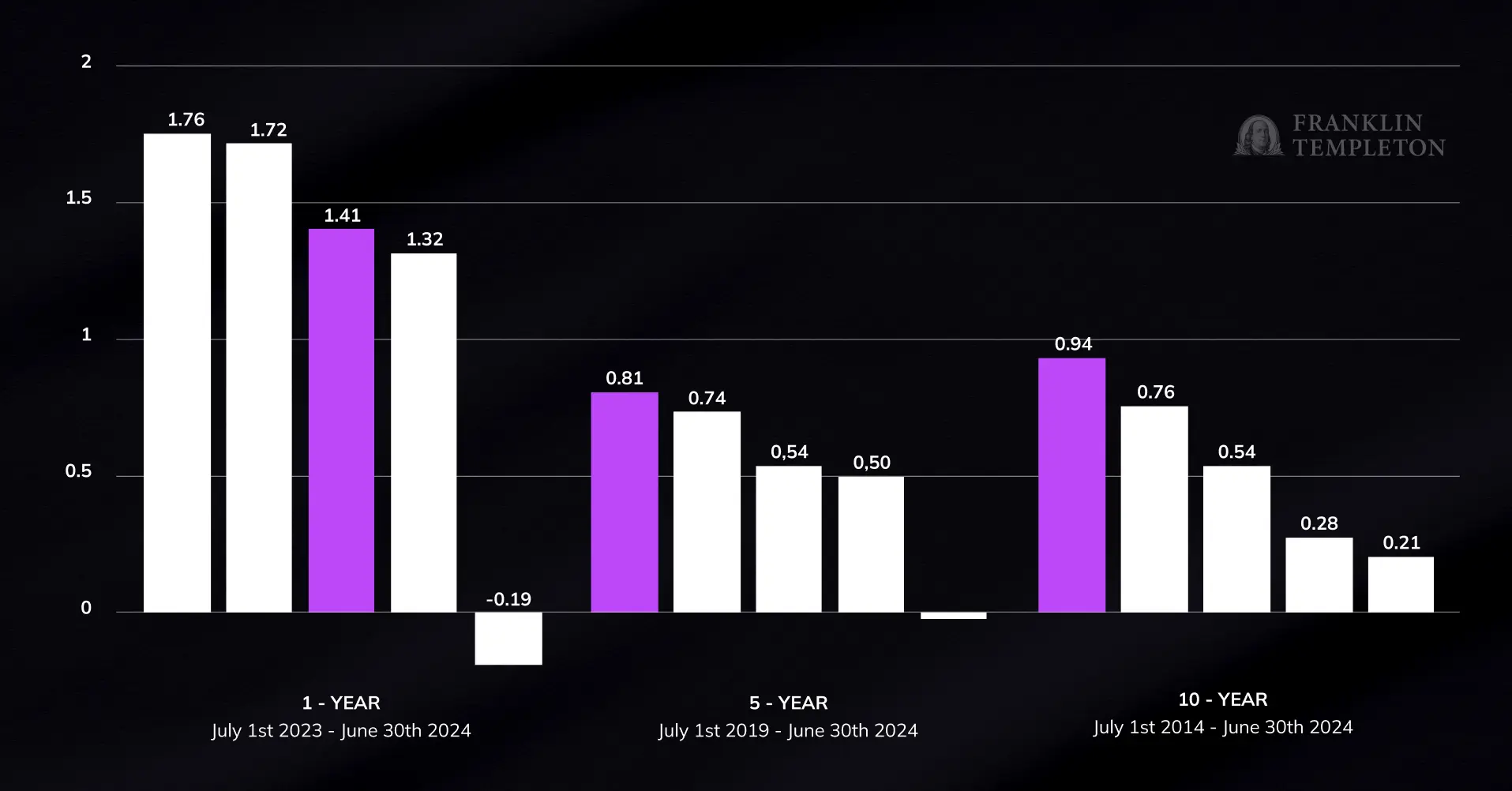

📊 Bitcoin Outperforms Gold & US Stocks in Risk-Adjusted Returns!

