Kingbest

No content yet

Kingbest

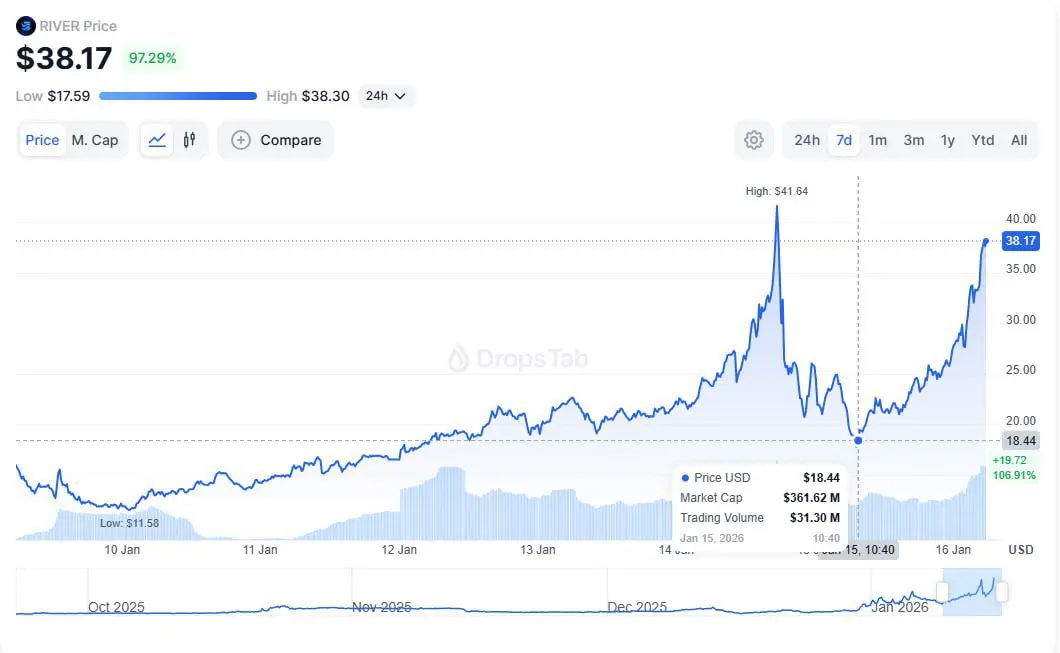

Cumulative volume up +56% YoY.

