Yiyun_dan1

No content yet

Yiyun_dan1

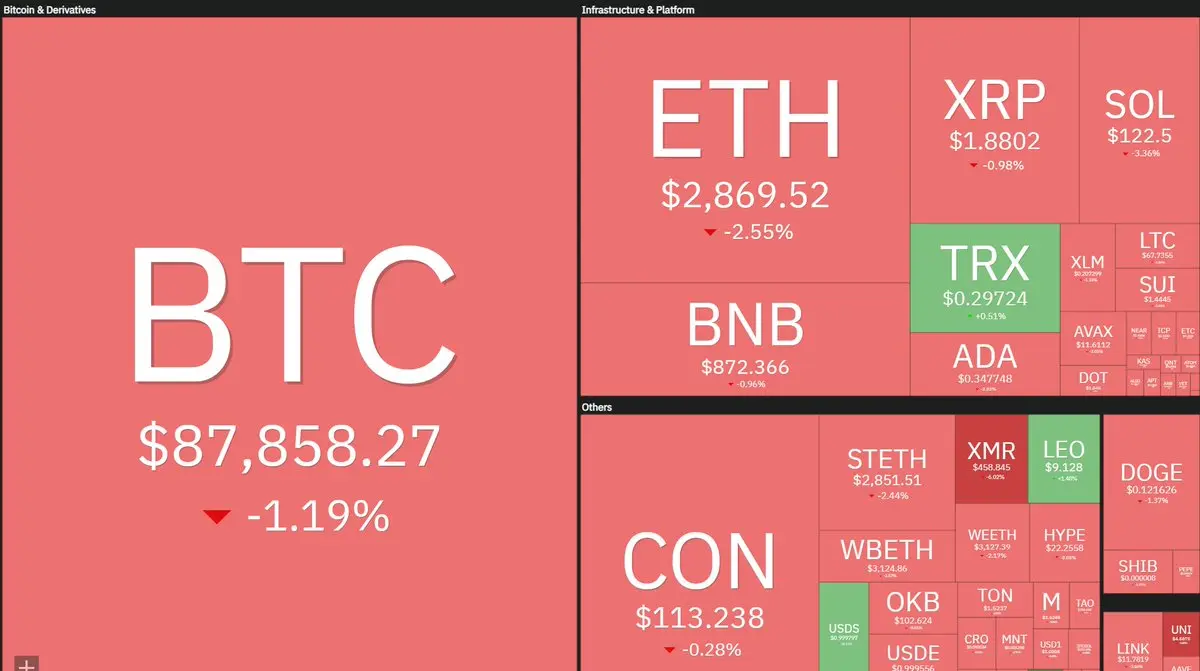

Within 24 hours, 136,000 people experienced liquidations, with $459 million in leverage wiped out, accompanied by a 50% drop in trading volume and extreme panic. The crypto market is entering a "killing moment" of liquidity exhaustion.

View Original

- Reward

- 2

- Comment

- Repost

- Share

Don't exhaust your strength for tomorrow in the middle of the night, and don't doubt the logic of spring in the cold winter. Acknowledge that the present is difficult, which is honesty; but maintaining the rhythm even when it's hard is a form of heroism.

