CryptoFalcon2x

No content yet

CryptoFalcon2x

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$BTC recent bounce isn’t backed by whales.

Futures data shows rising retail-sized orders while large players stay quiet. In past rallies, whales led. This time, they’re missing.

Retail-driven moves rarely hold → consolidation or downside risk remains.

Via @coinexcreators

Futures data shows rising retail-sized orders while large players stay quiet. In past rallies, whales led. This time, they’re missing.

Retail-driven moves rarely hold → consolidation or downside risk remains.

Via @coinexcreators

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

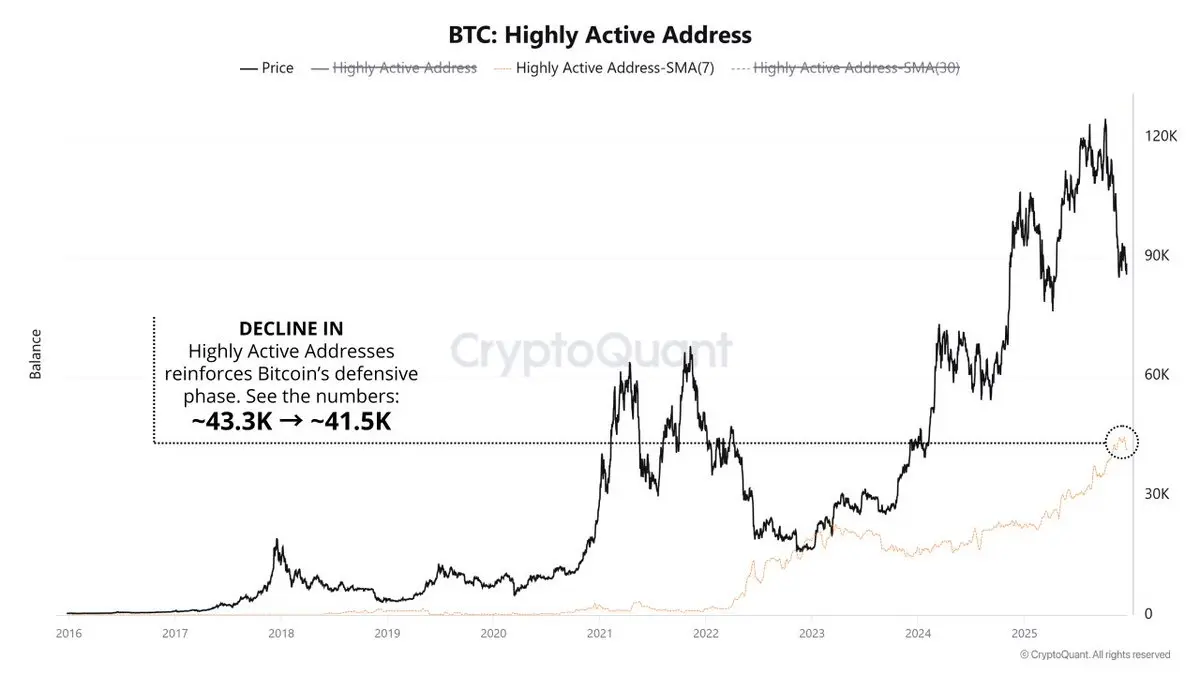

$BTC looks stable on the surface, but the behavior underneath tells a different story.

Older coins are moving, miners continue long-term distribution, and whales are active, locking profits and trimming holdings.

This isn’t strength. It’s quiet distribution.

Via @coinexcreators

Older coins are moving, miners continue long-term distribution, and whales are active, locking profits and trimming holdings.

This isn’t strength. It’s quiet distribution.

Via @coinexcreators

- Reward

- like

- Comment

- Repost

- Share

When new $BTC buyers pay less than holders from 3–6 months ago, it looks scary, but it’s not structural weakness.

This inversion is rare, short-lived, and usually marks stress + reset. Supply shifts to lower-cost hands.

That’s consolidation, not collapse.

Via @coinexcreators

This inversion is rare, short-lived, and usually marks stress + reset. Supply shifts to lower-cost hands.

That’s consolidation, not collapse.

Via @coinexcreators

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More28.11K Popularity

34.9K Popularity

20.32K Popularity

4.56K Popularity

3.23K Popularity

Pin