EyeOnChain

No content yet

EyeOnChain

When the Market Shake, But this guy Didn’t. people trade like they’re tip-toeing across thin ice. This guy ran.

Five days back, this wallet walked into Hyperliquid with three million in USDC and did the one thing everyone swears they won’t do .... full send, max leverage, straight into shorts.

And when the market started to slip? He leaned in, Every green number became fuel. Profits weren’t an exit door, they were ammo. The position grew, then grew again, until the screen stopped looking like a trade and started looking like a statement.

Right now, he’s sitting on a wall of red candles with ze

Five days back, this wallet walked into Hyperliquid with three million in USDC and did the one thing everyone swears they won’t do .... full send, max leverage, straight into shorts.

And when the market started to slip? He leaned in, Every green number became fuel. Profits weren’t an exit door, they were ammo. The position grew, then grew again, until the screen stopped looking like a trade and started looking like a statement.

Right now, he’s sitting on a wall of red candles with ze

- Reward

- like

- Comment

- Repost

- Share

From Hero to “Why Didn’t I Sell?” . Swing Trader’s Rollercoaster.

Markets have a cruel sense of humor, and nemorino.eth just got the full experience. Between late November and January 20, he stacked 9,043 WETH at an average of $3,085, riding the wave like a pro. By mid-January, the screen was glowing green, a clean $2.87M floating profit. The kind of number that makes you lean back and think, yeah… I’ve got this.

He didn’t sell. and today to the pullback. Around 14 hours ago, as $ETH slipped, he finally thinks and let go of 3,000 WETH, locking in… Brutal compared to what was sitting there ju

Markets have a cruel sense of humor, and nemorino.eth just got the full experience. Between late November and January 20, he stacked 9,043 WETH at an average of $3,085, riding the wave like a pro. By mid-January, the screen was glowing green, a clean $2.87M floating profit. The kind of number that makes you lean back and think, yeah… I’ve got this.

He didn’t sell. and today to the pullback. Around 14 hours ago, as $ETH slipped, he finally thinks and let go of 3,000 WETH, locking in… Brutal compared to what was sitting there ju

ETH-4,27%

- Reward

- like

- Comment

- Repost

- Share

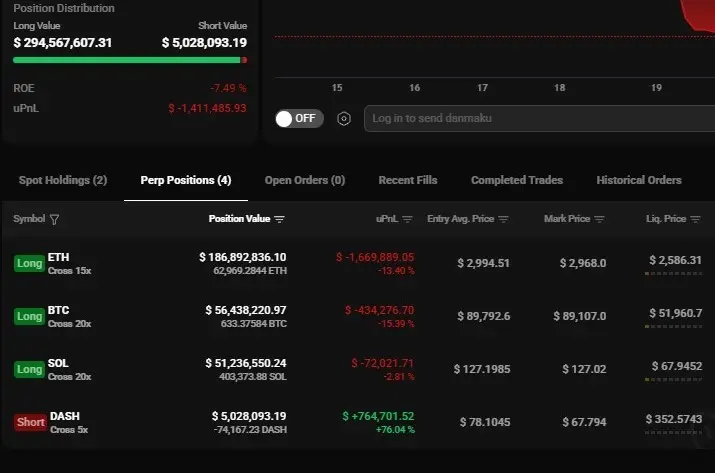

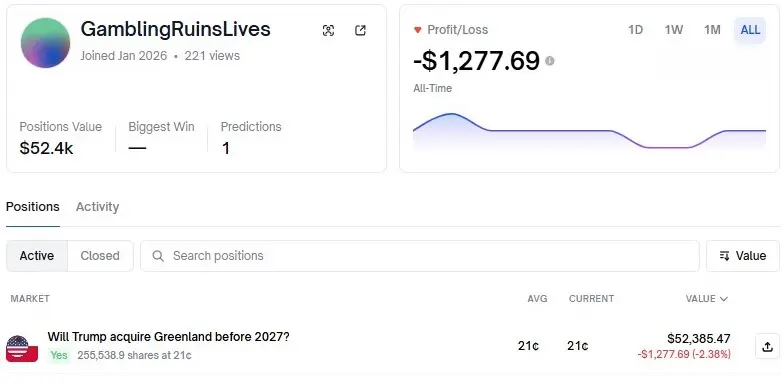

After bleeding through 22 straight trades, this whale finally caught a breath. Eight hours ago, address 0x94d…33814 .... once the #1 BTC short on Hyperliquid ... closed every short on $BTC, $ETH, and $SOL for a clean $3.12M win. First green week in a while. Relief, maybe even a little pride.

And then… instant mood swing.

Without hesitation, he flipped sides and went long.