View Original- Reward

- like

- Comment

- Repost

- Share

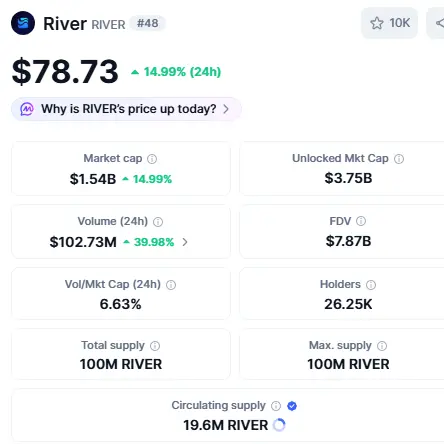

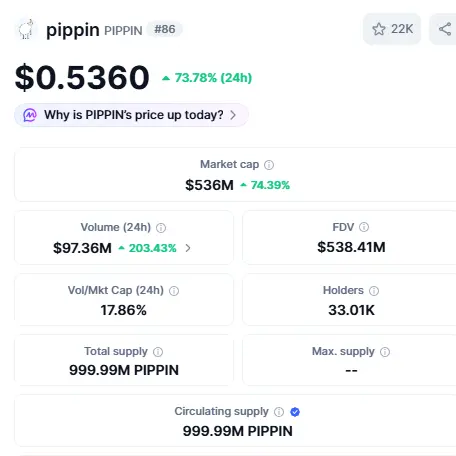

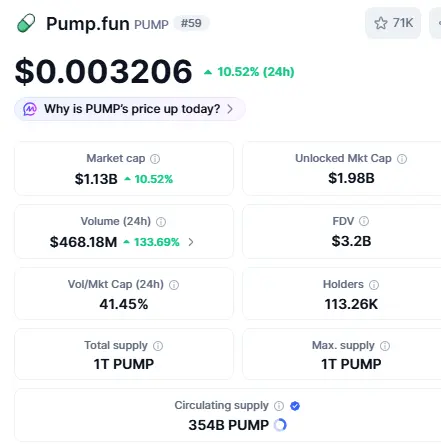

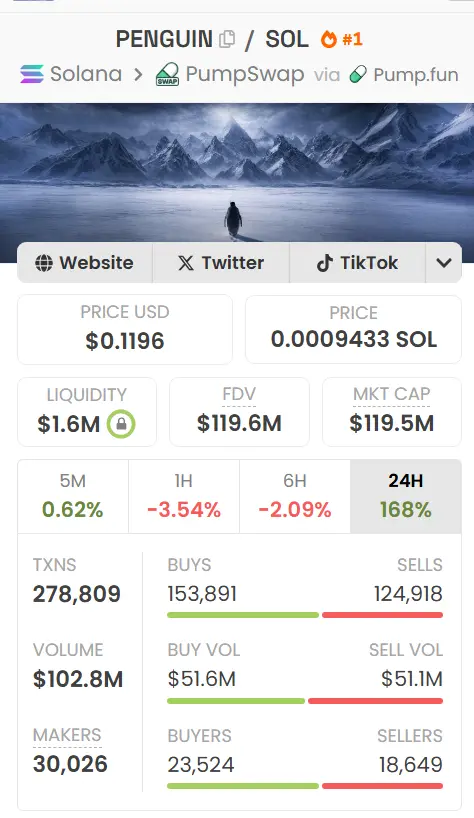

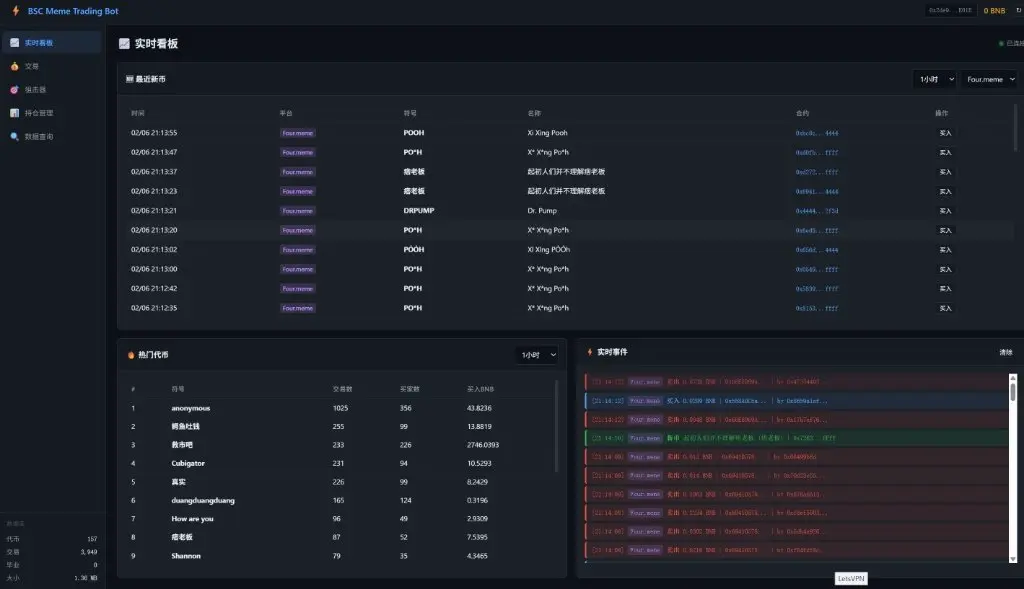

This afternoon felt a bit sci-fi. Staring at the screen as AI rapidly writes code and designs interfaces, I was still stunned when this Meme trading dashboard was placed in front of me. It's not that the code can't be finished; it's that my brain can't keep up with the speed of AI's iteration anymore. In an era where the productivity threshold has been completely flattened, the competition is no longer about physical effort but about imagination. 💡#AI

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Just now, a friend came to pick up a package from me (she sent it to the wrong address), and she also stayed for a while. The sunlight outside the window was still good, but as soon as the topic shifted to "recent circumstances," the atmosphere grew heavy. She is not a trader accustomed to the fluctuations in our circle; she has been working steadily at a state-owned enterprise, which many see as a safe harbor. But the waves of life never bypass you just because you're in the harbor. She half-jokingly expressed her despair: years of savings were firmly trapped at the peak of gold prices; anoth

View Original- Reward

- like

- Comment

- Repost

- Share

If you're trading traditional assets in the crypto industry, make sure to read the small print carefully, but you should look at $tesla.

View Original

- Reward

- like

- Comment

- Repost

- Share

#GOLD Used to mock aunties before, then understood aunties later, now wants to become an auntie

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

After 1011, the market movements seem like a targeted explosion of retail investors' faith. The longer you're in the crypto world, the more you develop a physiological "desensitization." The numbers bouncing on the screen, even if you hold a heavy position in a Meme coin, are just some kind of "chips" to us. We're used to PVP (player versus player), used to seeking liquidity in deep waters, like a group of gamblers who never dock in the open sea. People's hearts can't be stopped; they are eager for quick gains. But when you occasionally look up and see that the gold you bought last year has do

