KamazXBT

No content yet

Onchain $BTC

This chart shows onchain cost basis levels where different classes of BTC holders are positioned. It’s built from realized price data, not price action. F1 around 81k is the short-term holder cluster. F2 is a low-volume gap. F3 is where institutional buyers and ETF flows are likely anchored, around 65-68k. F4 is the long-term holder realized price zone at 56-60k, the last line of defense in macro terms. It doesn’t show liquidations, open interest, or footprint behavior.

This chart shows onchain cost basis levels where different classes of BTC holders are positioned. It’s built from realized price data, not price action. F1 around 81k is the short-term holder cluster. F2 is a low-volume gap. F3 is where institutional buyers and ETF flows are likely anchored, around 65-68k. F4 is the long-term holder realized price zone at 56-60k, the last line of defense in macro terms. It doesn’t show liquidations, open interest, or footprint behavior.

BTC-5,55%

- Reward

- like

- Comment

- Repost

- Share

gameplan for jan 🐂

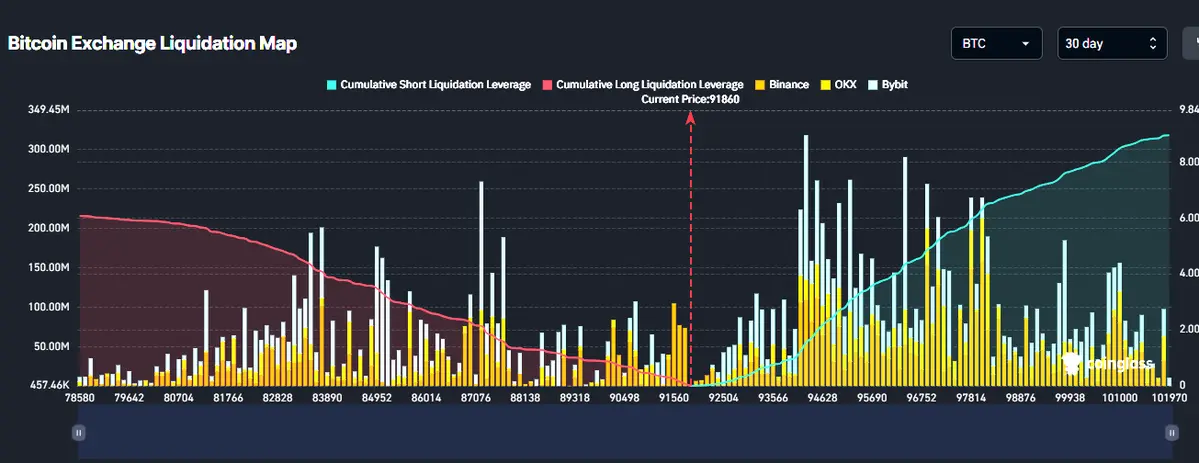

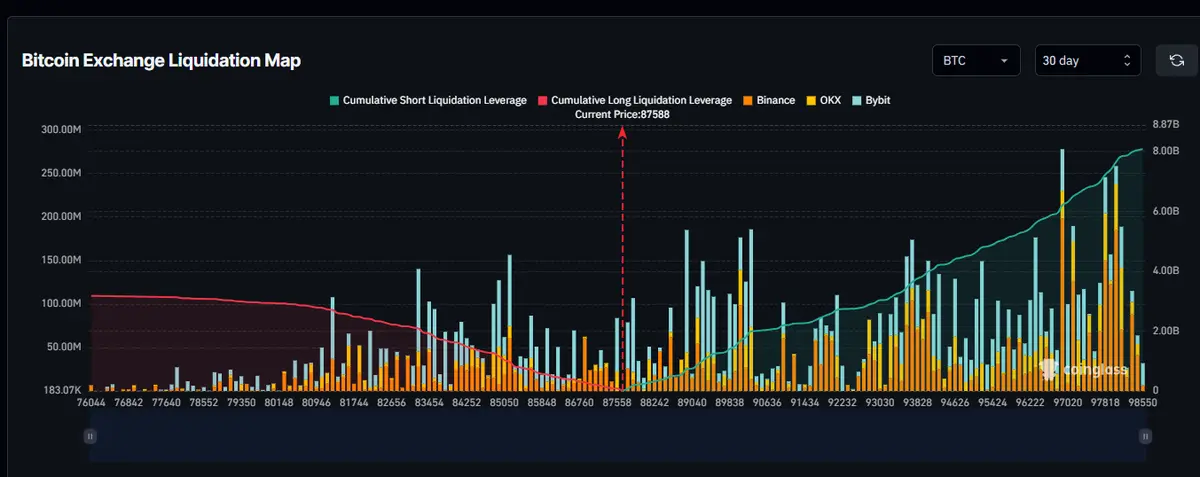

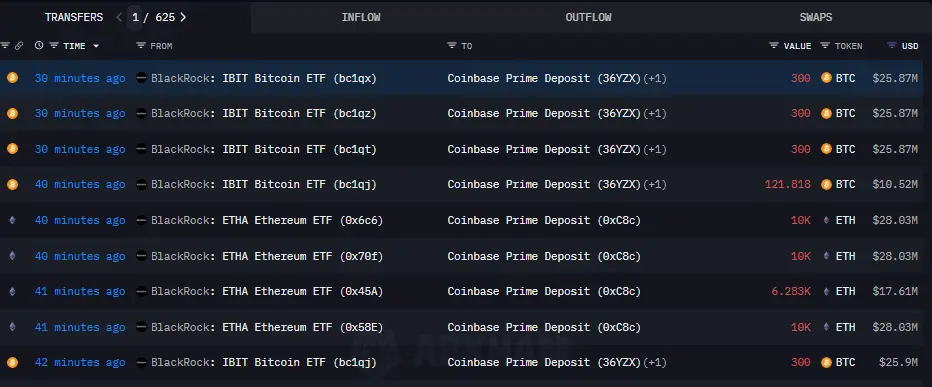

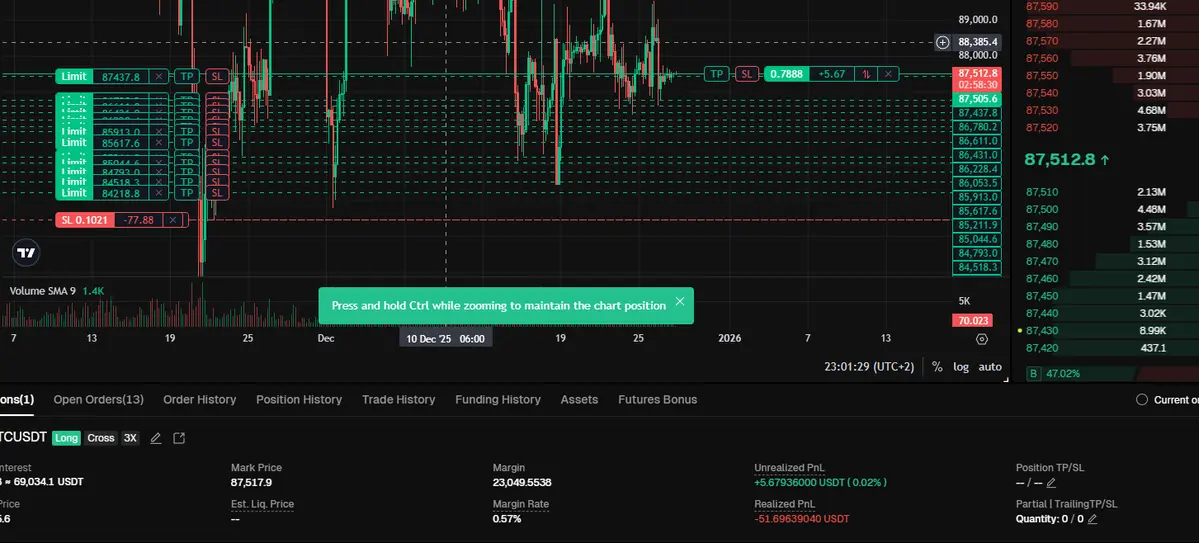

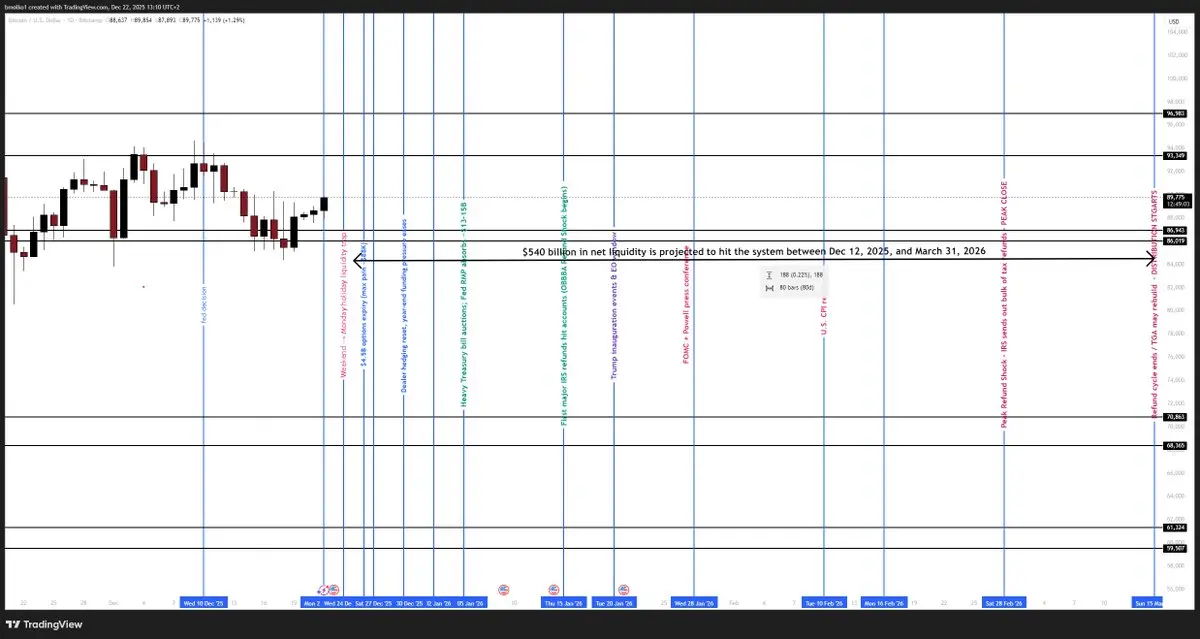