Right now, the wallet is sitting on a monster $294M in open positions. The biggest chunk is #ETH ... about 62,969 ETH valued at $186.9M, entered around $2,994, now hovering near $2,968, leaving ETH alone bleeding roughly $1.6

And then… instant mood swing.

Without hesitation, he flipped sides and went long.

Right now, the wallet is sitting on a monster $294M in open positions. The biggest chunk is #ETH ... about 62,969 ETH valued at $186.9M, entered around $2,994, now hovering near $2,968, leaving ETH alone bleeding roughly $1.6

- Reward

- like

- Comment

- Repost

- Share

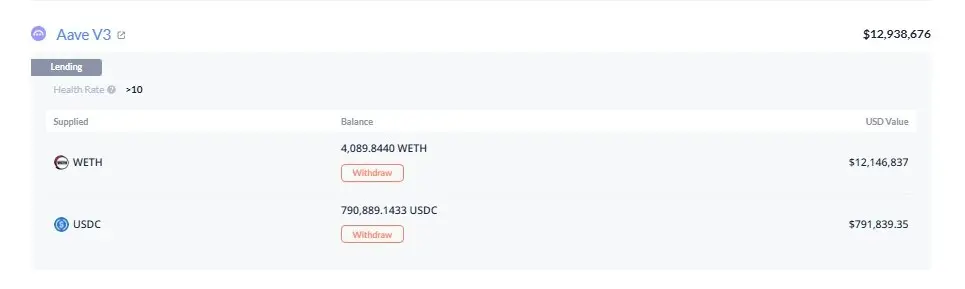

Bitmine Isn’t Watching ETH… It’s Slowly Owning It. #Bitmine is out there doing something far louder than words -- stacking Ethereum like it’s building a digital fortress.

Just last week, they added another 35,268 ETH to their balance sheet. That’s over $108 million worth of conviction in a single move.

And that wasn’t a one-off.

Bitmine now sits on a staggering 4,203,036 $ETH . At today’s prices, that’s nearly $13 billion in Ether under one roof.

What Bitmine is doing with #ETH has the same energy. Which is usually how the most important moves look while they’re happening.

Markets love noise.

Just last week, they added another 35,268 ETH to their balance sheet. That’s over $108 million worth of conviction in a single move.

And that wasn’t a one-off.

Bitmine now sits on a staggering 4,203,036 $ETH . At today’s prices, that’s nearly $13 billion in Ether under one roof.

What Bitmine is doing with #ETH has the same energy. Which is usually how the most important moves look while they’re happening.

Markets love noise.

ETH-4,27%

- Reward

- like

- Comment

- Repost

- Share

Pocket Money to a Small Fortune ... One Wallet’s Wild $ZReaL Run.

Insider wallet for sure, turned a casual $285 into $627,000 on #zreal that’s a clean 2,200×. It started slowly, buying 66.3 million #ZReaL for what most people spend on icecream in a month. Then the story change. About 19.98 million tokens were slowly offloaded for $210K, not in one obvious dump, but spread across four different wallets.

And the craziest part? The trade isn’t even done. The main stack still holds 46.3 million ZReaL, worth roughly $417K, just sitting there like a loaded spring.

You can almost imagine the moment

Insider wallet for sure, turned a casual $285 into $627,000 on #zreal that’s a clean 2,200×. It started slowly, buying 66.3 million #ZReaL for what most people spend on icecream in a month. Then the story change. About 19.98 million tokens were slowly offloaded for $210K, not in one obvious dump, but spread across four different wallets.

And the craziest part? The trade isn’t even done. The main stack still holds 46.3 million ZReaL, worth roughly $417K, just sitting there like a loaded spring.

You can almost imagine the moment

- Reward

- like

- Comment

- Repost

- Share

Betting Against the Crowd… and the Market Gives Good Returns.

Three days ago, this wallet walked in with $3M in USDC and did the one thing nobody wanted to hear , he simply shorted.

Today the screen looks very different. The account is sitting on about $147M in open positions, every single dollar aimed downward, and the curve has finally turned green.

His $ETH short alone is carrying the story, roughly 31,000 ETH on 25x, opened around 3,269, now hovering near 3,196, floating more than $2.2M in unrealized profit with liquidation price just above 3,275. Nearly $4M in margin holds it together,

Three days ago, this wallet walked in with $3M in USDC and did the one thing nobody wanted to hear , he simply shorted.

Today the screen looks very different. The account is sitting on about $147M in open positions, every single dollar aimed downward, and the curve has finally turned green.