MEME-1,37%

- Reward

- 1

- 1

- Repost

- Share

ComeOnEveryDay :

:

Hahaha😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁😁Staring at the screen for a long time, I still have to admit: I can't achieve perfect objectivity. Even when my logic has already sounded the alarm, and subconsciously I feel it's wrong, my hand hovering over the keyboard still pops up that damn thought: "What if this time is different?" Honestly, we are all inherently arrogant. We always think that at some moment we can grasp the back of fate's neck, believe that the world should revolve around us, and see ourselves as the destined child in this script. But in reality, the world never needs a supporting role to nod; it continues to run regard

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

The current market psychology can be summarized into the following 6 core pathological mentalities:

1. Catching the Bag Delusion: Any buying action is subconsciously viewed as "taking over the bag," leading to even bullish signals not daring to jump in easily.

2. Time Folding: Holding a position for more than an hour is mocked as "big-picture thinking," because the default assumption is that the project won't last until the next day.

3. KOL Counter-Indicators: Signal calls are no longer a rallying cry for entry but a "withdrawal signal" telling existing funds to quickly exit.

4. Smart Money Fa

View Original1. Catching the Bag Delusion: Any buying action is subconsciously viewed as "taking over the bag," leading to even bullish signals not daring to jump in easily.

2. Time Folding: Holding a position for more than an hour is mocked as "big-picture thinking," because the default assumption is that the project won't last until the next day.

3. KOL Counter-Indicators: Signal calls are no longer a rallying cry for entry but a "withdrawal signal" telling existing funds to quickly exit.

4. Smart Money Fa

- Reward

- like

- Comment

- Repost

- Share

Trump Media Group collaborates to distribute digital tokens to qualified shareholders

This is not simply a shareholder dividend, but a financial guerrilla warfare disguised as Web3.

