Andy2024

No content yet

andy2024

The future is happening right now.

- Reward

- like

- Comment

- Repost

- Share

The vibes at AI conferences feel like crypto conferences in 2021 tbh

- Reward

- like

- Comment

- Repost

- Share

LIVE DAY 2 IN SF.

A full day of conversations with the leaders in AI, investors at the intersection of blockchain x AI, and innovators from the valley.

Tune in.

A full day of conversations with the leaders in AI, investors at the intersection of blockchain x AI, and innovators from the valley.

Tune in.

- Reward

- like

- Comment

- Repost

- Share

"How's your crypto portfolio looking man?"

My portfolio:

My portfolio:

- Reward

- like

- Comment

- Repost

- Share

JUNE 2028.

We are live from NEARCON today with leading AI entrepreneurs & investors all day. Tune in.

We are live from NEARCON today with leading AI entrepreneurs & investors all day. Tune in.

- Reward

- like

- Comment

- Repost

- Share

In a sea of red, there's a little bit of green in this world...

Morpho, Hyperliquid, Sky.

Morpho, Hyperliquid, Sky.

- Reward

- 2

- Comment

- Repost

- Share

Rumor mill saying this is the last ETHDenver ever.

Not sure if confirmed yet, but heard across multiple people.

Not sure if confirmed yet, but heard across multiple people.

- Reward

- like

- Comment

- Repost

- Share

Digital assets >>> crypto

Legacy finance >>> Tradfi

Legacy finance >>> Tradfi

- Reward

- like

- Comment

- Repost

- Share

It might be time to let go of the term "crypto" as an industry.

- Reward

- 1

- Comment

- Repost

- Share

NEW: CME GROUP TO LAUNCH 24/7 CRYPTO FUTURES AND OPTIONS TRADING ON MAY 29

Their global head of equities stated that "client demand for risk management in the digital asset market is at all-time highs" and that 24/7 markets allow clients to do this.

Their global head of equities stated that "client demand for risk management in the digital asset market is at all-time highs" and that 24/7 markets allow clients to do this.

- Reward

- 2

- Comment

- Repost

- Share

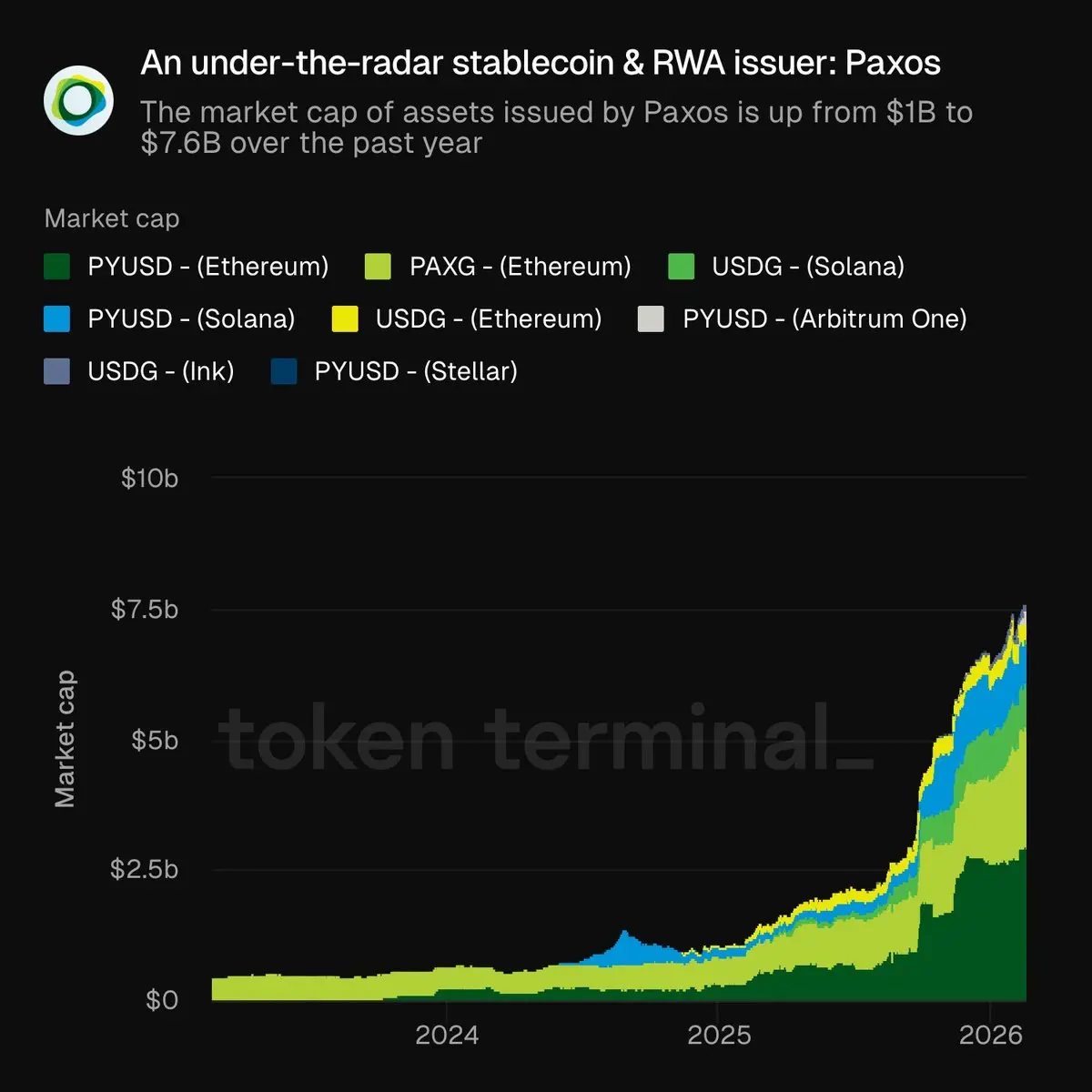

The two biggest trends in neo finance this year are RWA looping and vaults.

- Reward

- like

- Comment

- Repost

- Share

We are live from ETHDenver.

Fireside chats, panels, and we even have robots. If ya missed the conference, come hang!

Fireside chats, panels, and we even have robots. If ya missed the conference, come hang!

- Reward

- 2

- Comment

- Repost

- Share

ETHDenver so far:

- No airport sponsorships

- Everyone thinks DATs were a terrible idea

- Hyperliquid event had very solid group of familiar faces and builders + good new ones

- Most people are very aware of the ongoing structural changes in the space, others just feel its cyclical

- Chilly and windy

- Folks continue to be excited about tokenization, equity/commodity perps, convergence of legacy finance and DeFi

- Not sure what it is, but feels like industry is growing up (maybe were just getting older?)

- Way less noise

- Feels somber, but rooms aren't empty, so its not deep bear yet

- There'

- No airport sponsorships

- Everyone thinks DATs were a terrible idea

- Hyperliquid event had very solid group of familiar faces and builders + good new ones

- Most people are very aware of the ongoing structural changes in the space, others just feel its cyclical

- Chilly and windy

- Folks continue to be excited about tokenization, equity/commodity perps, convergence of legacy finance and DeFi

- Not sure what it is, but feels like industry is growing up (maybe were just getting older?)

- Way less noise

- Feels somber, but rooms aren't empty, so its not deep bear yet

- There'

- Reward

- like

- Comment

- Repost

- Share