His $ETH short alone is carrying the story, roughly 31,000 ETH on 25x, opened around 3,269, now hovering near 3,196, floating more than $2.2M in unrealized profit with liquidation price just above 3,275. Nearly $4M in margin holds it together,

- Reward

- like

- Comment

- Repost

- Share

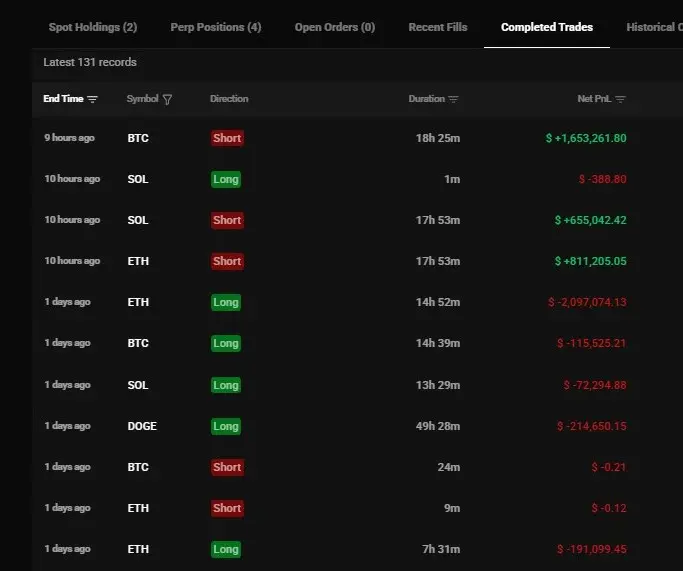

Debating #Greenland "… and someone already Put $53K on It.

Out of all the timelines we could be living in, people are seriously asking, “Will Trump acquire Greenland before 2027?”

And yes… that’s an actual market now.

One brand-new account jumped straight into the news. It’s called “GamblingRuinsLives” -- which, honestly, makes this even funnier. The wallet was created barely 11 hours ago and hasn’t touched anything else.

It dropped $53.7K on the bet that #TRUMP will acquire Greenland before 2027. That’s it.

Right now, the position is already floating at a loss of about $1,277. just the marke

Out of all the timelines we could be living in, people are seriously asking, “Will Trump acquire Greenland before 2027?”

And yes… that’s an actual market now.

One brand-new account jumped straight into the news. It’s called “GamblingRuinsLives” -- which, honestly, makes this even funnier. The wallet was created barely 11 hours ago and hasn’t touched anything else.

It dropped $53.7K on the bet that #TRUMP will acquire Greenland before 2027. That’s it.

Right now, the position is already floating at a loss of about $1,277. just the marke

