BitLiuBei

No content yet

BitLiuBei

Not waiting for the US stocks, did the market open early?

Trading sentiment is really important. Prices fluctuate daily. When it rises, some see 100,000; when it falls, they see 80,000. The target is not a problem, but it must be realistic. You need to have unlimited bullets to endure the frustration of holding short positions. The targets will be reached, but most retail investors jump in with the hope of a one-night turnaround, only to fall before the rainbow after the rain, and big dreams are just illusions!

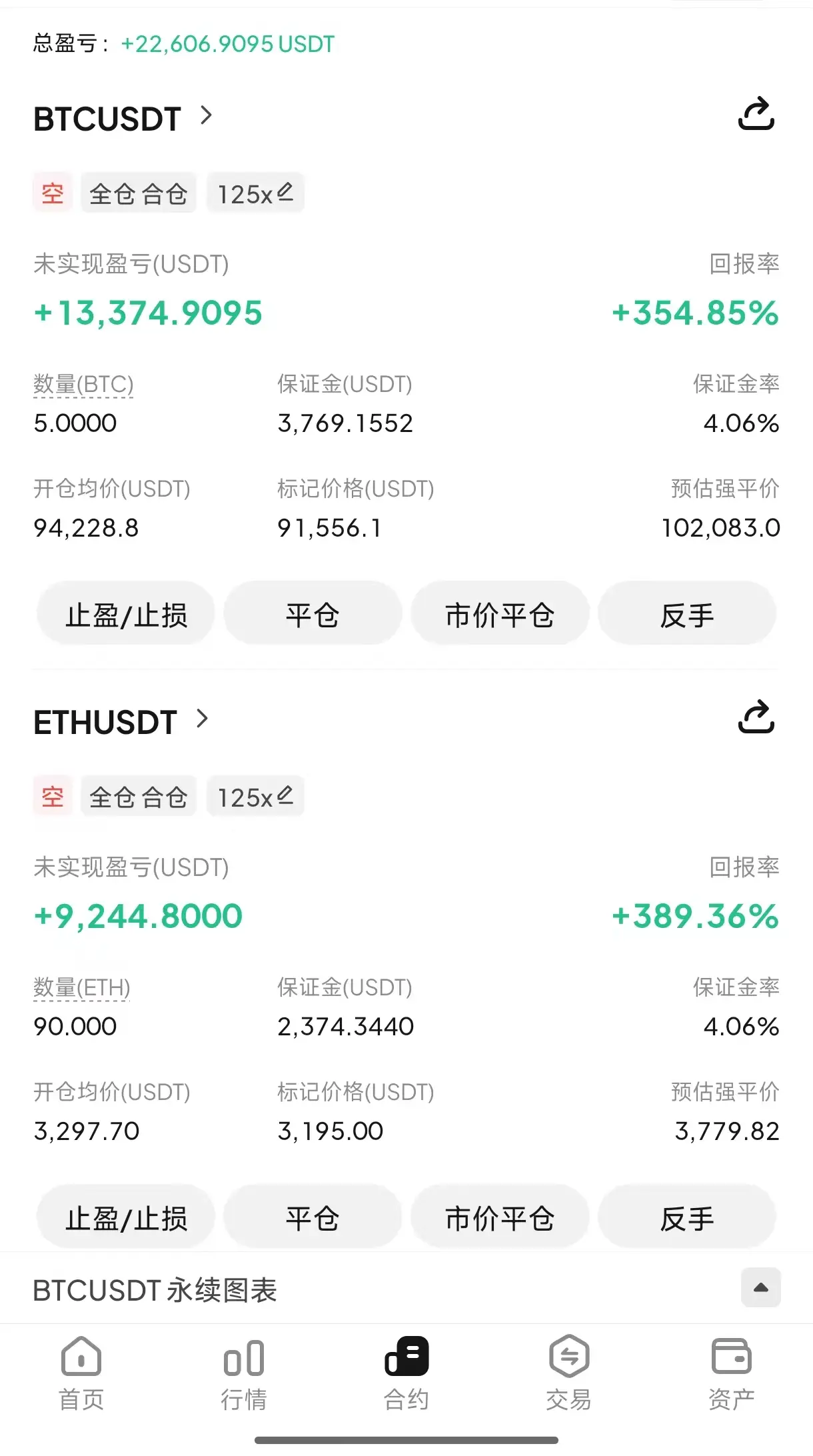

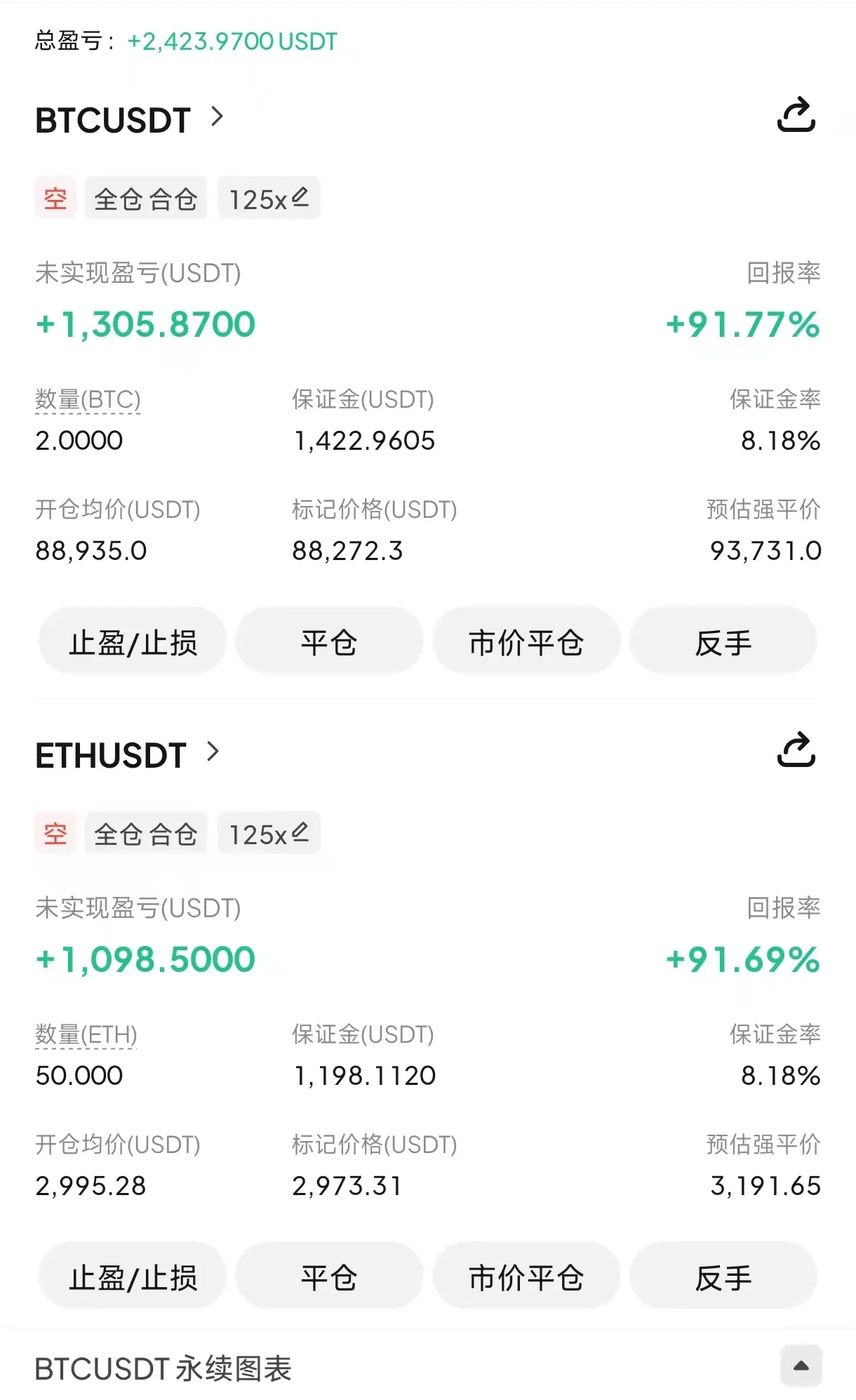

Currently, Bitcoin short positions are still held. The target of 91,500 has been re

Trading sentiment is really important. Prices fluctuate daily. When it rises, some see 100,000; when it falls, they see 80,000. The target is not a problem, but it must be realistic. You need to have unlimited bullets to endure the frustration of holding short positions. The targets will be reached, but most retail investors jump in with the hope of a one-night turnaround, only to fall before the rainbow after the rain, and big dreams are just illusions!

Currently, Bitcoin short positions are still held. The target of 91,500 has been re

BTC-1,92%

- Reward

- 1

- Comment

- Repost

- Share

Does this count as a post-hoc analysis?

Let the bullets fly for a while, time will prove the truth!

The trend is clearly bullish, no doubt. However, the strong resistance level at 9450, which has been tested multiple times, has not been broken and stabilized. A deep retracement is still likely to occur. Chasing the rally halfway through will definitely make you uncomfortable. The rebound space is limited, and the risk is extremely high. The expected retracement to 9120 occurred overnight. Isn't the 3000-point space above 9400 attractive for shorting? For those who like to go long, both support

