Mr_Desoza

No content yet

Mr_Desoza

$ASTER just saw a strong long liquidation near the $0.4866 level, signaling a sharp downside liquidity sweep that cleared overleveraged buyers from the market. This flush pushed price into an important short-term support zone around $0.47–$0.48 where buyers are likely to step in for stabilization. If ASTER holds above this demand area, a recovery toward immediate resistance near $0.50–$0.52 becomes the primary upside scenario, with the next bullish target sitting around $0.55 where previous supply was formed. Liquidation sweeps like this often reset momentum and allow for healthier rebounds. H

ASTER-7,36%

- Reward

- like

- Comment

- Repost

- Share

$BULLA experienced a long liquidation spike around $0.03644, showing strong sell pressure that wiped out late long positions and pushed price lower into a key support region. The current demand zone sits around $0.035–$0.036 where buyers are expected to defend and slow further downside. If price holds this base, BULLA can attempt a recovery toward resistance near $0.038–$0.040, with the next upside target positioned around $0.043 where liquidity remains stacked. These liquidation-driven drops often create short-term bottoms if selling pressure fades. A breakdown below $0.035 would expose the m

- Reward

- 1

- Comment

- Repost

- Share

$ZAMA triggered a short liquidation near $0.0302, signaling a sudden bullish impulse that forced sellers to exit positions and accelerated upward momentum. This type of squeeze usually indicates strong buyer control entering the market. Price should now aim to hold above the support zone around $0.0295–$0.0300 to maintain bullish structure. As long as this level holds, ZAMA can push toward immediate resistance near $0.032–$0.034, with the next upside target sitting around $0.037 where higher liquidity is located. Short liquidation events often fuel continuation moves when buyers remain active.

ZAMA16,26%

- Reward

- like

- 1

- Repost

- Share

European,American,AndRussian :

:

Stop pretending, the price has plummeted tenfold, losing 11 billion.$CLO saw a notable long liquidation around $0.06516, indicating a downside liquidity grab that removed weak long positions and briefly intensified selling pressure. This move has driven price into a demand zone near $0.063–$0.065 where buyers historically show interest. Holding above this area keeps rebound scenarios active with immediate resistance around $0.068–$0.070 where selling pressure previously appeared. A break above $0.070 could open the path toward the next upside target near $0.075. Liquidation flushes often signal temporary exhaustion of sellers, allowing for recovery attempts. H

- Reward

- like

- Comment

- Repost

- Share

$SKR experienced a strong short liquidation near $0.02444, reflecting a rapid upward push that trapped sellers and boosted bullish momentum. This squeeze suggests buyers aggressively took control and forced price higher. The key support zone now lies around $0.0235–$0.0240 which should act as a base for continuation. If price holds above this level, SKR can target immediate resistance near $0.026–$0.028, with the next bullish objective around $0.030 where liquidity is concentrated. After short liquidation events, momentum often remains in favor of buyers unless structure breaks down sharply. A