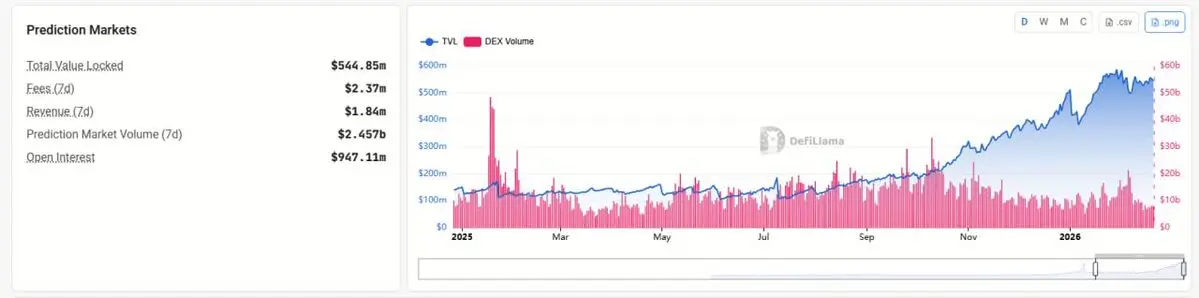

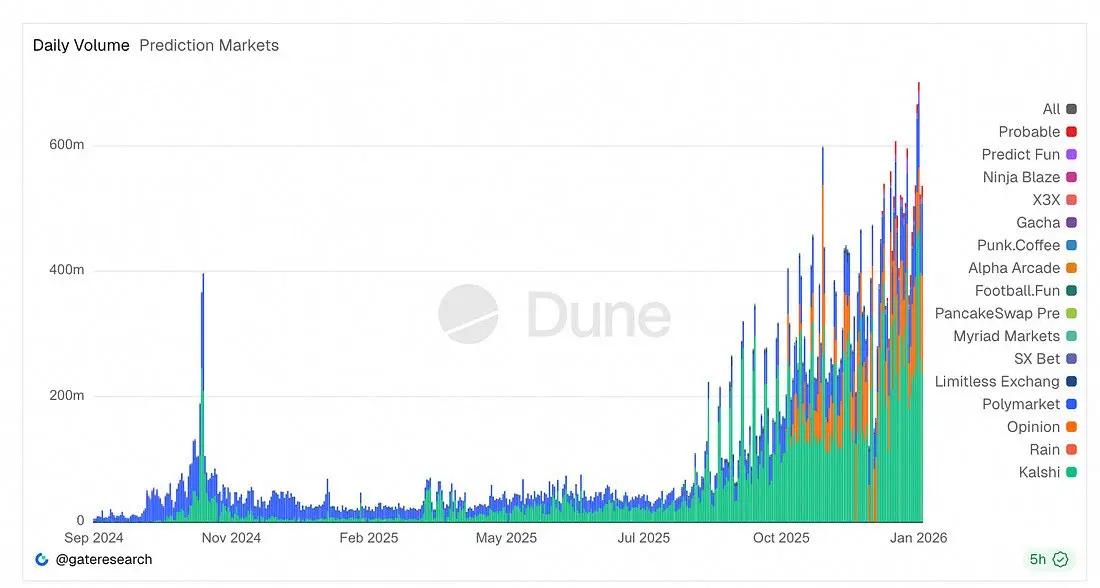

Prediction markets aren’t just for the election anymore. people are hedging their actual lives, pricing in CPI, and betting on culture in real time. Binary outcomes are the only way to find truth when everything else is noise.

2024 was memes.

2025 was infrastructure.

2026 is the year of the prediction market breakout.

The liquidity is becoming the oracle. Don’t fade the truth machine.

Prediction markets aren’t just for the election anymore. people are hedging their actual lives, pricing in CPI, and betting on culture in real time. Binary outcomes are the only way to find truth when everything else is noise.

2024 was memes.

2025 was infrastructure.

2026 is the year of the prediction market breakout.

The liquidity is becoming the oracle. Don’t fade the truth machine.

- Reward

- like

- Comment

- Repost

- Share

When leverage leaves quietly, the market gets confused.

$ETH is down, OI has slid to $10.19B, a six-month low.

Whale wallets trimmed roughly 1.5% of reserves.

Price slipped under $2,000 and briefly below the realized price of recent accumulation addresses.

It looks weak.

But weakness and reset are not the same thing.

𝐖𝐡𝐚𝐭 𝐓𝐡𝐢𝐬 𝐏𝐡𝐚𝐬𝐞 𝐀𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐑𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐬

Every cycle has a moment where conviction doesn’t disappear, it thins.

OI collapsing by roughly 60% since October tells you something important:

Speculators left.

Not believers.

Spot activity continues.

Accumulatio

$ETH is down, OI has slid to $10.19B, a six-month low.

Whale wallets trimmed roughly 1.5% of reserves.

Price slipped under $2,000 and briefly below the realized price of recent accumulation addresses.

It looks weak.

But weakness and reset are not the same thing.

𝐖𝐡𝐚𝐭 𝐓𝐡𝐢𝐬 𝐏𝐡𝐚𝐬𝐞 𝐀𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐑𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐬

Every cycle has a moment where conviction doesn’t disappear, it thins.

OI collapsing by roughly 60% since October tells you something important:

Speculators left.

Not believers.

Spot activity continues.

Accumulatio

ETH0,33%

- Reward

- like

- Comment

- Repost

- Share

I’ve been bullish on the RWA space for a while, and $MSVP has been trending across DEXs consistently, now they are live on @bingXofficial

This is their first CEX listing, and it feels like more are already in the pipeline.

They’re also running a mega airdrop and BingX campaign right now.

Link below

This is their first CEX listing, and it feels like more are already in the pipeline.

They’re also running a mega airdrop and BingX campaign right now.