Let the bullets fly for a while, time will prove the truth!

The trend is clearly bullish, no doubt. However, the strong resistance level at 9450, which has been tested multiple times, has not been broken and stabilized. A deep retracement is still likely to occur. Chasing the rally halfway through will definitely make you uncomfortable. The rebound space is limited, and the risk is extremely high. The expected retracement to 9120 occurred overnight. Isn't the 3000-point space above 9400 attractive for shorting? For those who like to go long, both support

BTC-1,92%

- Reward

- 1

- Comment

- Repost

- Share

Don't chase the rally at high levels, don't become the bagholder!

Bitcoin is testing the weekly resistance at 9450. If it doesn't break through, it is likely to test the support zone between 9020-9100. This is why I keep saying not to chase the rally—it's easy to get caught in the middle, stuck in the halfway point. In the early session, the rebound above 9400 also reached the target support level with a 1000-point space. Short-term profit-taking and risk management are recommended; wait for the US stocks to stabilize.

Ethereum faces the strongest selling pressure around 3250. During the day,

Bitcoin is testing the weekly resistance at 9450. If it doesn't break through, it is likely to test the support zone between 9020-9100. This is why I keep saying not to chase the rally—it's easy to get caught in the middle, stuck in the halfway point. In the early session, the rebound above 9400 also reached the target support level with a 1000-point space. Short-term profit-taking and risk management are recommended; wait for the US stocks to stabilize.

