THEDEFIGURU

No content yet

THEDEFIGURU

🎭 From Exit Liquidity to Real Adoption Choose Your Battlefield

Let’s talk about what just happened.

Retail just burned $4.3B on $TRUMP and $MELANIA tokens.

Meanwhile?

“Insiders” and whales quietly extracted over $600M in fees and sales.

That’s not a community win.

That’s a transfer of wealth.

20:1 loss ratio.

They got mansions.

Retail got Discord roles and a 99% drawdown.

Hard truth:

If you don’t understand token structure, supply control, and liquidity traps…

you are the liquidity.

Memecoins aren’t evil.

But asymmetric information is brutal.

Now flip the lens.

Narrative check: $TRENCHES.

🔰

Let’s talk about what just happened.

Retail just burned $4.3B on $TRUMP and $MELANIA tokens.

Meanwhile?

“Insiders” and whales quietly extracted over $600M in fees and sales.

That’s not a community win.

That’s a transfer of wealth.

20:1 loss ratio.

They got mansions.

Retail got Discord roles and a 99% drawdown.

Hard truth:

If you don’t understand token structure, supply control, and liquidity traps…

you are the liquidity.

Memecoins aren’t evil.

But asymmetric information is brutal.

Now flip the lens.

Narrative check: $TRENCHES.

🔰

- Reward

- 1

- Comment

- Repost

- Share

🌉 Europe Just Leveled Up the TradFi → DeFi Bridge

This isn’t a random token launch.

When a major European banking player like Société Générale’s digital arm (SG-FORGE) decides to issue a euro stablecoin on the XRP Ledger, that’s not experimentation.

That’s positioning.

Here’s why this matters ↓↓

🔰 MiCA gives regulatory clarity

Europe now has one of the clearest digital asset frameworks in the world. Institutions don’t move without legal rails. Now they have them.

🔰 EUR-native liquidity matters

Stablecoins have been USD-dominated for years. A regulated euro stablecoin shifts power. It gives

This isn’t a random token launch.

When a major European banking player like Société Générale’s digital arm (SG-FORGE) decides to issue a euro stablecoin on the XRP Ledger, that’s not experimentation.

That’s positioning.

Here’s why this matters ↓↓

🔰 MiCA gives regulatory clarity

Europe now has one of the clearest digital asset frameworks in the world. Institutions don’t move without legal rails. Now they have them.

🔰 EUR-native liquidity matters

Stablecoins have been USD-dominated for years. A regulated euro stablecoin shifts power. It gives

XRP-2,58%

- Reward

- 1

- Comment

- Repost

- Share

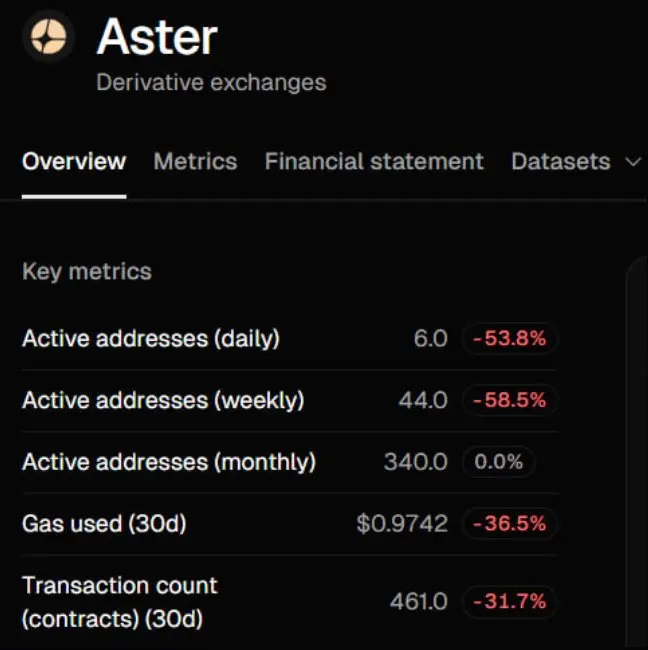

🥊 Hype vs Reality Choose Your Fighter Carefully

The world has 8.3B people…

and it feels like only 6 are actually using Aster.

Remember when it was called the “Hyperliquid killer”?

Yeah… about that.

You can fake volume.

You can farm impressions.

You can spin narratives.

But you can’t fake real traders parking real capital.

Wash trading isn’t community.

Incentives aren’t loyalty.

Marketing isn’t infrastructure.

While some projects chase timelines and engagement metrics, $HYPE keeps doing the boring work:

🔰 Building liquidity depth

🔰 Growing organic volume

🔰 Strengthening infrastructure

🔰 Le

The world has 8.3B people…

and it feels like only 6 are actually using Aster.

Remember when it was called the “Hyperliquid killer”?

Yeah… about that.

You can fake volume.

You can farm impressions.

You can spin narratives.

But you can’t fake real traders parking real capital.

Wash trading isn’t community.

Incentives aren’t loyalty.

Marketing isn’t infrastructure.

