PaperImperium

No content yet

PaperImperium

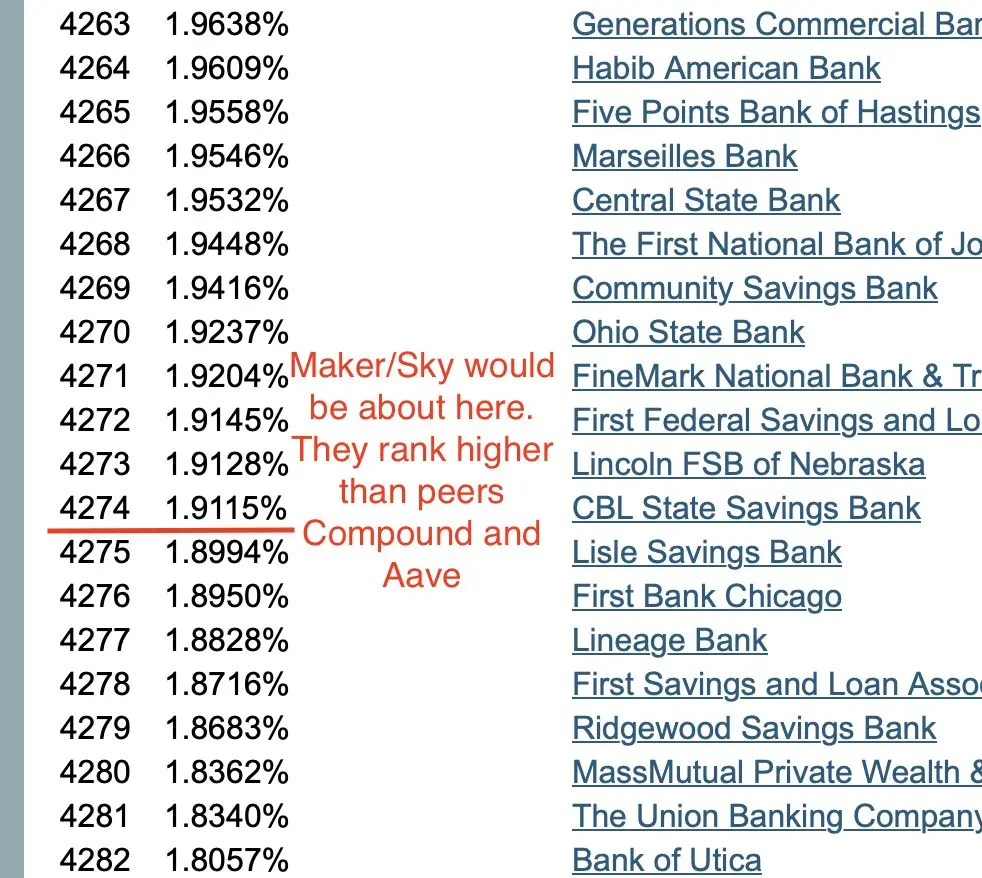

TLDR; DeFi protocols would be some of the least efficient banks in the US.

I’m a big believer in DeFi, but people have to understand it’s still very primitive and inefficient. To understand what I mean, let’s zoom in to a key metric for lenders - the net interest margin (NIM).

NIM is a measure of how financially efficient a bank or other lender is, and is calculated with the basic formula of (Interest Income - Interest Expense)/Average Earning Assets. We won’t clog the timeline with calculations here, but some quick estimates on NIM for major protocols:

Aave v3 (Etherum): ~0.4%

Compound v3 US

I’m a big believer in DeFi, but people have to understand it’s still very primitive and inefficient. To understand what I mean, let’s zoom in to a key metric for lenders - the net interest margin (NIM).

NIM is a measure of how financially efficient a bank or other lender is, and is calculated with the basic formula of (Interest Income - Interest Expense)/Average Earning Assets. We won’t clog the timeline with calculations here, but some quick estimates on NIM for major protocols:

Aave v3 (Etherum): ~0.4%

Compound v3 US

- Reward

- like

- Comment

- Repost

- Share

Pro tip: You can turn off auto-play for videos. I did this a year ago and made the doom scrolling much less doomified. Text and thumbnails aren’t Michelangelo, but they’re better than short form video.

- Reward

- like

- Comment

- Repost

- Share

I feel like I do KYC for crypto more than I do for everything else combined. What are we even doing here?

- Reward

- like

- Comment

- Repost

- Share

Every simp post I see supporting SBF is unironically making the Gary Gensler case that people are too stupid to make decisions for themselves in crypto.

- Reward

- like

- Comment

- Repost

- Share

I think it’s a shame that DeFi got introduced to US and European banks before it got introduced to ASA, Grameen Bank, and Bandhan Bank.

DEFI-9,44%

- Reward

- like

- Comment

- Repost

- Share

Downhill skiing shows speed in mph. I wish they’d do that for luge/skeleton/bobsled where they seem to be going very fast

- Reward

- 1

- Comment

- Repost

- Share

Why is China underperforming so badly in the Olympics? They’re in 19th place by medal count, and 1 of their 4 medals was won by an American.

They were 4th in the Beijing Olympics, for comparison. Maybe their best sports haven’t happened yet?

They were 4th in the Beijing Olympics, for comparison. Maybe their best sports haven’t happened yet?

- Reward

- like

- Comment

- Repost

- Share

All this drive to tokenize stocks, which is great. By why can’t I get an onchain SBLOC for my offchain portfolio? Is anyone doing this?