Ethereum faces the strongest selling pressure around 3250. During the day,

BTC-1,92%

- Reward

- 1

- Comment

- Repost

- Share

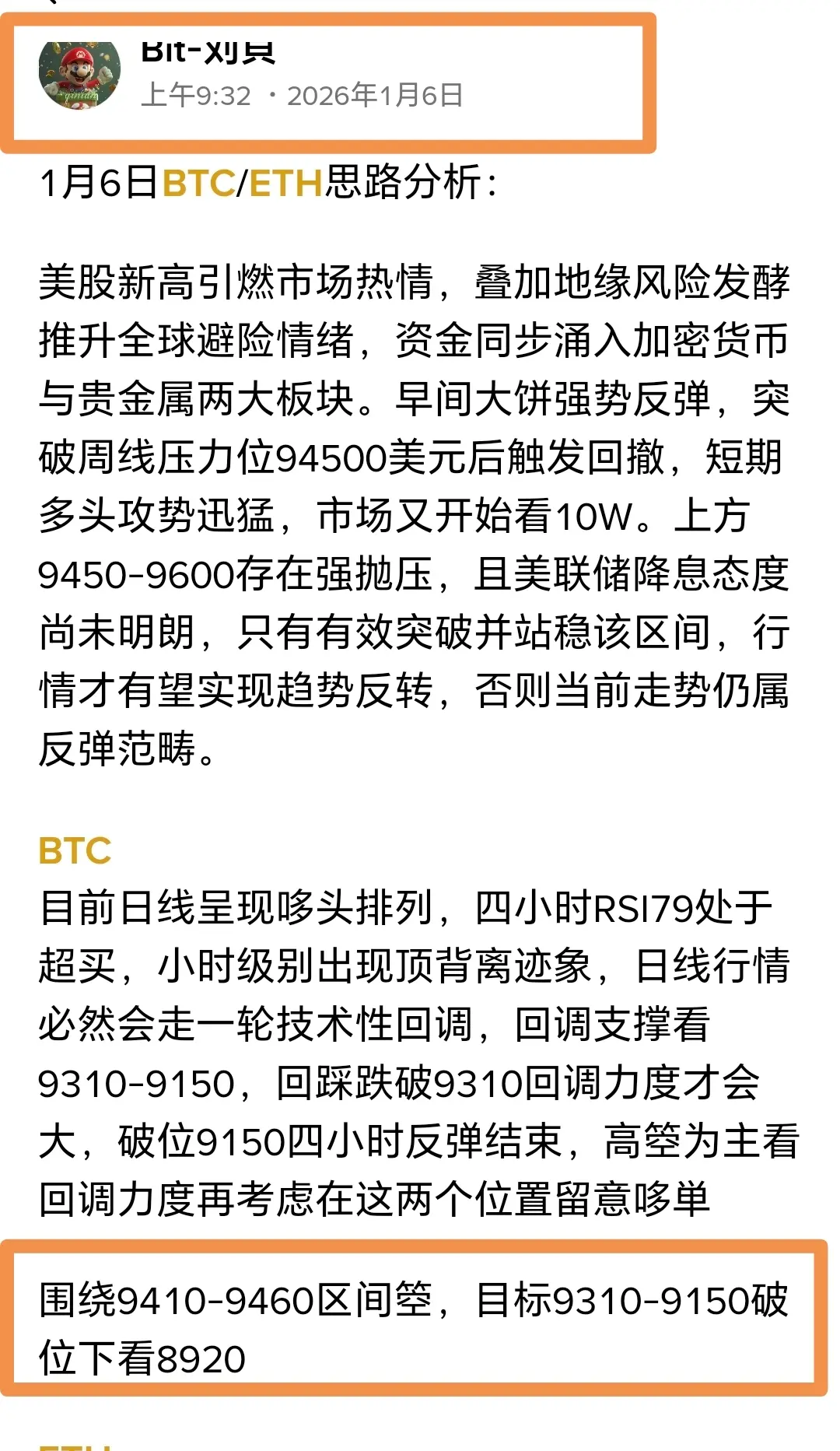

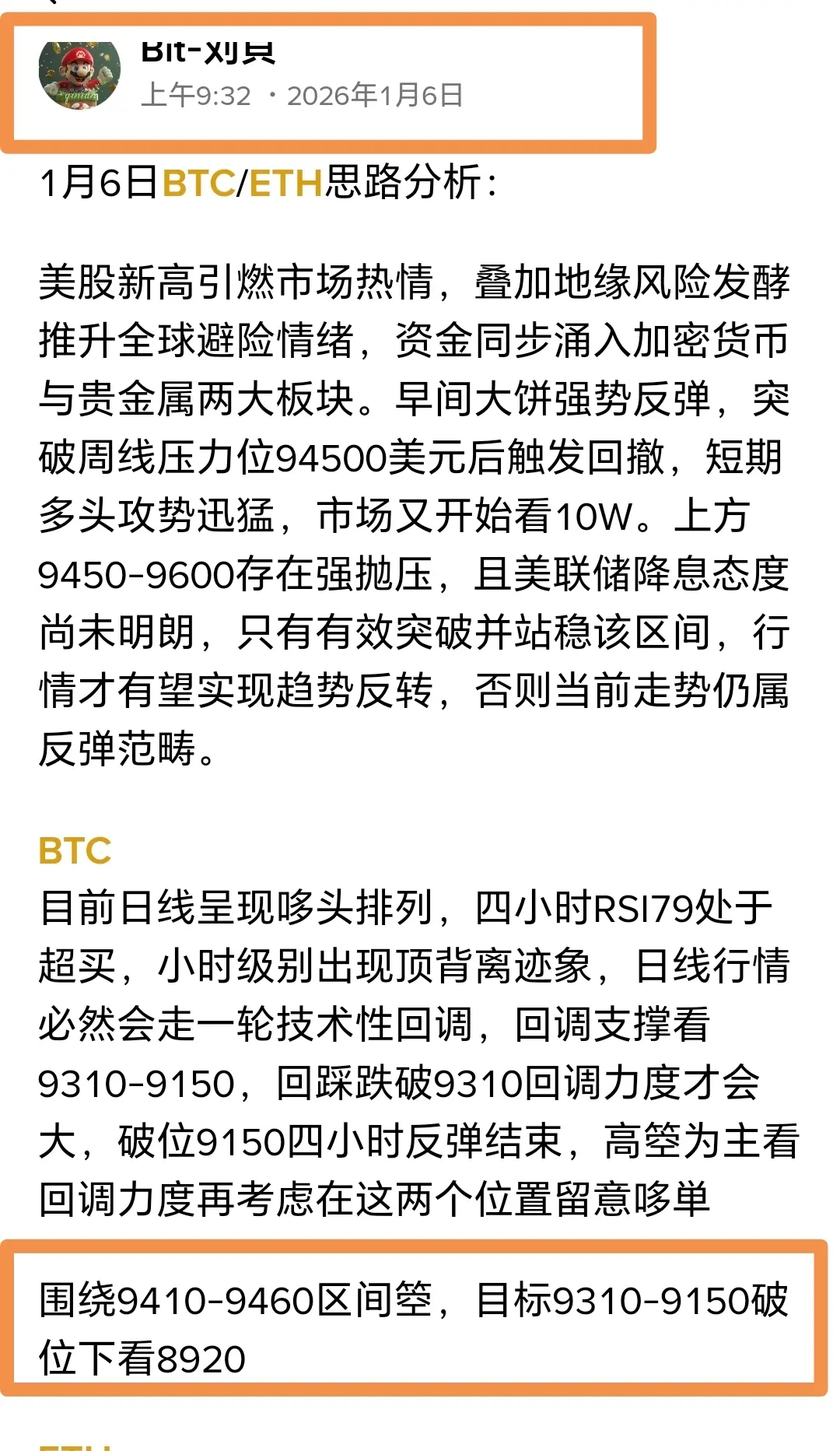

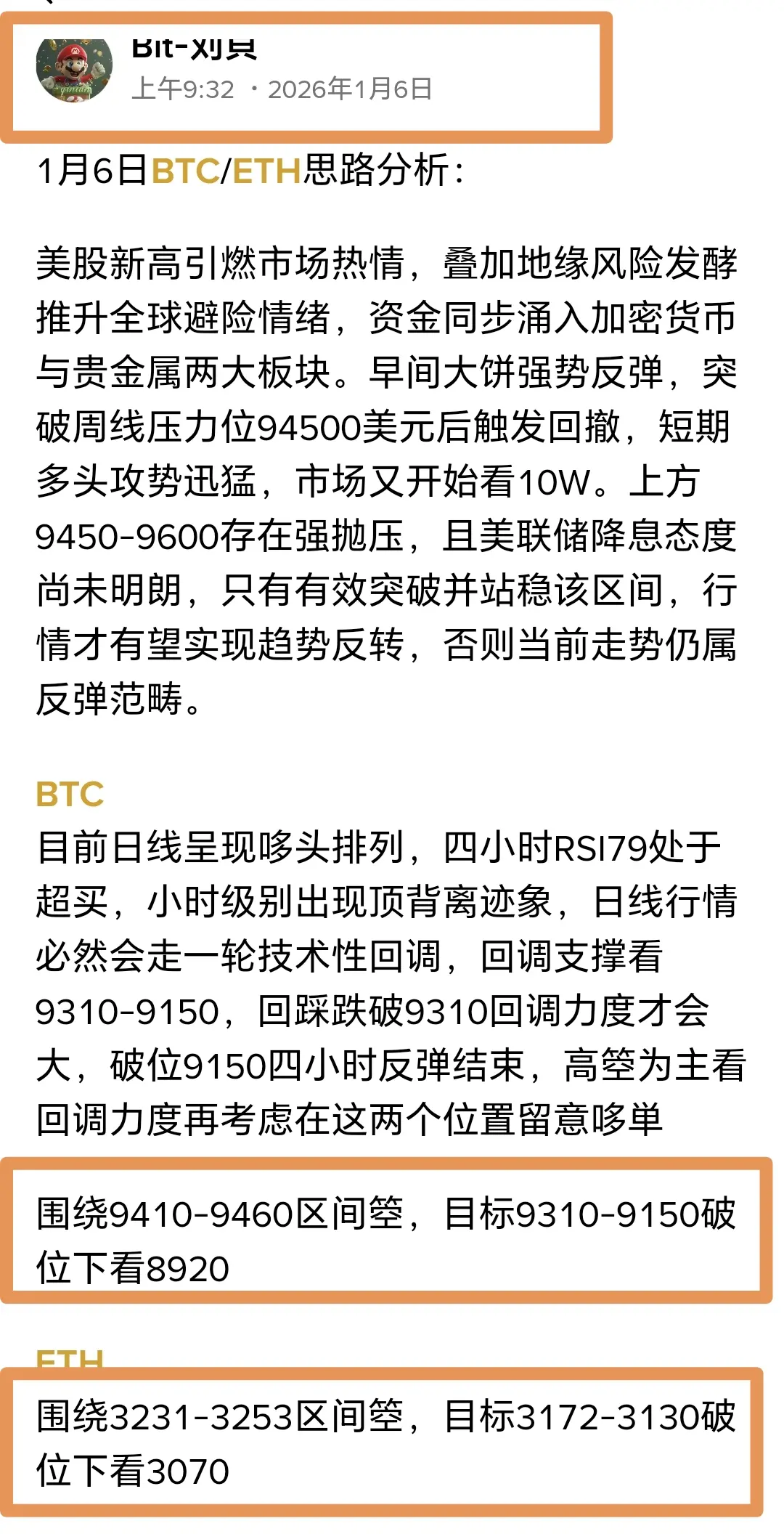

January 6th BTC/ETH Analysis:

The new high in the US stock market has ignited market enthusiasm, coupled with geopolitical risks fermenting and boosting global risk aversion sentiment. Funds are flowing into the two major sectors of cryptocurrencies and precious metals. This morning, Bitcoin rebounded strongly, breaking through the weekly resistance level of $94,500 and then triggering a pullback. The short-term bullish momentum is rapid, and the market is once again eyeing 100,000. There is strong selling pressure in the 9,450-9,600 range, and the Federal Reserve's stance on interest rate cut

The new high in the US stock market has ignited market enthusiasm, coupled with geopolitical risks fermenting and boosting global risk aversion sentiment. Funds are flowing into the two major sectors of cryptocurrencies and precious metals. This morning, Bitcoin rebounded strongly, breaking through the weekly resistance level of $94,500 and then triggering a pullback. The short-term bullish momentum is rapid, and the market is once again eyeing 100,000. There is strong selling pressure in the 9,450-9,600 range, and the Federal Reserve's stance on interest rate cut

BTC-1,92%

- Reward

- like

- Comment

- Repost

- Share

January 5th BTC/ETH Analysis:

A new week, the market is warming up across the board. Last week’s early warning about liquidity returning this week prompted everyone to watch for low positions. Today, the weekly chart saw a rally! The current surge is mainly due to the contraction in the US job market, with the unemployment rate rising to 5%, forcing the Federal Reserve to increase the pace of rate cuts. It is estimated that by the end of 2026, there will be five rate cuts of 25 basis points each, totaling 125 basis points to 2.25%. Institutions like BlackRock IBIT have continuously injected la