...is to get into a low leverage long, risking around 10k to catch the bull train they’re preparing, i'm pretty bullish going into jan, expecting we test the 90k area again, and a move above toward 104k isn’t crazy if liquidity aligns, but before the 31st i expect a flushdown which is why i’ve layered all my bids in advance, since i’ll be traveling a lot and can’t watch charts 24 7 or time it properly, so i’m layering around to get an average near 86300, with a total nominal size of 384000, which at that entry equals around 4.45 btc, total risk on the move is about 9 to 10

...is to get into a low leverage long, risking around 10k to catch the bull train they’re preparing, i'm pretty bullish going into jan, expecting we test the 90k area again, and a move above toward 104k isn’t crazy if liquidity aligns, but before the 31st i expect a flushdown which is why i’ve layered all my bids in advance, since i’ll be traveling a lot and can’t watch charts 24 7 or time it properly, so i’m layering around to get an average near 86300, with a total nominal size of 384000, which at that entry equals around 4.45 btc, total risk on the move is about 9 to 10

- Reward

- like

- Comment

- Repost

- Share

The pivot is happening - I'm pretty bullish for mid-Jan, February, and mid-March, then expecting chop afterward.

Still flat - no new positions added. It’s been a good month. Getting ready for the holidays and heading out tonight for a Christmas trip with the fam. Not chasing anything now - preserving capital, resting up, and preparing for what looks like a high-conviction Q1 2026 window. Happy holidays guys If you have any questions just DM or tag me i will try to answer

$BTC

Still flat - no new positions added. It’s been a good month. Getting ready for the holidays and heading out tonight for a Christmas trip with the fam. Not chasing anything now - preserving capital, resting up, and preparing for what looks like a high-conviction Q1 2026 window. Happy holidays guys If you have any questions just DM or tag me i will try to answer

$BTC

BTC-5,55%

- Reward

- like

- Comment

- Repost

- Share

oh wow , after 3 years my NFTs value is like 100$

- Reward

- like

- Comment

- Repost

- Share

The size of that fist. If @jakepaul pulls this off with @anthonyjoshua going to be crazy.

- Reward

- like

- Comment

- Repost

- Share

On December 10, 2025, the Federal Reserve announced it will begin Reserve Management Purchases (RMPs) starting December 12, injecting approximately $40 billion in Treasury bills into the system to maintain ample banking reserves. These monthly purchases, focused on short-term Treasuries, aim to offset upcoming liquidity drains such as tax payments and shifts in non-reserve liabilities, with schedules released each month around the 9th business day. While not outright QE, this move effectively adds liquidity, supporting market functioning and risk assets. The Fed anticipates the elevated pace t