While some projects chase timelines and engagement metrics, $HYPE keeps doing the boring work:

🔰 Building liquidity depth

🔰 Growing organic volume

🔰 Strengthening infrastructure

🔰 Le

HYPE-2,4%

- Reward

- 1

- Comment

- Repost

- Share

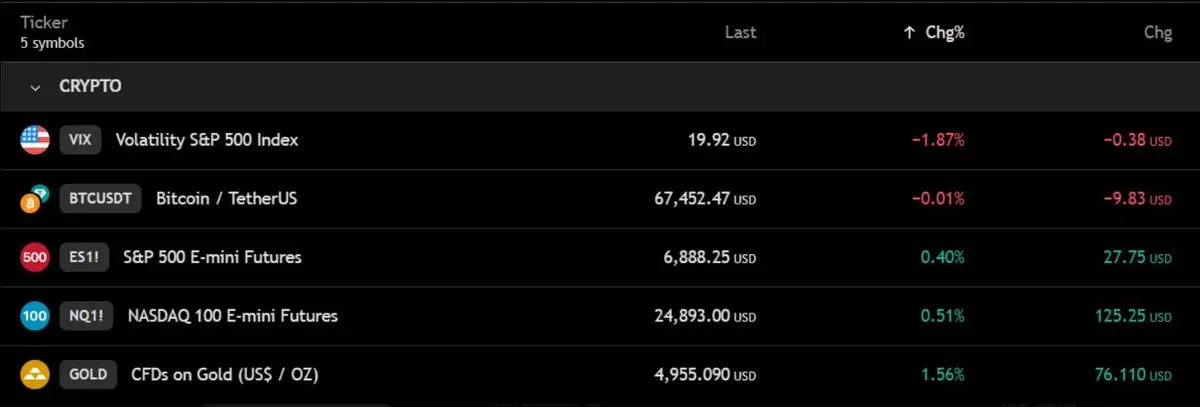

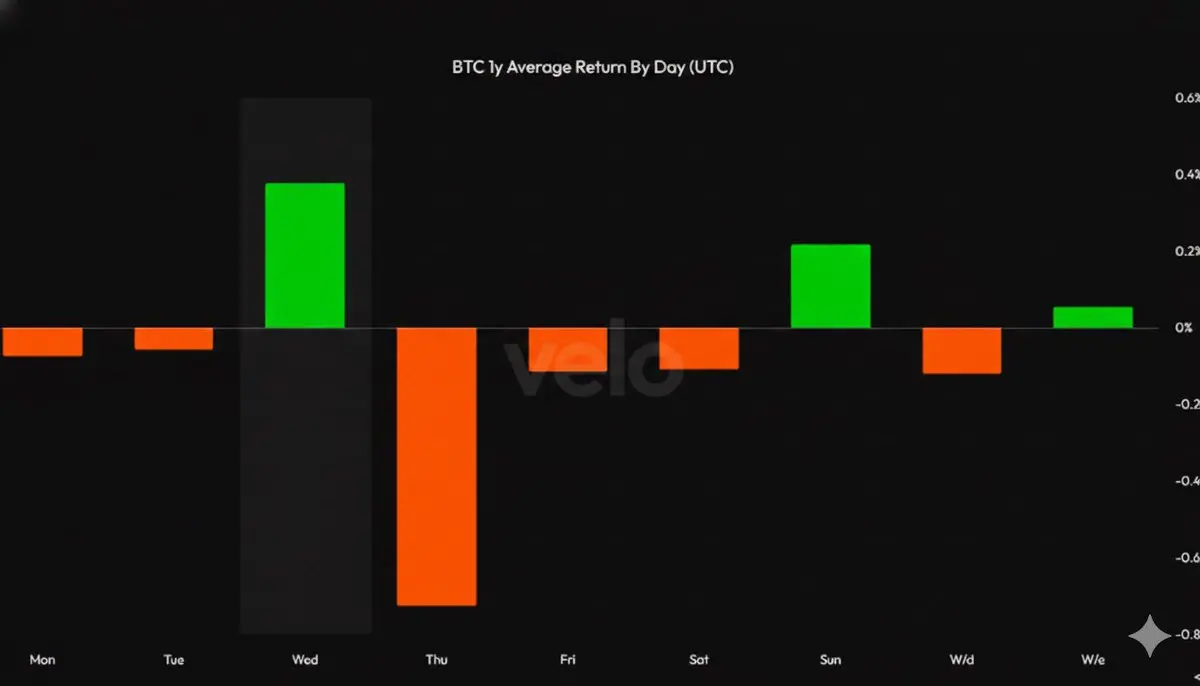

🚀 BTC Squeeze Incoming Are You Ready?

$BTC is coiled at $68K, bears talking “Crypto Winter” while the whales quietly stack. One push above $70K and we could see a God Candle wipe the floor clean.

Here’s the setup:

🔰 Liquidity drain incoming AI & Fixed Income flows are moving capital.

