Defioasis

No content yet

defioasis

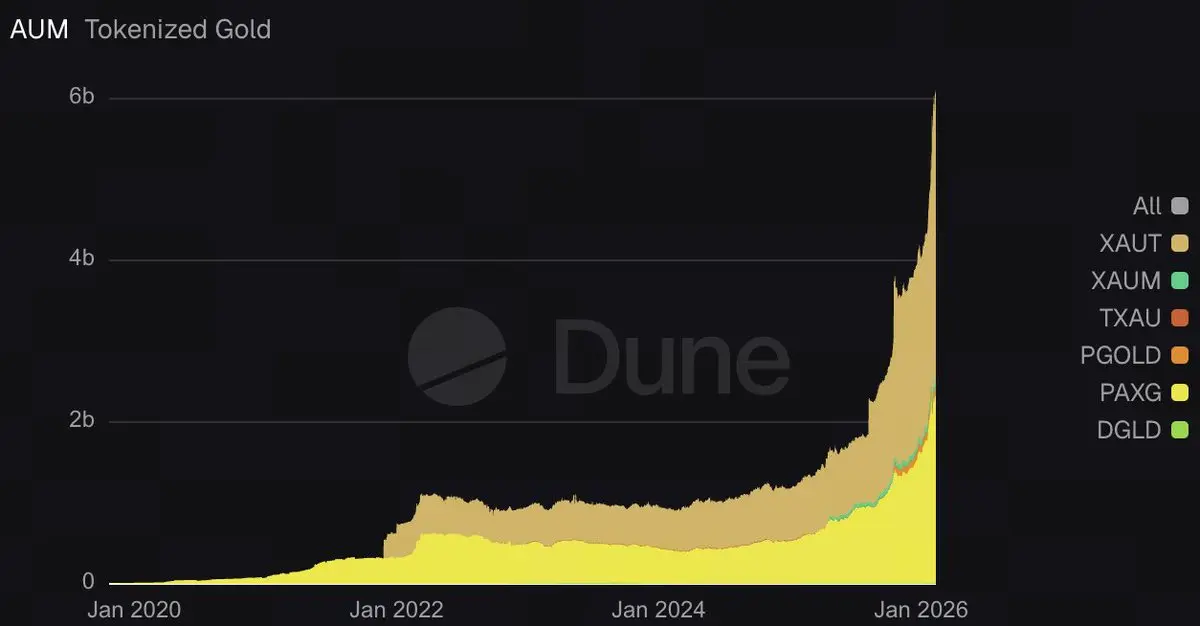

Unknowingly, the total market capitalization of tokenized gold has reached $6 billion, locking in over 1.2 million ounces of gold, with rapid growth.

Among them, XAUT and PAXG together account for over 95% of the tokenized gold market share, and are also part of the index components for some CEX's XAU perpetual contracts.

View OriginalAmong them, XAUT and PAXG together account for over 95% of the tokenized gold market share, and are also part of the index components for some CEX's XAU perpetual contracts.

- Reward

- like

- 1

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

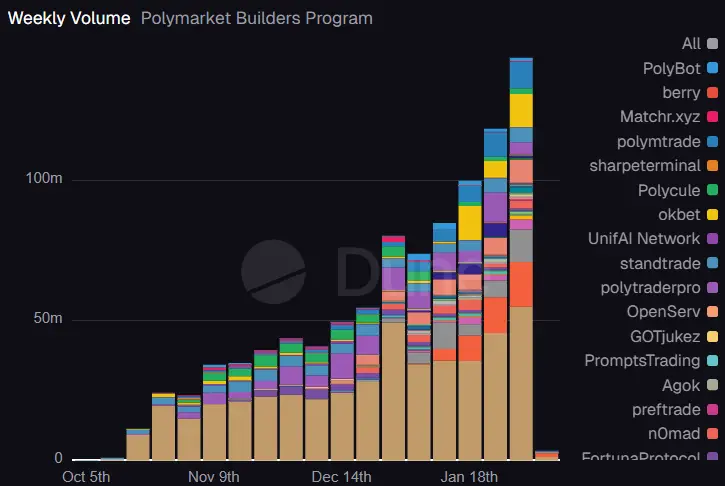

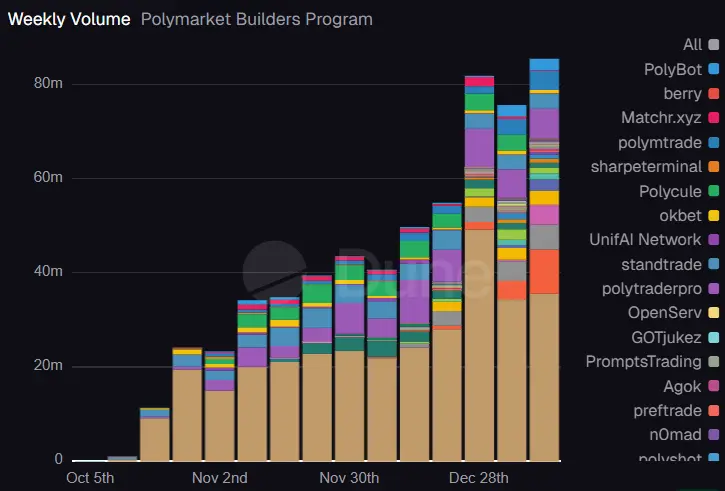

Thank you for sharing the information; it was very inspiring to me🤩Polymarket Builders have achieved four consecutive weeks of record-high trading volume. Last week’s trading volume reached $144 million, nearly doubling the weekly volume from January. Four Builders had weekly trading volumes exceeding $10 million, namely betmoar, Chance, okbet, and PolyCop. Among them, betmoar set a new weekly high of $55 million, while Chance has ranked second for two consecutive weeks.

