# RiskManagement

9.96K

DragonFlyOfficial

#CryptoMarketPullback | Dragon Fly Official

The crypto market just went through a sharp deleveraging wave. BTC slipping below $76K triggered synchronized selling across ETH, SOL, and major altcoins. When volatility expands this fast, the real game is no longer about chasing quick profits — it’s about **protecting capital and positioning smartly for the next move**.

Right now the structure looks like a classic liquidity reset. Forced liquidations cleared overheated leverage, and historically these phases often create **strong reaction zones** rather than instant trend reversals. The key level

The crypto market just went through a sharp deleveraging wave. BTC slipping below $76K triggered synchronized selling across ETH, SOL, and major altcoins. When volatility expands this fast, the real game is no longer about chasing quick profits — it’s about **protecting capital and positioning smartly for the next move**.

Right now the structure looks like a classic liquidity reset. Forced liquidations cleared overheated leverage, and historically these phases often create **strong reaction zones** rather than instant trend reversals. The key level

- Reward

- 7

- 7

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#CryptoSurvivalGuide

The crypto market right now is not just volatile — it’s selectively brutal. This phase is designed to shake out impatience, over-leverage, and weak conviction. Understanding where we are matters more than predicting the next 5% move.

1️⃣ Market Structure: Distribution, Not Capitulation (Yet)

Despite sharp pullbacks, we are not seeing classic panic signals:

Funding rates are cooling, not collapsing

Open interest is decreasing in an orderly way

No extreme volume spike that usually marks full capitulation

This suggests the market is in a distribution + re-pricing phase, not

The crypto market right now is not just volatile — it’s selectively brutal. This phase is designed to shake out impatience, over-leverage, and weak conviction. Understanding where we are matters more than predicting the next 5% move.

1️⃣ Market Structure: Distribution, Not Capitulation (Yet)

Despite sharp pullbacks, we are not seeing classic panic signals:

Funding rates are cooling, not collapsing

Open interest is decreasing in an orderly way

No extreme volume spike that usually marks full capitulation

This suggests the market is in a distribution + re-pricing phase, not

BTC-1,12%

- Reward

- 1

- Comment

- Repost

- Share

#CryptoSurvivalGuide

The crypto market right now is not just volatile — it’s selectively brutal. This phase is designed to shake out impatience, over-leverage, and weak conviction. Understanding where we are matters more than predicting the next 5% move.

1️⃣ Market Structure: Distribution, Not Capitulation (Yet)

Despite sharp pullbacks, we are not seeing classic panic signals:

Funding rates are cooling, not collapsing

Open interest is decreasing in an orderly way

No extreme volume spike that usually marks full capitulation

This suggests the market is in a distribution + re-pricing phase, not

The crypto market right now is not just volatile — it’s selectively brutal. This phase is designed to shake out impatience, over-leverage, and weak conviction. Understanding where we are matters more than predicting the next 5% move.

1️⃣ Market Structure: Distribution, Not Capitulation (Yet)

Despite sharp pullbacks, we are not seeing classic panic signals:

Funding rates are cooling, not collapsing

Open interest is decreasing in an orderly way

No extreme volume spike that usually marks full capitulation

This suggests the market is in a distribution + re-pricing phase, not

BTC-1,12%

- Reward

- 2

- 2

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#BuyTheDipOrWaitNow?

Markets are once again at a critical decision point. After sharp volatility and a partial rebound, investors are facing the classic dilemma: is this pullback a strategic buying opportunity, or a temporary bounce before another leg down?

In times like these, discipline matters more than emotions. Buying the dip only makes sense when aligned with strong fundamentals, clear risk management, and a defined time horizon. For long-term investors, gradual accumulation during fear-driven corrections can reduce average entry costs. For short-term traders, patience is often the edge—

Markets are once again at a critical decision point. After sharp volatility and a partial rebound, investors are facing the classic dilemma: is this pullback a strategic buying opportunity, or a temporary bounce before another leg down?

In times like these, discipline matters more than emotions. Buying the dip only makes sense when aligned with strong fundamentals, clear risk management, and a defined time horizon. For long-term investors, gradual accumulation during fear-driven corrections can reduce average entry costs. For short-term traders, patience is often the edge—

- Reward

- 5

- 8

- Repost

- Share

CryptoChampion :

:

Ape In 🚀View More

#CryptoSurvivalGuide This market isn’t for the emotional.

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

BTC-1,12%

- Reward

- 9

- 13

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#CryptoSurvivalGuide This market isn’t for the emotional.

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

BTC-1,12%

- Reward

- 8

- 6

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#BuyTheDipOrWaitNow? | Gate Plaza Market Update – Feb 6

Bitcoin below $60K, metals plunging, equities under pressure — markets have entered a clear risk-off phase.

