JackBTC

No content yet

Pin

JackBtc

- Reward

- 3

- Comment

- Repost

- Share

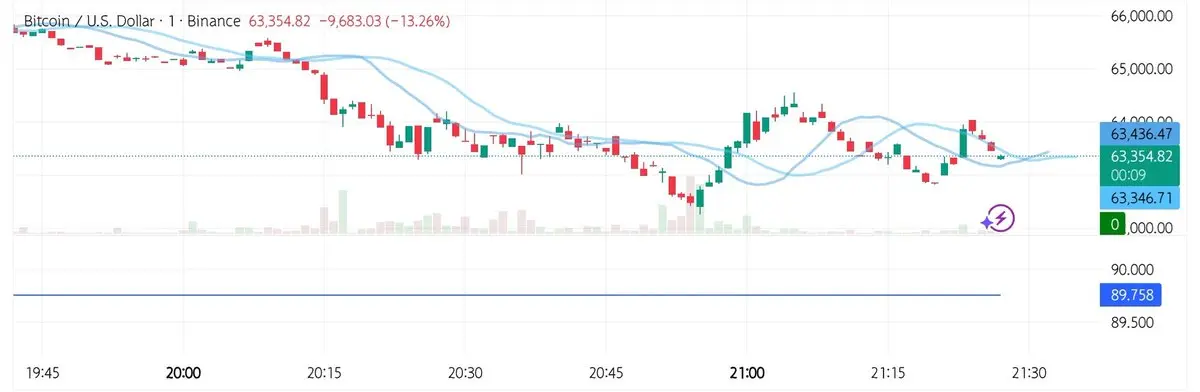

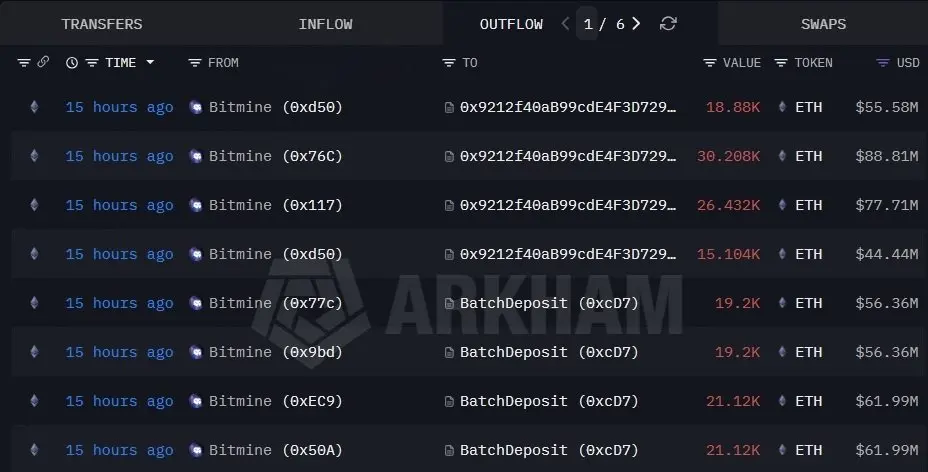

Over $230 billion has vanished from the market.Hopefully, you didn’t go in with everything on the line.

- Reward

- 2

- Comment

- Repost

- Share

Silver just suffered a brutal sell-off, dropping nearly a quarter in 24 hours and erasing around $1.6 trillion in value.Naturally, questions are starting to surface, is the team still fully committed to the project?