The DJT issue is not only a worthless "digital souvenir" but also an invisible search warrant targeting Wall Street short-selling institutions—using blockchain technology to enforce complex share verification (checking household registration), aiming to replicate Overstock-style short squeeze scripts and to trap short sellers with the cumbersome OBO/NOBO settlement mechanism;

This marks DJT's complete departure fro

This is not simply a shareholder dividend, but a financial guerrilla warfare disguised as Web3.

The DJT issue is not only a worthless "digital souvenir" but also an invisible search warrant targeting Wall Street short-selling institutions—using blockchain technology to enforce complex share verification (checking household registration), aiming to replicate Overstock-style short squeeze scripts and to trap short sellers with the cumbersome OBO/NOBO settlement mechanism;

This marks DJT's complete departure fro

TRUMP-2,59%

- Reward

- like

- Comment

- Repost

- Share

We always try to appear "social" by putting on a performance in this noisy world: pretending to understand boring jokes, pretending to be interested in others' lives, then returning home exhausted. In fact, your fear of socializing is not due to introversion, but because your soul has a cleanliness obsession. You can't tolerate fake excitement, nor do you want to lose yourself just to please others.

Remember, in this fast-paced era, being able to settle your own mind is far more admirable than trying to please everyone. If you can't fit in, there's no need to force it. The world is noisy, and

View OriginalRemember, in this fast-paced era, being able to settle your own mind is far more admirable than trying to please everyone. If you can't fit in, there's no need to force it. The world is noisy, and

- Reward

- like

- Comment

- Repost

- Share

Please fellow "On-Chain Beggars" (Degen) to practice with this, to preserve your principal in the PVP market, and to seize profits.

Meme On-Chain Dog-Beating Stick Method

Mental Method Overview:

Heavy positions at the bottom like filling a big egg, small trades to test the waters. Swing trading without attachment to battles to prevent market makers from covering the hotpot. Running fast is the hard truth, and a unified mindset with flow eliminates the dog market.

1. Beat the Double Dogs: When double bottoms stabilize without breaking, heavily buy the dip to turn the tide.

2. Beat the Dog’s Hea

View OriginalMeme On-Chain Dog-Beating Stick Method

Mental Method Overview:

Heavy positions at the bottom like filling a big egg, small trades to test the waters. Swing trading without attachment to battles to prevent market makers from covering the hotpot. Running fast is the hard truth, and a unified mindset with flow eliminates the dog market.

1. Beat the Double Dogs: When double bottoms stabilize without breaking, heavily buy the dip to turn the tide.

2. Beat the Dog’s Hea

- Reward

- like

- Comment

- Repost

- Share

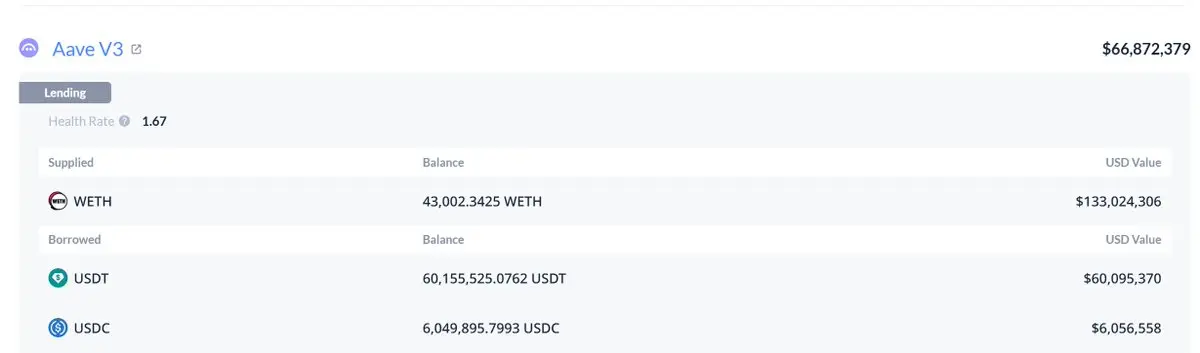

Why is everyone saying they're afraid of eating takeout and seeing YLH? I checked the position and it seems quite safe.