View Original

- Reward

- like

- 1

- 1

- Share

GateUser-3030c9aa :

:

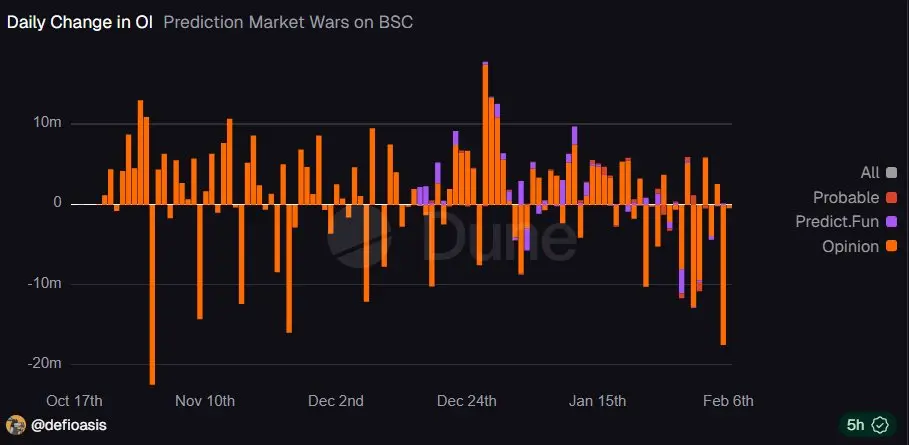

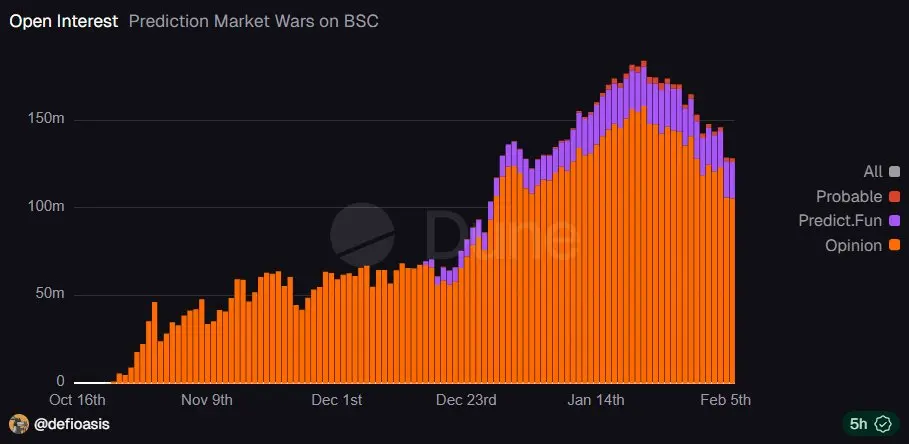

Polymarket Builders have achieved four consecutive weeks of record-high trading volume. The past week’s trading volume reached $144 million, nearly doubling the single-week trading volume from January. Four Builders had weekly trading volumes exceeding $10 million, namely betmoar, Chance, okbet, and PolyCop. Among them, betmoar set a new weekly trading volume high of $55 million, while Chance has ranked second for two consecutive weeks.Opinion Yesterday, nearly $17.5 million in funds flowed out of positions, the second-highest in history. Since reaching a peak of over $150 million on January 22, Opinion's holdings have declined by nearly $50 million, returning to around the $100 million mark. The overall market environment is too poor; is everyone withdrawing to add margin? 🥹 I wonder how the market will value the upcoming BSC's first prediction market token issuance in such a terrible market condition.