🔰 Equity vs. crypto tug-of-war Nasdaq pumps, VIX drops, Gold holding. “War Hedge” trade outperforming “Digital Gold.”

🔰 Key level: $68,500 4H close above flips bias bullish.

🔰 $SUI alert: $1.05 target near, but path of least resistance still down. Lower liquidity zones = smart money playground.

This isn’t ran

$BTC is coiled at $68K, bears talking “Crypto Winter” while the whales quietly stack. One push above $70K and we could see a God Candle wipe the floor clean.

Here’s the setup:

🔰 Liquidity drain incoming AI & Fixed Income flows are moving capital.

🔰 Equity vs. crypto tug-of-war Nasdaq pumps, VIX drops, Gold holding. “War Hedge” trade outperforming “Digital Gold.”

🔰 Key level: $68,500 4H close above flips bias bullish.

🔰 $SUI alert: $1.05 target near, but path of least resistance still down. Lower liquidity zones = smart money playground.

This isn’t ran

- Reward

- like

- Comment

- Repost

- Share

🚨 Shutdown Risk Just Got Crushed

Probability went from 96% → 26% in a heartbeat. The market just called the bluff.

Fear is evaporating. Panic is being priced out live.

Smart money doesn’t overreact they position.

✍️ Conclusion:

When risk premiums collapse this fast, opportunities appear. Stay alert, stay stacked, and don’t get caught chasing fear. 🐒📈

Probability went from 96% → 26% in a heartbeat. The market just called the bluff.

Fear is evaporating. Panic is being priced out live.

Smart money doesn’t overreact they position.

✍️ Conclusion:

When risk premiums collapse this fast, opportunities appear. Stay alert, stay stacked, and don’t get caught chasing fear. 🐒📈

- Reward

- like

- Comment

- Repost

- Share

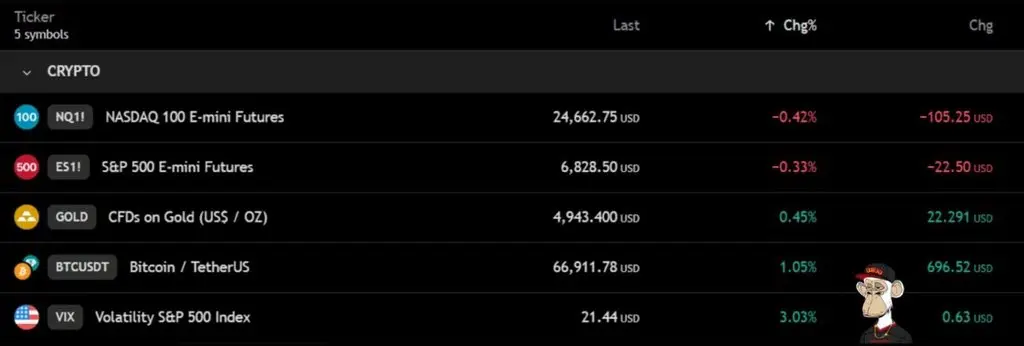

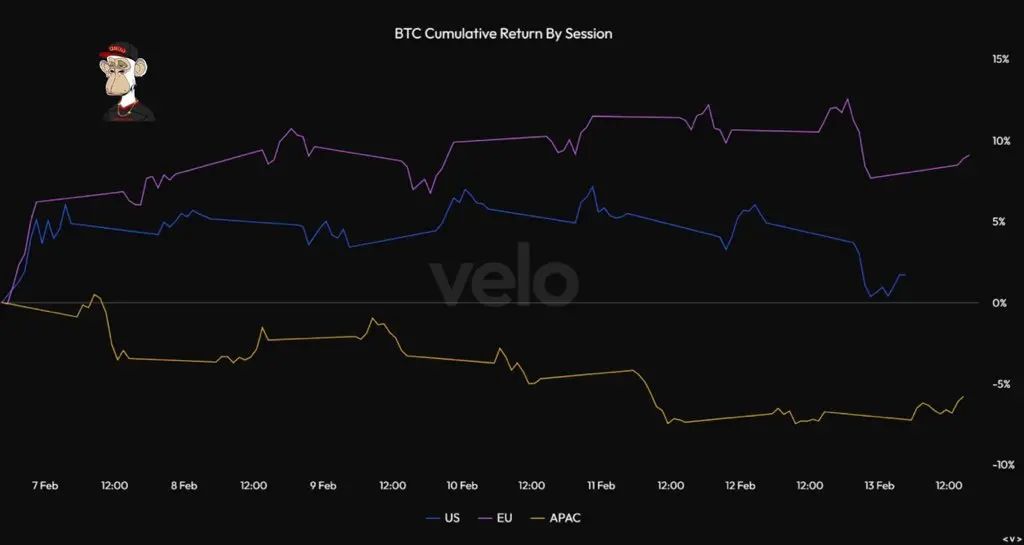

🚨 BTC Battles, Smart Money Wins

Consolidation or distribution? $BTC at $67K feels heavy as Nasdaq pre-market bleeds.

