InvestingWithBrandon

No content yet

InvestingWithBrandon

Buy calls when sentiment is bad

Sell them when sentiment is good

Sell puts when sentiment is bad

Buy them back when sentiment is good

This is how you maximize human emotions to get the most bang for your buck with option premiums.

Sell them when sentiment is good

Sell puts when sentiment is bad

Buy them back when sentiment is good

This is how you maximize human emotions to get the most bang for your buck with option premiums.

- Reward

- like

- Comment

- Repost

- Share

WHAT REALLY MOVES THE PRICES OF OPTIONS CONTRACTS:

(it's not just the share price)

1. Share Price.

2. Sentiment.

3. Implied Volatility.

4. Demand for the contract.

5. Duration.

6. Strike.

Use this to your advantage.

(it's not just the share price)

1. Share Price.

2. Sentiment.

3. Implied Volatility.

4. Demand for the contract.

5. Duration.

6. Strike.

Use this to your advantage.

- Reward

- like

- Comment

- Repost

- Share

How to get rich in the stock market (simplified)

1. Buy great companies at good prices.

2. Only do 1+ year options on ultra high confidence setups.

3. Keep ratios in check.

4. Always be able to survive & capitalize in a 50% crash.

5. Keep emotions in check during volatility.

That's how you get rich my friends.

1. Buy great companies at good prices.

2. Only do 1+ year options on ultra high confidence setups.

3. Keep ratios in check.

4. Always be able to survive & capitalize in a 50% crash.

5. Keep emotions in check during volatility.

That's how you get rich my friends.