View Original

- Reward

- like

- Comment

- Repost

- Share

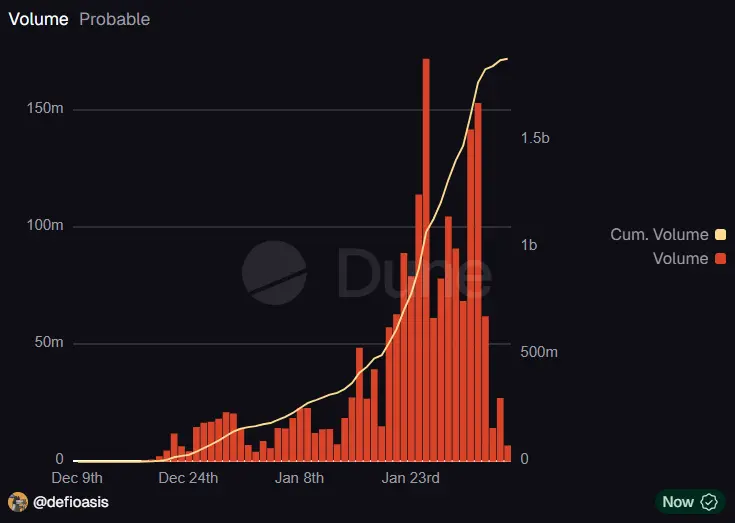

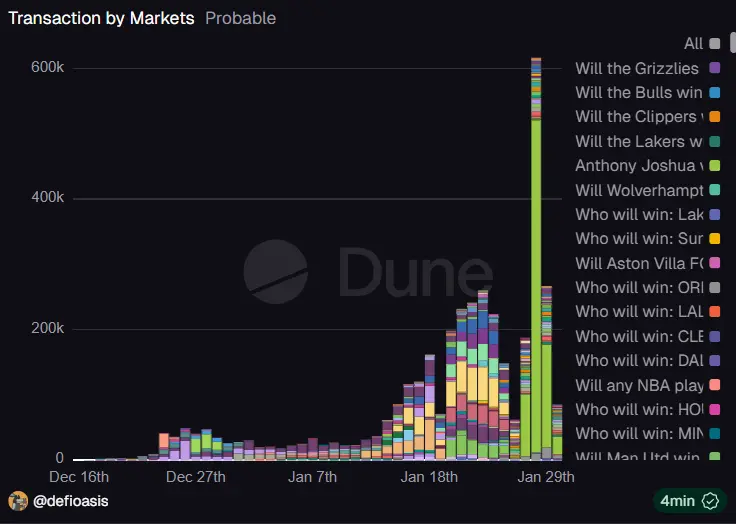

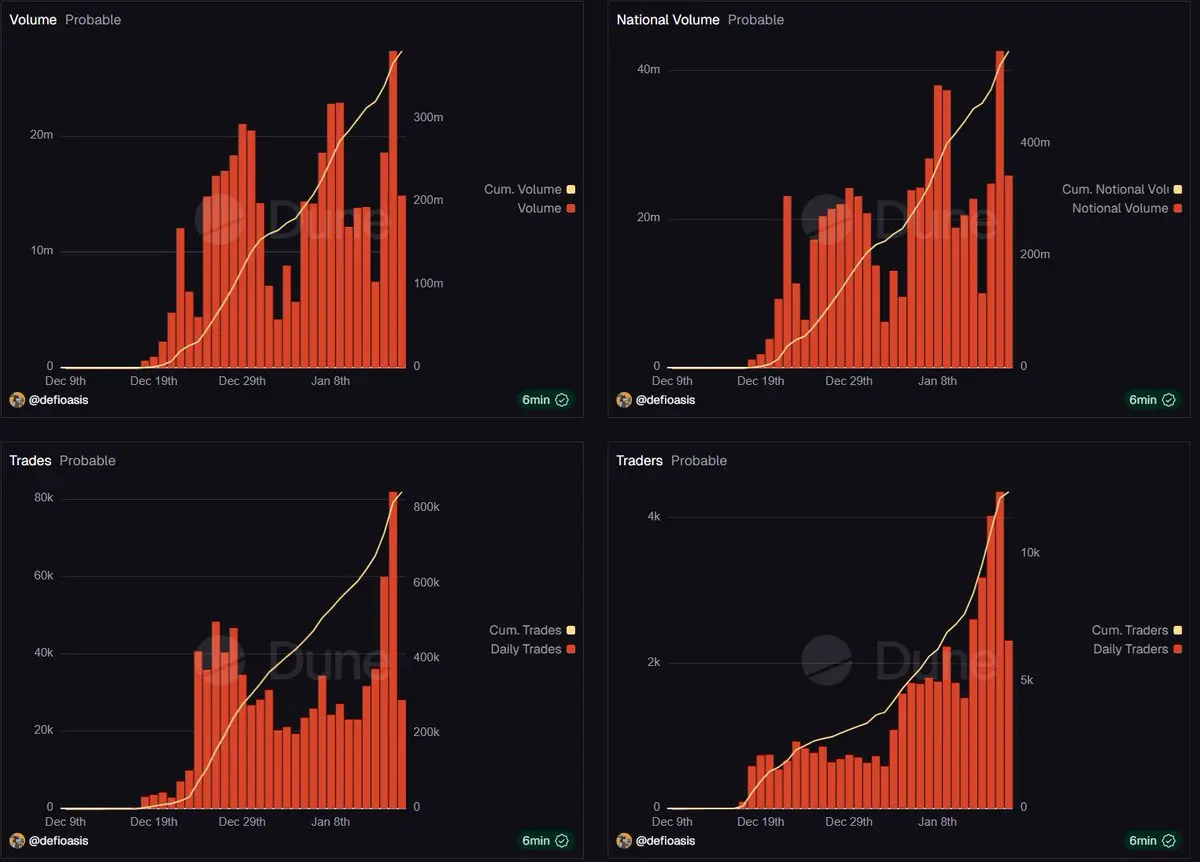

In the past two days since the launch, Probable's daily trading volume has plummeted from over $150 million to less than $30 million, and on February 3rd, it even dropped below $15 million. The main reason is that they started charging Takers, and many users may no longer want to trade. Without zero fees, there’s no real advantage over the other two competing platforms.