According to Franklin Templeton and Visual Capitalist, Bitcoin posted a Sharpe ratio of 1.41 over the past year, outperforming gold and the US dollar, though slightly behind S&P 500 (1.76) and Nasdaq 100 (1.72).

⏳ Over a 5-year period, Bitcoin recorded a Sharpe ratio of 0.81, still ahead of gold (0.50) and USD (negative).

📈 In the 10-year timeframe, Bitcoin leads again with a Sharpe ratio of 0.94, confirming its position as a high-potential, risk-adjusted asset for long-term investors.

🔍 Despite its volatility, Bitcoin has pro

According to Franklin Templeton and Visual Capitalist, Bitcoin posted a Sharpe ratio of 1.41 over the past year, outperforming gold and the US dollar, though slightly behind S&P 500 (1.76) and Nasdaq 100 (1.72).

⏳ Over a 5-year period, Bitcoin recorded a Sharpe ratio of 0.81, still ahead of gold (0.50) and USD (negative).

📈 In the 10-year timeframe, Bitcoin leads again with a Sharpe ratio of 0.94, confirming its position as a high-potential, risk-adjusted asset for long-term investors.

🔍 Despite its volatility, Bitcoin has pro

BTC0,19%

- Reward

- like

- Comment

- Repost

- Share

Analysis $DOGE 1 Day (LONG/SHORT)

ENTRY:

- LONG: Breakout 0.2083 (Fib 23.6%) with high volume – bullish EMA.

- SHORT: Breakdown 0.2041 (Fib 61.8%) + candle bearish – stochastic overbought.

LEVERAGE: 5x-10x – moderate to avoid rek.

SL/TP:

- LONG: SL 0.2041 (support), TP 0.2120 (target next).

- SHORT: SL 0.2083 (resistance), TP 0.2000 (psych level).

RISK: Low volume (ATR 0.00154) + mixed signal (Doji vs EMA) – false breakout possible.

ACCURACY: 60-70% – beware of FOMO trap.

Monitor breakout/breakdown confirmation – don't go all-in. #Crypto Market Rebound

ENTRY:

- LONG: Breakout 0.2083 (Fib 23.6%) with high volume – bullish EMA.

- SHORT: Breakdown 0.2041 (Fib 61.8%) + candle bearish – stochastic overbought.

LEVERAGE: 5x-10x – moderate to avoid rek.

SL/TP:

- LONG: SL 0.2041 (support), TP 0.2120 (target next).

- SHORT: SL 0.2083 (resistance), TP 0.2000 (psych level).

RISK: Low volume (ATR 0.00154) + mixed signal (Doji vs EMA) – false breakout possible.

ACCURACY: 60-70% – beware of FOMO trap.

Monitor breakout/breakdown confirmation – don't go all-in. #Crypto Market Rebound

DOGE-1,95%

- Reward

- like

- Comment

- Repost

- Share

🐋 Mega Whale Accumulates Ethereum Amid Price Dip What’s Going On?

📈 Arkham Intelligence data reveals massive Ethereum (ETH) accumulation by a mega whale, right when the price was pulling back!

🔹 One wallet scooped up US$300 million worth of ETH via an OTC deal through Galaxy Digital on Sunday (Aug 3).

🔹 That address now holds 79,461 ETH valued at approximately US$282.5 million.

📊 Dune Analytics shows a vertical surge in Ethereum ETF holdings up over 40% in the last 30 days.

👑 "Mega whales" are defined as entities holding over 10,000 ETH. Since early July, these whales have added 200+ ETH

📈 Arkham Intelligence data reveals massive Ethereum (ETH) accumulation by a mega whale, right when the price was pulling back!

🔹 One wallet scooped up US$300 million worth of ETH via an OTC deal through Galaxy Digital on Sunday (Aug 3).

🔹 That address now holds 79,461 ETH valued at approximately US$282.5 million.

📊 Dune Analytics shows a vertical surge in Ethereum ETF holdings up over 40% in the last 30 days.