Link below

- Reward

- like

- Comment

- Repost

- Share

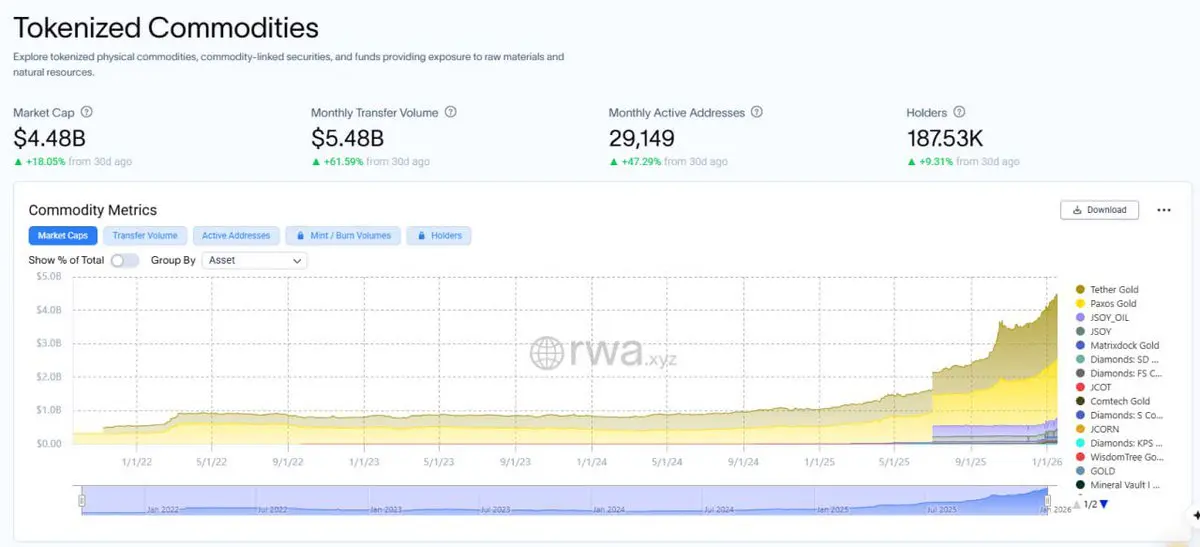

This week's rotation is measurable.

While $BTC and $ETH traded lower on macro uncertainty, capital did not exit onchain rails. It rotated inside them.

Tokenized commodities now sit at $4.4B total market value, led by:

- @tethergold ($XAUT): $1.9B

- @Paxos Gold ($PAXG): $1.8B

Combined, gold-backed tokens account for 85%+ of tokenized commodity supply.

That shift coincided with:

- Spot gold pushing to fresh highs

- Tokenized gold trading volumes exceeding $5.7B in 2025, including an 8× QoQ surge in Q4

- Stable or rising holder counts in gold-backed tokens, even as crypto risk appetite softened

C

While $BTC and $ETH traded lower on macro uncertainty, capital did not exit onchain rails. It rotated inside them.

Tokenized commodities now sit at $4.4B total market value, led by:

- @tethergold ($XAUT): $1.9B

- @Paxos Gold ($PAXG): $1.8B

Combined, gold-backed tokens account for 85%+ of tokenized commodity supply.

That shift coincided with:

- Spot gold pushing to fresh highs

- Tokenized gold trading volumes exceeding $5.7B in 2025, including an 8× QoQ surge in Q4

- Stable or rising holder counts in gold-backed tokens, even as crypto risk appetite softened

C

- Reward

- like

- Comment

- Repost

- Share

Daily trading activity across prediction markets has hit record highs, around $700 million in a single day!

It is impressive to watch prediction markets evolve from niche bets on sports and politics into a major financial primitive that Wall Street, hedge funds, and regulators now have to take seriously.

When big players pay attention, it is worth paying attention too.

@xodotmarket introduces a unique model where anyone can create and trade beliefs on real world events while turning collective insight into clear market signals.

I placed a trade today on XO Market and it clicked. Prediction ma

It is impressive to watch prediction markets evolve from niche bets on sports and politics into a major financial primitive that Wall Street, hedge funds, and regulators now have to take seriously.

When big players pay attention, it is worth paying attention too.

@xodotmarket introduces a unique model where anyone can create and trade beliefs on real world events while turning collective insight into clear market signals.