View Original

- Reward

- like

- Comment

- Repost

- Share

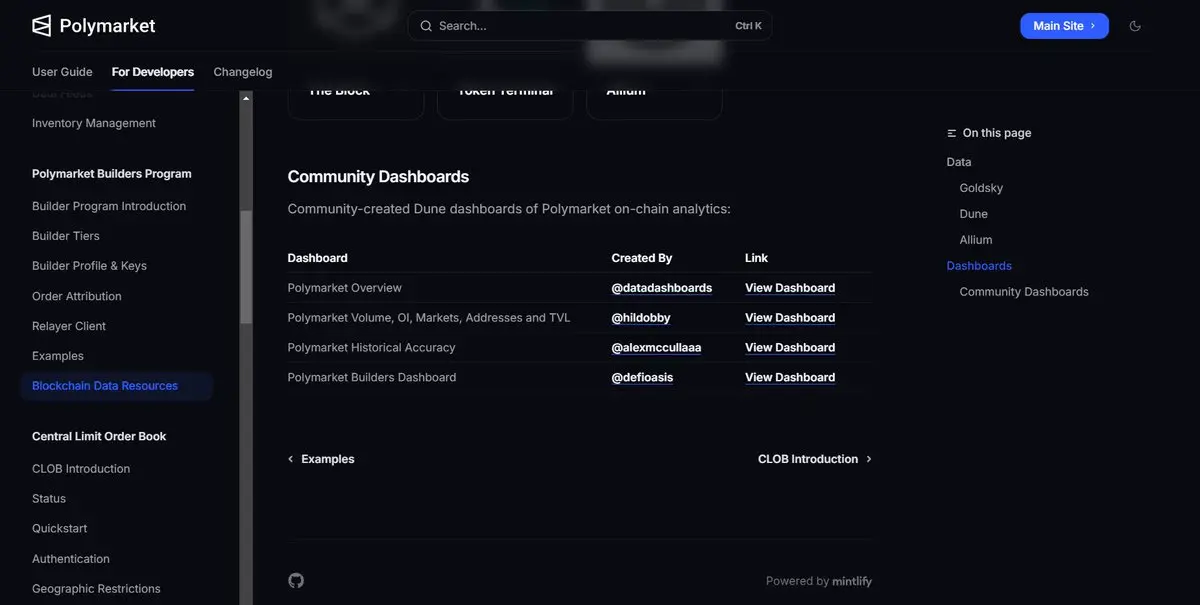

Honored to be featured in the Polymarket official documentation for the Community Dashboards permanent display🫡 I have always believed that Polymarket and prediction markets are the biggest opportunities for Crypto Native projects. In the future, I will continue to focus on on-chain data and the prediction market track by building some Polymarket and prediction market data dashboards on Dune: - Polymarket Traders PnL Distribution (currently restructuring PnL rules): - BSC Prediction Market War: - Polymarket Builders Tracking: - Prediction Market Protocol Overview: - Viewing Prediction Markets

View Original

- Reward

- like

- Comment

- Repost

- Share

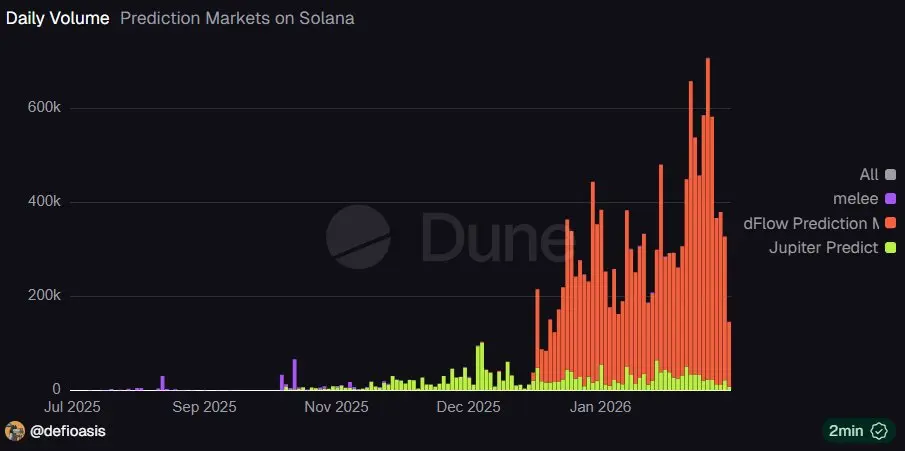

It seems that Solana really needs a reliable native prediction market. The two major aggregators are competing to bring Kalshi and Polymarket onto Solana—Jupiter has been integrating Kalshi since October last year by launching the Predict frontend, and recently promoted Polymarket to log in to Solana. dFlow provides Predict API services for Kalshi on the chain, with wallets like Phantom using the dFlow API to integrate Kalshi. Because there is no native prediction market, Solana's two major aggregators can only introduce external protocols through frontend aggregation or backend Tokenization A