- Reward

- like

- Comment

- Repost

- Share

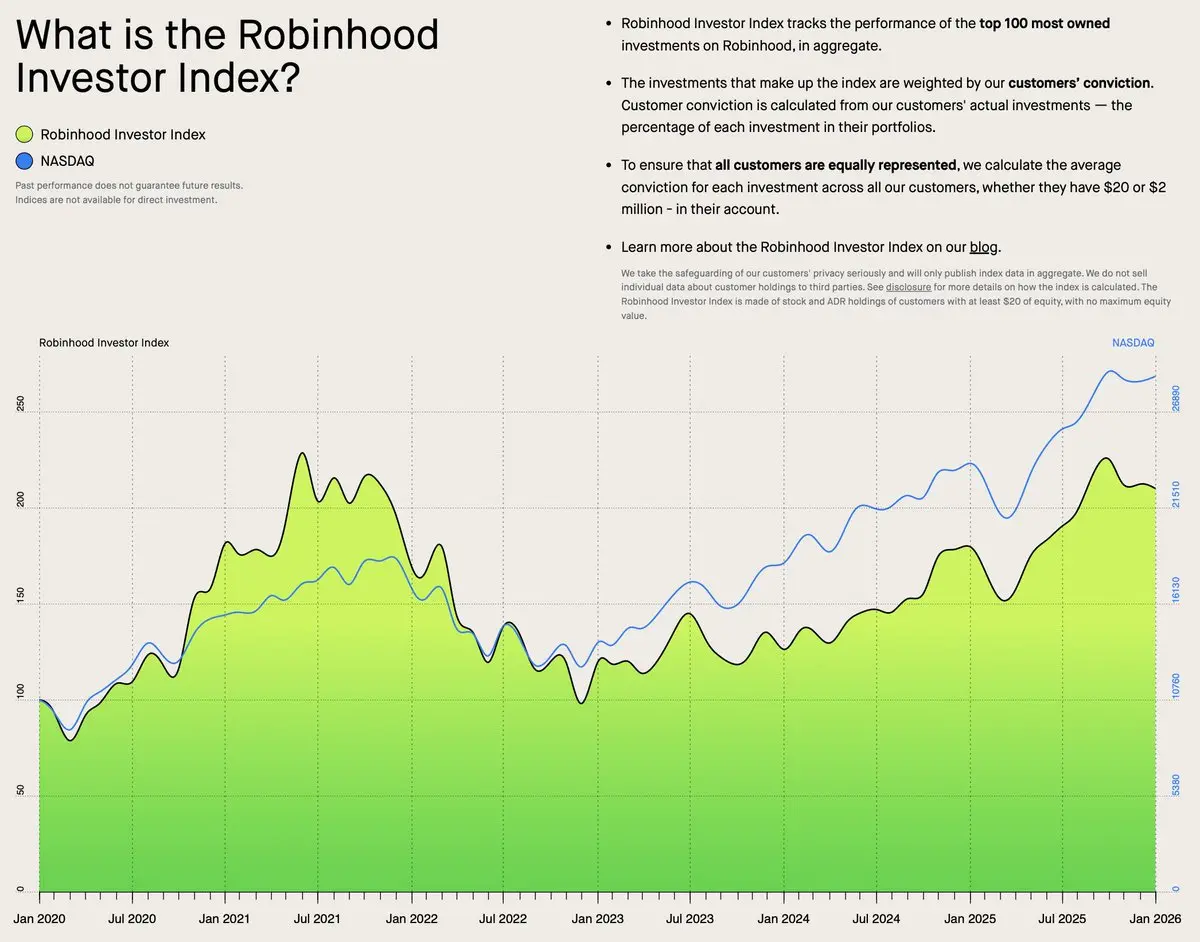

A lot of people do cash secured puts, covered calls, poor man covered calls, & spreads.

A lot of people also underperform the Nasdaq...

A lot of people also underperform the Nasdaq...

- Reward

- 1

- Comment

- Repost

- Share

THE REAL RISK IS NOT BEING INVESTED...

Everyone talks about the risk of buying stocks.

Nobody talks about the risk of not owning them.

Missing the biggest technological wave ever created is a bigger risk than any short term volatility.

The upside is asymmetric.

The downside is temporary.

The future is obvious.

Buy great companies at good prices.

The question is whether you have the emotional control to benefit from it.

Everyone talks about the risk of buying stocks.

Nobody talks about the risk of not owning them.

Missing the biggest technological wave ever created is a bigger risk than any short term volatility.

The upside is asymmetric.

The downside is temporary.

The future is obvious.

Buy great companies at good prices.

The question is whether you have the emotional control to benefit from it.

- Reward

- like

- Comment

- Repost

- Share

Think of every dollar you have as an employee.

You don’t want anyone slacking on the job.

Keep every single dollar working to multiple itself.

Money is a tool.

Use it.

You don’t want anyone slacking on the job.

Keep every single dollar working to multiple itself.

Money is a tool.

Use it.

- Reward

- like

- Comment

- Repost

- Share

🔴How to stop being a retail investor that underperforms the market in the long term:

Stop selling CSP's

Stop selling covered calls on bullish stocks

Stop day trading

Stop doing short duration options trades

Stop getting emotional with your investments

Stop following the broke herd

Instead, do this:

Sell portfolio secured puts (not cash secured)

Only sell CCs when bearish

Know what you own and why

Accept volatility as opportunity

Do duration plays because they are safer

Keep ratios in check.

Be patient

Stop selling CSP's

Stop selling covered calls on bullish stocks

Stop day trading

Stop doing short duration options trades

Stop getting emotional with your investments

Stop following the broke herd

Instead, do this:

Sell portfolio secured puts (not cash secured)

Only sell CCs when bearish

Know what you own and why

Accept volatility as opportunity

Do duration plays because they are safer

Keep ratios in check.

Be patient

- Reward

- like

- Comment

- Repost

- Share

🟢ALWAYS ALLOCATE TO THE BEST EXPECTED FUTURE RETURNS.

Do not get attached to something where the story changed from when you bought it.

- Maybe the valuation doubled.

- Maybe competition is stiffer than expected.

- Maybe growth is unlikely to be durable.

Always re assess your current positions on a regular basis & look for better opportunities.

Do not get attached to something where the story changed from when you bought it.

- Maybe the valuation doubled.

- Maybe competition is stiffer than expected.

- Maybe growth is unlikely to be durable.

Always re assess your current positions on a regular basis & look for better opportunities.