- Reward

- 2

- Comment

- Repost

- Share

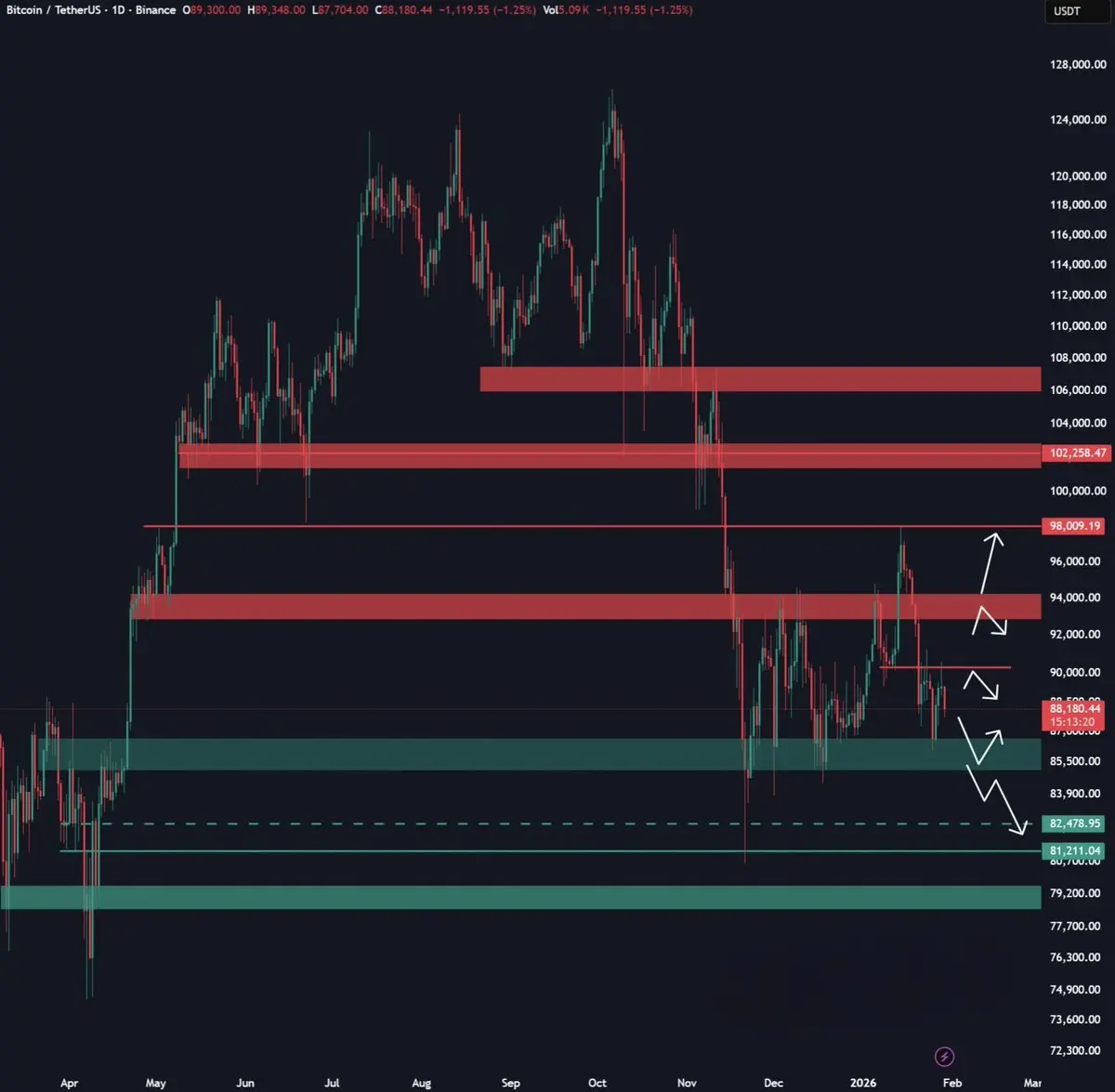

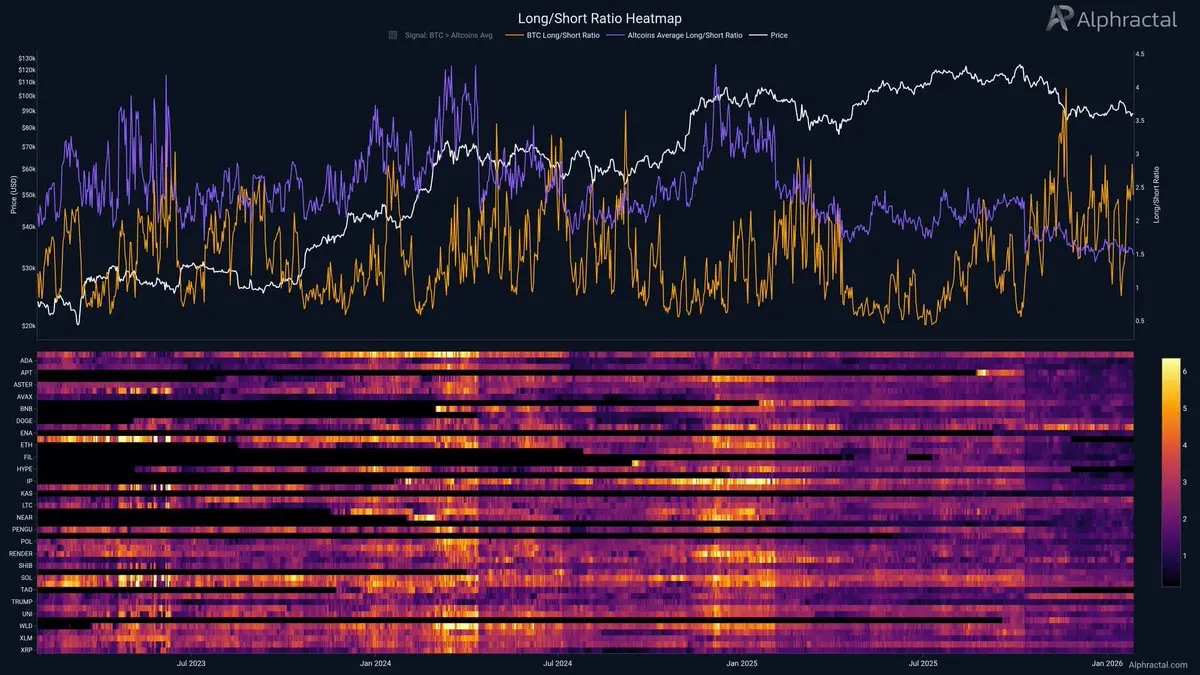

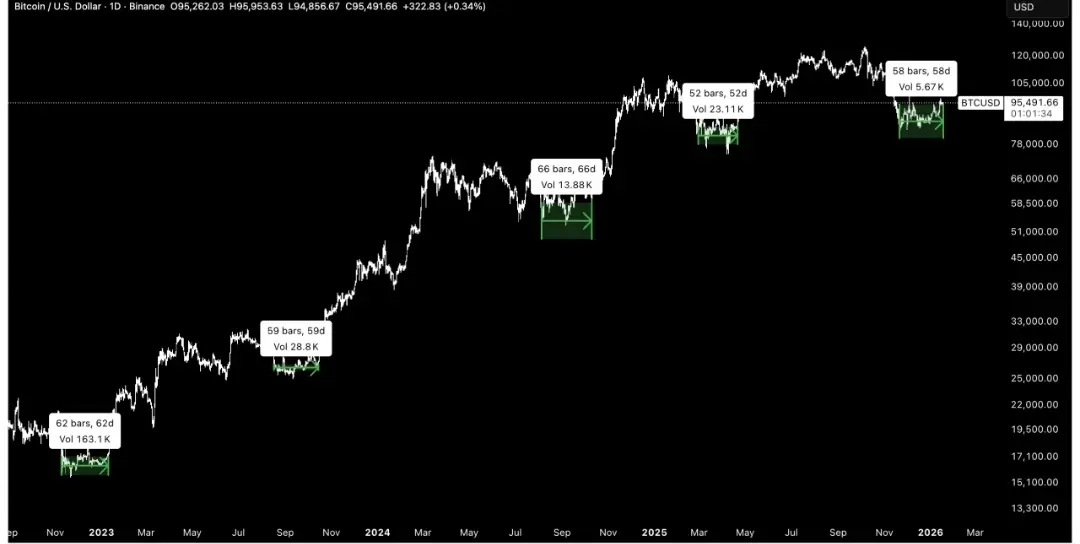

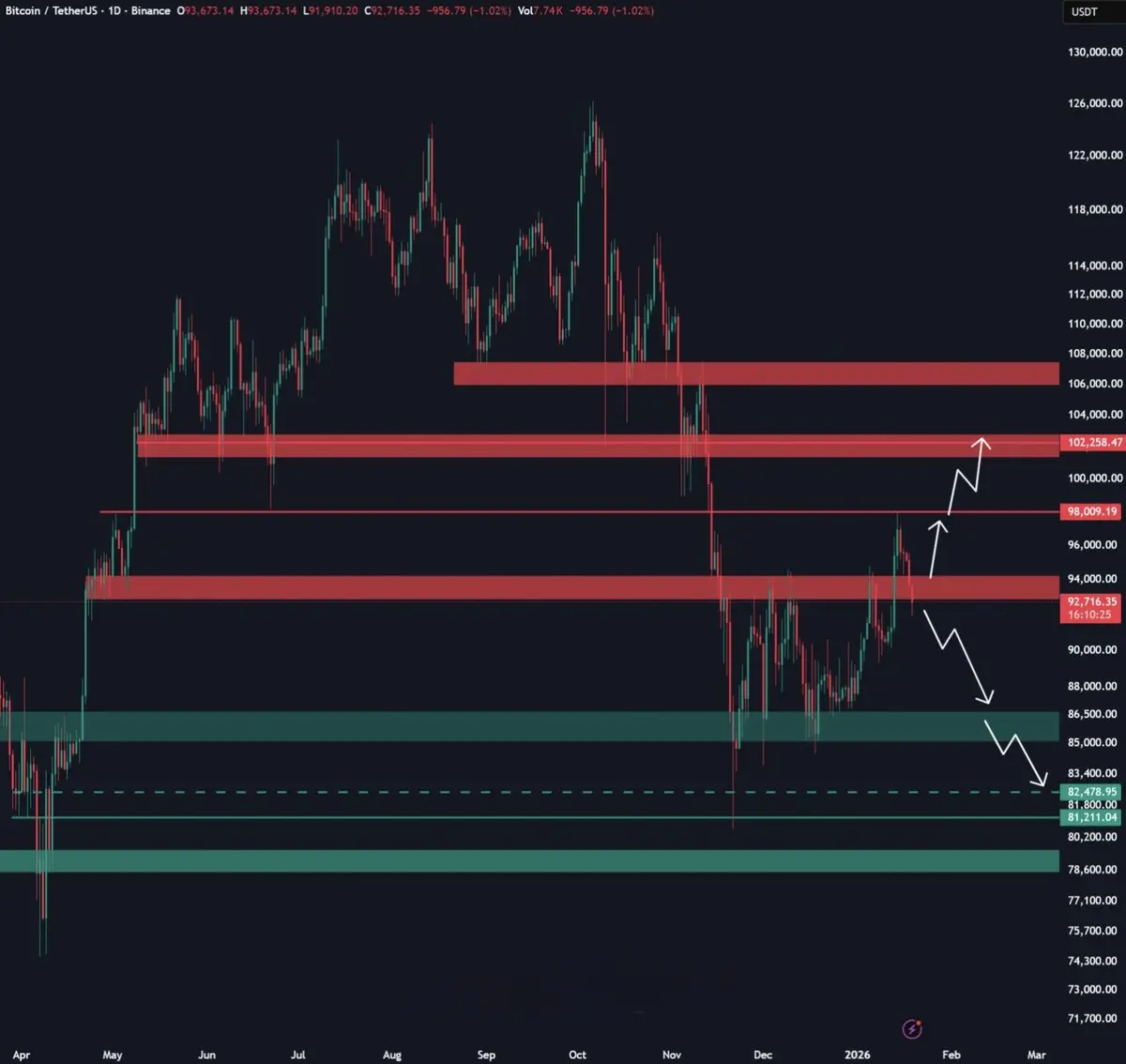

Altcoins are under heavy pressure right now.▫️ A multi-year support level has broken▫️ Price failed to hold above the bull-market support zoneFor a real turnaround, total altcoin market cap must regain the weekly bull-market support range.

- Reward

- 3

- Comment

- Repost

- Share

Gate CrossEx Account Now Live

Experience unified multi-exchange trading with spot, cross margin, and USDT perpetuals.

Up to 20× leverage, advanced risk control, and API-only trading for professionals.

VIP+3 Fee Benefit: Jan 19 – Feb 19, 2026

Open Now:

Experience unified multi-exchange trading with spot, cross margin, and USDT perpetuals.

Up to 20× leverage, advanced risk control, and API-only trading for professionals.

VIP+3 Fee Benefit: Jan 19 – Feb 19, 2026

Open Now:

- Reward

- 3

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share