View Original

- Reward

- like

- Comment

- Repost

- Share

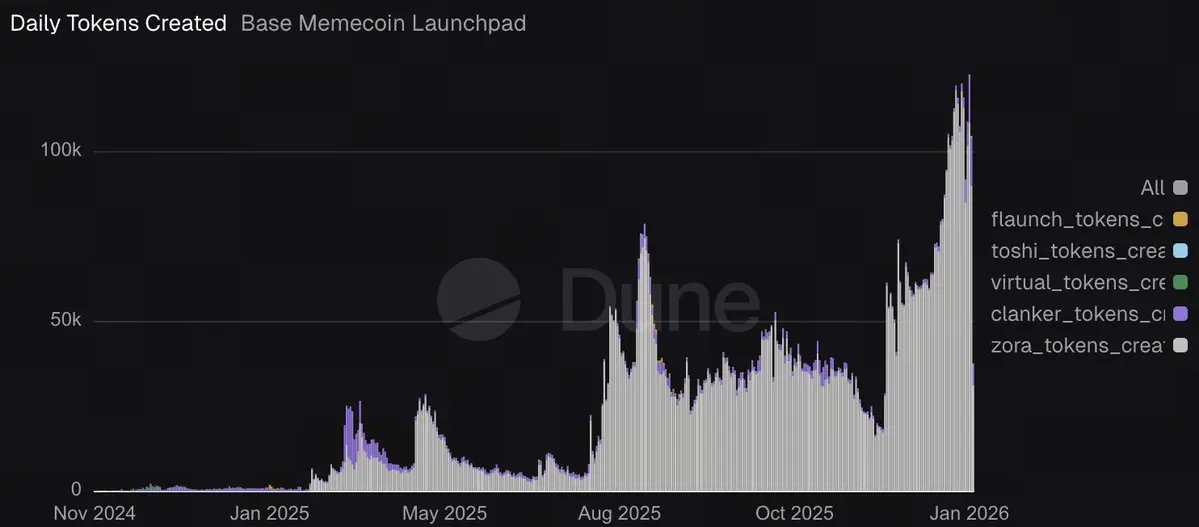

Unnoticed, the daily token creation on the Base network has skyrocketed to over 100,000, with a peak of over 120,000. Leveraging the rapidly growing large AI Agents community on moltbook, Clawnch has issued tokens to tens of thousands of Agents in the past few days, and Clawnch is backed by Clanker. Additionally, after the full launch of the Base app, the daily number of posts using Zora Coins has gradually surged to over 100,000, which to some extent also reflects the activity level of the Base app. No wonder the Launchpad-as-Service protocol Doppler behind Zora Coins recently took the opport

ZORA-2,78%

- Reward

- 1

- Comment

- Repost

- Share

Probable's average trading volume over the past 7 days once surpassed Opinion. However, despite its relatively low open interest, it experienced a 50% drop, falling from $4 million OI last weekend to below $2 million. Notably, the event 'Will Justin Bieber perform at the Super Bowl halftime show' became a major hotspot for Probable trading volume, with over 500,000 transactions recorded the day before, yet completed by fewer than 300 trading addresses...

View Original

- Reward

- 1

- Comment

- Repost

- Share

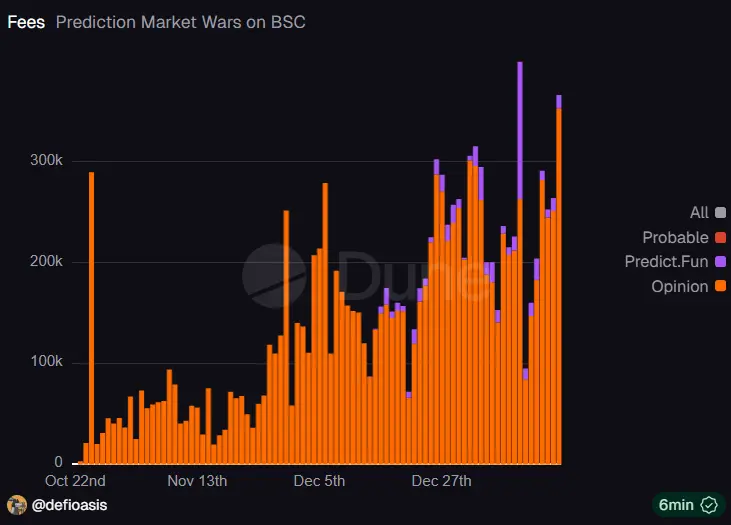

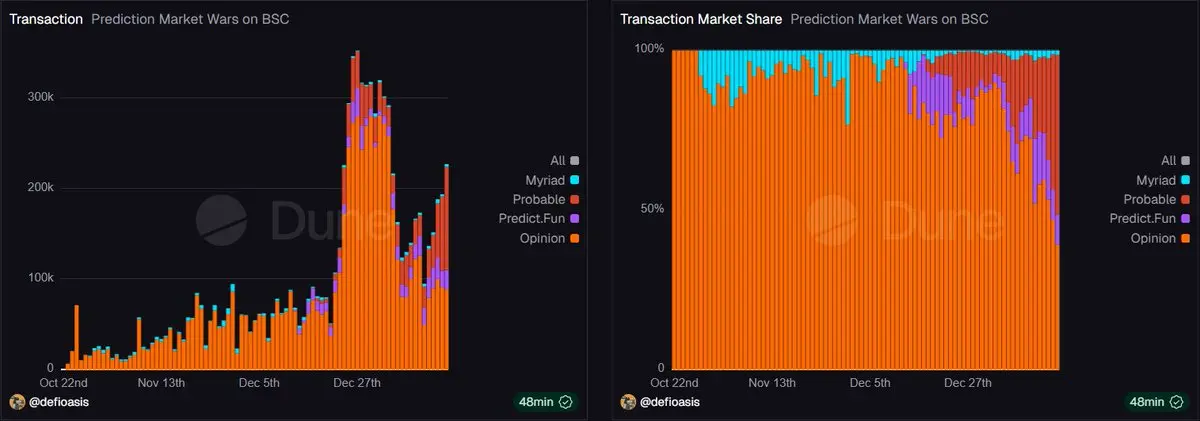

Predict Fun's trading volume and market share both reach new highs

Single-day trading volume exceeds $34 million, with BSC prediction market market share surpassing 25% for the first time

Top three events by trading volume in the past 24 hours:

- Will the Federal Reserve adjust interest rates in January?

- Will Other teams win the 2026 Super Bowl?

- Will Juventus win the UEFA Champions League in the 2025–26 season?

Top three events by liquidity:

- Will NVIDIA become the world's largest company by market capitalization before January 31?