Tech is tired AI spend fatigue is real. VIX at 21+ confirms fear creeping in. If $SPX futures don’t reclaim the open, expect choppy swings.

Regional tug-of-war is on:

🔰 Asia selling like there’s no tomorrow

🔰 EU quietly gobbling every satoshi

Smart money is stacking in Europe. The floor isn’t theoretical it’s being built live.

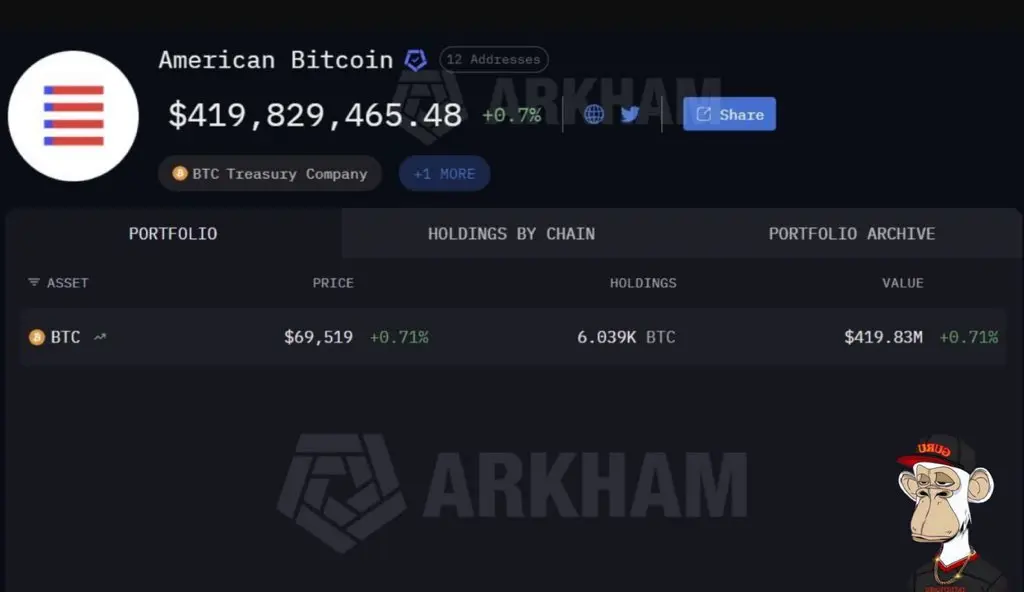

BREAKING: $ABTC joins the Top 20 public Bitcoin holders.

Eric Trump isn’t just talking about Bitcoin’s future he’s buying it. 6,000+ $BTC now in Americ

Consolidation or distribution? $BTC at $67K feels heavy as Nasdaq pre-market bleeds.

Tech is tired AI spend fatigue is real. VIX at 21+ confirms fear creeping in. If $SPX futures don’t reclaim the open, expect choppy swings.

Regional tug-of-war is on:

🔰 Asia selling like there’s no tomorrow

🔰 EU quietly gobbling every satoshi

Smart money is stacking in Europe. The floor isn’t theoretical it’s being built live.

BREAKING: $ABTC joins the Top 20 public Bitcoin holders.

Eric Trump isn’t just talking about Bitcoin’s future he’s buying it. 6,000+ $BTC now in Americ

BTC-0,46%

- Reward

- 1

- Comment

- Repost

- Share

🚨 The Great Revision Just Exposed the Truth

They told us 2025 was “slow.”

Turns out… it wasn’t slow.

It was frozen.

New revisions show only 181,000 jobs added all year.

That’s roughly 15,000 per month.

For context?

That’s the weakest non-recession job year in over two decades.

Let that sink in.

On paper, everything looked “stable.”

On the ground, people felt the squeeze.

Hiring freezes.

Ghost listings.

Endless interviews with no offers.

Now the data finally matches the reality.

This is the dangerous gap:

Official numbers say “soft landing.”

Real people feel “silent downturn.”

And when revisio

They told us 2025 was “slow.”

Turns out… it wasn’t slow.

It was frozen.

New revisions show only 181,000 jobs added all year.

That’s roughly 15,000 per month.

For context?

That’s the weakest non-recession job year in over two decades.

Let that sink in.

On paper, everything looked “stable.”

On the ground, people felt the squeeze.

Hiring freezes.

Ghost listings.

Endless interviews with no offers.

Now the data finally matches the reality.

This is the dangerous gap:

Official numbers say “soft landing.”

Real people feel “silent downturn.”

And when revisio

- Reward

- like

- Comment

- Repost

- Share

Everyone keeps asking for the bottom. Truth is simple:There’s heavy liquidity at $68k previous ATH support + major trendline retest. Lose $72k today and a quick wick to $68k is on the table.I’m keeping bids lower and stables ready. No hero longs. Patience beats chop.

- Reward

- like

- Comment

- Repost

- Share

10-year returns tell the whole story.Gold did 3.5×.Silver managed 6.5×.Bitcoin ran 220×.One is a metal.One is a legacy asset.One is the future of money.Anon, you don’t argue with this chart.You position around it.