- Reward

- like

- Comment

- Repost

- Share

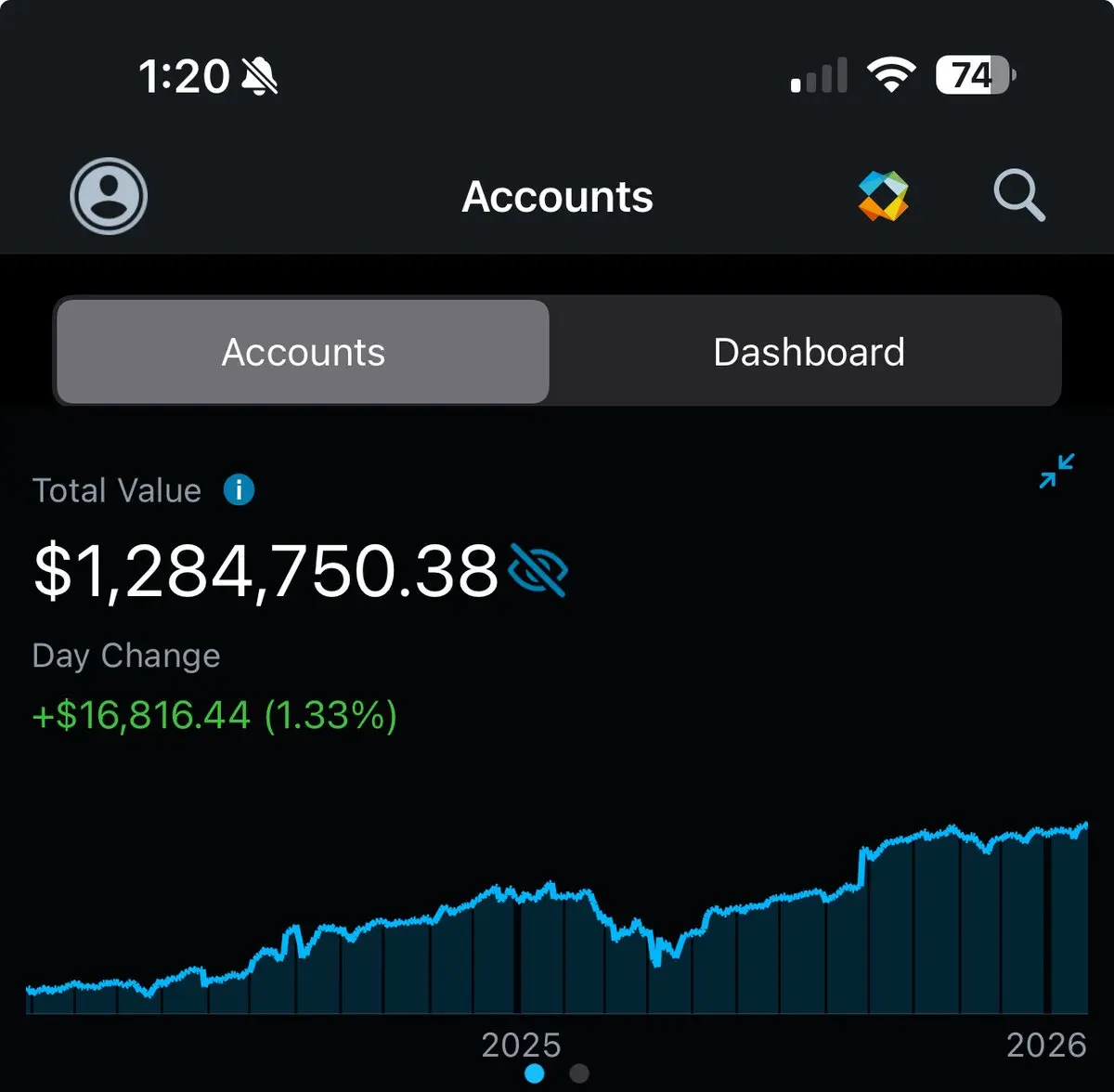

I SCALED MY TRADING ACCOUNT FROM NOTHING TO $1.3m IN A FEW YEARS DOING THIS SIMPLE STRATEGY:

(No luck required lol)

35% $VOO

35% $Q

30% in undervalued companies.

- Sell puts with strikes 10% ish below the current prices assuming market/company is near intrinsic value.

- Company must have a durable competitive advantage.

- 1+ year durations on all options

- Reinvest the put premiums back into more shares.

- Portfolio secured, not cash secured for puts.

KEEP IT SIMPLE GUYS

(No luck required lol)

35% $VOO

35% $Q

30% in undervalued companies.

- Sell puts with strikes 10% ish below the current prices assuming market/company is near intrinsic value.

- Company must have a durable competitive advantage.

- 1+ year durations on all options

- Reinvest the put premiums back into more shares.

- Portfolio secured, not cash secured for puts.