A sharp, synchronized selloff across crypto, stocks, and precious metals signals that this move is driven less by fundamentals and more by leverage unwinding and macro uncertainty.

Market Snapshot

Bitcoin: Briefly dipped below $60,000, down ~30% over the past month, with volatility remaining elevated. Key support lies in the $56K–$58K zone.

U.S. Equities: Nasdaq, S&P, and Dow continue to slide as risk appetite fades amid tech and ma

Bitcoin below $60K, metals plunging, equities under pressure — markets have entered a clear risk-off phase.

A sharp, synchronized selloff across crypto, stocks, and precious metals signals that this move is driven less by fundamentals and more by leverage unwinding and macro uncertainty.

Market Snapshot

Bitcoin: Briefly dipped below $60,000, down ~30% over the past month, with volatility remaining elevated. Key support lies in the $56K–$58K zone.

U.S. Equities: Nasdaq, S&P, and Dow continue to slide as risk appetite fades amid tech and ma

BTC-1,12%

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

Happy New Year! 🤑#StrategyBitcoinPositionTurnsRed

#StrategyBitcoinPositionTurnsRed

Bitcoin positions are turning red for many traders after the recent pullback, but this phase is more about strategy than panic.

When BTC retraces sharply, weak hands exit — while disciplined traders reassess risk, size, and key levels.

Historically, red positions during high-volatility phases often become opportunities if risk management is respected.

Key strategic points right now:

• Avoid over-leveraging during unstable momentum

• Focus on strong support zones instead of chasing rebounds

• Red positions don’t mean wrong posit

#StrategyBitcoinPositionTurnsRed

Bitcoin positions are turning red for many traders after the recent pullback, but this phase is more about strategy than panic.

When BTC retraces sharply, weak hands exit — while disciplined traders reassess risk, size, and key levels.

Historically, red positions during high-volatility phases often become opportunities if risk management is respected.

Key strategic points right now:

• Avoid over-leveraging during unstable momentum

• Focus on strong support zones instead of chasing rebounds

• Red positions don’t mean wrong posit

BTC-1,12%

- Reward

- 3

- 6

- Repost

- Share

AylaShinex :

:

HODL Tight 💪View More

#FedLeadershipImpact 🌍 Macro Expectations Are Back in Focus

Inflation data, interest rate signals, and liquidity trends are once again shaping market sentiment — and crypto is feeling it.

At this stage, macro doesn’t decide every trade for me, but it clearly sets the context: • Liquidity tells me when to be aggressive or defensive

• Rates & dollar strength influence risk appetite

• Macro trends help separate short-term noise from structural moves

📊 My approach:

I let macro guide position sizing & patience, while price action and structure decide entries.

💬 How much weight do you give macro

Inflation data, interest rate signals, and liquidity trends are once again shaping market sentiment — and crypto is feeling it.

At this stage, macro doesn’t decide every trade for me, but it clearly sets the context: • Liquidity tells me when to be aggressive or defensive

• Rates & dollar strength influence risk appetite

• Macro trends help separate short-term noise from structural moves

📊 My approach:

I let macro guide position sizing & patience, while price action and structure decide entries.