BTC-5,55%

- Reward

- like

- Comment

- Repost

- Share

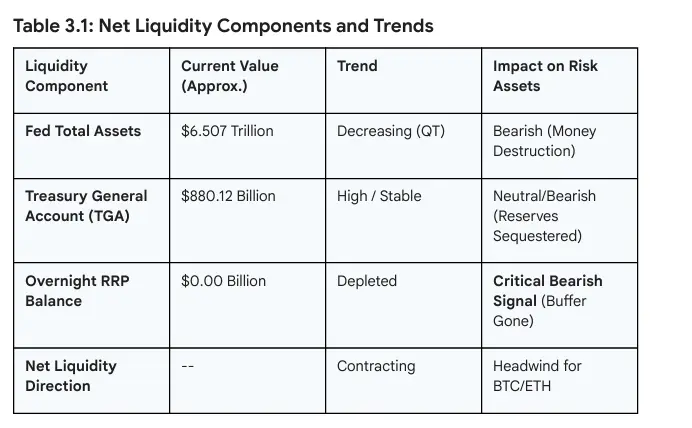

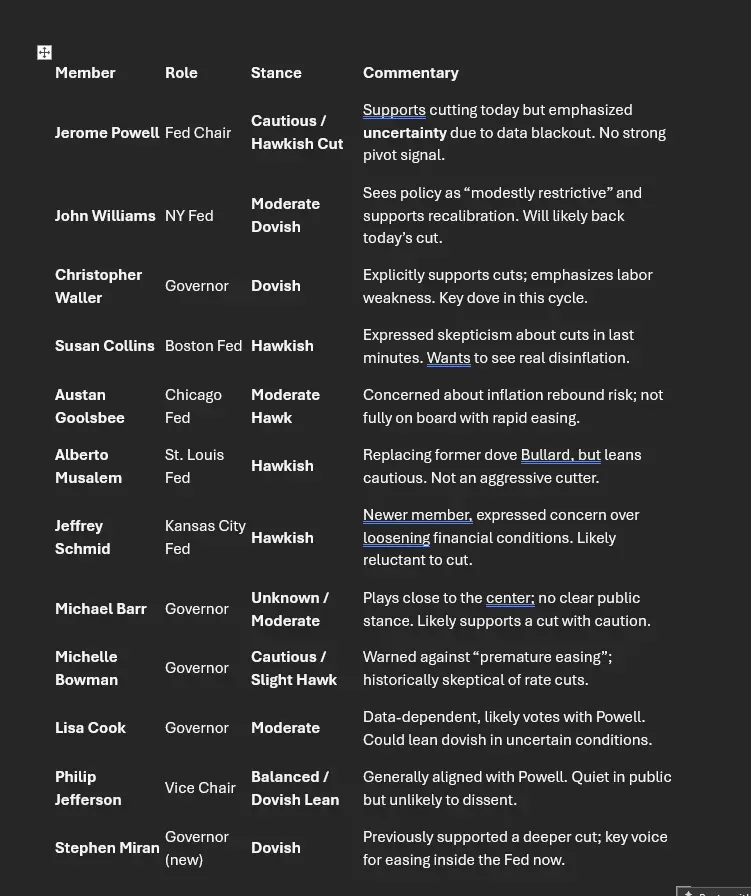

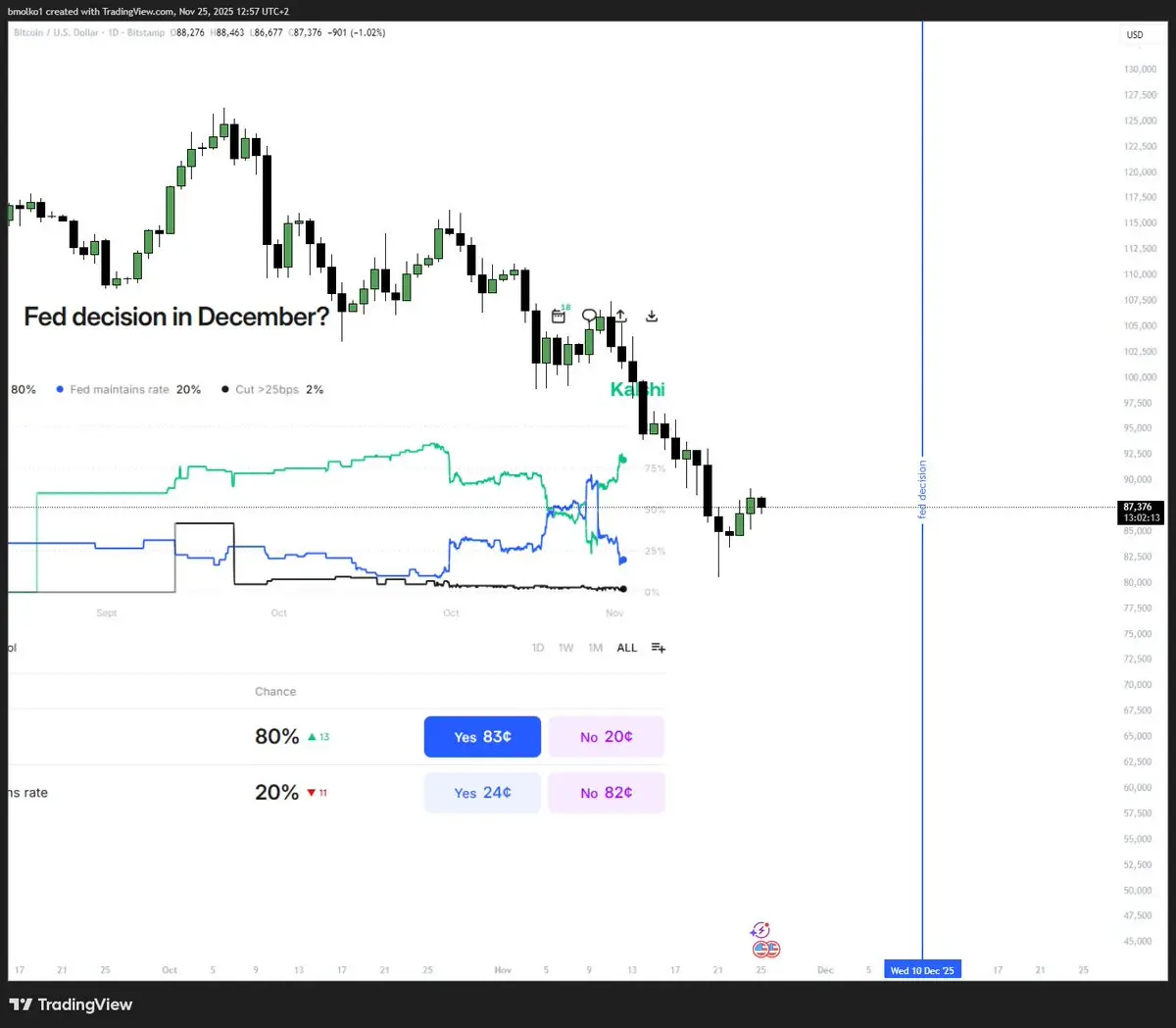

Right now, markets are positioned for a Fed rate cut , and they'll likely get one. But that doesn’t mean conditions are bullish. The Fed is operating in a data blackout: no CPI, no jobs numbers, no clear view on inflation. That raises the risk Powell cuts rates today, but he can deliver a cautious message, warning that future cuts aren’t guaranteed without stronger evidence. If that happens, it’s a “hawkish cut” , and markets could sell off, especially if the updated dot plot shows fewer rate cuts in 2026 than the market expects. Meanwhile, the deeper issue is liquidity. The Fed’s balance she

BTC-5,55%

- Reward

- like

- Comment

- Repost

- Share

$BTC - Even though my plan failed and I took a big L, I managed to recover the loss but failing still stings not gonna lie. Because i knew and i was expecting this but tbh i didnt expect markets to dip to 80 area. Anyway no huge dmg taken or losses just bit of ego hit.

The thesis was correct: markets priced in no cuts aggressively, then the Fed signaled easing by December, and now markets are repricing those cuts. So even when the thesis is right, timing is everything. Anyone can draw levels, but few can pull the trigger at the exact right moment. That’s the real edge.

Still holding 25% posit