BTC-0,46%

- Reward

- 1

- Comment

- Repost

- Share

ALPHA: Commodities Are About to Go On-Chain

Everyone is fixated on tokenized T-bills like that’s the endgame.

It’s not. That’s just the warm-up.

The real RWA unlock is commodities.

Steel.

Oil.

Industrial minerals.

The stuff that actually runs the world.

While CT is busy debating yields, Asara Group is already pushing real industrial assets onto the blockchain using Locus Chain’s serverless architecture.

That part matters.

No heavy infra.

No clunky onchain bottlenecks.

Just scalable rails built for real enterprise use.

We already saw phase one with $XAUT and $PAXG.

Digital gold proved the conce

Everyone is fixated on tokenized T-bills like that’s the endgame.

It’s not. That’s just the warm-up.

The real RWA unlock is commodities.

Steel.

Oil.

Industrial minerals.

The stuff that actually runs the world.

While CT is busy debating yields, Asara Group is already pushing real industrial assets onto the blockchain using Locus Chain’s serverless architecture.

That part matters.

No heavy infra.

No clunky onchain bottlenecks.

Just scalable rails built for real enterprise use.

We already saw phase one with $XAUT and $PAXG.

Digital gold proved the conce

- Reward

- like

- Comment

- Repost

- Share

Bitcoin Isn’t a Chart. It’s a Machine.

Most people are staring at the price.

Smart people are watching the hash rate.

While headlines scream and politicians argue, Bitcoin just keeps doing one thing better than any system ever built: securing value with raw energy and math.

This isn’t just money.

It’s the most powerful computer network humans have ever created.

No CEO.

No country.

No central switch to turn it off.

Banks can freeze accounts.

Governments can change rules.

Bitcoin doesn’t care who’s in power or what policy dropped today.

Every new block makes the network stronger.

Every increase

Most people are staring at the price.

Smart people are watching the hash rate.

While headlines scream and politicians argue, Bitcoin just keeps doing one thing better than any system ever built: securing value with raw energy and math.

This isn’t just money.

It’s the most powerful computer network humans have ever created.

No CEO.

No country.

No central switch to turn it off.

Banks can freeze accounts.

Governments can change rules.

Bitcoin doesn’t care who’s in power or what policy dropped today.

Every new block makes the network stronger.

Every increase

BTC-0,46%

- Reward

- like

- Comment

- Repost

- Share

Europe Isn’t Flat… It’s Just Uneven 🇵🇱

While most of the West keeps arguing in circles, Poland quietly moved forward.

No drama. No slogans. Just execution.

Here’s what they did differently and why it matters ⬇️

First, identity came before ideology.

Poland focused on social cohesion instead of importing culture wars. Strong identity = stable society. Simple math.

Second, education over narratives.

Skills, engineering, industry, real productivity. Not endless theory. You can’t build an economy on vibes.

Third, financial independence as policy.

Less obsession with debt games. More respect for h

While most of the West keeps arguing in circles, Poland quietly moved forward.

No drama. No slogans. Just execution.

Here’s what they did differently and why it matters ⬇️

First, identity came before ideology.

Poland focused on social cohesion instead of importing culture wars. Strong identity = stable society. Simple math.

Second, education over narratives.

Skills, engineering, industry, real productivity. Not endless theory. You can’t build an economy on vibes.

Third, financial independence as policy.