TRUMP-0,32%

- Reward

- like

- Comment

- Repost

- Share

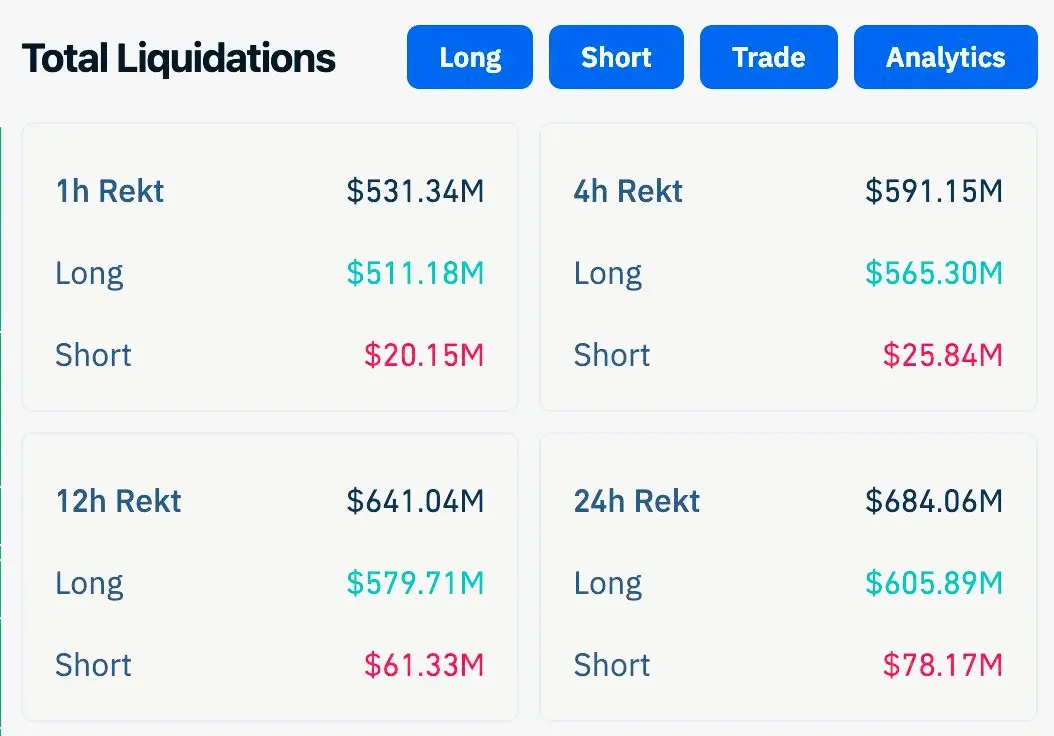

Monday Opened With a Slap From the Market😭 Woke up, charts already bleeding, face fully washed by the tape.

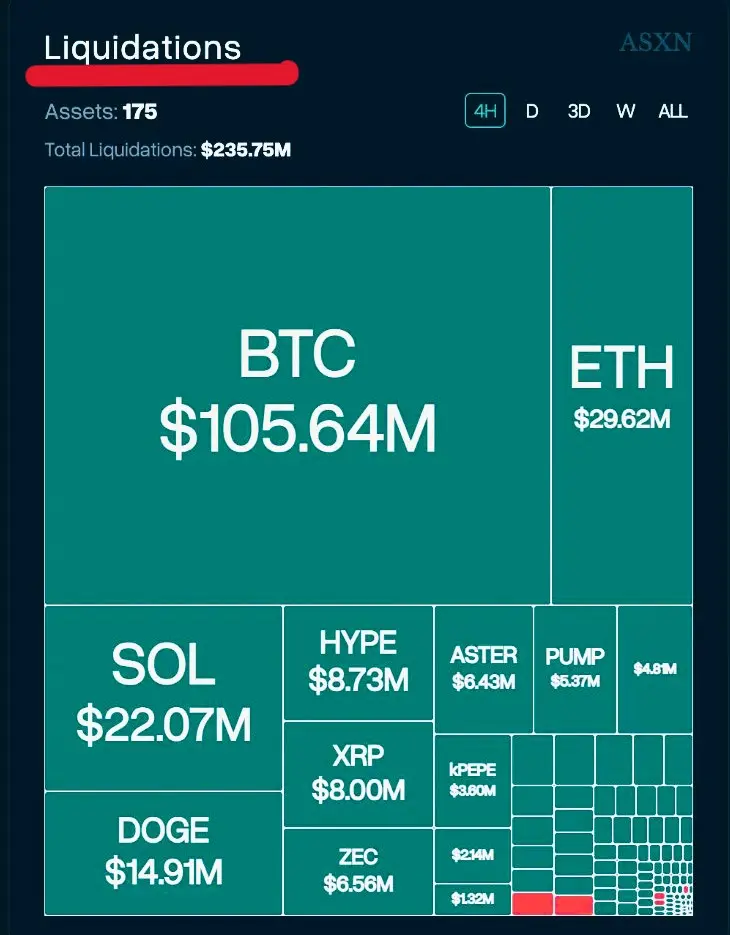

First stop was Coinglass… and yeah, the damage showed up fast. What stood out was where it all happened. Most of the big liquidations before 8 a.m. were piling up on Hyperliquid.

In just the last four hours, Hyperliquid alone wiped out about $235 million. Nearly half of that was $BTC , roughly $105 million with $ETH and $SOL right behind it. And almost all of it? Longs.

People were leaning one way… and the market leaned harder.

while digging a bit and it gets more interesting. Since De

First stop was Coinglass… and yeah, the damage showed up fast. What stood out was where it all happened. Most of the big liquidations before 8 a.m. were piling up on Hyperliquid.

In just the last four hours, Hyperliquid alone wiped out about $235 million. Nearly half of that was $BTC , roughly $105 million with $ETH and $SOL right behind it. And almost all of it? Longs.

People were leaning one way… and the market leaned harder.

while digging a bit and it gets more interesting. Since De

- Reward

- like

- Comment

- Repost

- Share

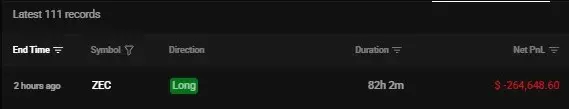

FAct or we say Reality: Size doesn’t save you. Experience doesn’t shield you. Sometimes the market doesn’t need a reason.😳

Few days the market doesn’t argue… It just takes.

Two hours ago, " @machibigbrother " finally let go of the $ZEC trade. That cut alone burned through roughly $264K. ( means booked loss )

And the rest? They didn’t get any kinder.

