November 2 Market Analysis!

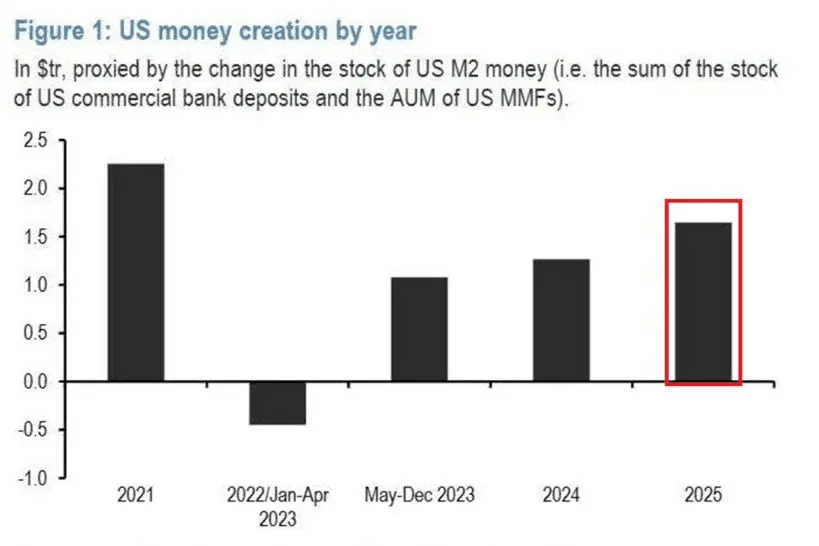

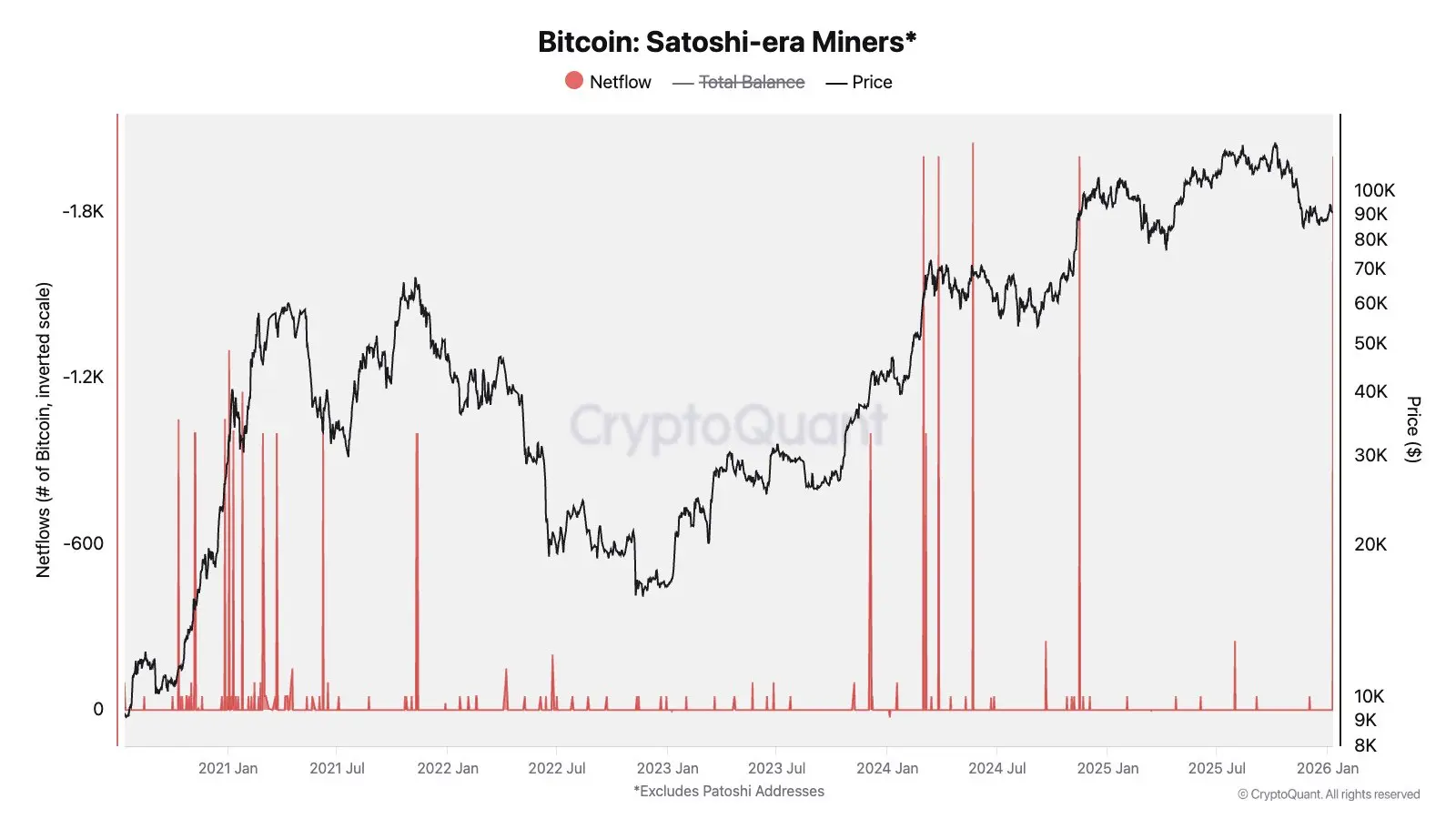

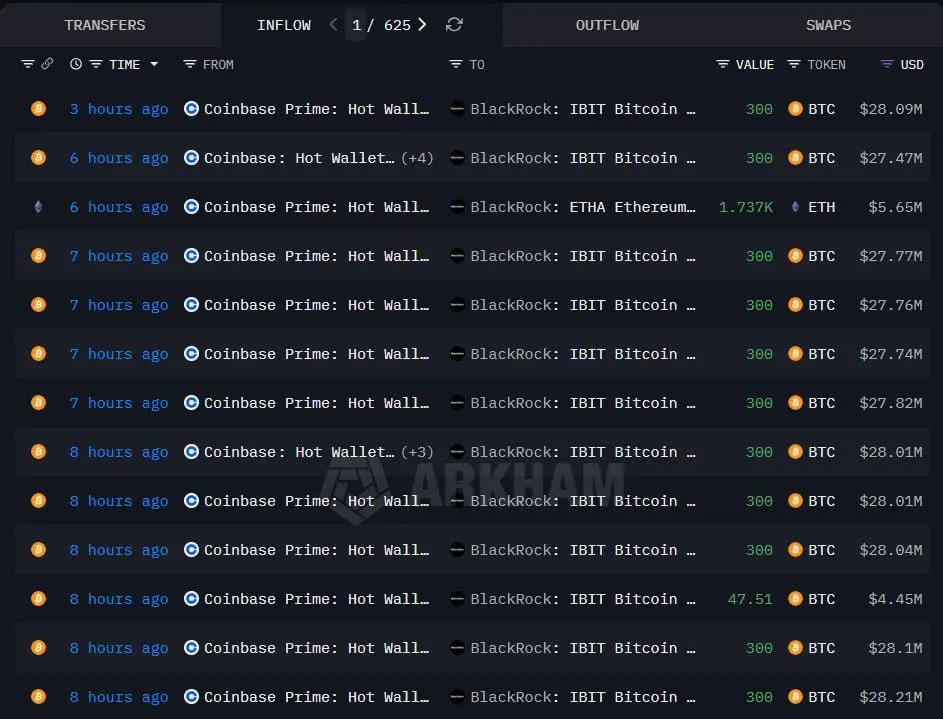

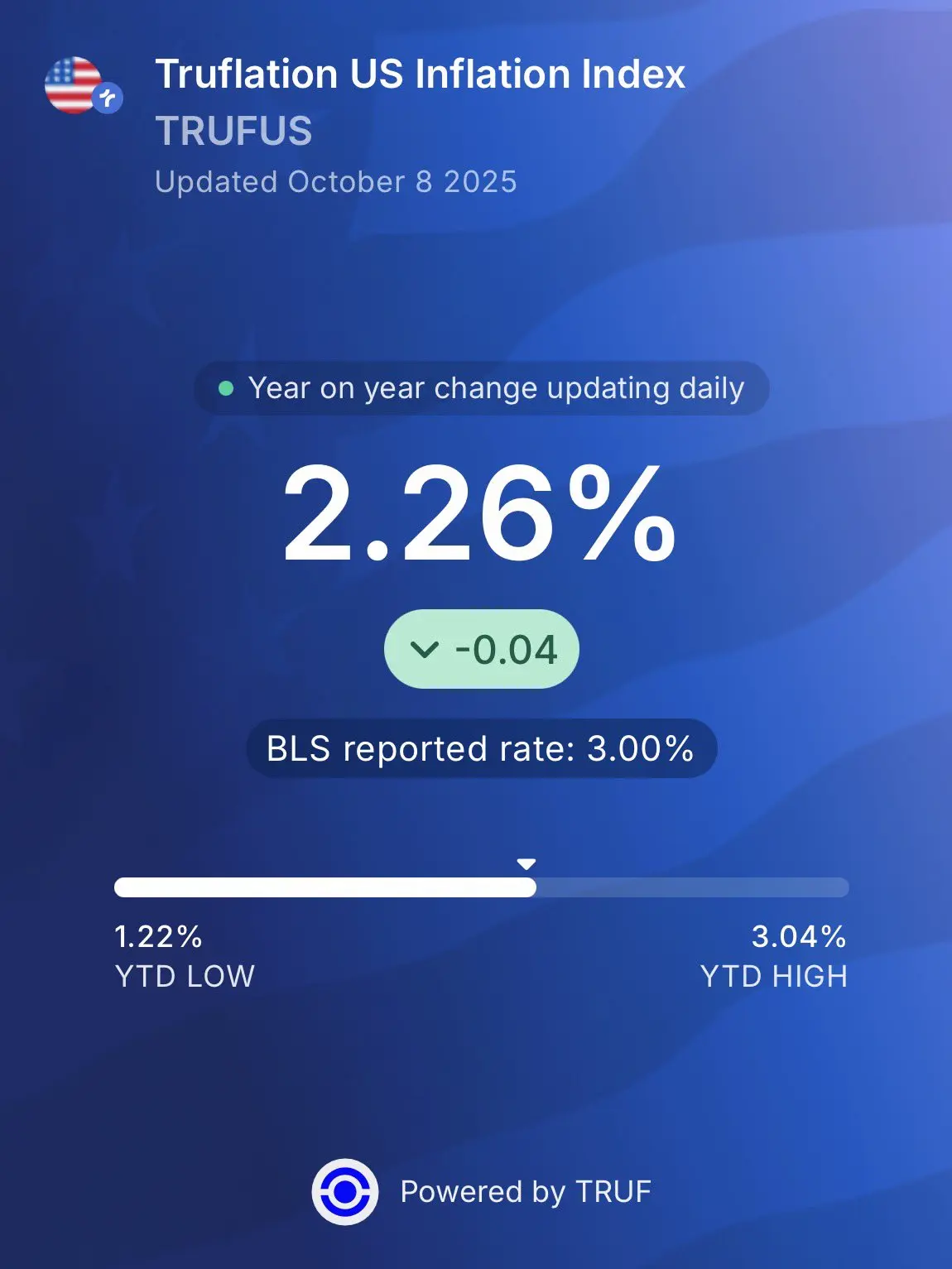

After the rapid decline on November 31, the market has undergone three days of indicator correction and consolidation. Currently, there are signs of market maker manipulation. Ethereum has repeatedly attempted to break through and stabilize above 3900 but has failed; selling pressure above remains heavy. Bitcoin has also made multiple attempts to push towards the four-hour oscillation upward trendline, around 1110, but has not succeeded in reclaiming it. Looking