SKR44,67%

- Reward

- like

- Comment

- Repost

- Share

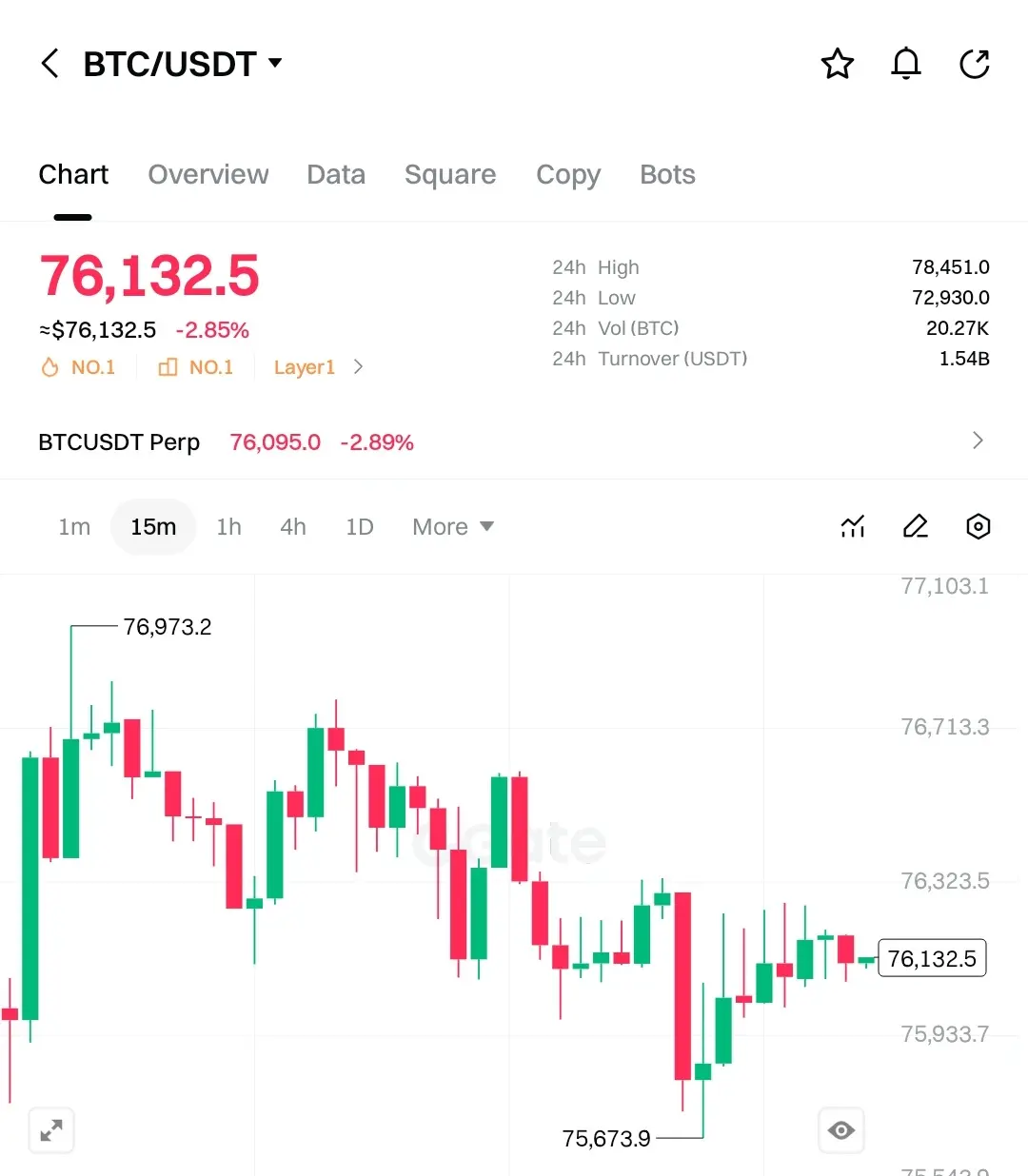

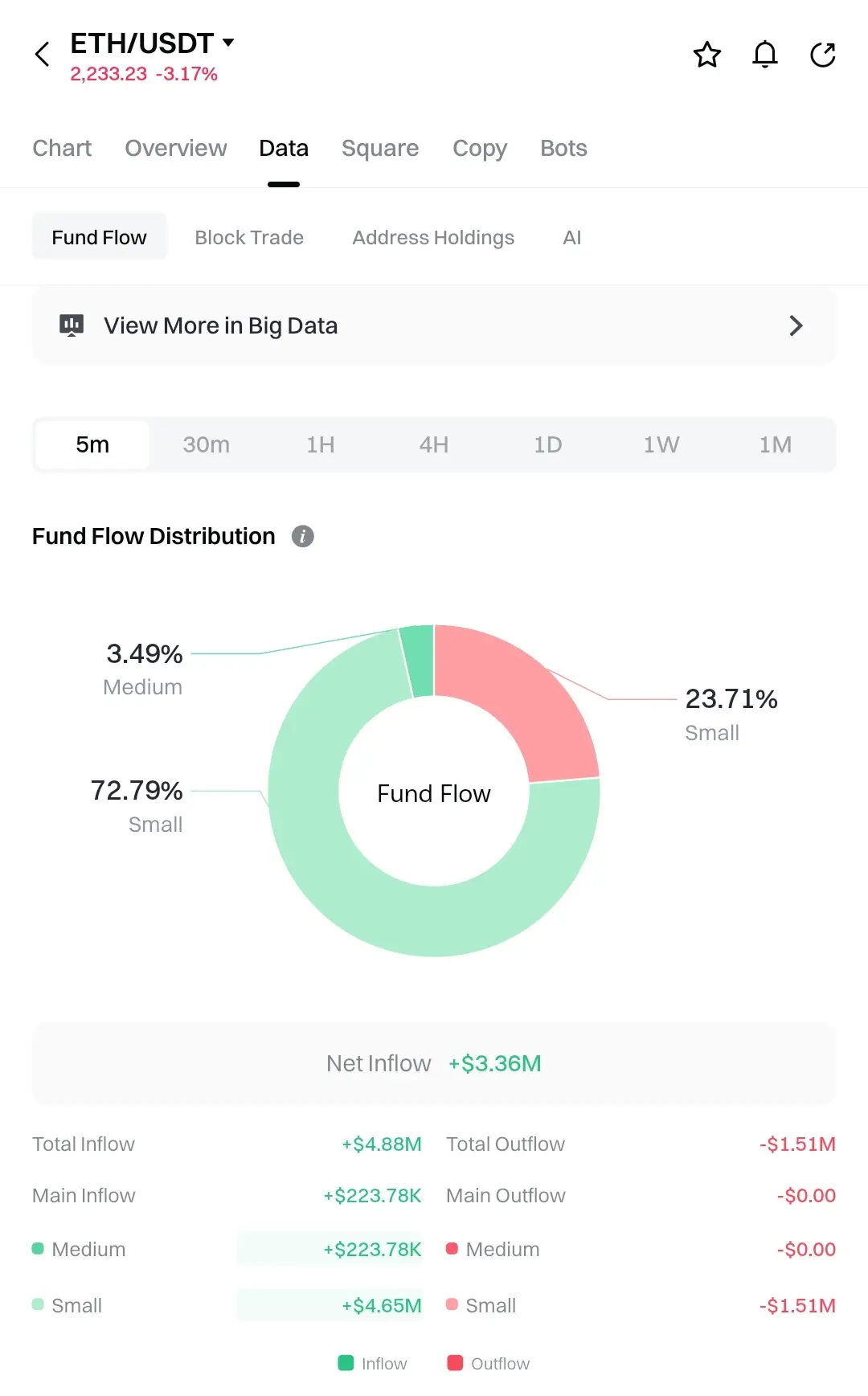

$BTC

BTC is consolidating after a sharp volatility move that swept liquidity down toward the $75,670 region before bouncing back above the key support zone around $76,000–$76,200. This area is now acting as a short-term base where buyers are defending actively. Holding above this zone keeps recovery momentum intact with immediate resistance positioned near $76,800–$77,100 where multiple rejections formed earlier. A confirmed breakout above $77,100 could drive BTC toward the next upside target around $78,000–$78,500, filling the upper liquidity range. Selling pressure has eased following the sw

BTC is consolidating after a sharp volatility move that swept liquidity down toward the $75,670 region before bouncing back above the key support zone around $76,000–$76,200. This area is now acting as a short-term base where buyers are defending actively. Holding above this zone keeps recovery momentum intact with immediate resistance positioned near $76,800–$77,100 where multiple rejections formed earlier. A confirmed breakout above $77,100 could drive BTC toward the next upside target around $78,000–$78,500, filling the upper liquidity range. Selling pressure has eased following the sw