This account is still carrying three longs, together worth a little over $42 million. ETH is the big one. around 11,300 $ETH , leveraged 25x, sitting near $36.2M in size. It was opened around 3,238. Price now drifts closer to 3,207. Liquidation

Few days the market doesn’t argue… It just takes.

Two hours ago, " @machibigbrother " finally let go of the $ZEC trade. That cut alone burned through roughly $264K. ( means booked loss )

And the rest? They didn’t get any kinder.

This account is still carrying three longs, together worth a little over $42 million. ETH is the big one. around 11,300 $ETH , leveraged 25x, sitting near $36.2M in size. It was opened around 3,238. Price now drifts closer to 3,207. Liquidation

- Reward

- like

- Comment

- Repost

- Share

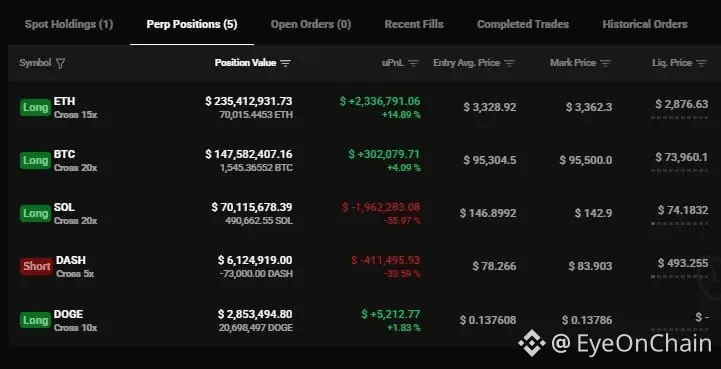

This guy isn’t trying to be loud. It’s just playing the game where the numbers are so big, even a “small” move becomes a headline.

This is #strategy ’s counterparty account, and it’s already sitting on more than $22.2 million in total profit.

Right now, this wallet is spread across five positions, and each one tells a small story of intent. $ETH is held long on 15x. About 70,015 ETH are in play, giving a position size of $235,412,931.73. Entry came in at $3,328.92, with price now near $3,362.3. It’s already floating a profit of $2,336,791.06, roughly +14.89%, with liquidation down at $2,876.63

This is #strategy ’s counterparty account, and it’s already sitting on more than $22.2 million in total profit.

Right now, this wallet is spread across five positions, and each one tells a small story of intent. $ETH is held long on 15x. About 70,015 ETH are in play, giving a position size of $235,412,931.73. Entry came in at $3,328.92, with price now near $3,362.3. It’s already floating a profit of $2,336,791.06, roughly +14.89%, with liquidation down at $2,876.63

- Reward

- 1

- Comment

- Repost

- Share

If you track flows, this is the kind of address you don’t scroll past. You bookmark it. You watch it for sure. Because legends in crypto don’t announce themselves… they leave trails on-chain. This wallet isn’t trading the market… IT IS THE MARKET.

$ETH ’s floating around 3.3K. Bitcoin’s hanging near 95K. SOL’s doing its thing around 142. Feels normal, right? Until you see out and realize there’s one address sitting in the middle of all this with over $920 million riding the wave… and more than $150 million in profit already locked in.

That address is 0xb317d2bc2d3d2df5fa441b5bae0ab9d8b07283ae.

$ETH ’s floating around 3.3K. Bitcoin’s hanging near 95K. SOL’s doing its thing around 142. Feels normal, right? Until you see out and realize there’s one address sitting in the middle of all this with over $920 million riding the wave… and more than $150 million in profit already locked in.

That address is 0xb317d2bc2d3d2df5fa441b5bae0ab9d8b07283ae.

- Reward

- like

- Comment

- Repost

- Share

Is $DASH About to Punch Through $100? Short answer? We think… yeah.

Something about DASH feels different right now. The kind of tension you get when price refuses to break, no matter how hard sellers push. They try again and again. still -- nothing gives.

That kind of pressure doesn’t sit there forever.

Markets don’t stay this quiet without reason. When a chart goes flat like this, when volatility dries up, the next move is rarely gentle. It’s usually sharp and we think sudden.

What really caught our eye is what’s sitting above: a cluster of short positions stacked at higher levels. If price s

Something about DASH feels different right now. The kind of tension you get when price refuses to break, no matter how hard sellers push. They try again and again. still -- nothing gives.

That kind of pressure doesn’t sit there forever.

Markets don’t stay this quiet without reason. When a chart goes flat like this, when volatility dries up, the next move is rarely gentle. It’s usually sharp and we think sudden.

What really caught our eye is what’s sitting above: a cluster of short positions stacked at higher levels. If price s

DASH-1,43%

- Reward

- like

- Comment

- Repost

- Share