Less obsession with debt games. More respect for h

- Reward

- like

- Comment

- Repost

- Share

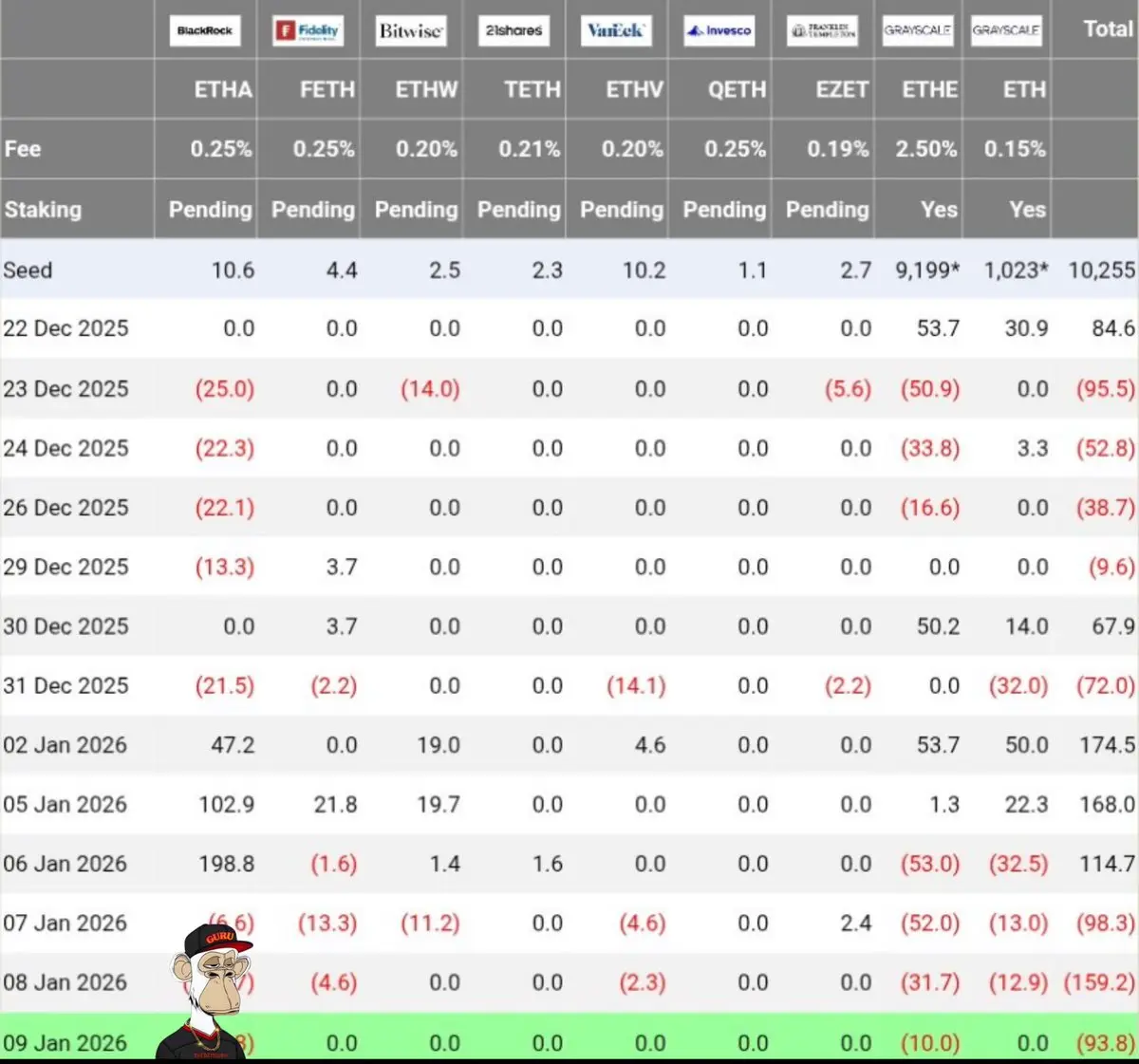

ETH Reality Check: The ETF Party Just Ended 🧊

The ETH ETF hype had its moment… and now the hangover is here.

Yesterday told a very clear story:

👉 ~$94M in net ETH ETF outflows

👉 BlackRock-linked desks dumped ~$83M

👉 Big money wasn’t buying dips they were pressing sell

That matters more than any chart pattern.

When the largest asset manager on earth starts reducing exposure, it doesn’t mean ETH is dead.

It means the easy upside is gone for now.

This is how it usually plays out:

🔰ETFs launch → hype explodes

🔰 Early inflows chase momentum

🔰 Institutions rebalance, take profit

🔰 Market coo

The ETH ETF hype had its moment… and now the hangover is here.

Yesterday told a very clear story:

👉 ~$94M in net ETH ETF outflows

👉 BlackRock-linked desks dumped ~$83M

👉 Big money wasn’t buying dips they were pressing sell

That matters more than any chart pattern.

When the largest asset manager on earth starts reducing exposure, it doesn’t mean ETH is dead.

It means the easy upside is gone for now.

This is how it usually plays out:

🔰ETFs launch → hype explodes

🔰 Early inflows chase momentum

🔰 Institutions rebalance, take profit

🔰 Market coo

ETH-0,86%

- Reward

- like

- 2

- Repost

- Share

GlacierTradingMemberHj :

:

2026 Go Go Go 👊View More

Everyone’s sleeping on $WLFI… and that’s usually when things get interesting.

While CT is busy chasing noise, the numbers on $WLFI are quietly holding their ground.

Let’s talk facts, not feelings ⬇️

Right now, $WLFI is one of the very few 2025 launches where early buyers are still green. That alone already puts it in a different category. Most new launches didn’t survive their first few weeks. This one did.

Price-wise, it’s only about 14% down from the $0.20 launch. In a market where many tokens are sitting 50–80% underwater, that’s strength, not weakness. Relative performance matters more tha

While CT is busy chasing noise, the numbers on $WLFI are quietly holding their ground.

Let’s talk facts, not feelings ⬇️

Right now, $WLFI is one of the very few 2025 launches where early buyers are still green. That alone already puts it in a different category. Most new launches didn’t survive their first few weeks. This one did.