A new week, the market is warming up across the board. Last week’s early warning about liquidity returning this week prompted everyone to watch for low positions. Today, the weekly chart saw a rally! The current surge is mainly due to the contraction in the US job market, with the unemployment rate rising to 5%, forcing the Federal Reserve to increase the pace of rate cuts. It is estimated that by the end of 2026, there will be five rate cuts of 25 basis points each, totaling 125 basis points to 2.25%. Institutions like BlackRock IBIT have continuously injected la

BTC-1,92%

- Reward

- like

- Comment

- Repost

- Share

January 3rd BTC/ETH Strategy Analysis:

The US stock market opened strongly for the new year, boosting market sentiment. Institutions like BlackRock continue to buy spot assets. Bitcoin spot ETF inflows reached $470 million, and altcoin spot inflows totaled $170 million. This rise is driven by spot buying. Since the US stock market is closed on Saturday, there is little volatility; it all depends on the depth of the correction!

BTC

After the US market closed, the price rose and broke through the daily resistance at 9050. Currently, the chart shows consolidation at a high level, with a bearish e

The US stock market opened strongly for the new year, boosting market sentiment. Institutions like BlackRock continue to buy spot assets. Bitcoin spot ETF inflows reached $470 million, and altcoin spot inflows totaled $170 million. This rise is driven by spot buying. Since the US stock market is closed on Saturday, there is little volatility; it all depends on the depth of the correction!