💬 How much weight do you give macro

- Reward

- 5

- 3

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

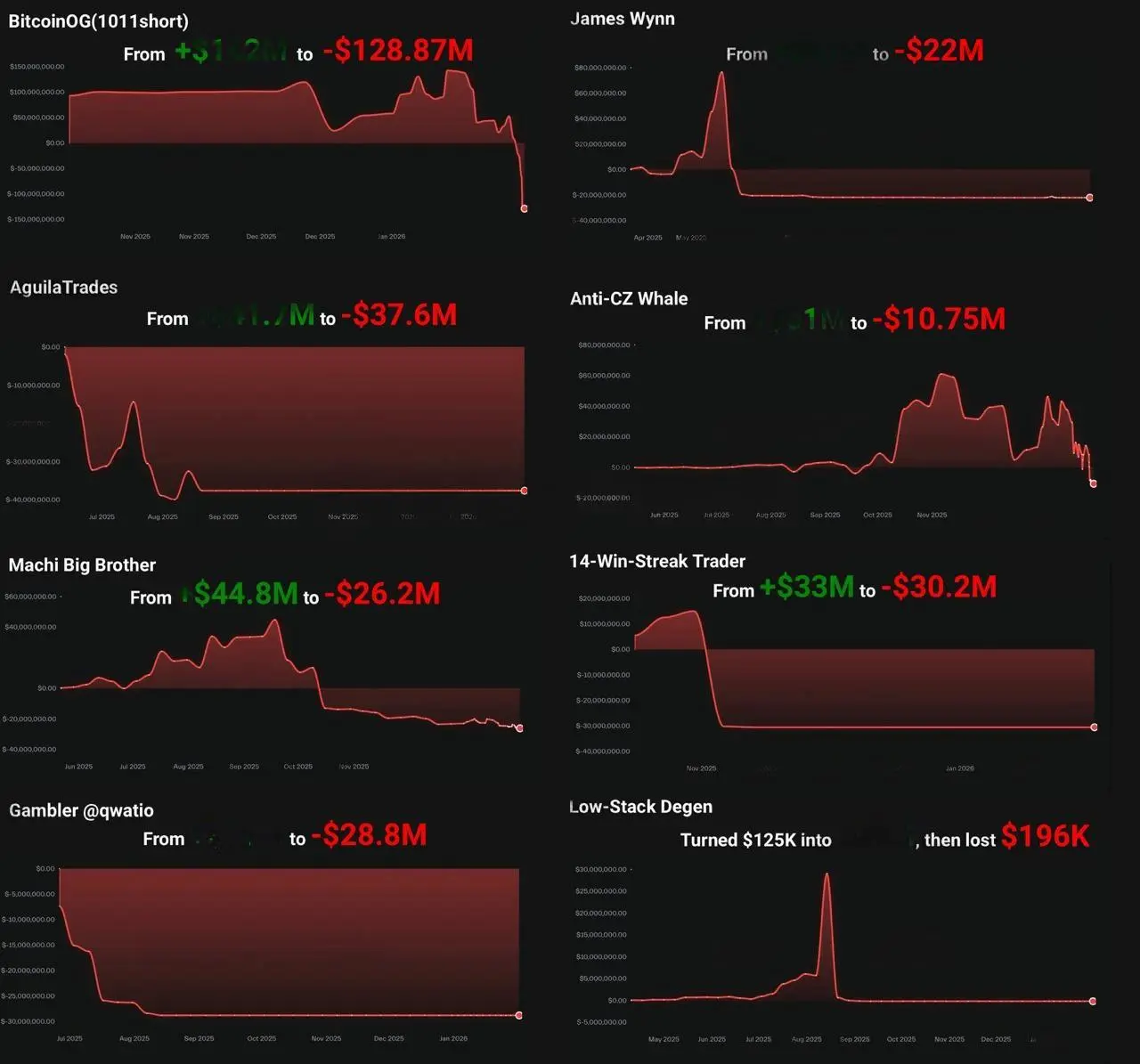

The market doesn't care about your past wins. 📉💀

This image is a brutal reminder that in crypto, your "streak" means nothing if you don't manage risk. From BitcoinOG losing $128M to a 14-win-streak trader ending up -$30M in the hole.

The Lesson:

Realized profits > Paper gains.

Leverage is a double-edged sword that eventually cuts deep.

The market can stay irrational longer than you can stay solvent.

Don't become a chart in someone else's "Rekt" compilation. Stay humble or the market will do it for you. 🏛️💸

#Crypto #TradingTips #Rekt #RiskManagement #Bitcoin

This image is a brutal reminder that in crypto, your "streak" means nothing if you don't manage risk. From BitcoinOG losing $128M to a 14-win-streak trader ending up -$30M in the hole.

The Lesson:

Realized profits > Paper gains.

Leverage is a double-edged sword that eventually cuts deep.

The market can stay irrational longer than you can stay solvent.

Don't become a chart in someone else's "Rekt" compilation. Stay humble or the market will do it for you. 🏛️💸

#Crypto #TradingTips #Rekt #RiskManagement #Bitcoin

BTC-1,12%

- Reward

- 2

- 2

- Repost

- Share

BitcoinEyes :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

195.58K Popularity

52.03K Popularity

26.67K Popularity

8.91K Popularity

3.86K Popularity

6.57K Popularity

7.63K Popularity

3.32K Popularity

16.43K Popularity

8.29K Popularity

4.71K Popularity

4.53K Popularity

26.86K Popularity

19.35K Popularity

38.83K Popularity

News

View MoreThe whale "degen-retard.sol" has lost over $3.6 million again on SOL

13 m

Base App announces a shift in product direction, focusing on creating an on-chain trading experience

14 m

Gate DEX Launches "7-Day Exchange Hunting Contest" with a total of 20,000 USDT for check-ins and sharing

15 m

The idOS token will be auctioned through Tally and will be launched on March 5th.

16 m

Data: 256,300 SOL transferred from an anonymous address to Galaxy Digital, valued at approximately $22.29 million.

27 m

Pin