👑 "Mega whales" are defined as entities holding over 10,000 ETH. Since early July, these whales have added 200+ ETH

ETH0,51%

- Reward

- 1

- Comment

- Repost

- Share

🚀 Metaplanet Buys 463 More Bitcoin Amid Price Recovery!

Metaplanet has further strengthened its Bitcoin reserves by purchasing 463 BTC at an average price of ¥17.26M/BTC. This move comes as Bitcoin recovers to around US$114,800 (+1.1% in 24 hours, Aug 4 morning).

🔹 Total Bitcoin holdings now stand at 17,595 BTC, with ¥261.27B spent in total (average ¥14.84M/BTC).

🔹 The company positions Bitcoin as the core of its financial strategy through Bitcoin Treasury Operations.

📊 From early July - Aug 4, 2025, Metaplanet recorded a 24.6% BTC Yield, generating 3,284 BTC in BTC Gains, equivalent to ¥5

Metaplanet has further strengthened its Bitcoin reserves by purchasing 463 BTC at an average price of ¥17.26M/BTC. This move comes as Bitcoin recovers to around US$114,800 (+1.1% in 24 hours, Aug 4 morning).

🔹 Total Bitcoin holdings now stand at 17,595 BTC, with ¥261.27B spent in total (average ¥14.84M/BTC).

🔹 The company positions Bitcoin as the core of its financial strategy through Bitcoin Treasury Operations.

📊 From early July - Aug 4, 2025, Metaplanet recorded a 24.6% BTC Yield, generating 3,284 BTC in BTC Gains, equivalent to ¥5

- Reward

- like

- Comment

- Repost

- Share

📉 Bitcoin & Ethereum ETFs See Nearly $1B Outflows!

The start of August saw massive capital outflows from US spot crypto ETFs, totaling nearly $1B, after a record-setting July.

🔹 Bitcoin (BTC) ETFs: Outflow of $812M in just one day the largest in 5 months and second-worst of 2025.

🔹 Ethereum (ETH) ETFs: Outflow of $153M, breaking a 20-day inflow streak that brought in over $5B.

💬 Nate Geraci (NovaDius Wealth) called the sell-off surprising, especially amid strong market momentum and the SEC’s pro-crypto “Project Crypto” initiative led by Paul Atkins.

👉 Is this a sign of investor caution o

The start of August saw massive capital outflows from US spot crypto ETFs, totaling nearly $1B, after a record-setting July.

🔹 Bitcoin (BTC) ETFs: Outflow of $812M in just one day the largest in 5 months and second-worst of 2025.

🔹 Ethereum (ETH) ETFs: Outflow of $153M, breaking a 20-day inflow streak that brought in over $5B.

💬 Nate Geraci (NovaDius Wealth) called the sell-off surprising, especially amid strong market momentum and the SEC’s pro-crypto “Project Crypto” initiative led by Paul Atkins.

👉 Is this a sign of investor caution o

- Reward

- like

- Comment

- Repost

- Share

🚀 SharpLink Increases Ethereum Holdings, Total Assets Now Worth $1.65 Billion!

SharpLink has aggressively accumulated 15,822 ETH worth $53.9M in the last few hours. Over the past two days, they purchased a total of 30,755 ETH spending $108.57M.

📌 Average purchase price: $3,530/ETH

📌 Total ETH holdings: 480,031 ETH (valued at $1.65B / IDR 27T!)

📌 SharpLink is now one of the major institutions heavily accumulating ETH.

💬 This move shows strong confidence in Ethereum’s future but also sparks speculation on their long-term strategy.

👉 Do you think ETH is about to hit new highs? 🤔#White Hous

SharpLink has aggressively accumulated 15,822 ETH worth $53.9M in the last few hours. Over the past two days, they purchased a total of 30,755 ETH spending $108.57M.

📌 Average purchase price: $3,530/ETH

📌 Total ETH holdings: 480,031 ETH (valued at $1.65B / IDR 27T!)

📌 SharpLink is now one of the major institutions heavily accumulating ETH.

💬 This move shows strong confidence in Ethereum’s future but also sparks speculation on their long-term strategy.