YLH Event Review: Mainly involved a稳健的巨鲸级 2倍做多策略 (a稳健的巨鲸级 2x long strategy): He collateralized 43,000 ETH (worth $133 million), borrowed $66 million in stablecoins, effectively using a 50% debt ratio to leverage double the ETH exposure.

Based on current data, the estimated liquidation price of this Ethereum position:

Current implied ETH price:

$133,024,306 / 43,002.34 WETH = $3,093

Liquidation buffer: Health factor 1.67 means that even if the collateral value drops by about 4

YLH Event Review: Mainly involved a稳健的巨鲸级 2倍做多策略 (a稳健的巨鲸级 2x long strategy): He collateralized 43,000 ETH (worth $133 million), borrowed $66 million in stablecoins, effectively using a 50% debt ratio to leverage double the ETH exposure.

Based on current data, the estimated liquidation price of this Ethereum position:

Current implied ETH price:

$133,024,306 / 43,002.34 WETH = $3,093

Liquidation buffer: Health factor 1.67 means that even if the collateral value drops by about 4

ETH-3,16%

- Reward

- like

- Comment

- Repost

- Share

There is a sense of helplessness that hits you instantly, but what follows is a moment of clarity.

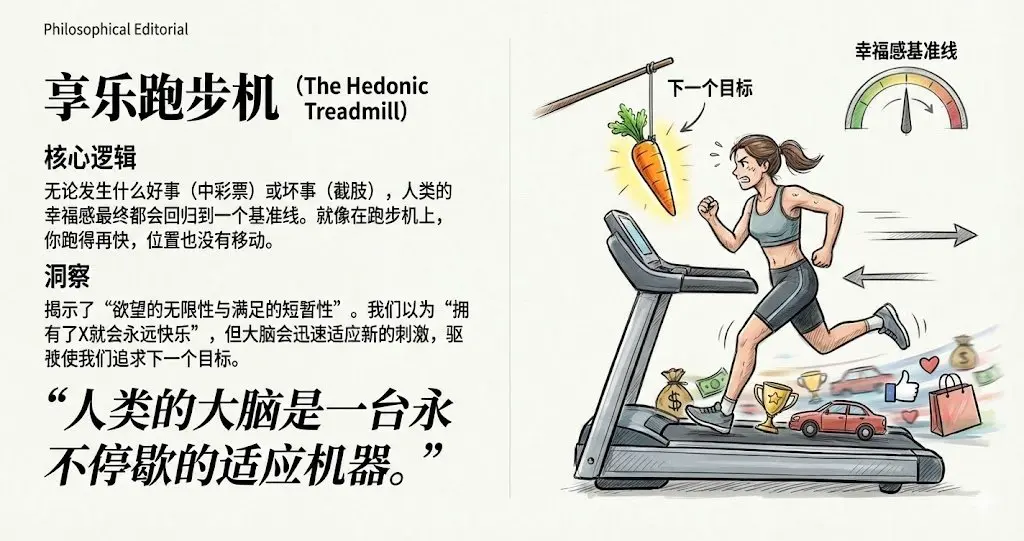

We always think that the current pain is because "it's not enough"—not enough money, not enough status, not enough house. We firmly believe that as long as we reach that dangling "carrot" (the next goal) in front of us, life will completely switch to happiness mode.

But the "pleasure treadmill" tells us a cruel truth: the endpoint you think you’ve reached is actually just the starting point for the next stage.

View OriginalWe always think that the current pain is because "it's not enough"—not enough money, not enough status, not enough house. We firmly believe that as long as we reach that dangling "carrot" (the next goal) in front of us, life will completely switch to happiness mode.

But the "pleasure treadmill" tells us a cruel truth: the endpoint you think you’ve reached is actually just the starting point for the next stage.

- Reward

- like

- Comment

- Repost

- Share