Post content & earn content mining yield

placeholder

- Reward

- like

- Comment

- Repost

- Share

When the Federal Reserve steps up to the podium, markets don’t just “react” they reprice reality. Stocks, bonds, currencies, and now crypto routinely explode into volatility during FOMC meetings, even when the Fed delivers exactly what traders expected.

Why?

Because the market isn't responding to the decision alone it’s responding to the new information frontier created in that moment.

For crypto traders, understanding how FOMC signals ripple across risk assets has become a critical edge. Here’s a deeper look at the forces behind those sudden jumps and dumps, and the mechanics that pros monito

Why?

Because the market isn't responding to the decision alone it’s responding to the new information frontier created in that moment.

For crypto traders, understanding how FOMC signals ripple across risk assets has become a critical edge. Here’s a deeper look at the forces behind those sudden jumps and dumps, and the mechanics that pros monito

BTC-0.75%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

TOP TRENDING COINS! 📈

Here's the latest on today's market dynamics:

1. Zswitch (ZSW/SOL) ⚡️🤯

🔹 24H Change: +53,813%

🔹 Current Price: $0.002748

🔹 Analysis: A monstrous 538x pump, classic microcap detonation. Moves of this size almost always come from ultra-thin liquidity, coordinated buyers, or bot-driven frenzy. The chart is almost certainly a vertical line. 🔹 Strategic Insight: Extreme caution. These rockets fade brutally once early buyers take profit. Only touch if you’re watching real-time liquidity, and even then, it’s roulette. *Disclaimer: For informational purposes only. Conduct d

Here's the latest on today's market dynamics:

1. Zswitch (ZSW/SOL) ⚡️🤯

🔹 24H Change: +53,813%

🔹 Current Price: $0.002748

🔹 Analysis: A monstrous 538x pump, classic microcap detonation. Moves of this size almost always come from ultra-thin liquidity, coordinated buyers, or bot-driven frenzy. The chart is almost certainly a vertical line. 🔹 Strategic Insight: Extreme caution. These rockets fade brutally once early buyers take profit. Only touch if you’re watching real-time liquidity, and even then, it’s roulette. *Disclaimer: For informational purposes only. Conduct d

SOL-1.91%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#PostToWinNIGHT

📊 30m Chart Analysis

The chart shows a perfect momentum breakout from the 0.038 zone — followed by a powerful green wave that pushed the price up to 0.07506, marking the strongest intraday rally of the session.

After the peak, the candles are now pulling back toward the short-term MAs (MA5/EMA5), indicating a healthy correction after an overheated run.

🔍 What the Indicators Say:

• MA & EMA clusters still bullish — even with the pullback, the moving averages haven’t flipped bearish.

• 0.060–0.062 zone is the immediate support where price may stabilize if buyers step in.

• The

📊 30m Chart Analysis

The chart shows a perfect momentum breakout from the 0.038 zone — followed by a powerful green wave that pushed the price up to 0.07506, marking the strongest intraday rally of the session.

After the peak, the candles are now pulling back toward the short-term MAs (MA5/EMA5), indicating a healthy correction after an overheated run.

🔍 What the Indicators Say:

• MA & EMA clusters still bullish — even with the pullback, the moving averages haven’t flipped bearish.

• 0.060–0.062 zone is the immediate support where price may stabilize if buyers step in.

• The

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

December 11 Evening SOL & BNB Forecast Analysis

1. BNB

1. Core Intraday Trends

BNB initially surged to 915.73 intra-day, then sharply declined, with the low reaching 861.69. After hitting a bottom in the afternoon, it weakly rebounded to 868.62. The rebound volume on the hourly chart continues to shrink, indicating insufficient bullish momentum and that short-term bears are in control.

2. Possible Evening Trends

- Most Likely Scenario: Without a strong rally driven by BTC/ETH, BNB is likely to trade within a narrow range of 860–870 tonight. The 861.69 level is a strong support at the intra-day

View Original1. BNB

1. Core Intraday Trends

BNB initially surged to 915.73 intra-day, then sharply declined, with the low reaching 861.69. After hitting a bottom in the afternoon, it weakly rebounded to 868.62. The rebound volume on the hourly chart continues to shrink, indicating insufficient bullish momentum and that short-term bears are in control.

2. Possible Evening Trends

- Most Likely Scenario: Without a strong rally driven by BTC/ETH, BNB is likely to trade within a narrow range of 860–870 tonight. The 861.69 level is a strong support at the intra-day

- Reward

- like

- Comment

- Repost

- Share

#JoinCreatorCertificationProgramToEarn$10,000

In today’s fast-evolving crypto landscape, content creators are more important than ever. They educate users, simplify complex concepts, share real-time insights, and help millions of traders make informed decisions every single day. Recognizing this, Gate.io has launched the Creator Certification Program — a groundbreaking initiative designed to reward talented individuals with opportunities, exposure, and earnings of up to $10,000.