👉 Do you think ETH is about to hit new highs? 🤔#White Hous

ETH0,51%

- Reward

- 8

- 4

- Repost

- Share

SBSomrat :

:

HODL Tight 💪View More

⚡ Institutions Now Control 17% of Bitcoin Supply – What Does It Mean?

Around 3.63 million Bitcoin (BTC) or 17% of the total supply is now held by major institutions including financial entities, public companies, and governments.

📌 ETFs & investment funds lead with 1.4M BTC.

📌 Public companies own 900K+ BTC in just the last 5 years.

📌 Michael Saylor’s Strategy tops the list with 628,791 BTC (US$74B).

📌 Followed by MARA Holdings (50,000 BTC), XXI (37,230 BTC), Tesla (11,509 BTC), and more.

👉 Experts say this shift in ownership could change the traditional 4-year Bitcoin cycle, as mass inst

Around 3.63 million Bitcoin (BTC) or 17% of the total supply is now held by major institutions including financial entities, public companies, and governments.

📌 ETFs & investment funds lead with 1.4M BTC.

📌 Public companies own 900K+ BTC in just the last 5 years.

📌 Michael Saylor’s Strategy tops the list with 628,791 BTC (US$74B).

📌 Followed by MARA Holdings (50,000 BTC), XXI (37,230 BTC), Tesla (11,509 BTC), and more.

👉 Experts say this shift in ownership could change the traditional 4-year Bitcoin cycle, as mass inst

- Reward

- like

- Comment

- Repost

- Share

⚡ Ethereum ETFs Record $17M Inflow While Bitcoin ETFs See Massive Outflow!

Spot Ethereum (ETH) ETFs booked $17 million daily inflow on Thursday (31/07), continuing weeks of positive momentum.

📌 Bitcoin (BTC) ETFs saw a huge $114 million outflow, ending a 5-day inflow streak.

📌 Ark & 21Shares (ARKB) Bitcoin ETF led the outflow with $89 million, followed by Grayscale & Fidelity.

📌 BlackRock’s IBIT still managed $18 million inflow.

📌 Ethereum ETFs were led by BlackRock (ETHA) with $18 million inflow, followed by Fidelity (FETH) with $5 million.

👉 Do you think Ethereum could become the new fa

Spot Ethereum (ETH) ETFs booked $17 million daily inflow on Thursday (31/07), continuing weeks of positive momentum.

📌 Bitcoin (BTC) ETFs saw a huge $114 million outflow, ending a 5-day inflow streak.

📌 Ark & 21Shares (ARKB) Bitcoin ETF led the outflow with $89 million, followed by Grayscale & Fidelity.

📌 BlackRock’s IBIT still managed $18 million inflow.

📌 Ethereum ETFs were led by BlackRock (ETHA) with $18 million inflow, followed by Fidelity (FETH) with $5 million.

👉 Do you think Ethereum could become the new fa

- Reward

- 1

- Comment

- Repost

- Share

⚡ Bitcoin Plunges to $115K as Trump’s Trade Tariffs Take Effect!

Bitcoin fell 2.02% to $115,000 in the past 24 hours after the U.S. trade tariffs officially took effect on Friday (01/08).

📌 Higher tariffs imposed on several countries, including Switzerland (39%) and Taiwan (20%), pushed the U.S. Dollar Index up 3%, adding pressure on Bitcoin.

📌 This marks the second-lowest price in a week.

📌 Skepticism from traditional finance players like JPMorgan, whose CEO Jamie Dimon favors stablecoins and blockchain tech, also weighed on BTC.

👉 Do you think these trade tariffs could trigger a long-ter

Bitcoin fell 2.02% to $115,000 in the past 24 hours after the U.S. trade tariffs officially took effect on Friday (01/08).

📌 Higher tariffs imposed on several countries, including Switzerland (39%) and Taiwan (20%), pushed the U.S. Dollar Index up 3%, adding pressure on Bitcoin.

📌 This marks the second-lowest price in a week.