- Will Opinion launch a token before December 31?

- Will

View OriginalSingle-day trading volume exceeds $34 million, with BSC prediction market market share surpassing 25% for the first time

Top three events by trading volume in the past 24 hours:

- Will the Federal Reserve adjust interest rates in January?

- Will Other teams win the 2026 Super Bowl?

- Will Juventus win the UEFA Champions League in the 2025–26 season?

Top three events by liquidity:

- Will NVIDIA become the world's largest company by market capitalization before January 31?

- Will Opinion launch a token before December 31?

- Will

- Reward

- like

- Comment

- Repost

- Share

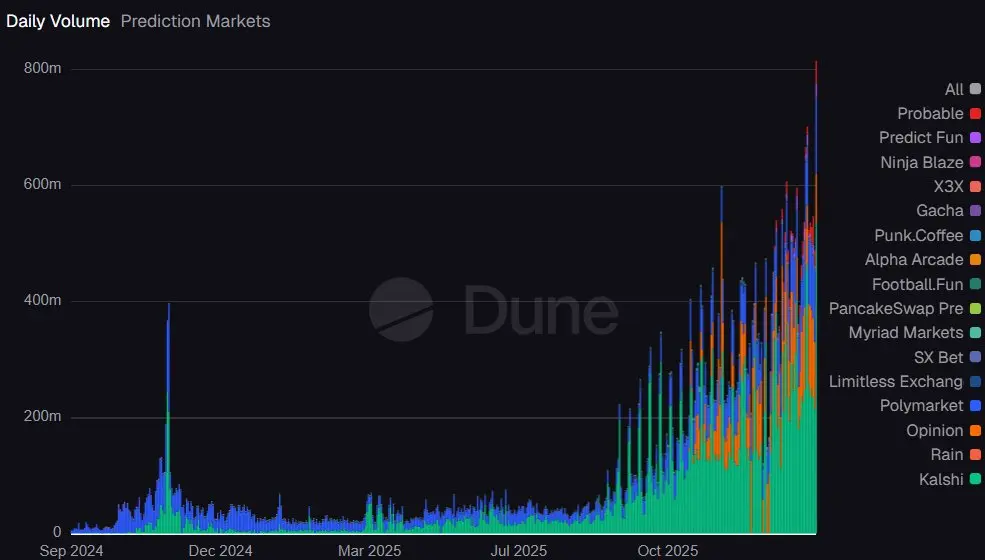

The prediction market's single-day trading volume has exceeded 800 million USD for the first time in history

Among them, Kalshi accounts for over 500 million USD, proving that trading volume skyrockets whenever there are sports games on the weekend

A single-day trading volume of over 1 billion USD in prediction markets is no longer a distant dream

View OriginalAmong them, Kalshi accounts for over 500 million USD, proving that trading volume skyrockets whenever there are sports games on the weekend

A single-day trading volume of over 1 billion USD in prediction markets is no longer a distant dream

- Reward

- like

- Comment

- Repost

- Share

Polymarket Builders weekly trading volume exceeds $85 million, reaching a new high after two weeks

betmoar continues to hold a dominant position, but as the number of Builders increases, the weekly market share drops to slightly above 40%

The stolen Polycule has fallen, while another platform focused on Copy Trading, PolyCop, rapidly rises to fill its position, with weekly trading volume surpassing $9.3 million, accounting for 11% of the market share

It is worth noting that the total number of Polymarket Builders has exceeded 100

View Originalbetmoar continues to hold a dominant position, but as the number of Builders increases, the weekly market share drops to slightly above 40%

The stolen Polycule has fallen, while another platform focused on Copy Trading, PolyCop, rapidly rises to fill its position, with weekly trading volume surpassing $9.3 million, accounting for 11% of the market share

It is worth noting that the total number of Polymarket Builders has exceeded 100

- Reward

- like

- Comment

- Repost

- Share

Opinion A day with record-high fees, reaching $353,600, with total revenue reaching $11.8 million.

Fun fact, on that day, Opinion's fees involved both Ethereum and BNB Chain. On the same day, Ethereum fees were 64.97 ETH (approximately $216,300), and BNB Chain fees were 453.98 BNB (approximately $430,000).

Currently, Polymarket, Predict Fun, and Probable have raised their valuation predictions for Opinion TGE's $1 billion tier to 72%-74%, while Aspecta's pre-market Opinion Key latest trading valuation is around $1.1 billion.

View OriginalFun fact, on that day, Opinion's fees involved both Ethereum and BNB Chain. On the same day, Ethereum fees were 64.97 ETH (approximately $216,300), and BNB Chain fees were 453.98 BNB (approximately $430,000).

Currently, Polymarket, Predict Fun, and Probable have raised their valuation predictions for Opinion TGE's $1 billion tier to 72%-74%, while Aspecta's pre-market Opinion Key latest trading valuation is around $1.1 billion.