I placed a trade today on XO Market and it clicked. Prediction ma

- Reward

- like

- Comment

- Repost

- Share

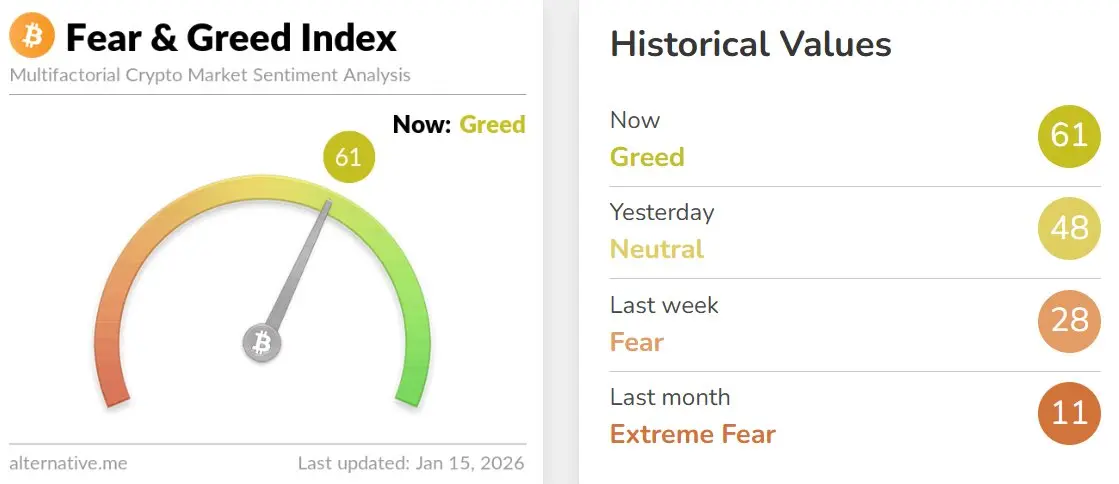

Sentiment flipping back to “greed” would usually be a warning.

This time, the structure doesn’t agree.

+ Price pushed from $89K to $97K while participation fell.

+ Exchange balances are at a 7-month low.

+ Non-empty wallets are declining, not growing.

+ October already cleared $19B in liquidations.

That’s not a crowd rushing in. It’s weak hands finishing their exit.

What matters is the order of operations: capitulation happened first → supply left exchanges → price stabilized → sentiment recovered.

That sequence is important. Early recoveries form when price rises with less activity, not more.

This time, the structure doesn’t agree.

+ Price pushed from $89K to $97K while participation fell.

+ Exchange balances are at a 7-month low.

+ Non-empty wallets are declining, not growing.

+ October already cleared $19B in liquidations.

That’s not a crowd rushing in. It’s weak hands finishing their exit.

What matters is the order of operations: capitulation happened first → supply left exchanges → price stabilized → sentiment recovered.

That sequence is important. Early recoveries form when price rises with less activity, not more.

- Reward

- like

- Comment

- Repost

- Share

This feels like a quiet shift: crypto maturing past the experiment stage.

The new adds aren’t the loudest narratives; they’re the systems people will rely on when noise fades.

+ AI is moving from hype to accountability (@NousResearch, Poseidon).

+ Execution layers are moving from raw speed to reliability (@megaeth, @horizenglobal).

+ Consumer apps are moving from novelty to daily use (@Aria_Protocol, Playtron).

That pattern shows a market growing up.

Grayscale isn’t chasing trends. It’s recognizing which categories are becoming non-optional.

Infrastructure always compounds before anyone calls

The new adds aren’t the loudest narratives; they’re the systems people will rely on when noise fades.

+ AI is moving from hype to accountability (@NousResearch, Poseidon).

+ Execution layers are moving from raw speed to reliability (@megaeth, @horizenglobal).

+ Consumer apps are moving from novelty to daily use (@Aria_Protocol, Playtron).

That pattern shows a market growing up.

Grayscale isn’t chasing trends. It’s recognizing which categories are becoming non-optional.