📌 Skepticism from traditional finance players like JPMorgan, whose CEO Jamie Dimon favors stablecoins and blockchain tech, also weighed on BTC.

👉 Do you think these trade tariffs could trigger a long-ter

- Reward

- like

- Comment

- Repost

- Share

🎉 Ethereum Celebrates 10 Years with Soaring Network Activity!

Ethereum marks its 10th anniversary with a massive surge in network activity.

📈 Daily active addresses hit 680,670, making it the 2nd busiest day in 2025.

📈 MVRV shows 1-year traders earned an average of 38% profit, and 15% just in the past month.

📈 Whales stepped up with 14,628 transactions > $100K on July 27 (4th busiest day of the year).

📈 Large wallets (10k–100k ETH) added 1.55M ETH in the last 3 weeks.

On the dev side, Ethereum remains strong with 157 GitHub events/day, ranking in the top 10 most active digital assets.

👉

Ethereum marks its 10th anniversary with a massive surge in network activity.

📈 Daily active addresses hit 680,670, making it the 2nd busiest day in 2025.

📈 MVRV shows 1-year traders earned an average of 38% profit, and 15% just in the past month.

📈 Whales stepped up with 14,628 transactions > $100K on July 27 (4th busiest day of the year).

📈 Large wallets (10k–100k ETH) added 1.55M ETH in the last 3 weeks.

On the dev side, Ethereum remains strong with 157 GitHub events/day, ranking in the top 10 most active digital assets.

👉

ETH0,51%

- Reward

- like

- Comment

- Repost

- Share

🔥 Crypto Market Likuidasi $433M After Hawkish Fed Comments!

The crypto market faced a massive liquidation of $433 million after hawkish remarks from Fed Chair Jerome Powell.

📉 Bitcoin (BTC) plunged to $116,000 before rebounding above $118,000.

📉 Ethereum (ETH) also dropped 3% but recovered to $3,850.

📉 Other altcoins like Solana, XRP, and Tron remain under pressure with no clear signs of recovery.

📝 Powell highlighted inflation risks from trade tariffs, triggering heavy sell-offs across the market.

👉 What’s your move during this volatility? Will you hold or buy the dip? 🤔

#Fed Rate Deci

The crypto market faced a massive liquidation of $433 million after hawkish remarks from Fed Chair Jerome Powell.

📉 Bitcoin (BTC) plunged to $116,000 before rebounding above $118,000.

📉 Ethereum (ETH) also dropped 3% but recovered to $3,850.

📉 Other altcoins like Solana, XRP, and Tron remain under pressure with no clear signs of recovery.

📝 Powell highlighted inflation risks from trade tariffs, triggering heavy sell-offs across the market.

👉 What’s your move during this volatility? Will you hold or buy the dip? 🤔

#Fed Rate Deci

- Reward

- like

- Comment

- Repost

- Share

🔥 Ethereum & Solana Surge, But Still Can't Beat Bitcoin?

Philanthropist Bill Miller believes the recent price surge of Ethereum and Solana is mainly due to the newly passed Clarity Act in the US, not because of their technological strength.

📌 Miller highlighted that these blockchains only benefited from being launched early, allowing them to be labeled “decentralized.” If launched today, they would face much stricter scrutiny.

🔹 Ethereum and Solana’s Proof-of-Stake (PoS) mechanism is, in Miller’s view, too similar to traditional systems: the wealthy hold the power.

🔹 Meanwhile, Bitcoin wit

Philanthropist Bill Miller believes the recent price surge of Ethereum and Solana is mainly due to the newly passed Clarity Act in the US, not because of their technological strength.

📌 Miller highlighted that these blockchains only benefited from being launched early, allowing them to be labeled “decentralized.” If launched today, they would face much stricter scrutiny.

🔹 Ethereum and Solana’s Proof-of-Stake (PoS) mechanism is, in Miller’s view, too similar to traditional systems: the wealthy hold the power.

🔹 Meanwhile, Bitcoin wit

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More317.24K Popularity

101.6K Popularity

418.44K Popularity

3.56K Popularity

100.62K Popularity

Pin