- Reward

- like

- Comment

- Repost

- Share

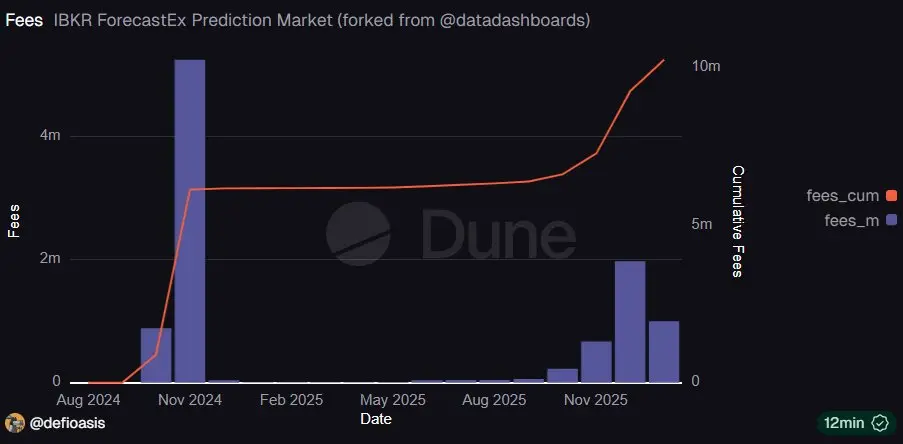

Possibly stimulated by the high growth of Kalshi, the predictive market ForecastEx under Interactive Brokers (IBKR) has also seen a gradual increase in trading volume over the past few months.

IBKR ForecastEx reached a trading volume of $199 million in December last year, and this month’s trading volume has also exceeded $100 million, but it still has a considerable gap from the election month in 2024.

Similarly, during the 2024 election month, the open interest peaked at over $300 million, even surpassing Polymarket and Kalshi at one point, but currently only about $4 million.

Since August 20

View OriginalIBKR ForecastEx reached a trading volume of $199 million in December last year, and this month’s trading volume has also exceeded $100 million, but it still has a considerable gap from the election month in 2024.

Similarly, during the 2024 election month, the open interest peaked at over $300 million, even surpassing Polymarket and Kalshi at one point, but currently only about $4 million.

Since August 20

- Reward

- like

- Comment

- Repost

- Share

Apart from Opinion, funds are already opening Probable

- The single-day trading volume is the most exaggerated, surpassing Opinion and accounting for slightly over 50% of the BSC prediction market share

- Daily trading volume soared to over $48 million, occupying 22% of the BSC prediction market share

- The number of daily independent traders has reached a new high for 5 consecutive days, approaching 5,000, accounting for 18.6% of the BSC prediction market

- Two Question trades exceeded $10 million, namely: Will SOL fall to $80 before 2026.1.31, and will the Federal Reserve's interest rate re

View Original- The single-day trading volume is the most exaggerated, surpassing Opinion and accounting for slightly over 50% of the BSC prediction market share

- Daily trading volume soared to over $48 million, occupying 22% of the BSC prediction market share

- The number of daily independent traders has reached a new high for 5 consecutive days, approaching 5,000, accounting for 18.6% of the BSC prediction market

- Two Question trades exceeded $10 million, namely: Will SOL fall to $80 before 2026.1.31, and will the Federal Reserve's interest rate re

- Reward

- like

- 1

- Repost

- Share

GateUser-19076b9a :

:

Very good information, thank you for sharing. Happy New Year, may all your wishes come true.Probable a day with new highs in daily trading volume, trading users, and number of trades

Daily trading volume $27.43m

Daily unique trading users ~4.4k (not deduplicated by event: 9.28k person-times)

Daily number of trades exceeds 82,000

However, Probable's open interest is $1.63m, and the Vol/OI ratio is quite exaggerated. Even when calculated with a 7-day average Vol, the ratio still exceeds 11, whereas leading market players' Vol/OI ratios are all below 1.

View OriginalDaily trading volume $27.43m

Daily unique trading users ~4.4k (not deduplicated by event: 9.28k person-times)

Daily number of trades exceeds 82,000

However, Probable's open interest is $1.63m, and the Vol/OI ratio is quite exaggerated. Even when calculated with a 7-day average Vol, the ratio still exceeds 11, whereas leading market players' Vol/OI ratios are all below 1.

- Reward

- like

- Comment

- Repost

- Share

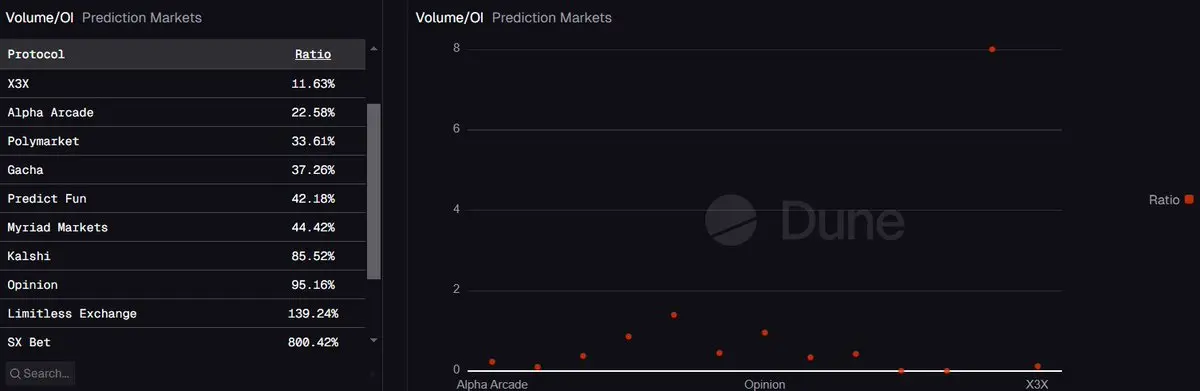

Based on the Volume/OI ratio, the predicted market generally stays below 1 and even lower, but Perp DEX can often exceed 10. If interacting with the market using the high-frequency opening and closing positions typical of Perp DEX, one might suffer significant losses and may not gain much profit.