This program is more than just a reward system. It’s a bridge between creators and one of the world’s leading crypto

In today’s fast-evolving crypto landscape, content creators are more important than ever. They educate users, simplify complex concepts, share real-time insights, and help millions of traders make informed decisions every single day. Recognizing this, Gate.io has launched the Creator Certification Program — a groundbreaking initiative designed to reward talented individuals with opportunities, exposure, and earnings of up to $10,000.

This program is more than just a reward system. It’s a bridge between creators and one of the world’s leading crypto

- Reward

- 12

- 12

- Repost

- Share

Ryakpanda :

:

Just go for it 💪View More

We don’t need another on-chain prediction market.

We need a better one.

Most new “decentralized prediction markets” are simply clones of Polymarket/Kalshi, offering less liquidity, reduced trust, and no genuine competitive edge.

Same regulatory grey zone.

Same binary markets.

Different logo.

Same topics.

Same UX.

If you’re not changing the structure of the game, you’re just fragmenting liquidity and making the entire sector weaker.

Polymarket owns the “permissionless, degen, real-world info” lane with deep liquidity on politics, macro, and culture. Kalshi owns the “regulated event exchange”

We need a better one.

Most new “decentralized prediction markets” are simply clones of Polymarket/Kalshi, offering less liquidity, reduced trust, and no genuine competitive edge.

Same regulatory grey zone.

Same binary markets.

Different logo.

Same topics.

Same UX.

If you’re not changing the structure of the game, you’re just fragmenting liquidity and making the entire sector weaker.

Polymarket owns the “permissionless, degen, real-world info” lane with deep liquidity on politics, macro, and culture. Kalshi owns the “regulated event exchange”

REP1.62%

- Reward

- 1

- 1

- Repost

- Share

Plastikkid :

:

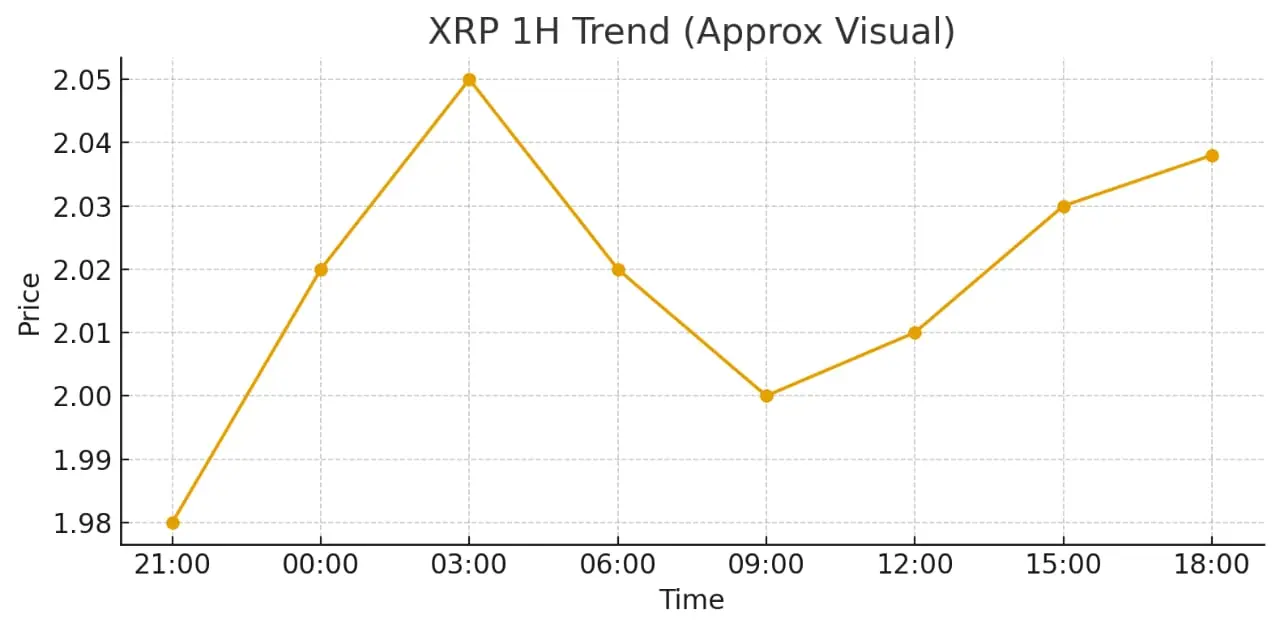

Right now, the entire market is disconnected from reality, just a simulation of trading by bots of a global market maker. I have already written several articles about this.$XRP 📊 XRP Market Update & Simple Outlook (1H & 4H View)

Personal opinion only — not financial advice.