Infrastructure always compounds before anyone calls

- Reward

- like

- Comment

- Repost

- Share

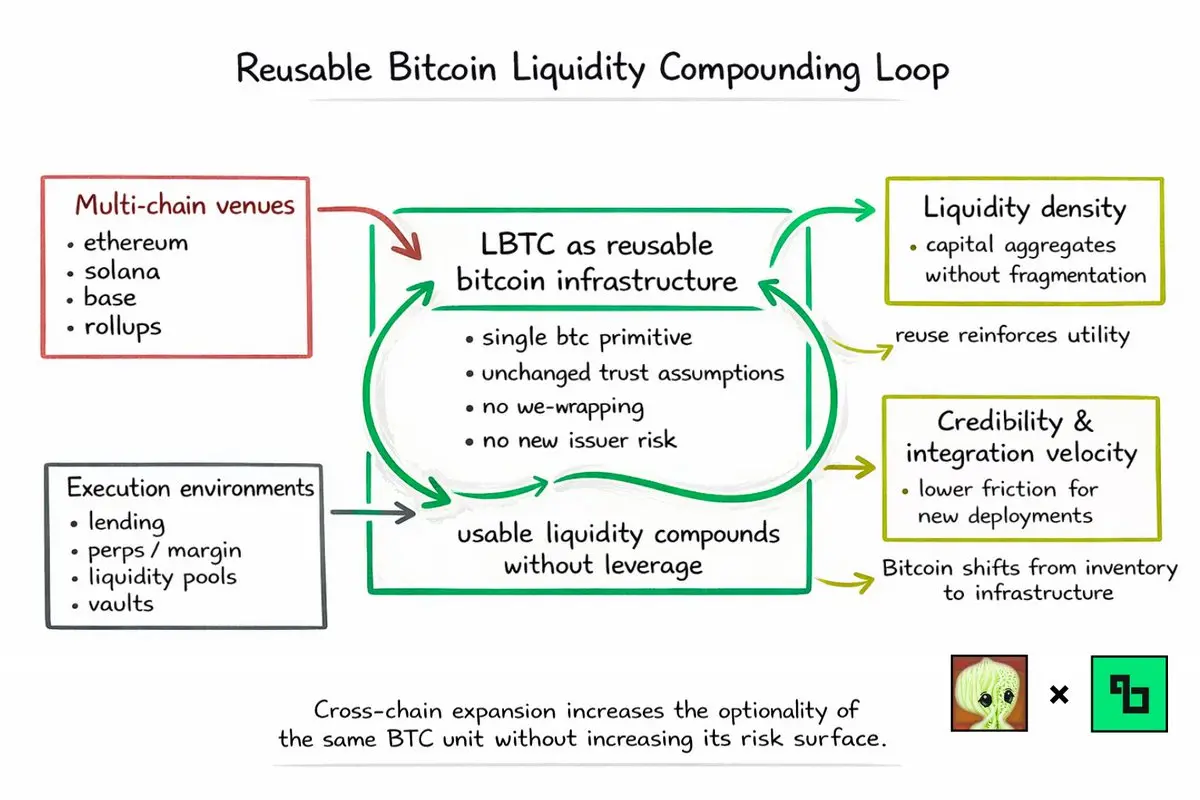

Bitcoin liquidity does not compound by sitting in one place.

It compounds by being reusable across systems without changing its trust profile.

That is the difference between wrapped BTC as inventory and LBTC as infrastructure, as implemented by @Lombard_Finance.

— 📌 The Core Mechanism

$LBTC operates across 14 chains, including Ethereum, Solana, Base, and multiple rollups. The important point is not chain count. It is composability without fragmentation.

Each chain adds:

+ a new execution environment

+ a new set of DeFi primitives

+ a new class of users and workflows

But $LBTC remains the same

It compounds by being reusable across systems without changing its trust profile.

That is the difference between wrapped BTC as inventory and LBTC as infrastructure, as implemented by @Lombard_Finance.

— 📌 The Core Mechanism

$LBTC operates across 14 chains, including Ethereum, Solana, Base, and multiple rollups. The important point is not chain count. It is composability without fragmentation.

Each chain adds:

+ a new execution environment

+ a new set of DeFi primitives

+ a new class of users and workflows

But $LBTC remains the same

- Reward

- like

- Comment

- Repost

- Share

Helium in 2025 proved that real world usage drives adoption.

The steady rise in signups shows growing demand for the network, not speculation.

With expansion into Brazil and new partnerships coming soon, @helium is moving beyond early adopters.

If this momentum continues, total signups could reach millions this year.

Most projects measure success by token price and short term hype. DePIN measures success by usage, fees, uptime, and real world demand.

The steady rise in signups shows growing demand for the network, not speculation.

With expansion into Brazil and new partnerships coming soon, @helium is moving beyond early adopters.

If this momentum continues, total signups could reach millions this year.

Most projects measure success by token price and short term hype. DePIN measures success by usage, fees, uptime, and real world demand.