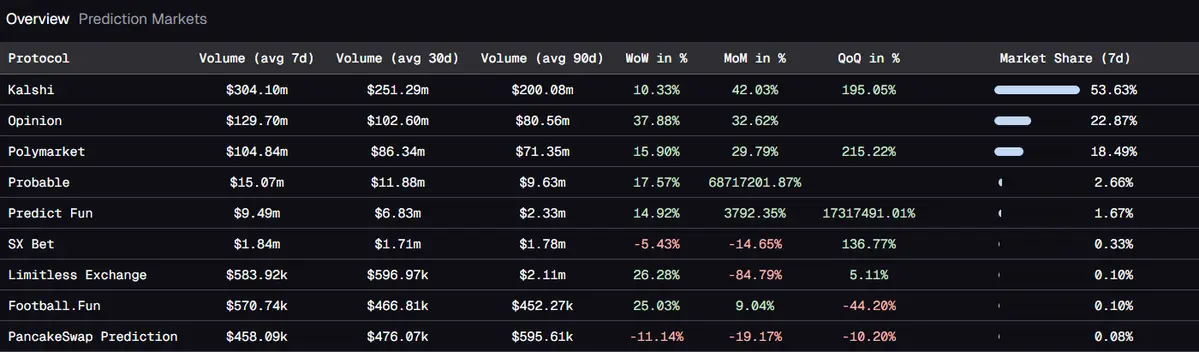

The Volume (Avg 7d)/OI ratios are as follows:

Opinion: 95.16%

Kalshi: 85.52%

Predict Fun: 42.18%

Polymarket: 33.61%

Opinion has the highest ratio, which I guess is because it is currently in the sprint before TGE. A notable indicator is that Opinion's weekly and monthly trading volume growth both exce

View OriginalThe Volume (Avg 7d)/OI ratios are as follows:

Opinion: 95.16%

Kalshi: 85.52%

Predict Fun: 42.18%

Polymarket: 33.61%

Opinion has the highest ratio, which I guess is because it is currently in the sprint before TGE. A notable indicator is that Opinion's weekly and monthly trading volume growth both exce

- Reward

- like

- Comment

- Repost

- Share

The Real Business Battle

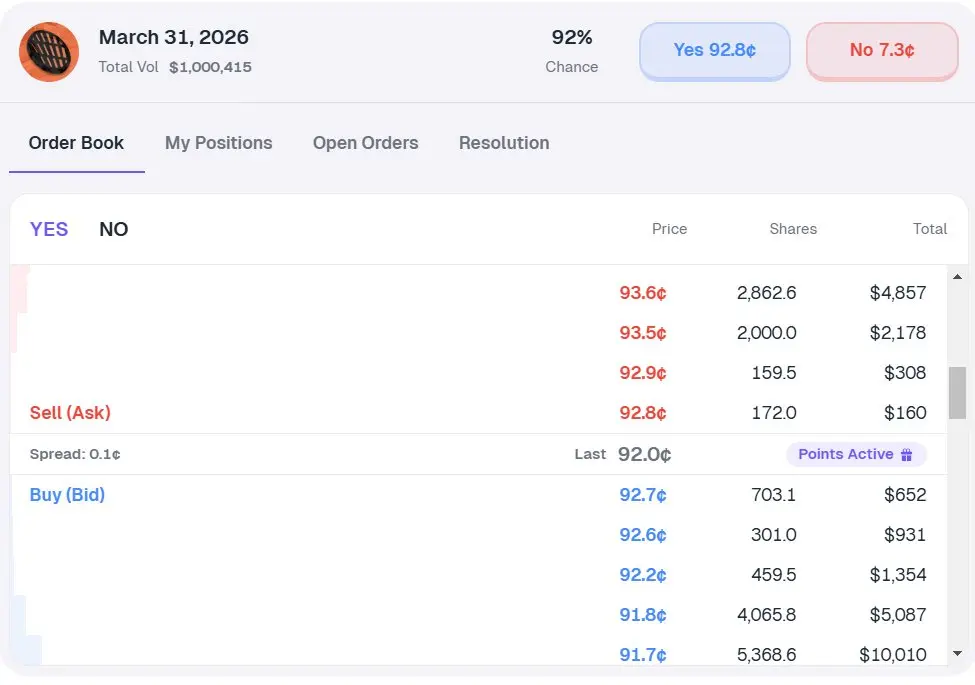

Predict Fun's liquidity is widely distributed across token TGE timing and valuation prediction events for competitors Opinion and Kalshi.

Additionally, it is worth mentioning that on Predict Fun, the probability of Opinion TGE before March 31 has reached 92.7%.

A major user named riandro on Predict Fun has bet a total of approximately $665,000 on four Opinion TGE time slots before 3.31/6.30/9.30/12.30, all in YES.

View OriginalPredict Fun's liquidity is widely distributed across token TGE timing and valuation prediction events for competitors Opinion and Kalshi.

Additionally, it is worth mentioning that on Predict Fun, the probability of Opinion TGE before March 31 has reached 92.7%.

A major user named riandro on Predict Fun has bet a total of approximately $665,000 on four Opinion TGE time slots before 3.31/6.30/9.30/12.30, all in YES.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More35.65K Popularity

69.52K Popularity

15.45K Popularity

41.82K Popularity

251.57K Popularity

Pin