Price-wise, it’s only about 14% down from the $0.20 launch. In a market where many tokens are sitting 50–80% underwater, that’s strength, not weakness. Relative performance matters more tha

WLFI-4,72%

- Reward

- like

- Comment

- Repost

- Share

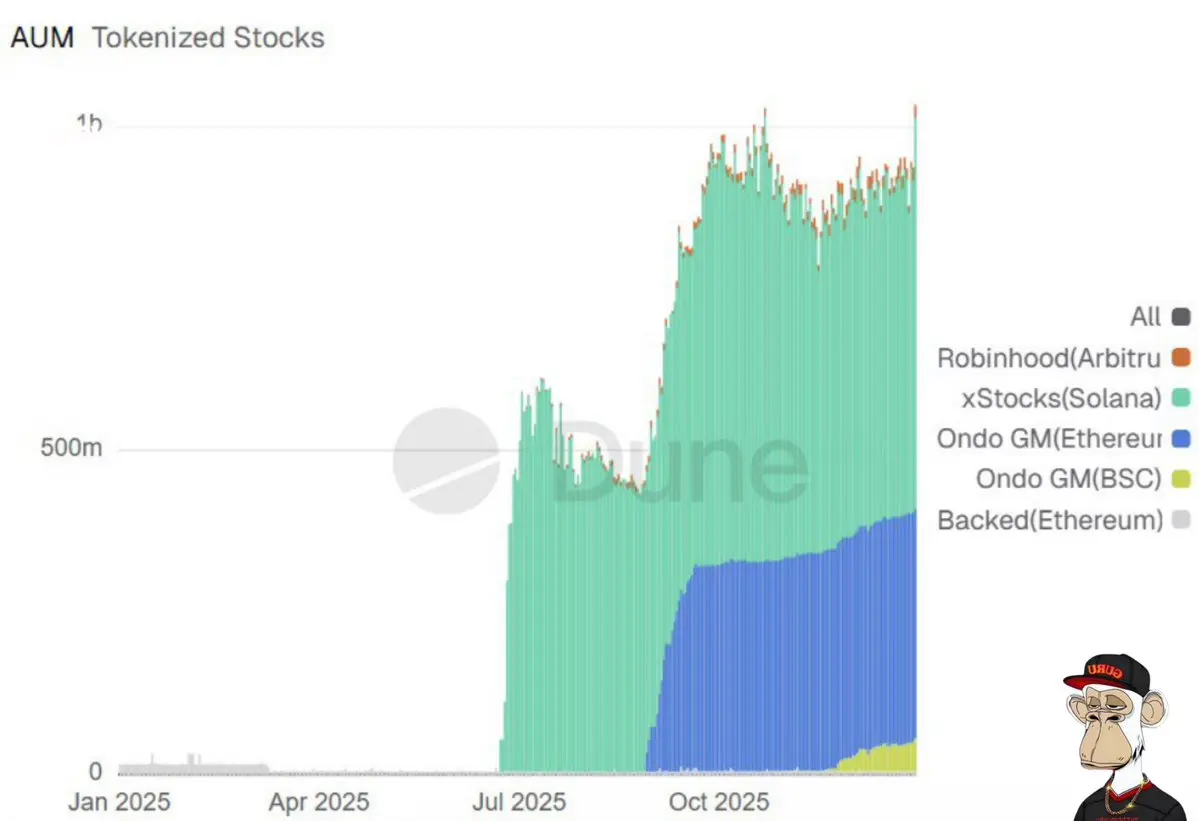

🚀 The Great Migration: Stocks Going On-Chain

Total tokenized stock AUM just hit $1B+.

Key points:

➤ Everyone laughed at $RWA… now top institutions are onboarding their equity.

➤ Why it matters: efficiency + transparency always win.

➤ On-chain settlement is final, auditable, and unstoppable.

✍️ Conclusion:

We’re watching traditional finance move onto blockchain in real-time. Meme? Maybe once. Now? The future is tokenized, and it’s happening fast.

Total tokenized stock AUM just hit $1B+.

Key points:

➤ Everyone laughed at $RWA… now top institutions are onboarding their equity.

➤ Why it matters: efficiency + transparency always win.

➤ On-chain settlement is final, auditable, and unstoppable.

✍️ Conclusion:

We’re watching traditional finance move onto blockchain in real-time. Meme? Maybe once. Now? The future is tokenized, and it’s happening fast.