🔹 1H Chart Overview

XRP is trading around $2.03–$2.04, holding well after bouncing from the $1.97 area.

Short-term MAs (5 & 10) are still leaning upward, showing steady buyer presence.

What I’m watching:

• Holding above $2.02 → keeps short-term strength intact

• Break above $2.05–$2.06 → could push toward $2.08

• Dropping below $2.00 → may open a move back toward $1.98

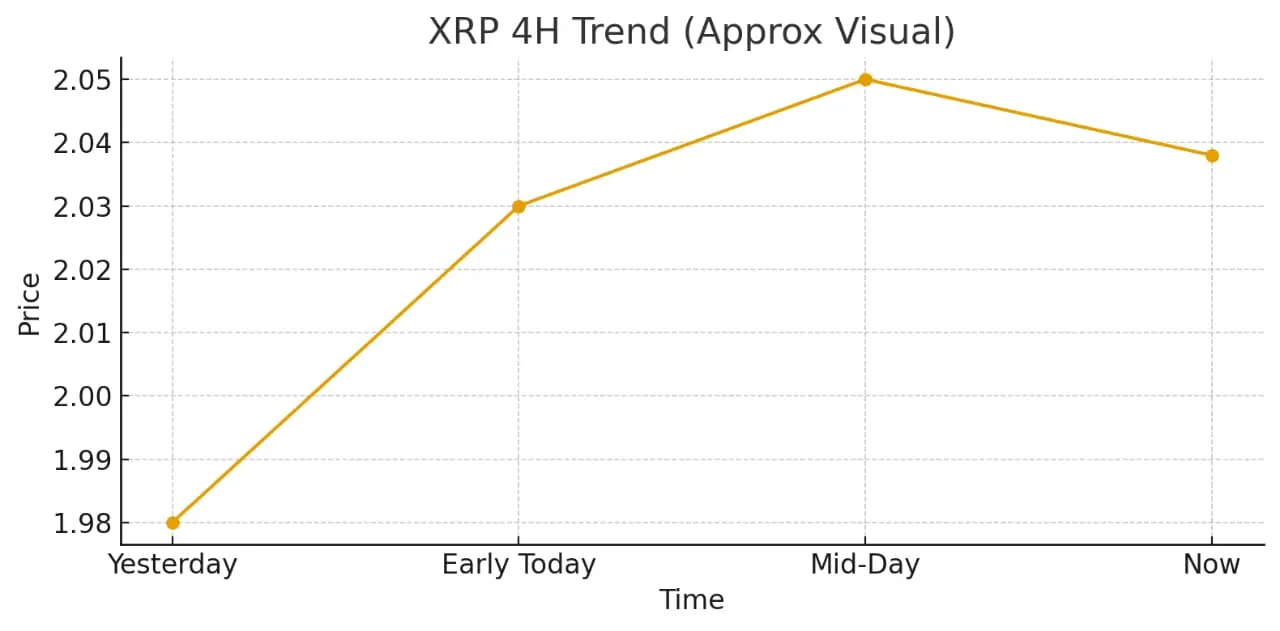

🔹 4H Chart Overview

The 4H trend shows slow but consistent recovery with price staying above the mid-MAs.

MACD is slight

Personal opinion only — not financial advice.

🔹 1H Chart Overview

XRP is trading around $2.03–$2.04, holding well after bouncing from the $1.97 area.

Short-term MAs (5 & 10) are still leaning upward, showing steady buyer presence.

What I’m watching:

• Holding above $2.02 → keeps short-term strength intact

• Break above $2.05–$2.06 → could push toward $2.08

• Dropping below $2.00 → may open a move back toward $1.98

🔹 4H Chart Overview

The 4H trend shows slow but consistent recovery with price staying above the mid-MAs.

MACD is slight

XRP-0.19%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

- Trending TopicsView More

9.78K Popularity

662.02K Popularity

58.65K Popularity

13.49K Popularity

542.17K Popularity

- Hot Gate FunView More

- MC:$3.59KHolders:20.07%

- MC:$3.54KHolders:10.00%

- MC:$3.63KHolders:10.83%

- MC:$6.15KHolders:311.56%

- MC:$3.58KHolders:30.09%

- Pin