BTC-6,74%

- Reward

- like

- Comment

- Repost

- Share

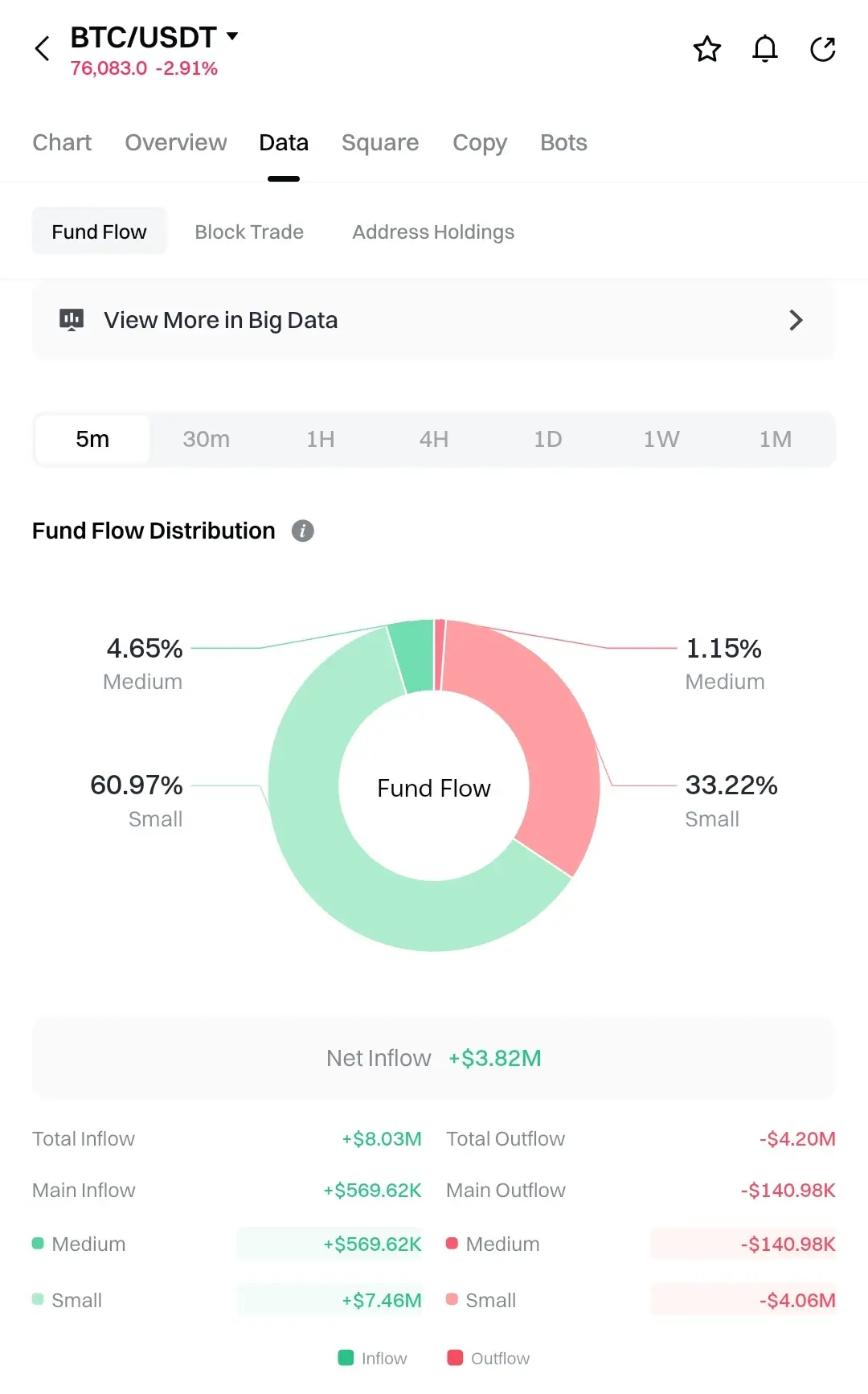

$GT

GT is currently showing a controlled pullback after rejecting from the $8.17 intraday high, with price now stabilizing around the key support zone near $7.88–$7.92 where buyers are beginning to absorb selling pressure. This area has acted as a short-term demand pocket and remains critical for maintaining structure. As long as GT holds above $7.88, rebound scenarios remain active with immediate resistance positioned near $8.05–$8.10 where sellers previously stepped in aggressively. A clean breakout above $8.10 could open the path toward the next upside target around $8.40–$8.70, aligning wi

GT is currently showing a controlled pullback after rejecting from the $8.17 intraday high, with price now stabilizing around the key support zone near $7.88–$7.92 where buyers are beginning to absorb selling pressure. This area has acted as a short-term demand pocket and remains critical for maintaining structure. As long as GT holds above $7.88, rebound scenarios remain active with immediate resistance positioned near $8.05–$8.10 where sellers previously stepped in aggressively. A clean breakout above $8.10 could open the path toward the next upside target around $8.40–$8.70, aligning wi

GT-10,1%

- Reward

- like

- 1

- Repost

- Share

GodIsAnArtist :

:

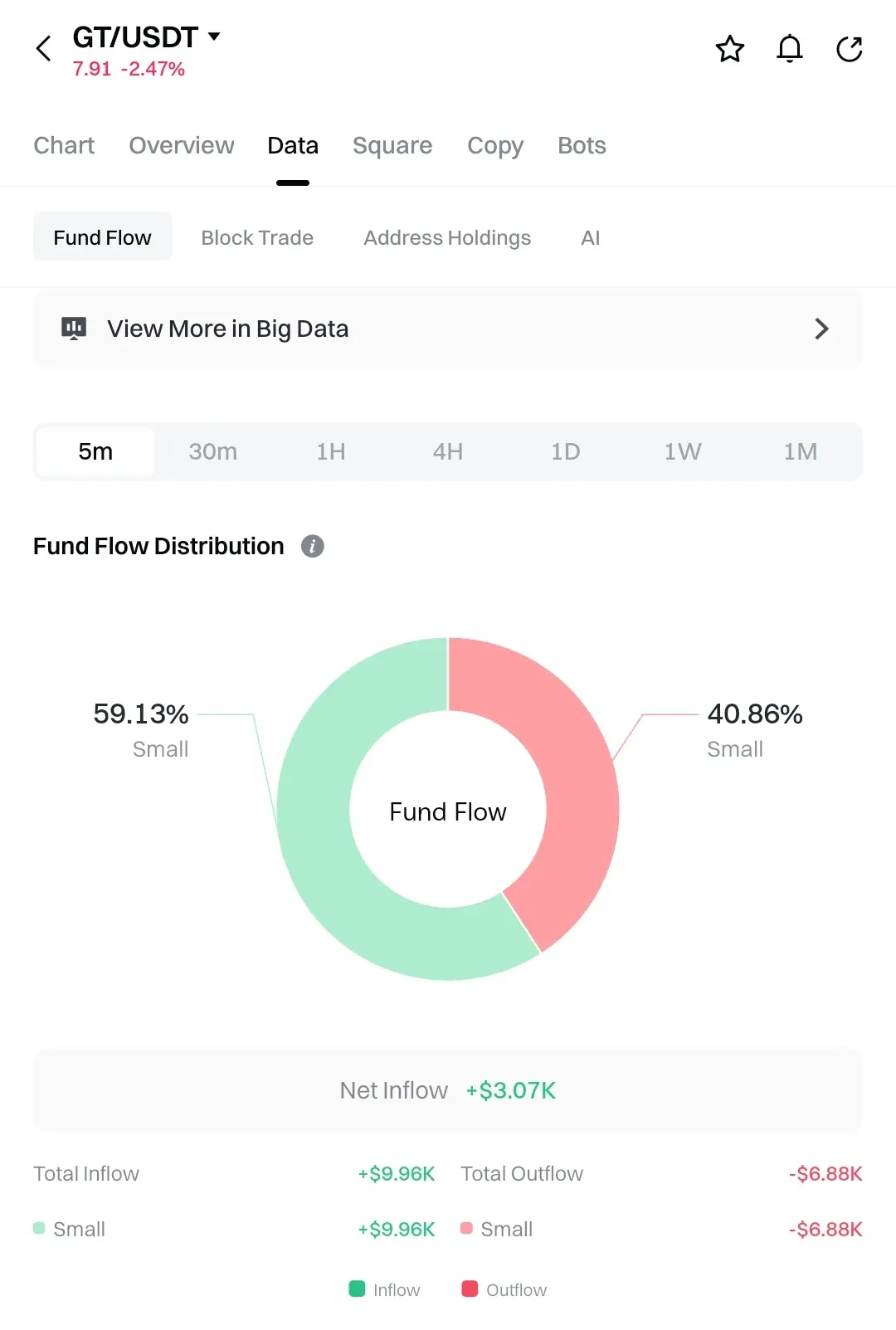

睁眼说瞎话$ETH

ETH is currently consolidating after a sharp drop from the $2,295 region toward the strong support zone near $2,226–$2,230, where buyers reacted quickly and pushed price back toward the $2,240–$2,250 range. This support area remains crucial for maintaining bullish structure. As long as ETH holds above $2,226, recovery momentum remains likely with immediate resistance around $2,270–$2,300 where multiple rejections previously formed. A breakout above $2,300 could drive ETH toward the next upside target around $2,360–$2,420 where heavier selling pressure may appear. Selling intensity has red

ETH is currently consolidating after a sharp drop from the $2,295 region toward the strong support zone near $2,226–$2,230, where buyers reacted quickly and pushed price back toward the $2,240–$2,250 range. This support area remains crucial for maintaining bullish structure. As long as ETH holds above $2,226, recovery momentum remains likely with immediate resistance around $2,270–$2,300 where multiple rejections previously formed. A breakout above $2,300 could drive ETH toward the next upside target around $2,360–$2,420 where heavier selling pressure may appear. Selling intensity has red