BTC

After the US market closed, the price rose and broke through the daily resistance at 9050. Currently, the chart shows consolidation at a high level, with a bearish e

BTC-1,92%

- Reward

- 1

- Comment

- Repost

- Share

Flood Warning⚠️⚠️⚠️Reopen the Gate

Since the rebound is not sustained, continue to short at the top!

The current market is in a phase of oscillation and accumulation. The specific trend should be considered based on the actual volume of spot and futures. Overall, the bullish volume is insufficient to break through resistance, so a pullback is inevitable!

Today, the short position accurately caught the top again. Before the US market, it fell back as expected. Currently, Bitcoin has about 1500 points of space, and Ethereum has about 50 points. At present, the bearish momentum still exists. Supp

Since the rebound is not sustained, continue to short at the top!

The current market is in a phase of oscillation and accumulation. The specific trend should be considered based on the actual volume of spot and futures. Overall, the bullish volume is insufficient to break through resistance, so a pullback is inevitable!

Today, the short position accurately caught the top again. Before the US market, it fell back as expected. Currently, Bitcoin has about 1500 points of space, and Ethereum has about 50 points. At present, the bearish momentum still exists. Supp

BTC-1,92%

- Reward

- 2

- Comment

- Repost

- Share

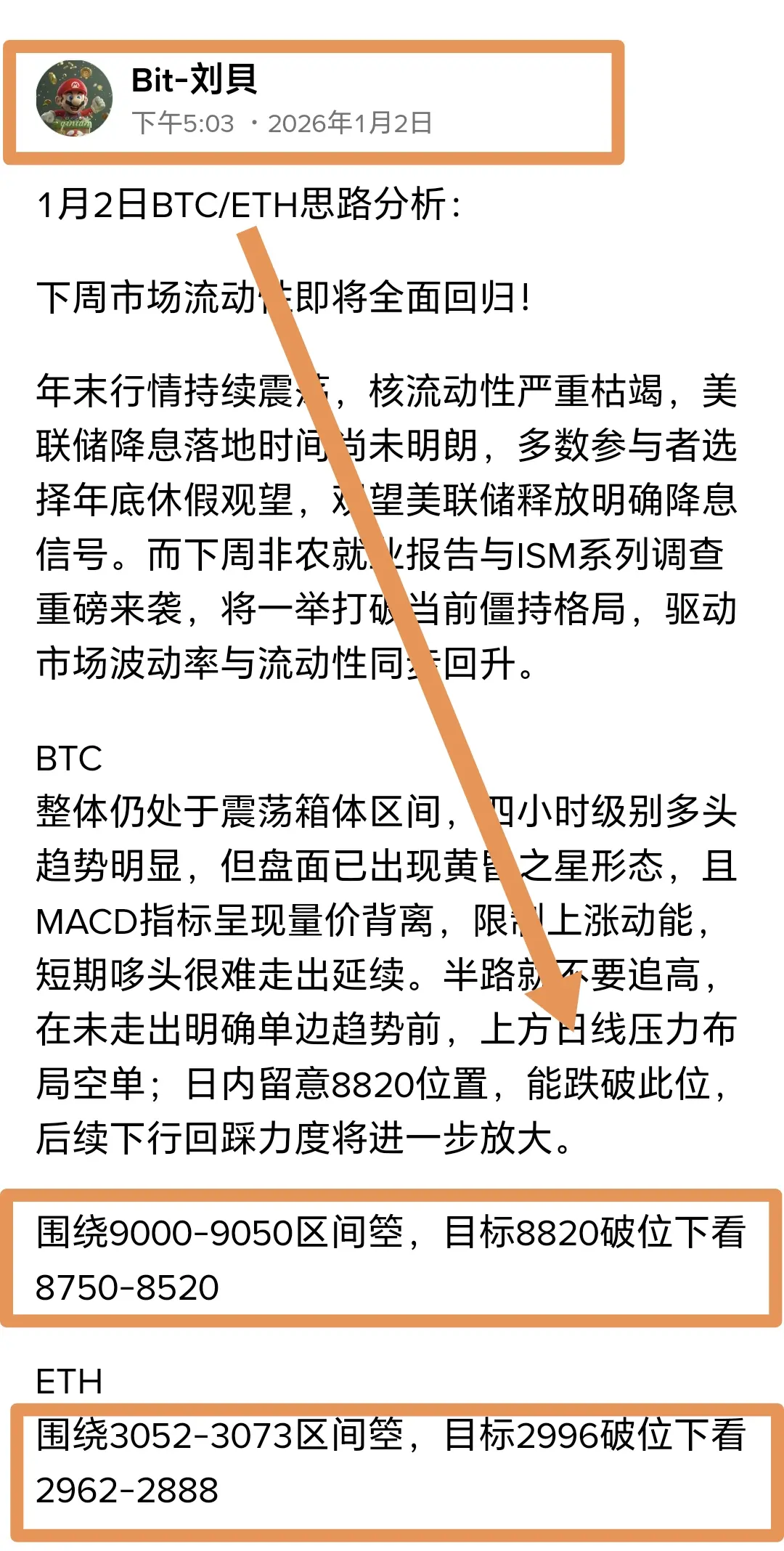

January 2nd BTC/ETH Analysis:

Next week, market liquidity is about to fully return!

The year-end market has been continuously volatile, with liquidity severely dried up. The Federal Reserve's rate cut timing remains uncertain, and most participants are choosing to take year-end vacations and wait, watching for clear signals of rate cuts from the Fed. Next week, the non-farm payroll report and ISM series surveys will be released, which will break the current stalemate and drive market volatility and liquidity to rise simultaneously.

BTC

Overall still in a consolidation range, with a clear bulli

View OriginalNext week, market liquidity is about to fully return!

The year-end market has been continuously volatile, with liquidity severely dried up. The Federal Reserve's rate cut timing remains uncertain, and most participants are choosing to take year-end vacations and wait, watching for clear signals of rate cuts from the Fed. Next week, the non-farm payroll report and ISM series surveys will be released, which will break the current stalemate and drive market volatility and liquidity to rise simultaneously.