- Reward

- like

- Comment

- Repost

- Share

People don’t talk much about censorship resistance in DeFi anymore. That betrays the lack of historical literacy of many participants.

I regularly joke that crypto is speed running economic history - we’re somewhere past the invention of, but before the ubiquity of, double-entry bookkeeping.

And one of the most important lessons is that complex and reliable finance is constantly exposed to political risk.

Looking only at anecdotes I’ve written about before, the pattern is consistent.

The d’Medici decline began with loans to the King of England and Duke of Burgundy, where there was no recourse

I regularly joke that crypto is speed running economic history - we’re somewhere past the invention of, but before the ubiquity of, double-entry bookkeeping.

And one of the most important lessons is that complex and reliable finance is constantly exposed to political risk.

Looking only at anecdotes I’ve written about before, the pattern is consistent.

The d’Medici decline began with loans to the King of England and Duke of Burgundy, where there was no recourse

- Reward

- like

- Comment

- Repost

- Share

Just for perspective, Aave DAO could buy a US bank for this amount of money. I think that’s a good opportunity cost framing.

Aave team can probably deliver more growth but even a poorly run bank has better net interest margin than a DeFi protocol.

Not sure what Aave’s equivalent of ROE is, but banks typically have pretty modest ROE.

Aave team can probably deliver more growth but even a poorly run bank has better net interest margin than a DeFi protocol.

Not sure what Aave’s equivalent of ROE is, but banks typically have pretty modest ROE.

AAVE1,05%

- Reward

- like

- Comment

- Repost

- Share

It’s time for Curation 2.0. The curator model was a big advancement, but there are some commonsense enhancements that can result in a better product for users.

Tranching is back in vogue lately. I think I’ve had at least three teams reach out to me about tranching design. Where there are three, there are likely more, so I’m going to share my advice publicly.

First, let’s understand how challenging it is to tranche an evergreen vehicle like a Morpho or Euler vault. People have to be able to withdraw at some point - there’s no winding down date where all the books are balanced and gains/losses d

Tranching is back in vogue lately. I think I’ve had at least three teams reach out to me about tranching design. Where there are three, there are likely more, so I’m going to share my advice publicly.

First, let’s understand how challenging it is to tranche an evergreen vehicle like a Morpho or Euler vault. People have to be able to withdraw at some point - there’s no winding down date where all the books are balanced and gains/losses d

- Reward

- like

- Comment

- Repost

- Share

This SBF filing seems so clearly a PR stunt. He had to get his mother to file it, and it focuses on solvency rather than… fraud?

Let’s for a moment assume we can trust the valuations claimed by FTX insiders. Then what?

If you broke into my house to throw a party, it’s still a crime even if you managed to clean up and not break anything.

Let’s for a moment assume we can trust the valuations claimed by FTX insiders. Then what?

If you broke into my house to throw a party, it’s still a crime even if you managed to clean up and not break anything.

- Reward

- like

- Comment

- Repost

- Share

At what point do L2s start waking up to the fact that Circle, Tether, L0 are now their competitors?

- Reward

- like

- Comment

- Repost

- Share

At what point do L2s start waking up to the fact that Circle, Tether, L0 are now their competitors?

Further evidence that most have zero business plan to threaten, lack conviction to make hard choices, or both.

Further evidence that most have zero business plan to threaten, lack conviction to make hard choices, or both.

- Reward

- like

- Comment

- Repost

- Share

Many chains want to become the hub for RWA lending. But most RWAs are illiquid onchain and/or gated redemptions.

Believe it or not, there’s a fix for this, and the first chain to repurpose their incentives budget will have a major differentiator and a lot of market power over lending protocols, asset issuers, and curators.

But it involves more effort than bleeding incentives on a DEX pool 🤷♂️

Believe it or not, there’s a fix for this, and the first chain to repurpose their incentives budget will have a major differentiator and a lot of market power over lending protocols, asset issuers, and curators.

But it involves more effort than bleeding incentives on a DEX pool 🤷♂️

- Reward

- like

- Comment

- Repost

- Share

“The first principle is that you must not fool yourself, and you’re the easiest person to fool.”

-Richard Feynman, probably to some stablecoin or blockchain or DEX startup that proceeded not to listen to him

-Richard Feynman, probably to some stablecoin or blockchain or DEX startup that proceeded not to listen to him

- Reward

- like

- Comment

- Repost

- Share

I’m not a venture capitalist, but I get asked to angel a fair bit. As someone with a value background, I think there’s a wide open VC niche in crypto by just Moneyballing into the original DeFi promise of improving financial services access to the middle- and low-income countries.

Rather than invest based on speculative potential or liquidity, I think you could make a solid return by investing in the regional lending and stablecoin ventures (maybe others, but those are what I know best) that are “better than replacement.”

Note that Tether is a great example of this! As I harp on constantly, Te

Rather than invest based on speculative potential or liquidity, I think you could make a solid return by investing in the regional lending and stablecoin ventures (maybe others, but those are what I know best) that are “better than replacement.”

Note that Tether is a great example of this! As I harp on constantly, Te

DEFI-9,44%

- Reward

- like

- Comment

- Repost

- Share

Surprised Kalshi and Polymarket aren’t out here pushing the Olympics more

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

crvUSD peg could use a little attention. If you have debt denominated in crvUSD, you may want to take advantage

- Reward

- like

- Comment

- Repost

- Share