ETH-7,84%

- Reward

- 1

- Comment

- Repost

- Share

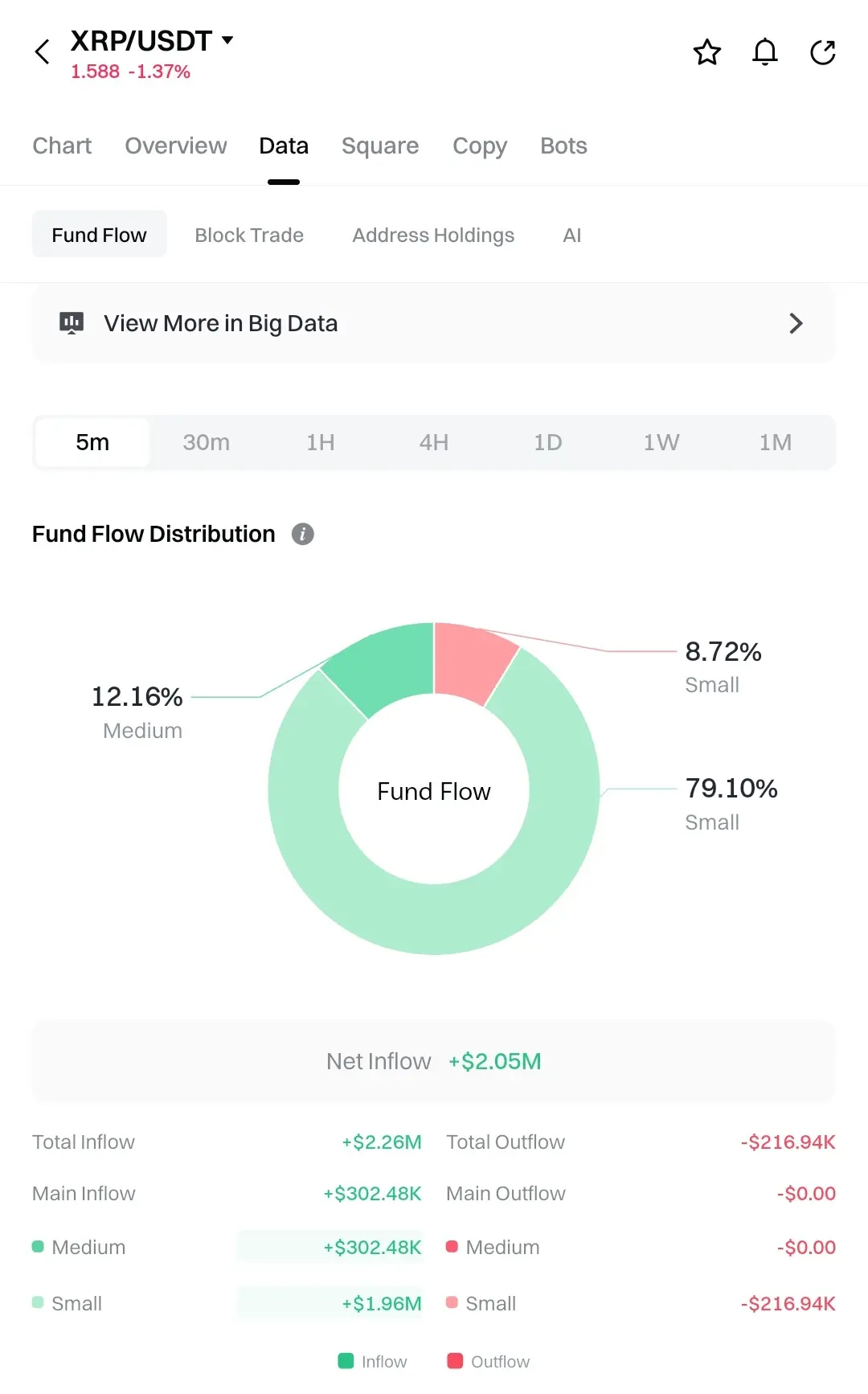

$XRP

XRP is showing controlled weakness after rejecting near the $1.61–$1.62 resistance zone, with price now drifting toward the key support area around $1.57–$1.58 where buyers previously defended strongly. This zone is acting as an important demand level for short-term structure. Holding above $1.57 keeps rebound scenarios active with immediate resistance positioned near $1.60–$1.63 where selling pressure has consistently appeared. A clean breakout above $1.63 could open the path toward the next upside target around $1.70–$1.75, aligning with previous liquidity highs. Momentum has cooled but

XRP is showing controlled weakness after rejecting near the $1.61–$1.62 resistance zone, with price now drifting toward the key support area around $1.57–$1.58 where buyers previously defended strongly. This zone is acting as an important demand level for short-term structure. Holding above $1.57 keeps rebound scenarios active with immediate resistance positioned near $1.60–$1.63 where selling pressure has consistently appeared. A clean breakout above $1.63 could open the path toward the next upside target around $1.70–$1.75, aligning with previous liquidity highs. Momentum has cooled but