BTC

Overall still in a consolidation range, with a clear bulli

- Reward

- 2

- Comment

- Repost

- Share

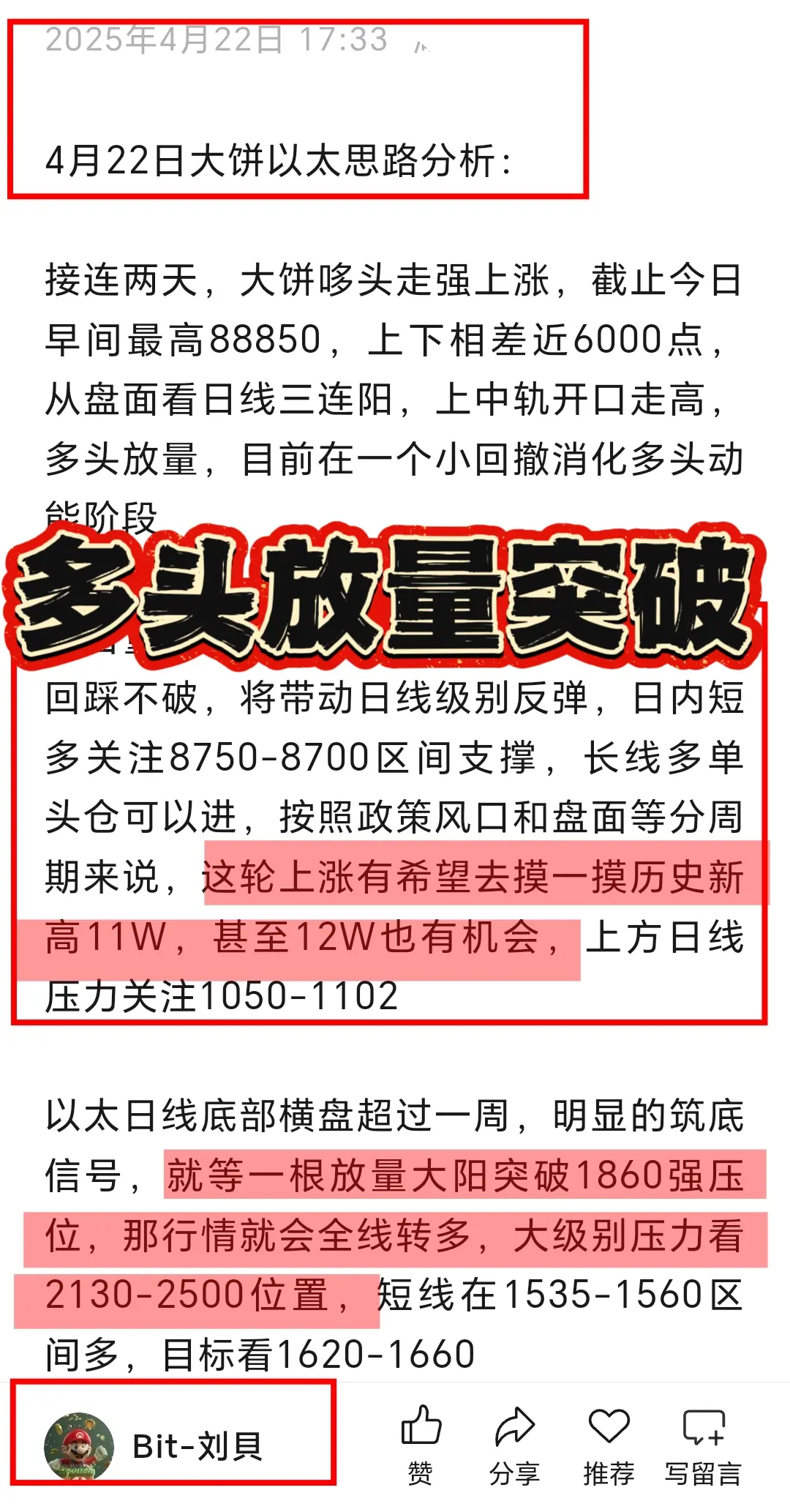

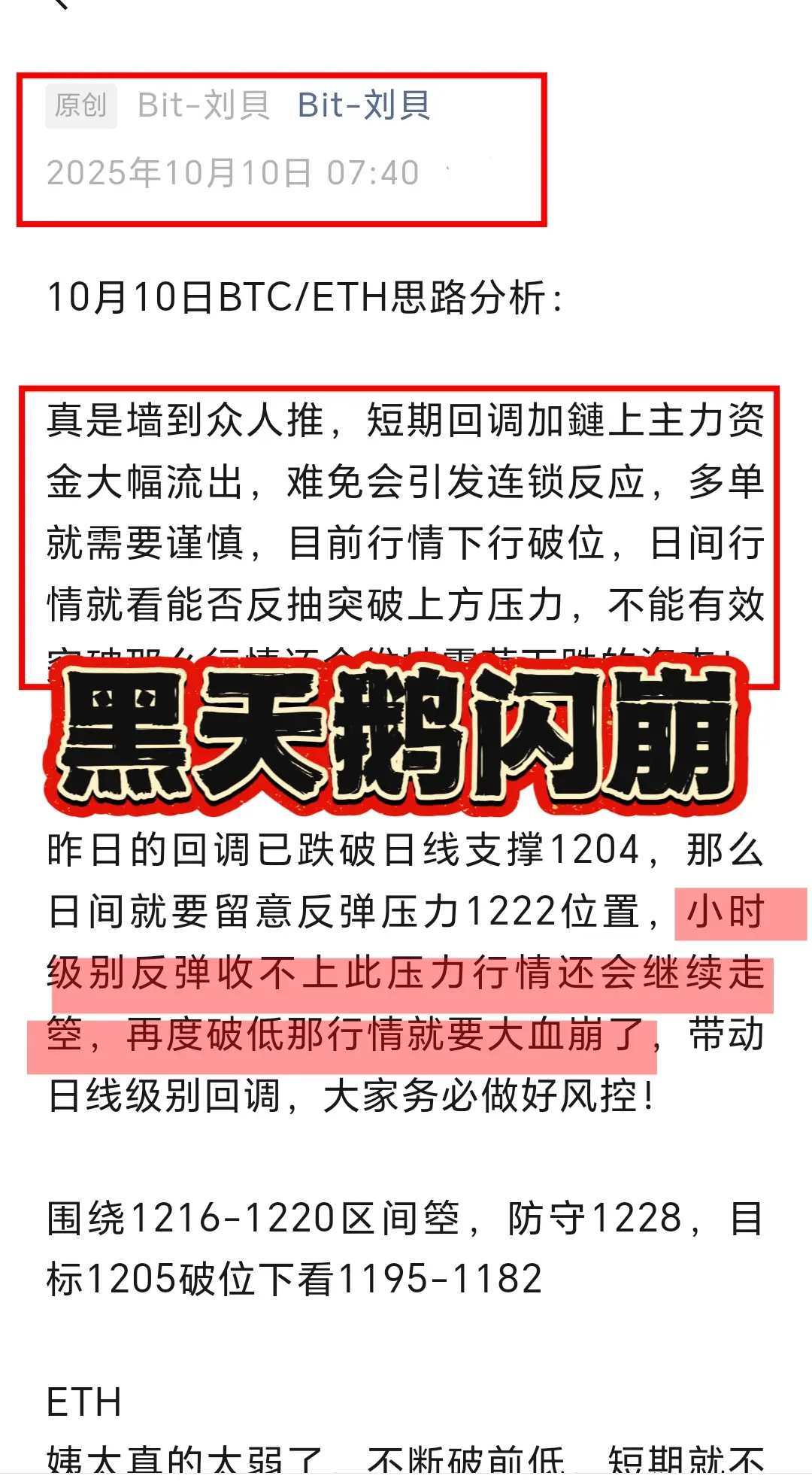

In the year of Yi Si 2025, like a snake slithering and lurking, accumulating strength amidst ups and downs.

In 2026, Bing Wu will arrive, like a warhorse raising its hooves, seeking breakthroughs amid sideways trading.

As the snake reaches the horse, let's stand firm at the last shift of 2025. During this transition from old to new, I wish everyone green on opening positions and quick profits!

The past year has seen volatile market movements, with key points predicted accurately in advance: on April 22, a long-term buy was positioned at the bottom, with a target reaching up to 126K; on Octob

In 2026, Bing Wu will arrive, like a warhorse raising its hooves, seeking breakthroughs amid sideways trading.

As the snake reaches the horse, let's stand firm at the last shift of 2025. During this transition from old to new, I wish everyone green on opening positions and quick profits!

The past year has seen volatile market movements, with key points predicted accurately in advance: on April 22, a long-term buy was positioned at the bottom, with a target reaching up to 126K; on Octob

BTC-1,92%

- Reward

- 2

- Comment

- Repost

- Share

December 31 BTC/ETH Analysis:

Year-end finale, the closing of the old year, this day marks the end of the past year and the beginning of a new chapter.

On the last day of 2025, last night's Federal Reserve meeting once again was a game of Tai Chi, failing to break the sideways pattern. On the contrary, major on-chain fund withdrawals surged, with 3,451 BTC continuously flowing out over 24 hours. The already weak market worsened further. As the monthly candle closes soon, everyone should protect their positions!

BTC

Currently, the short-term moving averages are entangled and flattening out. The

View OriginalYear-end finale, the closing of the old year, this day marks the end of the past year and the beginning of a new chapter.

On the last day of 2025, last night's Federal Reserve meeting once again was a game of Tai Chi, failing to break the sideways pattern. On the contrary, major on-chain fund withdrawals surged, with 3,451 BTC continuously flowing out over 24 hours. The already weak market worsened further. As the monthly candle closes soon, everyone should protect their positions!

BTC

Currently, the short-term moving averages are entangled and flattening out. The

- Reward

- 1

- Comment

- Repost

- Share

Federal Reserve Meeting Minutes Released with Three Points

In December, there were three dissenting votes on the rate cut, making the market trend even more unpredictable. Hold your positions and wait for the meeting announcement, and ensure proper protection to avoid being swept out!

From the chart perspective, it remains a consolidation range with oscillations between bulls and bears, shaking out traders. With just over twenty hours left in the year, the monthly candle is about to close. Bitcoin's rebound has not broken the previous high of the last gate, and the four-hour candle closing wit