KEEP IT SIMPLE GUYS

- Reward

- like

- Comment

- Repost

- Share

If you get value from my posts, you'll love my 10 Day Stock & Options Transformation Training.

No day trading.

No swing trading.

No BS.

Just straight up investing the right way.

Over the course of 10 days of training (you can do it faster if you want), you'll learn exactly how you can scale your portfolio to millions with Stocks & Options in a low risk way & get access to my mastermind Discord community.

This is the exact same system I have used for the last decade & scaled to millions with tens of thousands in monthly cash flow in a low risk way.

Get set up here:

No day trading.

No swing trading.

No BS.

Just straight up investing the right way.

Over the course of 10 days of training (you can do it faster if you want), you'll learn exactly how you can scale your portfolio to millions with Stocks & Options in a low risk way & get access to my mastermind Discord community.

This is the exact same system I have used for the last decade & scaled to millions with tens of thousands in monthly cash flow in a low risk way.

Get set up here:

- Reward

- like

- Comment

- Repost

- Share

Many people over complicate investing... LIKE BIG TIME.

You don't need 48 chart patterns & guess which one your company might be tracing...

NO.

What you do need is to find great companies at good prices.

Companies with a moat.

Companies with pricing power.

Companies that have a competitive advantage.

Companies that you are ok to hold long term.

While you can make money with complex short term strategies, 99.9% of people will not beat the SP500 in the long term doing it.

So why not buy the SP500 instead?

Well... The same reason Vegas is Vegas.

The herd loves the thrill of having the odds stacke

You don't need 48 chart patterns & guess which one your company might be tracing...

NO.

What you do need is to find great companies at good prices.

Companies with a moat.

Companies with pricing power.

Companies that have a competitive advantage.

Companies that you are ok to hold long term.

While you can make money with complex short term strategies, 99.9% of people will not beat the SP500 in the long term doing it.

So why not buy the SP500 instead?

Well... The same reason Vegas is Vegas.

The herd loves the thrill of having the odds stacke

- Reward

- like

- Comment

- Repost

- Share

If this volatility scares you…

It’s because you are allocated to crap companies at crap valuations.

I sleep well at night.

Do you?

It’s because you are allocated to crap companies at crap valuations.

I sleep well at night.

Do you?

- Reward

- like

- Comment

- Repost

- Share

I remember starting this account with NOTHING about 6 years ago...

No day trading.

No Fibonacci's

No VWAPs

No crazy margin.

No luck.

No BS.

Just a simple strategy of buying great companies at good prices & using options to magnify ULTRA high confidence plays.

No day trading.

No Fibonacci's

No VWAPs

No crazy margin.

No luck.

No BS.

Just a simple strategy of buying great companies at good prices & using options to magnify ULTRA high confidence plays.

- Reward

- like

- Comment

- Repost

- Share

If the swings in the market from🟢 to 🔴 makes you nervous or you got "wiped out"

You need to take a hard look into your portfolio and re allocate to something more reasonable.

We are still close to ATHs so yes, it's still a good time to de risk!

You need to take a hard look into your portfolio and re allocate to something more reasonable.

We are still close to ATHs so yes, it's still a good time to de risk!

- Reward

- like

- Comment

- Repost

- Share

I'll never criticize the new investor making $50/month selling options...

Unless they do covered calls or cash secured puts...

Then I will.

(those strategies are a trap)

Most new investors fall victim to this because it's viewed by the herd as "safe" and "low capital"

But in reality, it's a way to cap upside on a bullish company (covered call) & a way to sit on a bunch of cash when you are bullish on a company (cash secured put)

I haven't met a single person that made millions selling CCs or CSPs...

But I have personally made millions selling portfolio secured puts, not cash secured.

It will c

Unless they do covered calls or cash secured puts...

Then I will.

(those strategies are a trap)

Most new investors fall victim to this because it's viewed by the herd as "safe" and "low capital"

But in reality, it's a way to cap upside on a bullish company (covered call) & a way to sit on a bunch of cash when you are bullish on a company (cash secured put)

I haven't met a single person that made millions selling CCs or CSPs...

But I have personally made millions selling portfolio secured puts, not cash secured.

It will c

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More88.49K Popularity

7.72K Popularity

7.99K Popularity

54.96K Popularity

4.42K Popularity

Pin