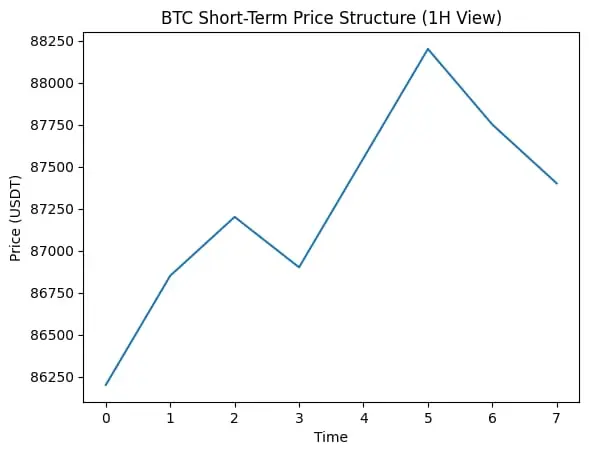

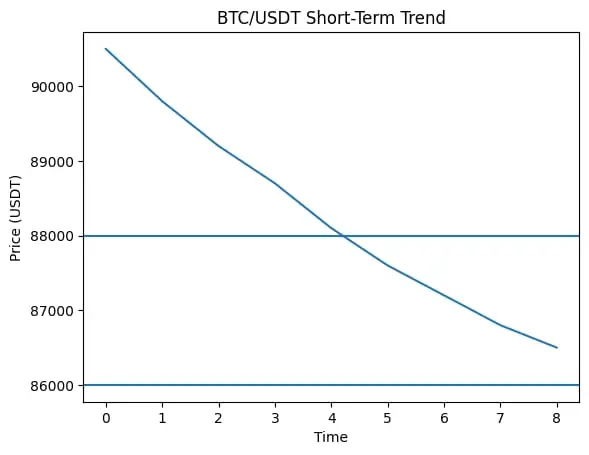

$BTC BTC is moving sideways after a sharp drop and recovery. Price is currently holding near 87.5K, showing balance between buyers and sellers.

What the chart shows

Strong rejection near 89.5K → sellers are active there

Solid support around 86.6K → buyers defended this zone well

Price is compressing, usually a sign that a move is coming

Short-term outlook (next few hours)

If BTC holds above 87K, a push toward 88.5K–89K is possible

A break below 86.6K may bring quick downside pressure

Mid-term outlook (next few days)

Above 89.5K → momentum can flip bullish again

Below 86.6K → market may retes

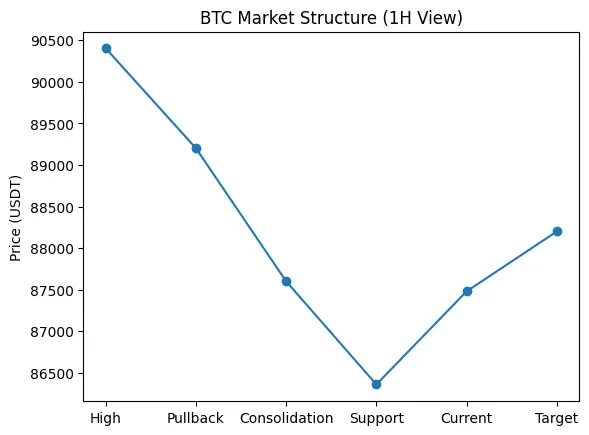

What the chart shows

Strong rejection near 89.5K → sellers are active there

Solid support around 86.6K → buyers defended this zone well

Price is compressing, usually a sign that a move is coming

Short-term outlook (next few hours)

If BTC holds above 87K, a push toward 88.5K–89K is possible

A break below 86.6K may bring quick downside pressure

Mid-term outlook (next few days)

Above 89.5K → momentum can flip bullish again

Below 86.6K → market may retes

BTC0,2%