In December, there were three dissenting votes on the rate cut, making the market trend even more unpredictable. Hold your positions and wait for the meeting announcement, and ensure proper protection to avoid being swept out!

From the chart perspective, it remains a consolidation range with oscillations between bulls and bears, shaking out traders. With just over twenty hours left in the year, the monthly candle is about to close. Bitcoin's rebound has not broken the previous high of the last gate, and the four-hour candle closing wit

BTC-1,92%

- Reward

- like

- Comment

- Repost

- Share

December 30th BTC/ETH Analysis:

The Federal Reserve added another 16 billion in liquidity to the crypto market this morning, which is a replenishment of liquidity through repurchase agreements via Bank of America, the second-largest liquidity injection post-pandemic. Do not mistake this for a sign of market recovery; this is not a buy signal. During the Christmas holiday season at year-end, institutional traders are on vacation, and trading volume is extremely thin. Only those in urgent need would consider quick-acting solutions!

BTC

Yesterday’s market movement was clear, with a rapid surge du

The Federal Reserve added another 16 billion in liquidity to the crypto market this morning, which is a replenishment of liquidity through repurchase agreements via Bank of America, the second-largest liquidity injection post-pandemic. Do not mistake this for a sign of market recovery; this is not a buy signal. During the Christmas holiday season at year-end, institutional traders are on vacation, and trading volume is extremely thin. Only those in urgent need would consider quick-acting solutions!

BTC

Yesterday’s market movement was clear, with a rapid surge du

BTC-1,92%

- Reward

- like

- Comment

- Repost

- Share

Rebound is just a rebound

Before the US market opens, a waterfall washout; in the early session, a small-scale rebound transition allows the bulls to see hope. A rally does not mean a real rise; it's a false appearance of chasing gains!

The large-scale bearish trend remains unchanged. Once again, the market returns to the starting point, exactly as expected. The long-term cycle is weak, with wide-range oscillations and accumulation. The same old advice: be cautious with rebounds. Without clear bullish signals, expect long-term decline and short-term gains!

Today, the short positions have alrea

Before the US market opens, a waterfall washout; in the early session, a small-scale rebound transition allows the bulls to see hope. A rally does not mean a real rise; it's a false appearance of chasing gains!

The large-scale bearish trend remains unchanged. Once again, the market returns to the starting point, exactly as expected. The long-term cycle is weak, with wide-range oscillations and accumulation. The same old advice: be cautious with rebounds. Without clear bullish signals, expect long-term decline and short-term gains!