XRP-9,63%

- Reward

- like

- Comment

- Repost

- Share

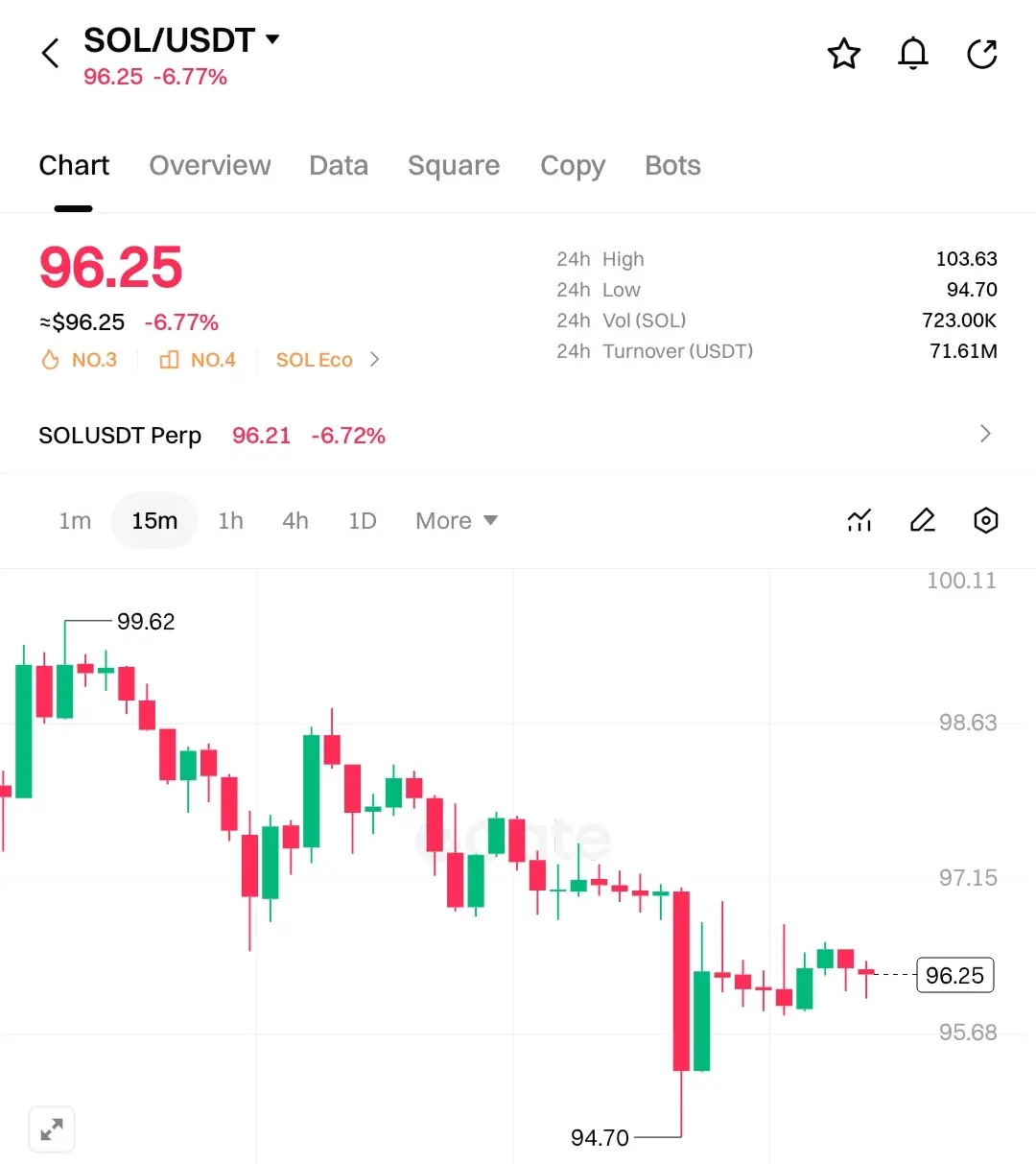

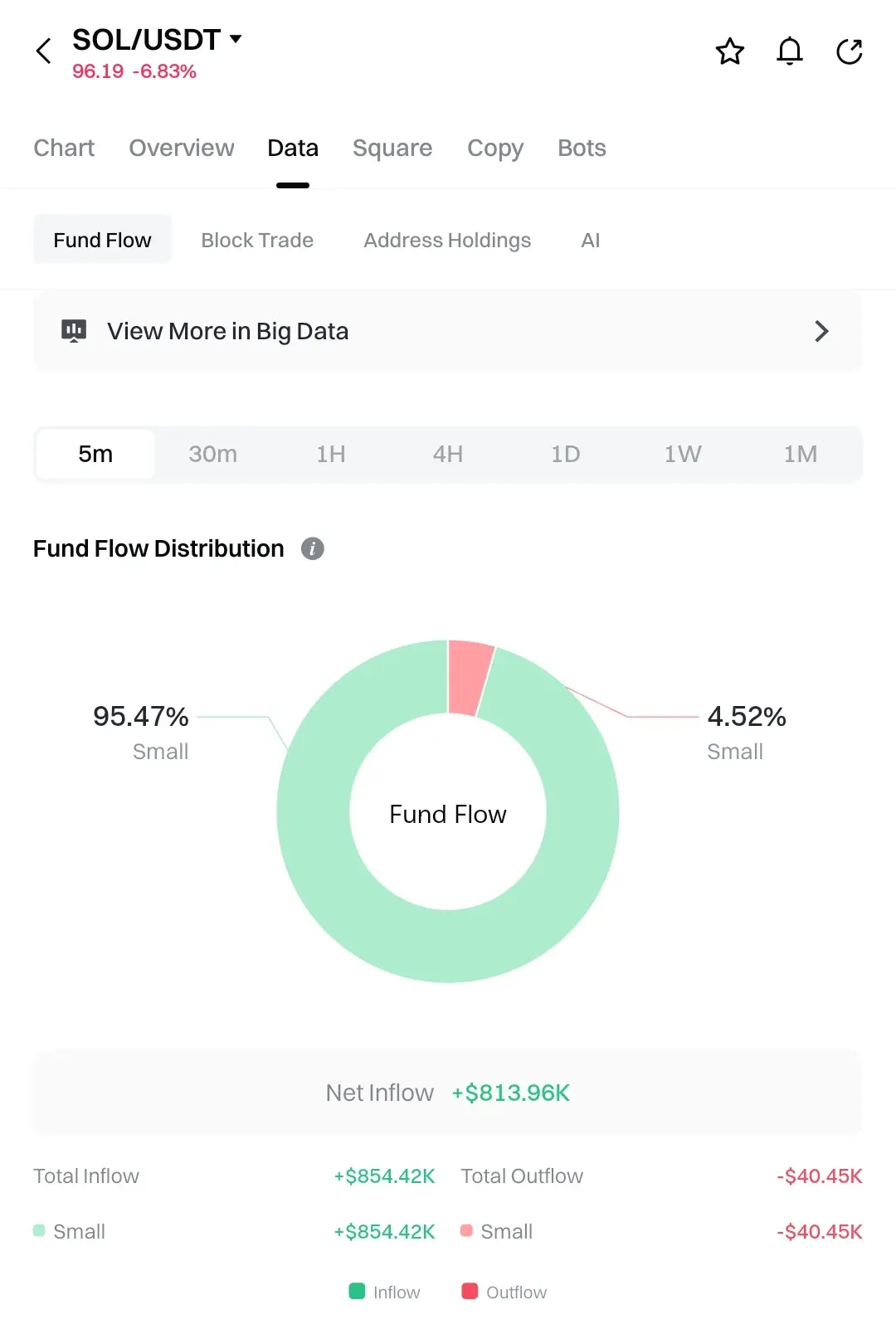

$SOL

SOL experienced a sharp downside flush from the $99.60 region, sweeping liquidity down toward the strong support zone near $94.70 before bouncing and consolidating around $96.00–$96.40. This area is now acting as a key short-term base where buyers are stepping in cautiously. As long as SOL holds above $95.80, rebound potential remains active with immediate resistance sitting near $97.80–$98.50 where previous breakdown occurred. A clean breakout above $98.50 could open the path toward the next upside target around $101.00–$103.50, aligning with prior highs. Downside momentum has slowed sig