ahead, the market appears more promising as long as Ethereum does not break below the bull trendline and Solana. Since it's a slope, Ethereum is roughly around 3700, Solana at 179, and Bitcoin still far from the bottom at 8.8K. My personal view is that we should try to buy the dip, even if it means taking some hits—just set stop-losses. Key positions should be built. If it breaks down without rebound, cut losses. I believe the bull market is still ongoing; my old view remains unchanged, mainly due to the uncertainty in the US, which boosts investors' risk aversion. Once the dust settles, a big rally is inevitable. In the short term, the market still favors bears! There might be another wave of decline, but the long-term bullish trend remains unchanged. As long as Ethereum's spot price stays above 3700, continue to position long-term buys around 3700. Remember, since futures are leveraged, everyone must set stop-losses. Take profits when possible to reduce positions. Ensure a no-loss game. Only then can we sustain long-term growth! Small losses for bigger profits!

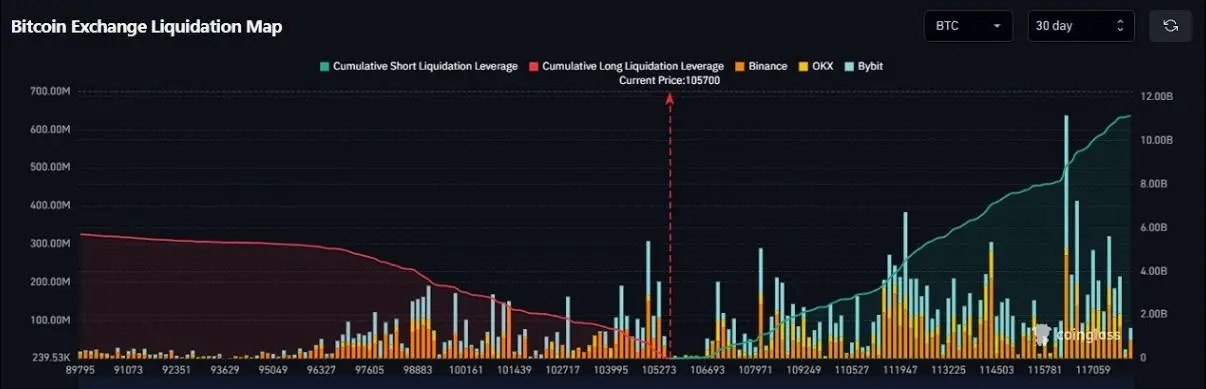

Bitcoin's swing trading buy zone is between 109100 and 108400; set stop-loss below 108400 and exit. Take-profit around 1115. The extreme support levels are at 1071, 1046, and 1020, with the ultimate support at 9.8K.