RWA1,08%

- Reward

- like

- Comment

- Repost

- Share

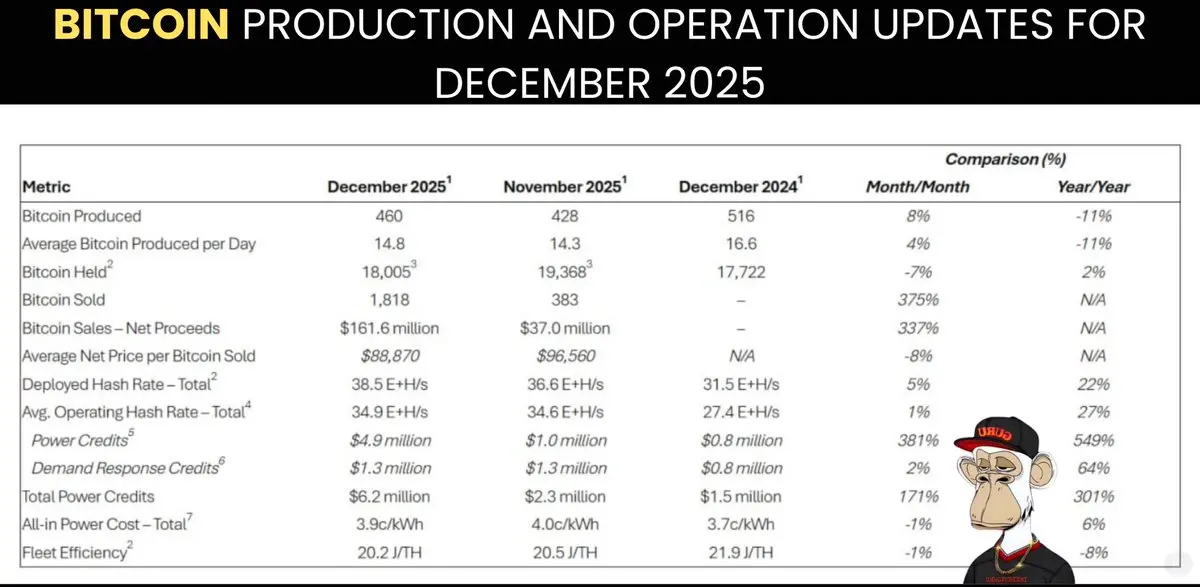

🚨 RIOT’S SHIFT: HODL NO MORE?

Big move in the mining world: $RIOT just sold 1,818 $BTC almost 4x their last month’s production.

Key points:

➤ Holdings remain solid at 18k $BTC, but the pace of selling is picking up.

➤ Sales are aimed at funding operational expansion, not panic or market timing.

➤ Signals a new era: the “mine and never sell” strategy is fading for major miners.

What this means for 2026:

➤ Supply from miners might increase, impacting short-term sentiment.

➤ Big players are prioritizing growth over pure accumulation.

➤ HODL culture is evolving strategic liquidity management is h

Big move in the mining world: $RIOT just sold 1,818 $BTC almost 4x their last month’s production.

Key points:

➤ Holdings remain solid at 18k $BTC, but the pace of selling is picking up.

➤ Sales are aimed at funding operational expansion, not panic or market timing.

➤ Signals a new era: the “mine and never sell” strategy is fading for major miners.

What this means for 2026:

➤ Supply from miners might increase, impacting short-term sentiment.

➤ Big players are prioritizing growth over pure accumulation.

➤ HODL culture is evolving strategic liquidity management is h

BTC-0,46%

- Reward

- like

- Comment

- Repost

- Share

🚦 Too Early to Call the Top

Only 2–3 real bull-market peak signals have shown up so far. That’s it.

Yet CT is already screaming “TOP IN 🚨” like we’re done.

Funny thing is… the data disagrees.

This phase is familiar:

▪️ Price goes up

▪️ Crowd gets loud

▪️ Doubt creeps in

▪️ Everyone starts calling tops early

History lesson 🐒

The most violent, face-melting moves usually come after this disbelief stage. Not before it.

When sentiment is confused and conviction is low, that’s when trends do the most damage.

Right now, the noise is emotional.

The metrics are calm.

One is trying to scare you out.

Only 2–3 real bull-market peak signals have shown up so far. That’s it.

Yet CT is already screaming “TOP IN 🚨” like we’re done.

Funny thing is… the data disagrees.

This phase is familiar:

▪️ Price goes up

▪️ Crowd gets loud

▪️ Doubt creeps in

▪️ Everyone starts calling tops early

History lesson 🐒

The most violent, face-melting moves usually come after this disbelief stage. Not before it.

When sentiment is confused and conviction is low, that’s when trends do the most damage.

Right now, the noise is emotional.

The metrics are calm.

One is trying to scare you out.

- Reward

- like

- Comment

- Repost

- Share

💰 Bitcoin vs Gold: The Great Wealth Transfer

Bitcoin: $1.85T

Gold: $31.1T

Gap = 16x.

Reality check: Gold doesn’t move. BTC? Infinite potential. Every transfer, every adoption is compounding.

We’re witnessing the biggest wealth shift in human history, happening in real-time.

2035 isn’t the earliest this happens it’s the latest.

If you’re not long $BTC, you’re literally missing the story.

The math is simple: scarce, digital, liquid. BTC has gravity. Gold? Just heavy metal.

Bitcoin: $1.85T

Gold: $31.1T

Gap = 16x.

Reality check: Gold doesn’t move. BTC? Infinite potential. Every transfer, every adoption is compounding.

We’re witnessing the biggest wealth shift in human history, happening in real-time.

2035 isn’t the earliest this happens it’s the latest.

If you’re not long $BTC, you’re literally missing the story.

The math is simple: scarce, digital, liquid. BTC has gravity. Gold? Just heavy metal.

BTC-0,46%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More351.03K Popularity

115.65K Popularity

426.87K Popularity

11.3K Popularity

128.14K Popularity

Pin