The thesis was correct: markets priced in no cuts aggressively, then the Fed signaled easing by December, and now markets are repricing those cuts. So even when the thesis is right, timing is everything. Anyone can draw levels, but few can pull the trigger at the exact right moment. That’s the real edge.

Still holding 25% posit

BTC-5,55%

- Reward

- like

- Comment

- Repost

- Share

So Fed Williams' declarations were enough to get markets into full hopium mode and spike the rate cut odds to 80%, but this doesn't change the fundamentals. Powell is trapped on messy data because of the shutdown and markets are acting like a cut is already locked in. He has two choices: cut in December and follow up with dovish lines, which keeps markets calm but chips away at Fed credibility, or hold steady and wait for cleaner January data, which makes markets freak out, risks a full meltdown, and makes him look a bit crazy in the eyes of the Trump administration. Either way, it's a lose-lo

- Reward

- like

- Comment

- Repost

- Share

🧾 US $PMI Flash (Nov):

• Manufacturing: 51.9 (vs 52.0 est)

• Services: 55.0 (vs 54.6 est)

• Composite: 54.8 (vs 54.5 est)

Services driving growth

Manufacturing still sluggish

meh data

• Manufacturing: 51.9 (vs 52.0 est)

• Services: 55.0 (vs 54.6 est)

• Composite: 54.8 (vs 54.5 est)

Services driving growth

Manufacturing still sluggish

meh data

- Reward

- like

- Comment

- Repost

- Share