For Bitcoin shorts, consider shorting around 1108 with close monitoring. Place maker orders near 1115 with a 500-point stop-loss and take-profit at 1105. Alternatively, halve the position risk at 500 points. Only consider a breakout above 1115 if volume increases, as a breakout could lead to a market turning point and reduce the effectiveness of short positions.

For Ethereum, focus on the 3812 level with a five-point range up and down. Place strong maker orders at 3782 with a 15-point stop-loss and take-profit near 3825. If support levels at 3744 and 3715 are broken, with the ultimate support around 3600, consider adjusting positions accordingly.

For Ethereum shorts, consider shorting around 3922 with a 15-point stop-loss and take-profit near 3890.

Watch resistance levels at 3960 and the ultimate around 4050. A breakout above these could signal a major market turning point with volume increase and upward movement.

For Solana, focus on longs around 182 and 181.3, with a safe stop-loss at 179.2 and near 178. Take profits and reduce positions at the bottom, with extreme support levels at 175.6 to 173.7.

For Solana shorts, consider shorting around 187.3 with a stop-loss at the recent high. Take-profit near 185 or hold through the move. Resistance levels are at 193.55, 197, and around 202.6. If the price reaches these levels in the coming days, consider shorting on a breakout above 202 for a market turning point.

Stay safe—short-term traders should watch for pullbacks, while the long-term remains bullish. The bull market is still ongoing! Be cautious, as the market will continue to undergo whipsawing to shake out liquidity. Like if you agree!

After the rapid decline on November 31, the market has undergone three days of indicator correction and consolidation. Currently, there are signs of market maker manipulation. Ethereum has repeatedly attempted to break through and stabilize above 3900 but has failed; selling pressure above remains heavy. Bitcoin has also made multiple attempts to push towards the four-hour oscillation upward trendline, around 1110, but has not succeeded in reclaiming it. Looking ahead, the market appears more promising as long as Ethereum does not break below the bull trendline and Solana. Since it's a slope, Ethereum is roughly around 3700, Solana at 179, and Bitcoin still far from the bottom at 8.8K. My personal view is that we should try to buy the dip, even if it means taking some hits—just set stop-losses. Key positions should be built. If it breaks down without rebound, cut losses. I believe the bull market is still ongoing; my old view remains unchanged, mainly due to the uncertainty in the US, which boosts investors' risk aversion. Once the dust settles, a big rally is inevitable. In the short term, the market still favors bears! There might be another wave of decline, but the long-term bullish trend remains unchanged. As long as Ethereum's spot price stays above 3700, continue to position long-term buys around 3700. Remember, since futures are leveraged, everyone must set stop-losses. Take profits when possible to reduce positions. Ensure a no-loss game. Only then can we sustain long-term growth! Small losses for bigger profits!

Bitcoin's swing trading buy zone is between 109100 and 108400; set stop-loss below 108400 and exit. Take-profit around 1115. The extreme support levels are at 1071, 1046, and 1020, with the ultimate support at 9.8K.

For Bitcoin shorts, consider shorting around 1108 with close monitoring. Place maker orders near 1115 with a 500-point stop-loss and take-profit at 1105. Alternatively, halve the position risk at 500 points. Only consider a breakout above 1115 if volume increases, as a breakout could lead to a market turning point and reduce the effectiveness of short positions.

For Ethereum, focus on the 3812 level with a five-point range up and down. Place strong maker orders at 3782 with a 15-point stop-loss and take-profit near 3825. If support levels at 3744 and 3715 are broken, with the ultimate support around 3600, consider adjusting positions accordingly.

For Ethereum shorts, consider shorting around 3922 with a 15-point stop-loss and take-profit near 3890.

Watch resistance levels at 3960 and the ultimate around 4050. A breakout above these could signal a major market turning point with volume increase and upward movement.

For Solana, focus on longs around 182 and 181.3, with a safe stop-loss at 179.2 and near 178. Take profits and reduce positions at the bottom, with extreme support levels at 175.6 to 173.7.

For Solana shorts, consider shorting around 187.3 with a stop-loss at the recent high. Take-profit near 185 or hold through the move. Resistance levels are at 193.55, 197, and around 202.6. If the price reaches these levels in the coming days, consider shorting on a breakout above 202 for a market turning point.

Stay safe—short-term traders should watch for pullbacks, while the long-term remains bullish. The bull market is still ongoing! Be cautious, as the market will continue to undergo whipsawing to shake out liquidity. Like if you agree!