SOL experienced a sharp downside flush from the $99.60 region, sweeping liquidity down toward the strong support zone near $94.70 before bouncing and consolidating around $96.00–$96.40. This area is now acting as a key short-term base where buyers are stepping in cautiously. As long as SOL holds above $95.80, rebound potential remains active with immediate resistance sitting near $97.80–$98.50 where previous breakdown occurred. A clean breakout above $98.50 could open the path toward the next upside target around $101.00–$103.50, aligning with prior highs. Downside momentum has slowed sig

SOL-12,56%

- Reward

- like

- Comment

- Repost

- Share

$YB

YB experienced a sharp impulse move from the $0.159 region up toward the $0.1735 high before entering a controlled pullback and consolidation phase. Price is now holding around the key support zone near $0.163–$0.165, which is acting as a strong structural level after the breakout. As long as this zone holds, bullish continuation remains likely with immediate resistance around $0.170–$0.173. A breakout above $0.173 could send YB toward the next upside target around $0.180–$0.188 where stronger selling pressure may appear. The consolidation remains tight and healthy, suggesting accumulation

YB experienced a sharp impulse move from the $0.159 region up toward the $0.1735 high before entering a controlled pullback and consolidation phase. Price is now holding around the key support zone near $0.163–$0.165, which is acting as a strong structural level after the breakout. As long as this zone holds, bullish continuation remains likely with immediate resistance around $0.170–$0.173. A breakout above $0.173 could send YB toward the next upside target around $0.180–$0.188 where stronger selling pressure may appear. The consolidation remains tight and healthy, suggesting accumulation

YB-8,86%

- Reward

- like

- Comment

- Repost

- Share

$TURTLE

TURTLE has entered a corrective phase after rejecting near the $0.0505 region and is now stabilizing around the strong support zone near $0.0488–$0.0492. This area is acting as a demand pocket where sellers are losing momentum and buyers are slowly absorbing pressure. As long as price holds above $0.0488, rebound scenarios remain active with immediate resistance near $0.0502. A breakout above $0.0502 could open the path toward the next upside target around $0.0530–$0.0550 where heavier profit-taking may appear. The structure shows slowing downside momentum, often signaling a potential

TURTLE has entered a corrective phase after rejecting near the $0.0505 region and is now stabilizing around the strong support zone near $0.0488–$0.0492. This area is acting as a demand pocket where sellers are losing momentum and buyers are slowly absorbing pressure. As long as price holds above $0.0488, rebound scenarios remain active with immediate resistance near $0.0502. A breakout above $0.0502 could open the path toward the next upside target around $0.0530–$0.0550 where heavier profit-taking may appear. The structure shows slowing downside momentum, often signaling a potential

TURTLE-10,25%

- Reward

- like

- Comment

- Repost

- Share

$GIGGLE

GIGGLE has shown a strong impulsive rally from the $34.40 zone, surging cleanly toward the $37.40 resistance and maintaining strength near current highs. The breakout structure remains intact with fresh support now forming around $36.20–$36.50, which should act as the primary pullback zone. Holding above this area keeps bullish momentum firmly in control with immediate resistance near $37.50. A confirmed breakout above $37.50 could send price toward the next upside target around $39.50–$41.00 as trend expansion continues. The trend shows strong buyer dominance with shallow retracements

GIGGLE has shown a strong impulsive rally from the $34.40 zone, surging cleanly toward the $37.40 resistance and maintaining strength near current highs. The breakout structure remains intact with fresh support now forming around $36.20–$36.50, which should act as the primary pullback zone. Holding above this area keeps bullish momentum firmly in control with immediate resistance near $37.50. A confirmed breakout above $37.50 could send price toward the next upside target around $39.50–$41.00 as trend expansion continues. The trend shows strong buyer dominance with shallow retracements

GIGGLE-17,03%

- Reward

- like

- 1

- Repost

- Share

LaughingAndGettingRich, :

:

You only sell when I’m bullish. If you think the market is going up, I will sell; if you think it’s going down, I will buy. My trading decisions depend on your predictions.$KITE

KITE is currently holding strong after a steady push toward the $0.151 region, showing healthy consolidation around the key support zone near $0.146–$0.148 where buyers continue to defend aggressively. This area has become the new structural base following the recent upside move. As long as price remains above $0.146, bullish continuation remains likely with immediate resistance sitting near $0.1515. A clean breakout above $0.1515 could drive KITE toward the next upside target around $0.158–$0.165 where stronger selling pressure may emerge. Momentum remains positive with higher lows form

KITE is currently holding strong after a steady push toward the $0.151 region, showing healthy consolidation around the key support zone near $0.146–$0.148 where buyers continue to defend aggressively. This area has become the new structural base following the recent upside move. As long as price remains above $0.146, bullish continuation remains likely with immediate resistance sitting near $0.1515. A clean breakout above $0.1515 could drive KITE toward the next upside target around $0.158–$0.165 where stronger selling pressure may emerge. Momentum remains positive with higher lows form

KITE-4,82%

- Reward

- like

- Comment

- Repost

- Share

$ENSO

ENSO is showing strong bullish recovery after bouncing firmly from the $1.21–$1.23 demand zone, supported by rising buy inflows and improving momentum following the recent pullback from the $1.45 high. Price is now holding above the key support region around $1.24–$1.26, which is acting as a solid base where buyers are actively absorbing selling pressure. As long as ENSO remains above this zone, upside continuation remains highly likely with immediate resistance positioned near $1.32–$1.35 where previous consolidation formed. A clean breakout above $1.35 could open the path toward the ne