Today, the short positions have alrea

BTC-1,92%

- Reward

- like

- Comment

- Repost

- Share

The decline is incredibly smooth

Bitcoin at 8900 and Ethereum at 3000 easily break below

The surge with no volume comes from nowhere and will return to the starting point. Did you hold your short positions during lunchtime? Bitcoin at 2000 and Ethereum at 100 are easily within reach!

Trading requires a complete system. Don't chase highs or sell lows. The wrong path won't lead to the destination. How can the wrong mindset expect the right results?$BTC

Bitcoin at 8900 and Ethereum at 3000 easily break below

The surge with no volume comes from nowhere and will return to the starting point. Did you hold your short positions during lunchtime? Bitcoin at 2000 and Ethereum at 100 are easily within reach!

Trading requires a complete system. Don't chase highs or sell lows. The wrong path won't lead to the destination. How can the wrong mindset expect the right results?$BTC

BTC-1,92%

- Reward

- 2

- Comment

- Repost

- Share

Buy more after a slight rebound?

Bullish attempts to push higher without breaking through and then pulling back is the true pattern!

Fasten your seatbelt, there is still room below. This rhythm is very familiar—Asian session pushes higher, European session oscillates, and then it crashes down again during the US session!$BTC

Bullish attempts to push higher without breaking through and then pulling back is the true pattern!

Fasten your seatbelt, there is still room below. This rhythm is very familiar—Asian session pushes higher, European session oscillates, and then it crashes down again during the US session!$BTC

BTC-1,92%

- Reward

- like

- Comment

- Repost

- Share

December 29 BTC/ETH Strategy Analysis:

The Asian market surged, is the opportunity for a short squeeze coming?

Actually, the current market is similar to the 2022 bear market, with a 30% plunge followed by consolidation and accumulation. It will likely form a rally pattern, then turn downward to clear out the short positions. The belief in going long is based on the Fed cutting interest rates. Whether they cut or not is uncertain, but a rate cut would cause a rise and also shake out the short-term bearish positions. At least, there will be one before the January 27 FOMC meeting!

BTC

The early

The Asian market surged, is the opportunity for a short squeeze coming?

Actually, the current market is similar to the 2022 bear market, with a 30% plunge followed by consolidation and accumulation. It will likely form a rally pattern, then turn downward to clear out the short positions. The belief in going long is based on the Fed cutting interest rates. Whether they cut or not is uncertain, but a rate cut would cause a rise and also shake out the short-term bearish positions. At least, there will be one before the January 27 FOMC meeting!

BTC

The early

BTC-1,92%

- Reward

- like

- Comment

- Repost

- Share

December 26 BTC/ETH Analysis:

Calm before the storm!

Just at 16:00, the world's largest options expiration took place, valued at approximately $23.7 billion. Based on previous expiration trends, significant volatility often follows, with the market moving in a single direction, likely ending over a month of wide-range consolidation!

BTC

Still within a consolidation range, with moving averages showing a golden cross and bullish engulfing candlesticks. Smaller timeframes show rebound demand, but without volume support, the upward move won't go too high. Currently treating it as sideways, with a

Calm before the storm!

Just at 16:00, the world's largest options expiration took place, valued at approximately $23.7 billion. Based on previous expiration trends, significant volatility often follows, with the market moving in a single direction, likely ending over a month of wide-range consolidation!

BTC

Still within a consolidation range, with moving averages showing a golden cross and bullish engulfing candlesticks. Smaller timeframes show rebound demand, but without volume support, the upward move won't go too high. Currently treating it as sideways, with a

BTC-1,92%

- Reward

- like

- Comment

- Repost

- Share

Today is Christmas Eve. Although we don't celebrate this holiday, foreigners are celebrating the New Year. The trend is similar to my previous forecast with no significant fluctuations, showing a slow consolidation pattern. The peak at 90500 is still held, and yesterday's suggestion to buy above 8830 was successful. Just keep watching!

BTC

Currently, the price has broken below the annual moving average. The market has fallen back from the middle of the daily line at 90500 under pressure. The small-scale rebound is very weak. This trend is likely to test the strong support at 8500. The intraday

BTC

Currently, the price has broken below the annual moving average. The market has fallen back from the middle of the daily line at 90500 under pressure. The small-scale rebound is very weak. This trend is likely to test the strong support at 8500. The intraday

BTC-1,92%

- Reward

- 1

- Comment

- Repost

- Share

The market at the end of the year is really boring🥱

The overall trend is a震荡箱体 structure, with liquidity continuously tightening. Without any stimulus from news, it won't break out into a large trend. Brothers, don't be too rigid when trading; if you need to exit, just do it. Giving back profits is not worth it!

BTC

Last night, I opened a short position at 90500 on the peak, which dropped to the 8700 level at its lowest. It has already broken the four-hour support level, and the rebound strength during the day is relatively weak. The pressure for a small-level rebound is around 8830,

The overall trend is a震荡箱体 structure, with liquidity continuously tightening. Without any stimulus from news, it won't break out into a large trend. Brothers, don't be too rigid when trading; if you need to exit, just do it. Giving back profits is not worth it!

BTC

Last night, I opened a short position at 90500 on the peak, which dropped to the 8700 level at its lowest. It has already broken the four-hour support level, and the rebound strength during the day is relatively weak. The pressure for a small-level rebound is around 8830,

BTC-1,92%

- Reward

- 1

- 4

- Repost

- Share

BitLiuBei :

:

Just go for it💪View More

December 23 BTC/ETH Analysis:

The dual collision of the Christmas holiday and options expiration!

The overall trend is still relatively weak at the moment. The increase in liquidity from yesterday's Federal Reserve repurchase agreement was also limited. The highest rebound for BTC was 90500 before retreating, which is also the position we were anticipating. In the last 24 hours, there was a liquidation of 160 million in the market, and overnight, the open positions for BTC decreased by 3 billion and for ETH by 2 billion, indicating a renewed liquidity crisis. The market is maintaining a wa

View OriginalThe dual collision of the Christmas holiday and options expiration!

The overall trend is still relatively weak at the moment. The increase in liquidity from yesterday's Federal Reserve repurchase agreement was also limited. The highest rebound for BTC was 90500 before retreating, which is also the position we were anticipating. In the last 24 hours, there was a liquidation of 160 million in the market, and overnight, the open positions for BTC decreased by 3 billion and for ETH by 2 billion, indicating a renewed liquidity crisis. The market is maintaining a wa

- Reward

- like

- Comment

- Repost

- Share