HNT0,09%

- Reward

- like

- Comment

- Repost

- Share

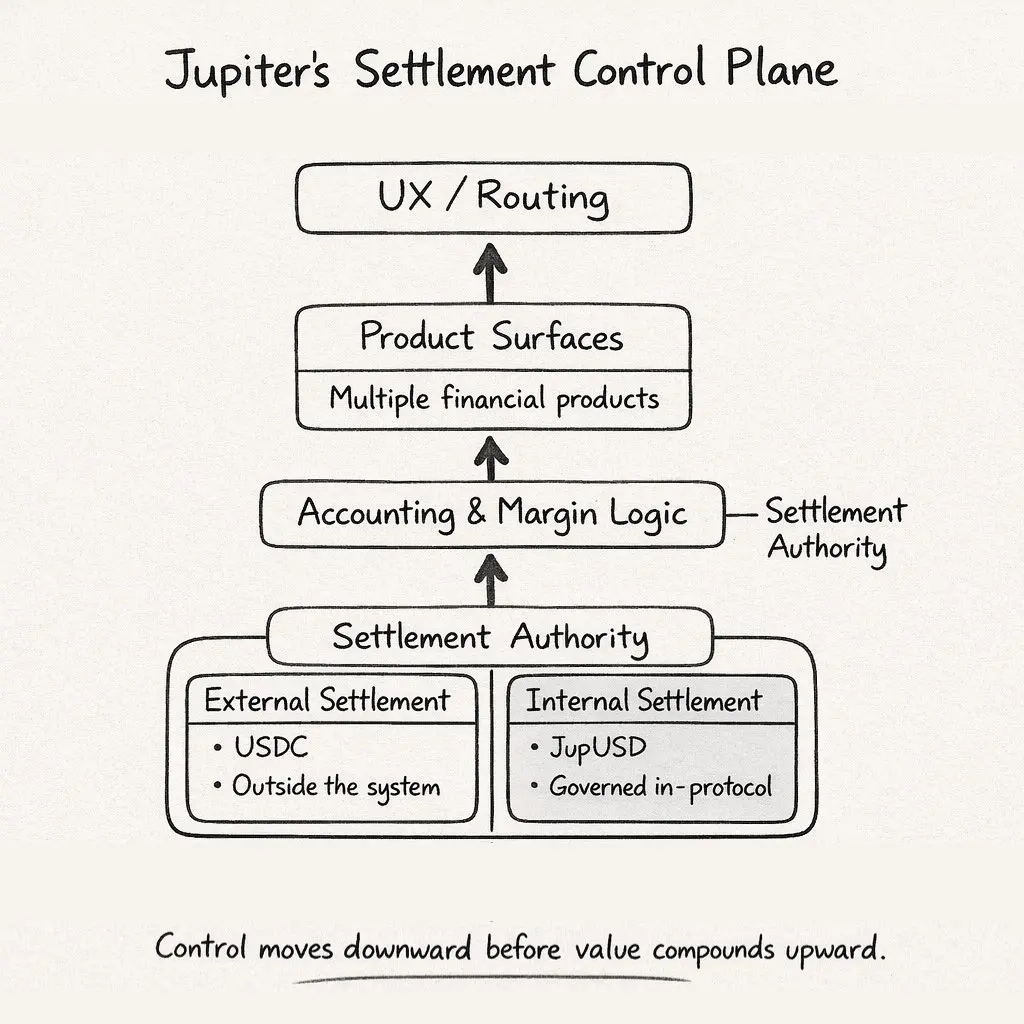

$JupUSD shouldn’t be analyzed as “another dollar on Solana.”

From my perspective, it’s a control-plane decision about where settlement authority lives inside a multi-product financial system.

That distinction is structural, not cosmetic, and it matters more than the stablecoin itself.

— 📌 How @JupiterExchange Collapsed Its Monetary Stack

Before $JupUSD, Jupiter’s stack was horizontally integrated but monetarily fragmented.

• Spot executed against $USDC liquidity

• Perps collateralized in $USDC

• Lending positions tracked separately

• Prediction markets settled externally

Each product worked i

From my perspective, it’s a control-plane decision about where settlement authority lives inside a multi-product financial system.

That distinction is structural, not cosmetic, and it matters more than the stablecoin itself.

— 📌 How @JupiterExchange Collapsed Its Monetary Stack

Before $JupUSD, Jupiter’s stack was horizontally integrated but monetarily fragmented.

• Spot executed against $USDC liquidity

• Perps collateralized in $USDC

• Lending positions tracked separately

• Prediction markets settled externally

Each product worked i

- Reward

- 3

- 1

- Repost

- Share

PumpSpreeLive :

:

Rush 2026 🚀