ENSO is showing strong bullish recovery after bouncing firmly from the $1.21–$1.23 demand zone, supported by rising buy inflows and improving momentum following the recent pullback from the $1.45 high. Price is now holding above the key support region around $1.24–$1.26, which is acting as a solid base where buyers are actively absorbing selling pressure. As long as ENSO remains above this zone, upside continuation remains highly likely with immediate resistance positioned near $1.32–$1.35 where previous consolidation formed. A clean breakout above $1.35 could open the path toward the ne

ENSO2,36%

- Reward

- like

- Comment

- Repost

- Share

$B3

The long liquidation around $0.00062 reflects a sharp downside sweep that flushed overleveraged buyers and reset short-term positioning. Price is now stabilizing near a strong demand pocket around $0.00059 where buyers have previously stepped in aggressively. Holding above this zone keeps rebound scenarios active with immediate resistance near $0.00066. A clean breakout above $0.00066 could open the path toward the next upside target around $0.00072 where selling pressure earlier increased. Selling momentum appears to be fading after the liquidation event, often signaling a potential short

The long liquidation around $0.00062 reflects a sharp downside sweep that flushed overleveraged buyers and reset short-term positioning. Price is now stabilizing near a strong demand pocket around $0.00059 where buyers have previously stepped in aggressively. Holding above this zone keeps rebound scenarios active with immediate resistance near $0.00066. A clean breakout above $0.00066 could open the path toward the next upside target around $0.00072 where selling pressure earlier increased. Selling momentum appears to be fading after the liquidation event, often signaling a potential short

B3-10,77%

- Reward

- like

- Comment

- Repost

- Share

$XAU

The long liquidation near $5063.63 shows a sudden downside sweep after strong upside expansion, clearing weak long positions. Price is now reacting around the key support zone near $4980–$5000, which previously acted as a breakout base. As long as this area holds, rebound momentum remains likely with immediate resistance around $5100. A breakout above $5100 could send XAU toward the next upside target around $5250–$5320 where heavier profit-taking may appear. Selling pressure has cooled after the flush, suggesting stabilization rather than trend reversal. If support fails below $4980, a d

The long liquidation near $5063.63 shows a sudden downside sweep after strong upside expansion, clearing weak long positions. Price is now reacting around the key support zone near $4980–$5000, which previously acted as a breakout base. As long as this area holds, rebound momentum remains likely with immediate resistance around $5100. A breakout above $5100 could send XAU toward the next upside target around $5250–$5320 where heavier profit-taking may appear. Selling pressure has cooled after the flush, suggesting stabilization rather than trend reversal. If support fails below $4980, a d

- Reward

- 1

- Comment

- Repost

- Share

$ZIL

The short liquidation around $0.00608 highlights a bullish squeeze where bearish positions were forced out as price surged upward. A fresh support base has now formed near $0.00585, which should act as the key pullback zone for continuation. Holding above this area keeps bullish momentum intact with immediate resistance near $0.00645. A confirmed breakout above $0.00645 could push ZIL toward the next upside target around $0.00695 where previous selling pressure concentrated. The squeeze indicates strong buyer control and improving trend strength. If price slips below $0.00585, a retrace t

The short liquidation around $0.00608 highlights a bullish squeeze where bearish positions were forced out as price surged upward. A fresh support base has now formed near $0.00585, which should act as the key pullback zone for continuation. Holding above this area keeps bullish momentum intact with immediate resistance near $0.00645. A confirmed breakout above $0.00645 could push ZIL toward the next upside target around $0.00695 where previous selling pressure concentrated. The squeeze indicates strong buyer control and improving trend strength. If price slips below $0.00585, a retrace t

ZIL-13,98%

- Reward

- like

- 1

- Repost

- Share

$ETH

The large short liquidation at $2274.99 confirms a powerful bullish impulse that forced bears to close positions rapidly, reinforcing upside momentum. ETH is now holding above a strong structural support zone near $2240, which previously acted as resistance. As long as this level remains intact, continuation toward immediate resistance at $2350 is highly likely. A clean breakout above $2350 could open the door toward the next upside target around $2480–$2550 where heavier selling pressure may emerge. Volume flow supports strong buyer participation after the squeeze. If support near $2240

The large short liquidation at $2274.99 confirms a powerful bullish impulse that forced bears to close positions rapidly, reinforcing upside momentum. ETH is now holding above a strong structural support zone near $2240, which previously acted as resistance. As long as this level remains intact, continuation toward immediate resistance at $2350 is highly likely. A clean breakout above $2350 could open the door toward the next upside target around $2480–$2550 where heavier selling pressure may emerge. Volume flow supports strong buyer participation after the squeeze. If support near $2240

ETH-7,84%

- Reward

- like

- Comment

- Repost

- Share

$RIVER

The short liquidation near $12.19851 signals a strong upside squeeze that forced bearish traders out as price surged higher. A new support zone has now formed around $11.80, acting as the key demand area for continuation. Holding above this level keeps bullish momentum intact with immediate resistance positioned near $12.90 where price previously hesitated. A breakout above $12.90 could send RIVER toward the next upside target around $13.80–$14.20 where profit-taking may intensify. The squeeze reflects strong demand entering the market and strengthening trend structure. If support fails

The short liquidation near $12.19851 signals a strong upside squeeze that forced bearish traders out as price surged higher. A new support zone has now formed around $11.80, acting as the key demand area for continuation. Holding above this level keeps bullish momentum intact with immediate resistance positioned near $12.90 where price previously hesitated. A breakout above $12.90 could send RIVER toward the next upside target around $13.80–$14.20 where profit-taking may intensify. The squeeze reflects strong demand entering the market and strengthening trend structure. If support fails

- Reward

- like

- Comment

- Repost

- Share